Get the free Ftb 3885p 2024

Get, Create, Make and Sign ftb 3885p 2024

How to edit ftb 3885p 2024 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ftb 3885p 2024

How to fill out ftb 3885p 2024

Who needs ftb 3885p 2024?

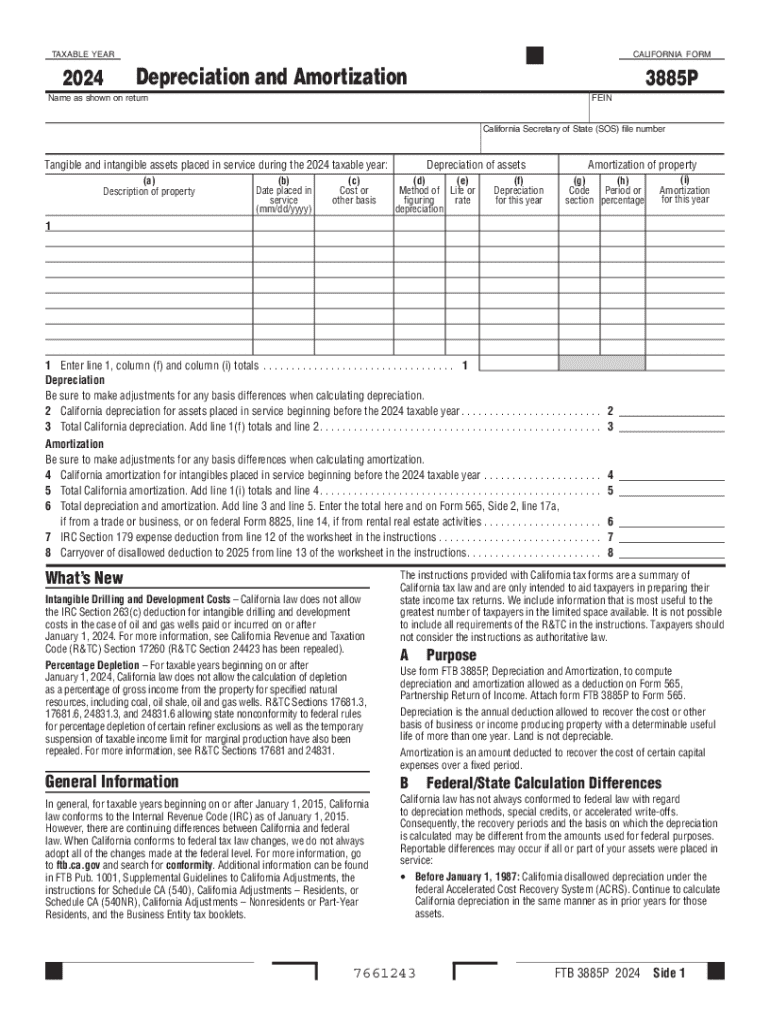

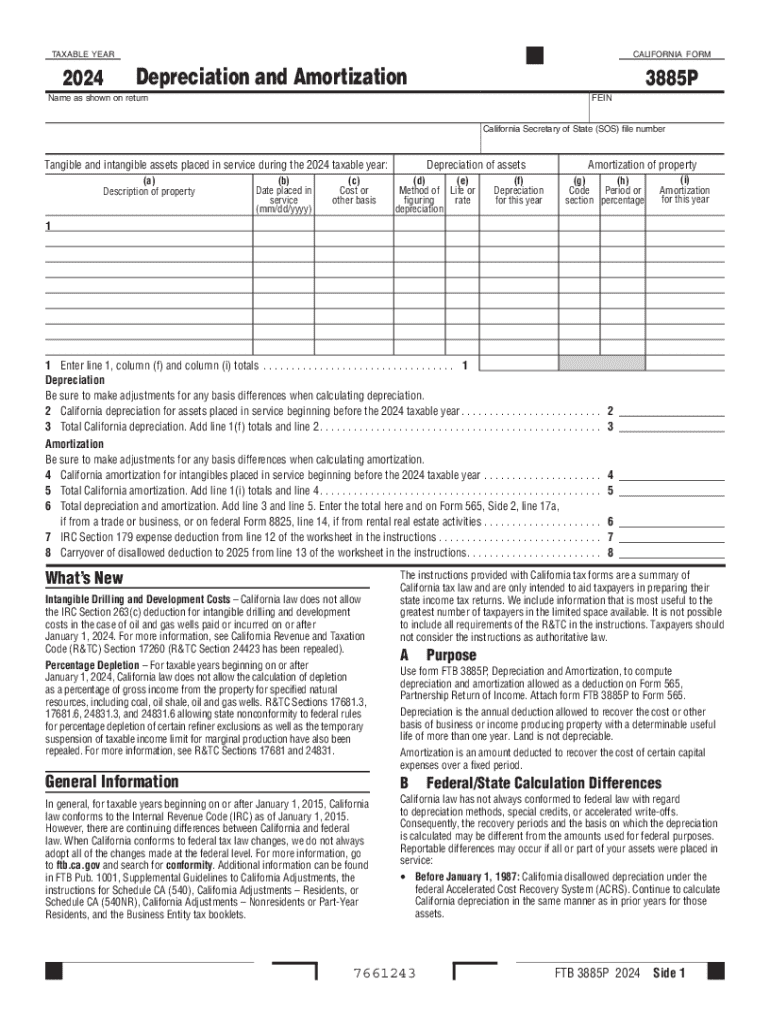

FTB 3885P 2024 Form: A Comprehensive How-to Guide

Understanding the FTB 3885P form

The FTB 3885P form is pivotal for California taxpayers as it facilitates the claim for the California Child and Dependent Care Expenses Credit. The 2024 version of this form is particularly significant due to recent adjustments in tax regulations and eligibility criteria.

Taxpayers who incur expenses for the care of dependents while they work or look for work must file this form. This applies especially to those who utilize the services of daycare providers, after-school care, or custodial programs.

Key features of the 2024 FTB 3885P form

The 2024 FTB 3885P form introduces critical updates that affect eligibility and how claims are calculated. Notably, adjustments to income thresholds may allow more taxpayers to qualify for the credit, reflecting the state's commitment to support families during challenging economic times.

These changes are expected to impact low to middle-income households significantly, as the newfound eligibility may alleviate some financial burdens. Taxpayers should consider these updates seriously as they prepare their filings for the year.

Step-by-step guide to filling out the FTB 3885P form

Before diving into filling out the FTB 3885P form, proper preparation is vital. Begin by gathering key documents such as Social Security numbers of all qualifying individuals, records of dependent care expenses, and any relevant tax documents from your employer.

Next, carefully fill out the sections of the form.

Detailed breakdown of sections

Section A requires personal information, such as your name and address. It’s crucial to enter this information accurately to avoid processing delays. In Section B, you must report income information, which encompasses wages, salaries, and taxable benefits.

Section C pertains to deductions and credits, where you'll articulate your eligible dependent care expenses. Lastly, Section D is where you must provide signatures and declarations, reflecting your commitment to the correctness of provided information. Common mistakes include misreporting dependent care costs or neglecting to check for signature requirements.

Editing and customizing your FTB 3885P form

Using pdfFiller for completing the FTB 3885P form allows for efficient editing of your documents. With pdfFiller's features, you can modify text, update necessary sections, and ensure your form conveys accurate information.

