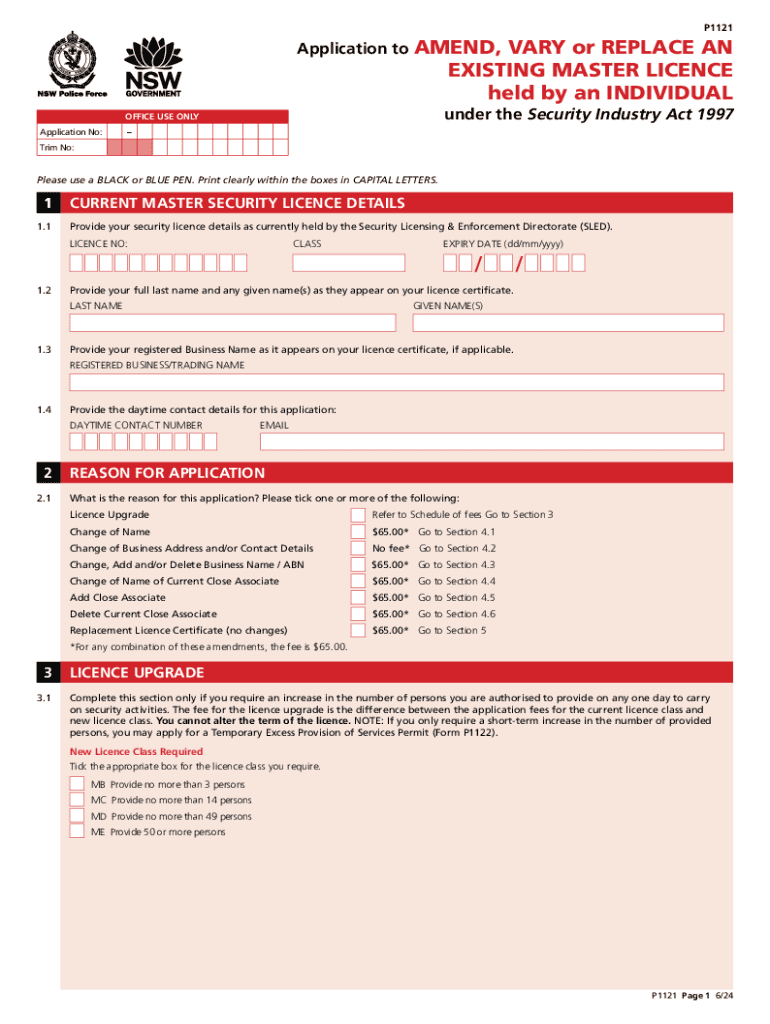

Get the free P1121

Get, Create, Make and Sign p1121

How to edit p1121 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out p1121

How to fill out p1121

Who needs p1121?

A Comprehensive Guide to the p1121 Form

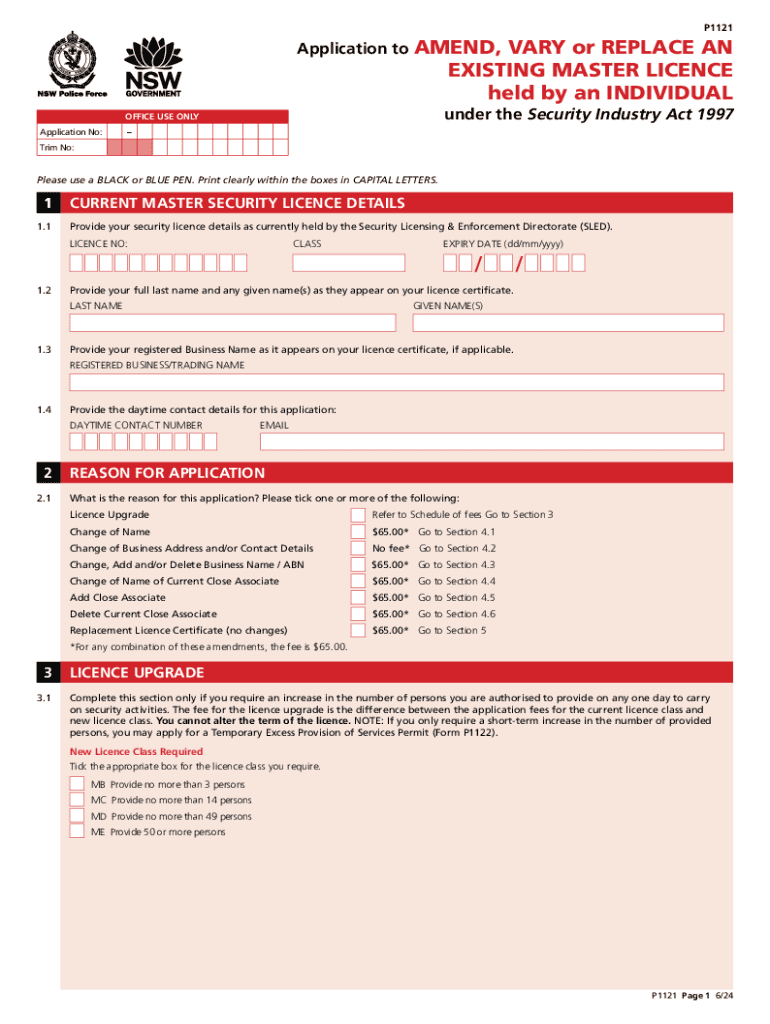

Understanding the p1121 Form

The p1121 form is an essential document utilized in various administrative and legal processes. Its primary purpose involves facilitating the reporting or request for specific information pertaining to individuals or teams. This form plays a vital role in ensuring compliance with regulatory standards, enabling organizations to maintain accurate records while also providing a straightforward way to document essential information.

