Get the free Tax Organizer

Get, Create, Make and Sign tax organizer

Editing tax organizer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax organizer

How to fill out tax organizer

Who needs tax organizer?

A comprehensive guide to tax organizer form

Understanding the tax organizer form

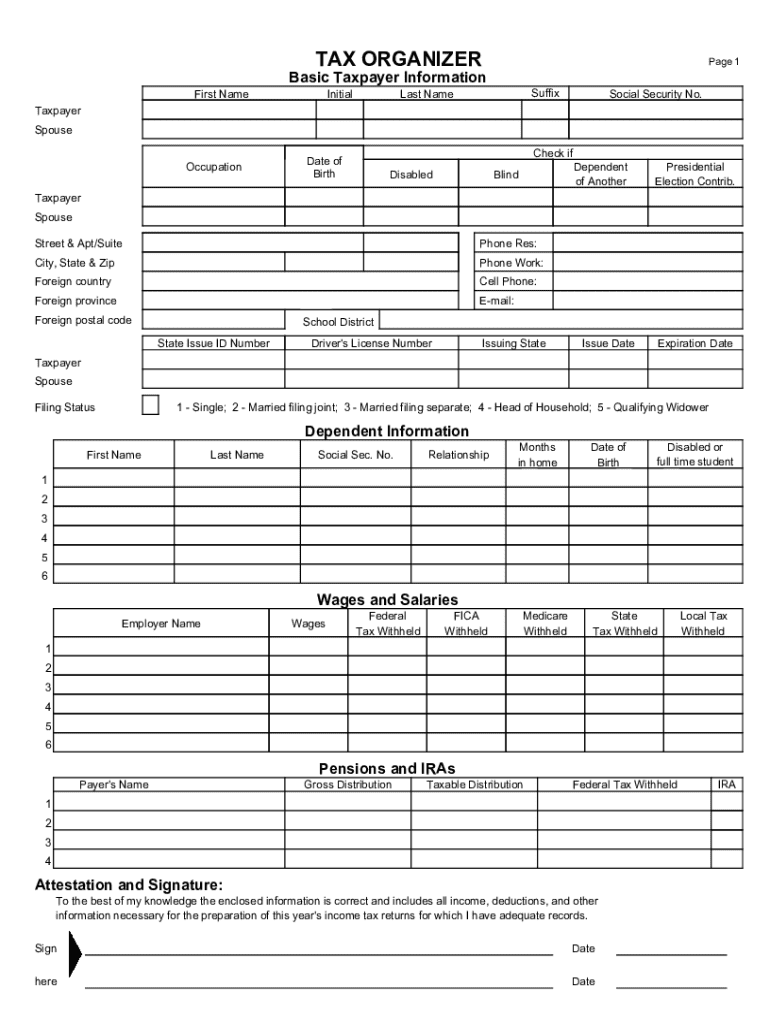

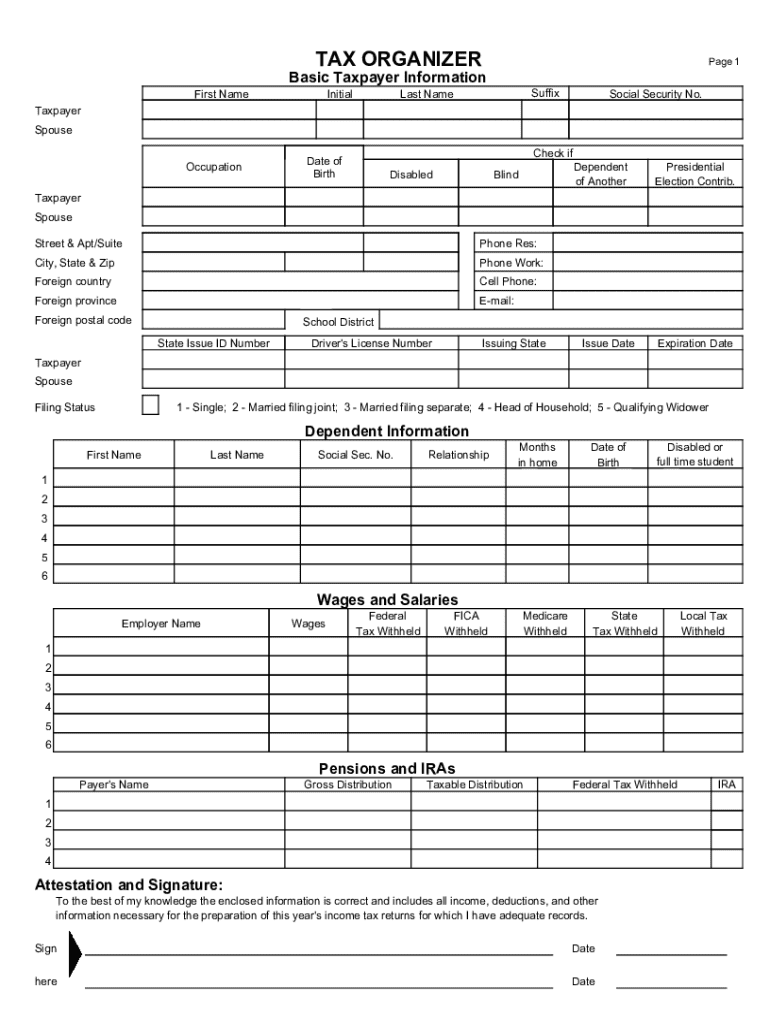

The tax organizer form is designed to help individuals and teams systematically collect and organize important tax-related information before filing. Its main purpose is to streamline the process of tax preparation by providing a structured framework where users can enter details about their personal and financial situations.