Collaborating with others on your submission is simple—pdfFiller provides tools that enhance teamwork through real-time edits and comments.

Submitting your FTB 3885P form

Once the form is complete, you have several avenues for submission. E-filing is often the most efficient method, allowing for immediate processing, while paper filing can take longer due to postal delays.

After filing, confirm successful submission. Most taxpayers receive an acknowledgment from the FTB, which acts as confirmation that your form has been received.

Collaborating on your FTB 3885P form

Collaboration on the FTB 3885P form can be vital whether you are a business team member or a family filing jointly. With pdfFiller, sharing documents securely ensures that only authorized users have access.

Managing your FTB 3885P form post-submission

After submitting the FTB 3885P form, tracking its status becomes essential. Taxpayers can check the FTB's online portal for processing updates, ensuring that they are notified of any issues.

FAQs about the FTB 3885P form

Many taxpayers have questions regarding the FTB 3885P form, especially concerning eligibility and filing intricacies. It is crucial to consult available resources to understand if you qualify for the credit.

Resources and tools for further assistance

For further assistance with the FTB 3885P form, several resources can guide you through the process. The California FTB website offers official guidelines, while pdfFiller provides essential tools for efficient form management.

Importance of staying updated with FTB guidelines

Staying informed about the latest tax guidelines from the FTB is paramount. This ensures compliance and maximizes benefits afforded by credits such as those in the FTB 3885P form. The streamlined communication through platforms like pdfFiller keeps users updated on critical changes.

Success stories

Many users have enhanced their tax filing experience using pdfFiller to manage the FTB 3885P form. Their success stories illustrate how they efficiently navigated the complexities with the help of the collaborative tools and seamless editing options available.

Contact information for expert help

For personalized assistance regarding the FTB 3885P form, pdfFiller offers dedicated support. Users can easily reach out and acquire help tailored to their specific needs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get ftb 3885p 2024?

How do I edit ftb 3885p 2024 online?

Can I create an electronic signature for the ftb 3885p 2024 in Chrome?

What is ftb 3885p 2024?

Who is required to file ftb 3885p 2024?

How to fill out ftb 3885p 2024?

What is the purpose of ftb 3885p 2024?

What information must be reported on ftb 3885p 2024?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.