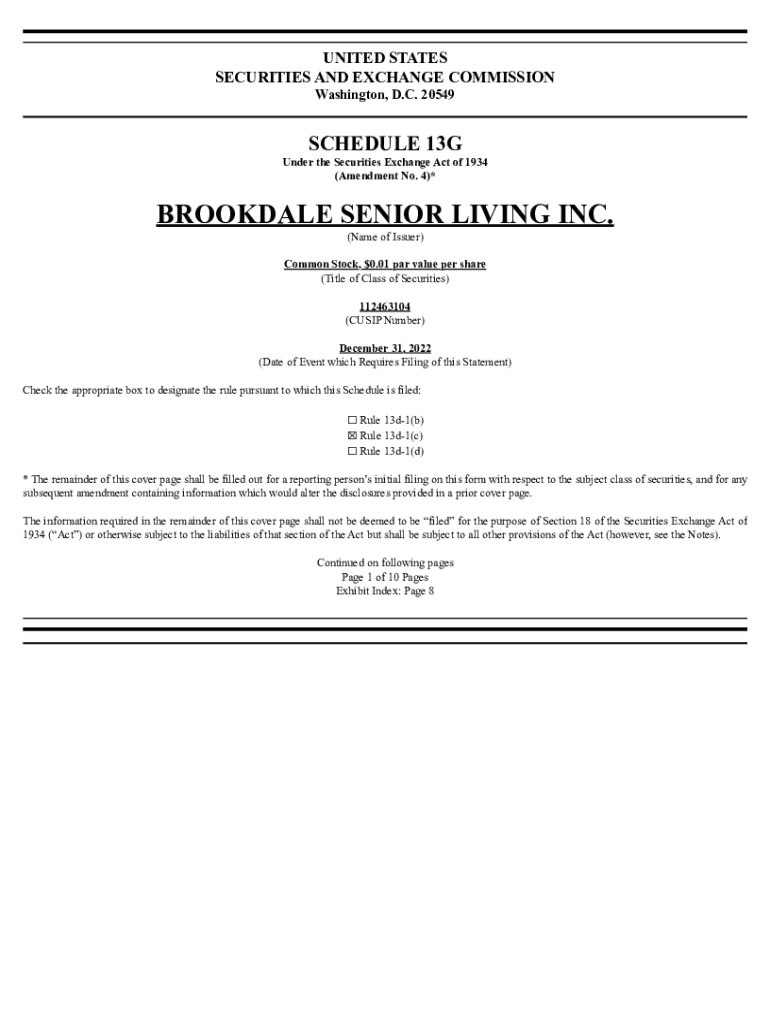

Get the free Schedule 13g

Get, Create, Make and Sign schedule 13g

How to edit schedule 13g online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule 13g

How to fill out schedule 13g

Who needs schedule 13g?

Understanding Schedule 13G Form: A Comprehensive Guide

Understanding the Schedule 13G form

The Schedule 13G form is a vital document utilized by investors to disclose their holdings in publicly traded companies within the United States. Specifically, it is designed for passive investors who acquire over 5% of a company's equity securities, allowing them to report their ownership transparently while avoiding the more burdensome Schedule 13D requirements.

The primary purpose of the Schedule 13G filing is to provide clear information to the public, the SEC, and the companies themselves concerning significant shareholders. Unlike Schedule 13D, which is used by activist investors intent on influencing management or control, Schedule 13G reflects passive ownership, primarily meant to keep the shareholders informed about who holds significant stakes in the company. This distinction is pivotal in shaping perceptions about corporate governance and investor intentions.

Who must file the Schedule 13G?

Filing a Schedule 13G is not just limited to any investor; specific eligibility requirements must be met. Primarily, individuals or institutions that acquire more than 5% of a class of a company's equity securities may need to file this form if their acquisition is passive. This includes mutual funds, pension funds, and family offices, which typically do not have aims to control or intervene in corporate governance.