For individuals, this form allows for clarity in collecting necessary data, ensuring that no vital details are overlooked, which may lead to delays or errors during the tax filing process. Teams or organizations that handle multiple tax preparations appreciate the tax organizer form for its capability to promote consistency and improve collaboration among team members.

pdfFiller significantly enhances your tax preparation experience by offering interactive features that make it easier to fill out the tax organizer form online. With its cloud-based platform, users can easily access and edit their forms from any location, making it a flexible tool for anyone looking to tackle their tax responsibilities efficiently.

Key features of the tax organizer form

The tax organizer form is comprised of several key sections tailored to capture specific financial information. These typically include personal identification details, income sources, deductions, credits, tax payments, and more. Having these sections clearly defined not only saves time but also increases accuracy when it comes to filing your taxes.

pdfFiller enriches users' experience with a range of interactive tools. Among them are fillable fields and checklists that guide users through the data entry process, reducing the risks of errors. The automatic calculations feature is particularly beneficial as it minimizes manual math, ensuring that tax figures are accurate right from the start.

Step-by-step guide to filling out the tax organizer form

Gathering the necessary information is crucial when tackling the tax organizer form. Initially, it is imperative to collect personal details such as your name, Social Security number, filing status, and contact information. Additionally, gather all relevant financial documents like W-2s, 1099s, investment income statements, and receipts for deductions.

When it comes to filling out the form, breaking down the sections is beneficial. Begin with the **Individual Tax Information**, where personal identification details should go. Under **Income Sources**, input all relevant earnings data from W-2s or 1099s. Next, pay attention to **Deductions and Credits**, ensuring that any eligible items are accurately noted. Lastly, track your **Tax Payments Made** to ensure all amounts accounted for align with your records.

Utilizing pdfFiller tools can greatly assist during this process. Real-time editing capabilities provide prompts and suggestions as you fill out your tax organizer form, allowing for quicker updates and changes. Additionally, collaborative features facilitate ease amongst team members working on tax preparations together, ensuring everyone is on the same page.

Editing and customizing your tax organizer form

One of the advantages of using pdfFiller is the range of editing and customization options at your disposal. To edit your tax organizer form, simply access the document on the platform and apply changes as needed. You can modify any field, adjust layouts, or add comments to clarify specific entries.

Saving templates for future use is also straightforward. Once you have a version of the tax organizer form filled out that you like, save it as a template to streamline the process for subsequent years. Personalization is key; consider customizing the form layout by reordering sections to better align with your workflow for easy navigation.

eSigning your tax organizer form

Incorporating electronic signatures into your tax organizer form is crucial for document integrity. eSigning ensures that your form is securely signed and dated, eliminating the need for printing and scanning, which is both time-consuming and less secure. Using pdfFiller, eSigning is as simple as clicking a designated button and following a few intuitive steps.

Security measures are in place through pdfFiller to protect your digital signature. Advanced encryption methods ensure that your signature is securely stored and that only authorized users can access your documents. This feature further guarantees the authenticity of your forms during the tax filing process.

Managing your tax organizer form with pdfFiller

pdfFiller's cloud storage provides a seamless way to manage your tax organizer forms. You can store and retrieve documents with ease, whether you're at home or on the go. Once saved in the cloud, your forms are not only accessible from any device but also safeguarded against loss or accidental deletion.

Sharing options allow users to collaborate effectively during the tax preparation process. You can easily share specific forms with tax professionals or team members, providing them with the necessary access to review or edit. Moreover, version control functionalities enable you to keep track of changes made to documents, ensuring that you always have access to the most up-to-date information.

Best practices for using the tax organizer form effectively

To ensure accuracy and completeness when utilizing the tax organizer form, double-checking entries before final submission is critical. Always cross-reference figures with your financial documents to avoid discrepancies that could lead to audit issues. It is also prudent to keep a separate checklist of items needed to complete the form to minimize the risk of missing any information.

Some common pitfalls include rushing the filling-out process or blindly assuming that previous years’ values still apply. Every year brings changes in tax laws and personal circumstances, so consulting a tax professional when unsure is wise. They can provide invaluable insight, especially for more complex situations, ensuring your tax organizer form is filled out correctly.

Frequently asked questions (FAQs)

Many users have similar queries when it comes to the tax organizer form. Common questions revolve around what information should be included and how to handle unique tax situations. Another frequent topic is troubleshooting: for instance, what to do if you encounter technical issues or need further guidance using pdfFiller.

Optimizing your experience with pdfFiller can be achieved by taking full advantage of available tutorials and user support. The platform offers a wealth of knowledge articles and step-by-step guides that can aid in clarifying the intricacies of using the tax organizer form effectively.

Client testimonials and user experiences

Users have reported significant improvements in their tax preparation processes thanks to the tax organizer form. Many success stories highlight how the structured format and accessible features of pdfFiller have minimized stress and errors associated with filing taxes. Teams, in particular, benefit from the collaborative tools available on the platform, ensuring everyone stays informed and accountable.

Several case studies demonstrate how organizations have transformed their document-handling during tax season. By adopting the tax organizer form via pdfFiller, businesses have experienced smoother workflows and enhanced communication among team members, ultimately increasing efficiency when it matters most.

Related content for enhanced understanding

For those wishing to deepen their understanding of tax matters, related articles and guides can provide additional insights. Topics might include specific deductions or credits, or links to tax workshops and webinars hosted by pdfFiller that cover current tax law changes and best practices for filings.

Moreover, exploring complementary forms and worksheets available through pdfFiller can further aid in the tax preparation journey, providing users with all necessary resources at their fingertips for a complete filing experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify tax organizer without leaving Google Drive?

How can I send tax organizer for eSignature?

How do I edit tax organizer on an Android device?

What is tax organizer?

Who is required to file tax organizer?

How to fill out tax organizer?

What is the purpose of tax organizer?

What information must be reported on tax organizer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.