Get the free Group Critical Illness Insurance Policy Terms and Conditions

Get, Create, Make and Sign group critical illness insurance

How to edit group critical illness insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out group critical illness insurance

How to fill out group critical illness insurance

Who needs group critical illness insurance?

Understanding the Group Critical Illness Insurance Form

Understanding group critical illness insurance

Group critical illness insurance is a specialized insurance product designed to provide coverage for major health issues that can significantly impact an individual's life. This insurance typically covers a range of illnesses specified in the policy, offering a financial safety net for members of a group—often employees within an organization. The key components of this insurance include defined critical illnesses like cancer, heart attack, and stroke, allowing insured individuals to receive a lump-sum benefit if diagnosed with one of these illnesses.

The importance of group critical illness insurance cannot be overstated. By offering this coverage, organizations can significantly mitigate the risks associated with health issues that may arise among their employees, ensuring that they feel safeguarded and valued. Additionally, it forms a vital part of a comprehensive employee benefits package.

Why choose group critical illness insurance?

Employers and employees can both benefit from group critical illness insurance. For employers, offering this type of insurance helps in attracting and retaining top talent, as comprehensive health coverage is a major consideration for prospective employees. Employees, on the other hand, gain peace of mind knowing that they are protected financially should a critical health issue arise.

Besides financial security, this insurance promotes employee satisfaction and loyalty. When employees feel that their organization cares for their well-being, they are more likely to remain loyal and engaged in their work.

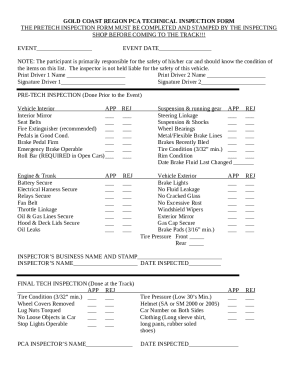

Key features of the group critical illness insurance form

Filling out the group critical illness insurance form requires various personal and health-related details. Applicants must provide specific information such as their name, date of birth, social security number, and contact details. In addition, the form typically requires detailed medical history, including any pre-existing conditions or previous surgeries.

Understanding the types of critical illnesses covered under the policy is crucial. Most policies cover common illnesses such as cancer, kidney failure, and heart attack. However, applicants should also be aware of any exclusions, such as certain pre-existing conditions or specific lifestyle-related diseases.

Step-by-step guide to completing the group critical illness insurance form

Step 1: Gathering necessary documents

Before beginning the application, it is essential to gather all necessary documents. These usually include identification such as a driver’s license or passport, medical records pertaining to your health history, and any previous insurance documents.

Step 2: Filling out the form

Filling out the group critical illness insurance form requires careful attention to detail. Begin by entering your personal information—this includes your full name, address, contact number, and employment details. If you are applying for dependents as well, ensure to fill out their details accurately.

Next, provide your medical history. This section is crucial as it may influence your coverage. Be transparent about any prior medical conditions or treatments. Finally, don’t forget to complete the declaration of health section, confirming the truthfulness of the information provided.

Step 3: Reviewing your application

After filling out the form, take the time to review your application thoroughly. This is the stage where you can ensure that all entries are accurate and complete. Double-check details, particularly in the medical history section, as missing or incorrect information could delay the approval process.

Step 4: Submitting the form

Once you are satisfied that your application is complete, it is time to submit it. Most insurers offer various submission options: online, via postal mail, or in-person at designated locations. After submission, you typically receive a confirmation email or letter, outlining timelines for the approval process and follow-up steps.

Editing and managing your group critical illness insurance form with pdfFiller

Using pdfFiller’s editing tools

After you have submitted your group critical illness insurance form, you might find yourself needing to make changes. Utilizing pdfFiller’s editing tools allows users to modify information efficiently. This includes updating personal details, adding signatures if needed, and collaborating with team members for a review before finalizing any changes.

Storing and accessing your document securely

Storing your completed form securely is vital. pdfFiller offers cloud-based storage features, allowing users to access their documents anytime, anywhere. This capability is particularly beneficial when traveling or if you need to retrieve essential paperwork quickly.

Frequently asked questions (FAQs) about group critical illness insurance forms

Common concerns about insurance coverage

One common concern among applicants is what happens if a claim is denied. In such cases, it is crucial to understand the reasons behind the denial — these could range from insufficient medical documentation to the policyholder's pre-existing conditions. Addressing these concerns promptly can help resolve issues faster.

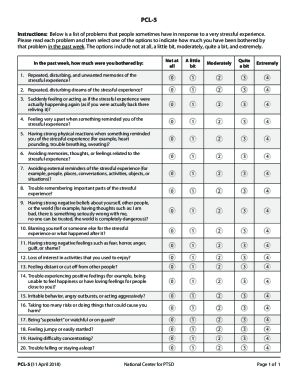

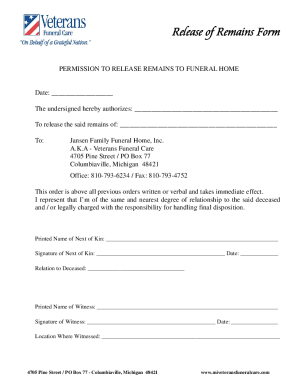

Understanding the claims process

Understanding the claims process for group critical illness insurance is essential. Upon diagnosis of a critical illness, the insured typically needs to gather relevant medical documents, including diagnosis letters and treatment records. These documents are necessary to support the claim. Additionally, it is vital to be informed about the claim processing timelines and any potential follow-up needed with the insurance provider.

Customer support and assistance

Contacting customer service for help

If you encounter issues or have questions while filling out your group critical illness insurance form, reaching out to customer service is recommended. Support channels typically include email, phone, and live chat. Having concise questions prepared can assist customer representatives in addressing your inquiries efficiently.

Access to industry professionals

For more in-depth discussions regarding specific cases, individuals may seek expert advice from professionals in the insurance industry. Many insurance companies and platforms like pdfFiller offer resources for consumers, including guides, webinars, and FAQs to help users navigate their insurance needs.

Legal and regulatory information

Understanding your rights as an insured member

It's essential for applicants to be aware of their rights when it comes to group critical illness insurance. Understanding the legal framework that governs these policies protects consumers from potential issues and ensures transparency. Each insurer must adhere to specific regulations that dictate how they manage claims and process applications.

Compliance and ethical considerations

Transparency and ethics play vital roles in the processing of insurance claims. Regulations ensure that claim processes are conducted fairly and honestly, helping to build trust between insurers and policyholders. Organizations must comply with these legal obligations to maintain integrity and uphold their commitments to insured members.

Final thoughts: Empowering health through insurance

Group critical illness insurance represents a vital component of employee benefits that addresses the well-being of the workforce. As businesses evolve and adapt to new health realities, providing access to such essential insurance can foster a culture of health and safety within organizations. By ensuring employees feel secure in their health journeys, companies can enhance their overall productivity and satisfaction.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send group critical illness insurance for eSignature?

How do I edit group critical illness insurance in Chrome?

How do I fill out the group critical illness insurance form on my smartphone?

What is group critical illness insurance?

Who is required to file group critical illness insurance?

How to fill out group critical illness insurance?

What is the purpose of group critical illness insurance?

What information must be reported on group critical illness insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.