Common use cases include scenarios where individuals or teams need to submit personal or team-related data to meet compliance guidelines, participate in grant applications, or fulfill requirements for certain organizational functions. Knowing when and how to use the p1121 form is crucial for effective document management.

Who needs to use the p1121 form?

The target audience for the p1121 form includes individuals, business teams, and nonprofit organizations among others. Any entity that requires formal documentation for compliance or reporting purposes would benefit from using this form.

Eligibility to use the p1121 form typically includes individuals over a certain age who are engaged in activities that necessitate administrative reporting. Businesses or organizations seeking to formalize their data collection and reporting processes also have a vested interest in utilizing this form to maintain good standing with their regulatory bodies.

Detailed insight into the p1121 form components

The p1121 form consists of various key sections that each serve specific purposes. Understanding what's required in each section is crucial for successful completion. Common sections found in the p1121 form include personal identification details, purpose of the form, and a declaration of information accuracy.

For personal identification, you typically need to provide your name, address, and contact information. In the purpose section, it's important to clearly articulate the aim of the submission. Last but not least, the declaration section often requires you to affirm the completeness and accuracy of the information provided, reflecting legal accountability.

Key terminology explained

Understanding key terminology used within the p1121 form is important. Some of the terms include 'compliance,' which refers to adhering to laws or regulations; 'declaration,' a formal statement; and 'submission,' which indicates the act of formally presenting the completed form to the relevant authority.

Step-by-step guide to filling out the p1121 form

Filling out the p1121 form requires careful preparation to ensure all required details are accurately captured. Begin by gathering necessary documents such as identification proof, previous submissions if applicable, and any supplementary information that may be needed.

Before diving into completion, review the specific guidelines available for the p1121 form to clarify any uncertainties.

Once prepared, follow this step-by-step approach to filling out the p1121 form:

Common pitfalls include missing essential details or failing to provide supporting documents, which could lead to delays or rejections.

Verifying and reviewing your submission

Before submission, it's critical to verify and review your p1121 form. Make use of a checklist that encompasses essential items such as completeness of sections, accuracy of information, and inclusion of any required documents.

Double-checking all provided information can help ensure that your submission is accepted without complications. A meticulous review can save you time and resources in the long run.

Editing and updating your p1121 form

Circumstances may arise when you need to update the p1121 form to reflect new information, correct errors, or alter a previously stated purpose. It’s vital to recognize these situations as they pertain to compliance and accuracy.

Common scenarios that compel updates include changes in personal status, such as relocation or changes in contact info, or when organizational changes necessitate revisions of data.

To edit the p1121 form using pdfFiller, follow these steps:

Using pdfFiller’s tools simplifies the editing process and allows for easy version management, ensuring you can keep track of changes effortlessly.

Signing and submitting the p1121 form

Once you've filled out the p1121 form, the next essential aspect is signing it. Choosing the right signing method is crucial, especially if you are working remotely.

pdfFiller offers several eSignature options, making it easier to comply with legal requirements for electronic signatures. Electronic signatures on the p1121 form are generally accepted as legally binding, provided they meet regulatory standards.

Here are the submission options you can consider:

Be cautious of common submission mistakes, such as incorrect recipient addresses or incomplete forms, which can lead to delays or compliance issues.

Managing your p1121 form with pdfFiller

Once submitted, managing your p1121 form effectively is key. Using the pdfFiller dashboard allows you to organize your forms efficiently.

You can create folders and utilize tags for easy retrieval of essential documents, which is particularly useful for teams working collaboratively.

Collaboration features within pdfFiller enhance teamwork, allowing users to edit the p1121 form simultaneously and provide feedback easily. Best practices involve clearly assigning roles in the collaborative environment, enabling a seamless workflow.

Frequently asked questions about the p1121 form

As with any administrative document, questions often arise regarding the p1121 form. Addressing common concerns can help reduce confusion and streamline the process.

Common questions include inquiries about how to correct a submitted form, the legal implications of electronic signatures, and what to do if the form is lost.

For troubleshooting common issues, it’s crucial to refer back to the original submission guidelines and maintain a thorough understanding of the requirements that govern the p1121 form.

Additional tips and best practices

Maximizing the use of pdfFiller for document management goes beyond just filling out the p1121 form. Utilizing features such as template creation, automatic reminders for updates, and document sharing can enhance overall efficiency.

Understanding compliance and security aspects is also paramount. Ensure your p1121 form complies with relevant regulations and take full advantage of pdfFiller’s security features, which protect your sensitive data through encryption and secure storage.

Feedback and support

Should you require assistance, reaching out to pdfFiller’s customer support is straightforward. They offer various resources, including live chat and comprehensive articles, to help guide users through any challenges.

Encouraging users to share their experiences not only contributes to continuous improvement but also promotes community learning regarding the p1121 form usage.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find p1121?

How do I edit p1121 in Chrome?

How can I edit p1121 on a smartphone?

What is p1121?

Who is required to file p1121?

How to fill out p1121?

What is the purpose of p1121?

What information must be reported on p1121?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.