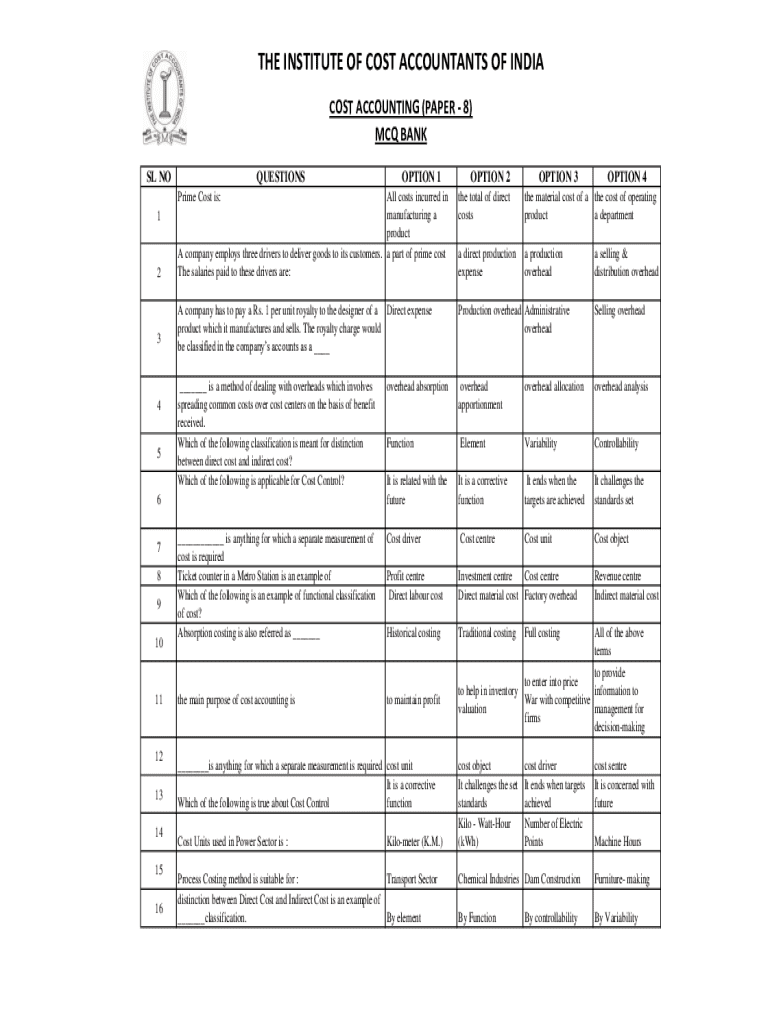

Get the free Cost Accounting (paper - 8) Mcq Bank

Get, Create, Make and Sign cost accounting paper

How to edit cost accounting paper online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cost accounting paper

How to fill out cost accounting paper

Who needs cost accounting paper?

A Complete Guide to Cost Accounting Paper Form

Understanding cost accounting: An overview

Cost accounting is a critical element of business management that involves the collection, analysis, and reporting of costs associated with producing goods or services. It helps organizations understand where their money is being spent and provides insights for making informed financial decisions.

The importance of cost accounting extends beyond simple tracking; it is vital for budgeting, price setting, and profitability analysis. By understanding costs, businesses can streamline operations, enhance efficiency, and maximize profits.

Purpose of the cost accounting paper form

The cost accounting paper form is designed to systematically collect and document cost-related information. Its primary objective is to facilitate accurate and comprehensible cost reporting, which is crucial for managerial decision-making.

This form is particularly useful in situations where businesses need to track specific costs associated with projects, production runs, or departmental expenses. By accurately recording these costs, organizations can ensure better financial oversight and control.

General information about the cost accounting form

The cost accounting paper form includes several essential components that work together to capture a company’s financial landscape accurately. Typically, it features sections for inputting data on fixed, variable, direct, and indirect costs.

