Get the free Ach Authorization Form

Get, Create, Make and Sign ach authorization form

Editing ach authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ach authorization form

How to fill out ach authorization form

Who needs ach authorization form?

ACH authorization form: A comprehensive how-to guide

Understanding ACH authorization forms

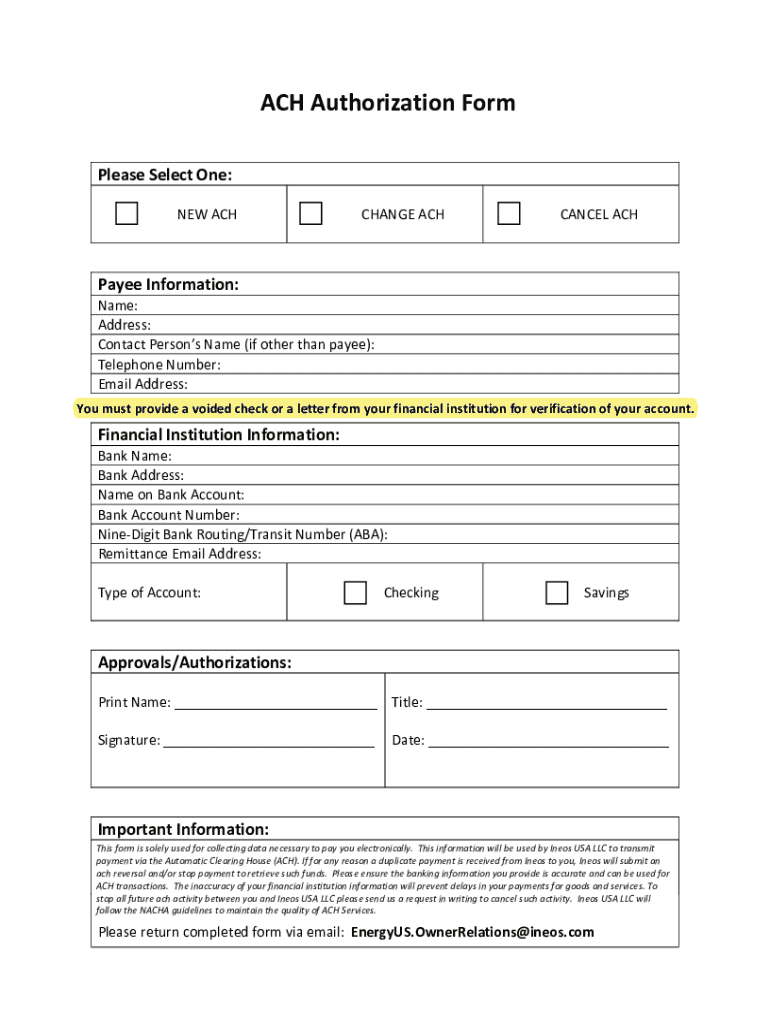

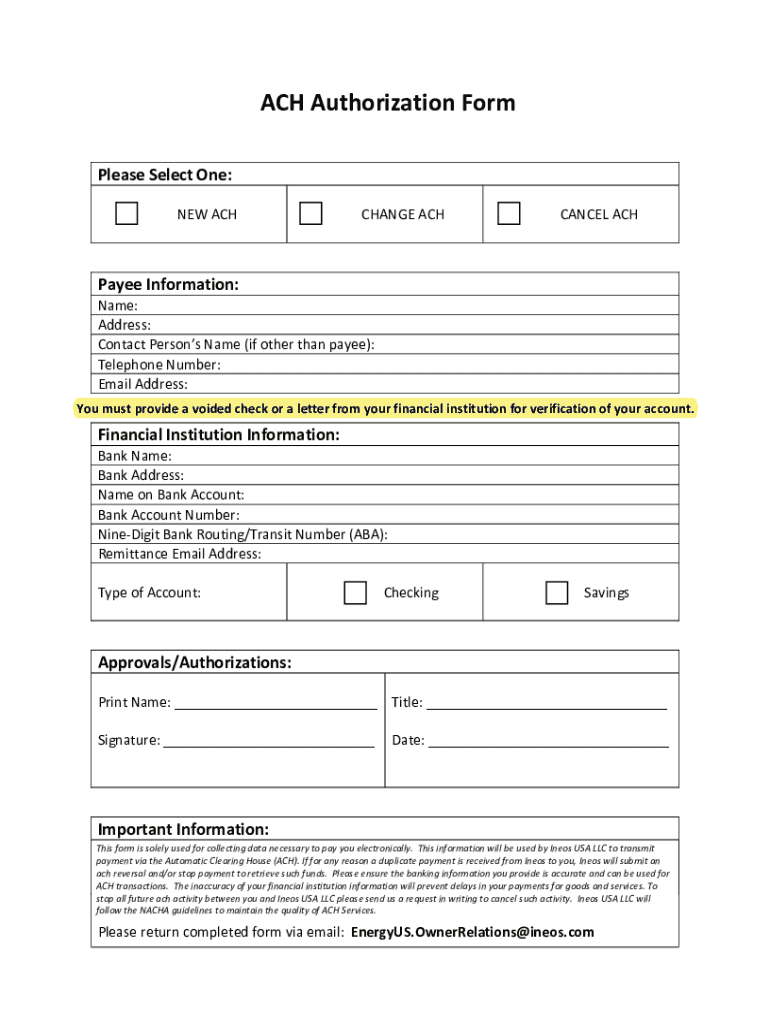

An ACH authorization form is a critical document used in the realm of automated clearing house (ACH) transactions, enabling individuals and businesses to authorize direct payments from their bank accounts. These forms allow for seamless transactions, whether for payroll, bill payments, or other periodic expenses. The underlying purpose of the ACH authorization is to facilitate clear communication and consent between the account holder and the entity initiating the transaction, thereby reducing errors and disputes.

The importance of ACH authorization in payment processing cannot be overstated. By providing a secured method of authorizing debit and credit transactions, these forms protect both consumers and businesses from fraud. This makes them an essential component of any financial transaction where funds are moved electronically. ACH authorization forms are employed across various applications, highlighting their versatility for both personal and business needs. From setting up recurring utility payments at home to establishing payroll for employees in a corporate environment, these forms play a vital role in ensuring timely and accurate payment processing.

Types of ACH authorization forms

ACH authorization forms come in different formats, mainly categorized into two types: ACH debit authorization forms and ACH credit authorization forms. An ACH debit authorization form allows a company to withdraw funds from a customer's account for services rendered, such as subscription services, loan payments, or utilities. Conversely, an ACH credit authorization form enables businesses to deposit funds into an account, such as payroll or tax refunds.

