Get the free Unpaid Funds Collection for Cookie Program Gseok 306

Get, Create, Make and Sign unpaid funds collection for

Editing unpaid funds collection for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out unpaid funds collection for

How to fill out unpaid funds collection for

Who needs unpaid funds collection for?

Unpaid Funds Collection for Form

Understanding unpaid funds

Unpaid funds refer to money that is owed to an individual or organization but has not yet been received. It commonly arises from various financial transactions, including refunds, benefits, and other forms of monetary exchanges. Understanding what unpaid funds are is crucial for effective collection and management.

The reasons behind unpaid funds can vary significantly. Some typical causes include administrative errors, lack of communication, financial difficulties of the debtor, or failure to meet conditions outlined in agreements. Furthermore, the legal framework surrounding unpaid funds often involves specific regulations that govern the collection processes, which vary from state to state.

The importance of collecting unpaid funds

Collecting unpaid funds is vital for ensuring that individuals and entities maintain their financial health. For businesses, unpaid debts can disrupt cash flow, adversely affecting operations and growth potential. Individuals may find themselves in precarious financial situations if they fail to reclaim funds owed to them.

Proper documentation plays a pivotal role in this process. It verifies claims and ensures that all parties understand their rights and obligations, ultimately facilitating smoother interactions with authorities. The consequences of inaction can be severe, leading to financial losses and missed opportunities for individuals and businesses alike.