Understanding the types of costs is crucial; fixed costs remain constant regardless of production levels, while variable costs fluctuate with output. Direct costs can be traced directly to the product, whereas indirect costs are overhead expenses that support production.

Step-by-step instructions for filling out the cost accounting form

Before filling out the cost accounting paper form, consider gathering all necessary documentation, such as invoices and receipts, to ensure you have accurate information at hand. Identifying relevant cost categories specific to your business will make the data entry process smoother.

When it comes to filling out the form, attention to detail is paramount. Here’s a section-by-section breakdown to guide you:

Exhibit and detailed instructions

To enhance understanding, a visual representation of the completed form can be invaluable. It serves as a reference point for users to ensure accuracy and completeness in their entries.

Common errors in filling out the cost accounting paper form can include incorrect calculations, misclassification of costs, and omissions. Avoid these pitfalls by double-checking your entries against supporting documents. Sample calculations for distinct cost categories help clarify how to assess total costs accurately.

Form requirements for submission

When preparing your cost accounting paper form for submission, certain specifications must be adhered to. The document must be completed in a structured format and often requires specific signatures for authorization.

Ensure you understand the internal and external submission guidelines that may apply to your organization, as these can vary significantly based on industry regulations. Typically, submitting the form in PDF format is preferred for its integrity and ease of use.

Number of copies and distribution process

The number of copies required for distribution can vary based on the organization’s needs. Typically, it is advisable to have at least three copies: one for internal records, one for financial oversight, and one for external audits.

Best practices for internal distribution include sharing copies with relevant department heads and ensuring that the finance team has access to detailed records for analysis. Understand the regulatory requirements for external submissions to ensure compliance.

Where to send the completed cost accounting forms

Once filled out, the completed cost accounting paper form must be sent to the designated departments or agencies in your organization. Identifying the correct recipients is critical to ensure that cost data is reviewed and acted upon appropriately.

Many organizations have strict deadlines for submission, so it is advised to check internal calendars and regulations to adhere to these timelines. Moreover, with advancements in technology, numerous platforms, such as pdfFiller, offer online submission options to streamline this process.

Contact information for inquiries

For any questions or support related to the cost accounting paper form, users can reach out via the contact channels provided by pdfFiller. The platform offers various support routes including email, chat, and knowledge bases to aid in navigating the form filling process.

Frequently asked questions may help clarify common concerns, and users can also explore additional resources within pdfFiller for thorough assistance and guidance.

Cross references with related documentation

The cost accounting paper form is interconnected with various other forms and templates within the financial management space. Linkages to purchase orders, invoices, and expense reports can often provide a fuller picture of a company's financial framework.

Incorporating cost accounting into overall business financial management is essential for comprehensive fiscal oversight. A resource database that offers comprehensive cost management solutions can supplement the insights gained from the form.

Tips on improving your cost accounting process

Improving your cost accounting process can yield significant benefits. Utilizing interactive tools provided by pdfFiller can significantly simplify your workflow, making it easier to fill out, edit, and collaborate on the cost accounting paper form.

Additionally, fostering collaboration among team members can lead to better accuracy and accountability in reporting. Consider employing strategies for managing and archiving completed forms systematically to boost future accessibility and referential integrity.

A closer look: Real-world applications of cost accounting

Understanding real-world applications of the cost accounting paper form can provide clarity on its significance. Numerous case studies show that effective use of the form leads to strategic financial decision-making that drives growth and efficiency.

Conversely, organizations that neglect cost management often learn harsh lessons from poor financial oversight. Their experiences underscore the importance of consistent practices in monitoring and analyzing costs to ensure sustainable operations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find cost accounting paper?

Can I sign the cost accounting paper electronically in Chrome?

How can I edit cost accounting paper on a smartphone?

What is cost accounting paper?

Who is required to file cost accounting paper?

How to fill out cost accounting paper?

What is the purpose of cost accounting paper?

What information must be reported on cost accounting paper?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.