When choosing a format, understanding the differences between electronic and paper forms is crucial. Electronic forms offer benefits like convenience and faster processing, while paper forms can sometimes provide a tangible record for compliance. Each format has its pros and cons, making it essential to consider the intended use and the preferences of individuals involved. Additionally, compliance is paramount. Ensuring that your chosen form aligns with regulations set forth by organizations like NACHA (National Automated Clearing House Association) is critical to avoid penalties and complications.

How to fill out an ACH authorization form

Filling out an ACH authorization form correctly is essential for preventing errors in processing transactions. Follow these step-by-step instructions to ensure completeness and accuracy:

Additionally, consider filling out optional fields that may ask for account type, the amount of the transaction (if applicable), and any pertinent notes regarding the authorization. To avoid any delays, review the completed form for accuracy before submitting.

Creating an ACH authorization form

Creating an ACH authorization form is simplified with tools like pdfFiller. Start by using this platform to design your own form, aligning it with your specific business or personal requirements. The software allows users to either create a form from scratch or use pre-made templates that save time and effort. These templates can be customized to include your branding and specific language that resonates with your target audience.

Customization options in pdfFiller let you add logos, adjust layouts, and modify required fields according to your needs. This degree of flexibility helps ensure that your ACH authorization forms are not only functional but also visually appealing, making them easier for clients to complete.

Managing ACH authorizations

Once your ACH authorization forms are in circulation, managing them effectively is crucial. Tracking payments can be streamlined with software that allows you to view transaction history and identify any discrepancies or delays promptly. pdfFiller provides tools for users to monitor the authorizations, ensuring that rows upon rows of transaction data become manageable and easily analyzed.