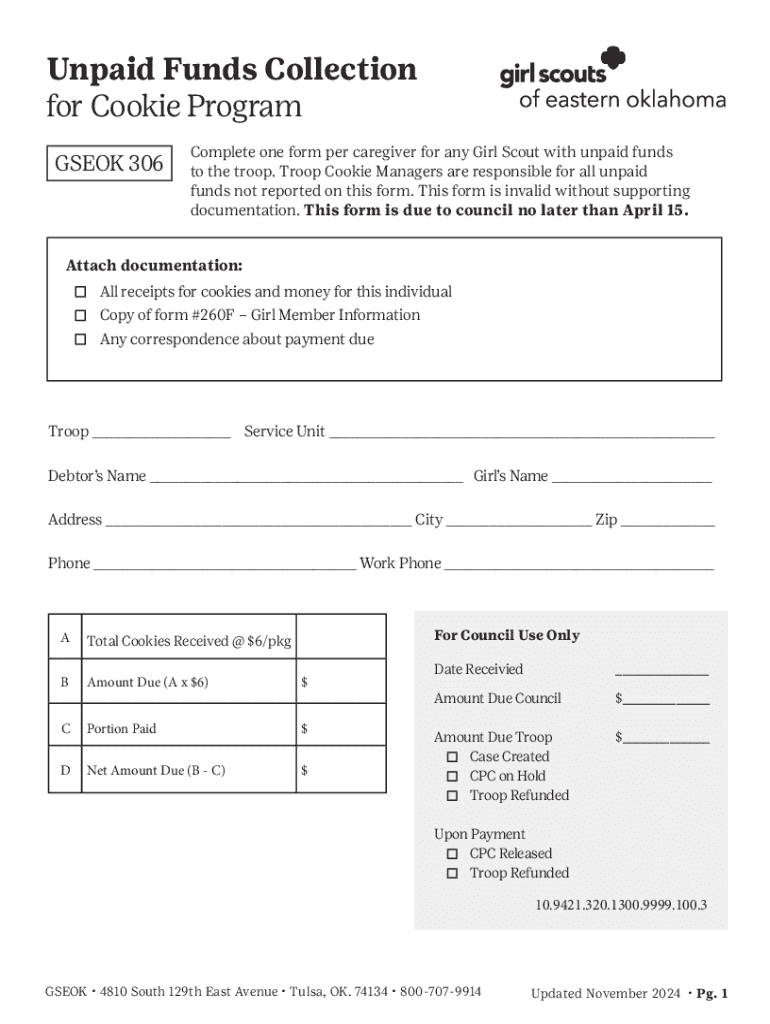

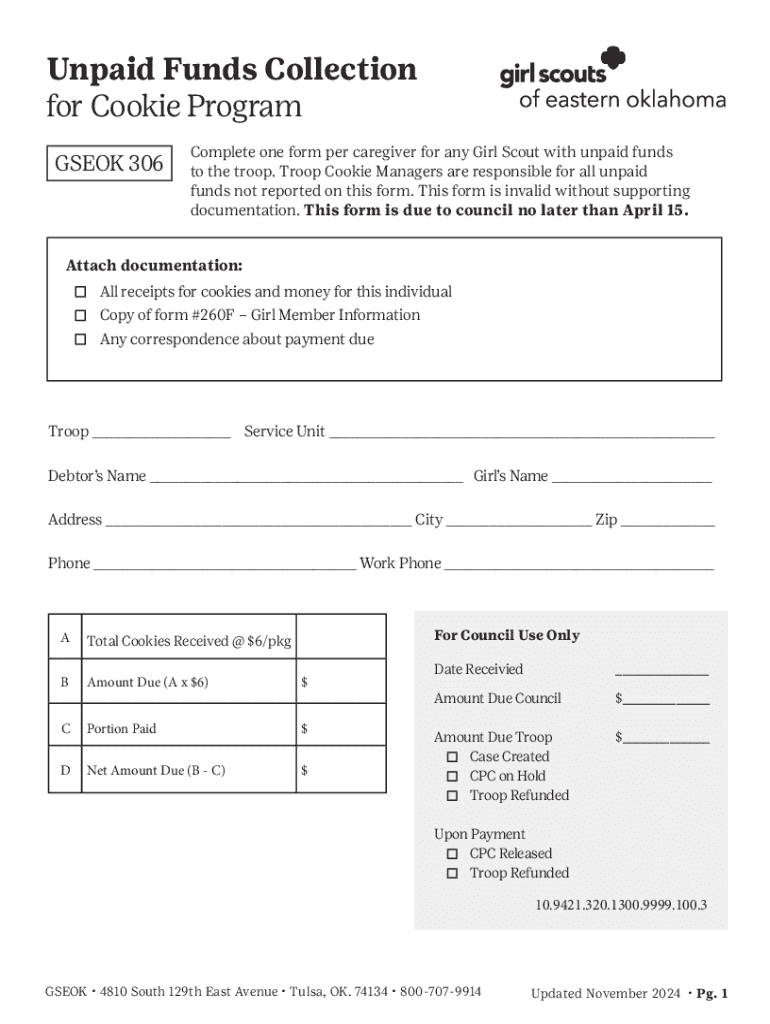

Types of forms involved in unpaid funds collection

Various forms are used to aid in the collection of unpaid funds. Understanding these forms is crucial for successfully claiming what's owed. Common examples include tax refund claim forms, unclaimed property forms, and benefit claims forms.

The required documentation for these forms may vary based on jurisdiction, which is crucial to keep in mind when preparing your submissions.

Steps to collecting unpaid funds

Successfully collecting unpaid funds involves a systematic approach. Here are the steps individuals and organizations should follow:

Utilizing pdfFiller for unpaid funds collection

pdfFiller significantly enhances the process of collecting unpaid funds by providing users with powerful document management tools. The platform allows seamless editing of PDFs, ensuring that users can modify forms as needed. With eSigning capabilities, individuals can quickly and securely sign documents, enabling faster submissions.

Furthermore, pdfFiller offers collaborative tools that are especially beneficial for teams looking to manage claims collectively. To navigate pdfFiller for unpaid funds forms:

FAQs on unpaid funds collection

Understanding the nuances surrounding unpaid funds can be challenging. Here are some common questions individuals often have related to unpaid funds collection:

By anticipating these queries, individuals can approach the unpaid funds collection process with greater confidence and clarity.

Case studies: Successful unpaid funds claims

Examining real-life examples of successful unpaid funds claims can provide valuable insights. For instance, one individual vividly recalled tracing missing tax refunds, identifying the correct forms through diligent research, ensuring timely submission, and ultimately receiving a substantial reimbursement.

Another case involved a small business that managed to recover thousands in unclaimed property by coordinating with local government offices. Each example reinforces the importance of thorough preparation and persistence in the claims process.

Additional considerations

After successfully claiming unpaid funds, it's essential to maintain accurate records for future reference and potential audits. Implementing proactive strategies to minimize the risk of unpaid funds can also be beneficial. This includes regularly monitoring financial accounts, staying informed about deadlines for claims, and investing in financial management education.

Final thoughts on managing unpaid funds

Staying organized throughout the unpaid funds collection process is crucial to avoid unnecessary complications. Future implications of unpaid funds management hinge on understanding processes and leveraging technology, such as pdfFiller, which simplifies documentation preparation. Embracing these tools can greatly enhance your success in reclaiming unpaid funds.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find unpaid funds collection for?

How can I edit unpaid funds collection for on a smartphone?

How do I edit unpaid funds collection for on an Android device?

What is unpaid funds collection for?

Who is required to file unpaid funds collection for?

How to fill out unpaid funds collection for?

What is the purpose of unpaid funds collection for?

What information must be reported on unpaid funds collection for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.