Additionally, if existing authorizations need to be edited—perhaps to change the payment amount or update banking details—pdfFiller provides a step-by-step guide to make those amendments. Collaborative features also allow team members to work together on forms, offering the ability to share updates and ensure that all relevant individuals are on the same page with each transaction.

Cancellation of ACH authorizations

Understanding how to cancel an ACH authorization is just as important as setting it up. To initiate a cancellation process, you should notify the company or individual that is receiving payments immediately. Provide them with necessary details such as your name, account number, and the date of the original authorization to ensure they can process your request efficiently.

Effective cancellations also require adherence to compliance norms. Record the cancellation with appropriate response confirmation to avoid future deductions. Common mistakes include failing to send cancellation requests in a timely manner or neglecting to verify that the cancellation was processed. Always follow up to ensure that transactions have stopped as stated.

Clarifying differences between ACH debit and credit authorizations

It's essential to distinguish between ACH debit and credit authorizations. ACH debit authorizations are used when funds are drawn from a bank account, typically for recurring payments like services or dues. On the other hand, ACH credit authorizations are utilized when funds are being deposited into an account—for example, payroll or refunds.

When deciding which type of authorization to use, consider the nature of the transaction. If you are setting up a payment to a provider, you will require a debit authorization form. Conversely, if you are receiving payments, like company salaries or customer refunds, a credit authorization is necessary. Understanding these distinctions is key to the successful management of ACH transactions.

Compliance and best practices for ACH authorization forms

Compliance with ACH regulations ensures a secure and effective payment process. Adhering to the NACHA rules is crucial, as they govern the conduct of ACH transactions. Key compliance issues often include incorrect account numbers, unauthorized transactions, and insufficient security measures. Being aware of such issues helps mitigate potential problems.

Best practices for managing ACH authorization forms include validating information before submission, regularly updating payment details, securing forms, and maintaining clear communication with all parties involved. Furthermore, prioritize clients' privacy and security by using encryption when transmitting sensitive information to protect against data breaches.

Making the most of ACH authorizations with pdfFiller

pdfFiller enhances the ACH authorization process significantly. Its cloud-based platform allows users to access, edit, and store documents anywhere at any time. This flexibility supports the remote working environment many are adopting today. Collaboration tools integrated into pdfFiller mean that teams can work together on forms, sharing insights and feedback instantly for a more synchronized workflow.

Additionally, pdfFiller’s eSigning features allow documents to be legally signed quickly, bypassing the need for physical signatures that can delay transactions. Users have reported increased efficiency in their payment processing and improved document management, underscoring the positive impact of leveraging cloud solutions for ACH authorizations.

Frequently asked questions about ACH authorizations

As with any process involving finances, questions abound regarding ACH authorizations. Some common queries include: What happens if a transaction is disputed? How do I address unauthorized withdrawals? Clarifying these points assures users that they can rely on the system. Misconceptions also need addressing; for instance, many people believe that ACH transactions can easily be reversed, while in fact, proper authorization must be provided for any adjustment or cancellation.

This section provides clarity on common issues and serves as a resource for both newcomers and seasoned users of ACH authorization forms, promoting an informed approach to their use.

Conclusion: Streamlining your ACH authorization process

Effectively managing your ACH authorization forms is vital for optimizing financial transactions. Utilizing a cloud-based solution like pdfFiller not only enhances document management but also simplifies the entire process, allowing users to focus on their core activities without worrying about the intricacies of paperwork. The ability to edit, sign, and collaborate in real time ensures a streamlined approach to ACH transactions, leading to a more productive workflow.

By taking advantage of the features offered by pdfFiller, users gain peace of mind and efficiency in managing their ACH authorizations, fostering stronger financial relationships and ensuring compliance throughout the payment process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my ach authorization form in Gmail?

Can I edit ach authorization form on an iOS device?

How do I complete ach authorization form on an Android device?

What is ach authorization form?

Who is required to file ach authorization form?

How to fill out ach authorization form?

What is the purpose of ach authorization form?

What information must be reported on ach authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.