Furthermore, certain exemptions exist under Schedule 13G. For instance, qualified institutional investors can file if they hold the securities for investment purposes only, without the intention of changing or influencing the company's management. Additionally, foreign investors may have different considerations depending on their home country's regulations.

Key information required in a Schedule 13G filing

Completing a Schedule 13G form necessitates accurate and comprehensive information to fulfill regulatory requirements. Investors must provide their identification details, which typically include the name, address, and date of birth for individuals, or the name and business address for institutional investors. This transparency is essential for maintaining corporate governance standards.

In addition to identification details, the filing must disclose the total number of shares owned and the corresponding percentage of ownership. This information illustrates the control or influence the shareholder may have over the target company. Moreover, the nature of ownership—whether it is sole, shared, or another identifiable form—must be specified. If the investor wishes to maintain the confidentiality of their identity, they may also provide information that protects their identity while still complying with SEC regulations.

Filing deadlines and timelines

Filing a Schedule 13G comes with specific timelines that must be adhered to avoid penalties. The initial filing is required within 45 days after the end of the calendar year in which the investor exceeds the 5% ownership threshold. This deadline ensures that the public, as well as the SEC, remain informed about significant shareholder changes swiftly.

After the initial filing, investors are also obligated to review and submit updates annually, maintaining accuracy across reported information. Failure to file within these deadlines can result in severe consequences, including penalties imposed by the SEC, which can incur hefty fines and diminish trust amongst investors.

Steps to fill out the Schedule 13G form

Completing the Schedule 13G form can seem daunting, but following these steps will ensure an organized and accurate filing. The first step is to gather all necessary documents and information, which includes details about your ownership of the company's stocks, personal identification, and any other relevant ownership clauses.

Once you’ve collected your documents, the next step involves accessing the Schedule 13G form via the SEC's EDGAR portal. Each relevant section of the form must be completed with accurate data, including personal information, beneficial ownership details, and the purpose of the filing. A well-prepared filing undergoes a review process to ensure compliance with SEC standards. This can be easily accomplished with digital document management tools like pdfFiller. Finally, after reviewing everything for accuracy, you can submit the form electronically or via mail.

Amendment requirements for Schedule 13G

Amendments to the Schedule 13G form may be required in specific circumstances. For instance, if there are any changes in ownership percentages, an amendment must be filed promptly. The SEC mandates that investors report if their stake undergoes a significant change, such as if their ownership crosses a new threshold.

To file an amendment, the same form can be utilized. However, it is essential to specify the nature of the amendment clearly and provide updated ownership details. This can include instances of acquiring or selling shares or when an investor's intention changes from passive to activist, necessitating a shift in filings to Schedule 13D.

Impact of Schedule 13G filings on public companies and investors

The implications of Schedule 13G filings can significantly influence both market perception and corporate governance. For public companies, a Schedule 13G filing indicates substantial ownership by passive investors, which may be interpreted as a sign of stability and long-term interest. This transparency often reassures other stakeholders and the broader market, creating a more favorable investment climate.

For investors, the filing serves as a useful indicator. Seeing who holds significant stakes and their intentions can inform investment decisions and align strategies with market trends. Companies and shareholders often respond to these filings proactively, gauging the implications of significant ownership changes and strategizing on retaining favorable relations with emergent investors.

FAQ: Common questions about Schedule 13G

The following are frequently asked questions regarding the Schedule 13G form, clarifying common misconceptions and practices associated with the filing process.

Best practices for filing Schedule 13G

To ensure compliance and facilitate the filing process, several best practices can be implemented. Investors should prioritize accuracy when entering information. Utilizing technology, such as pdfFiller, can streamline document management, allowing for efficient filing and record-keeping. It is also advisable to regularly review ownership and familiarize oneself with any changes in SEC regulations governing disclosures.

Additionally, maintaining open communication with potential investors and utilizing digital signatures for convenience can expedite the filing process. Collaboration among team members can enhance accuracy when preparing documents, ensuring all relevant data is captured correctly and timely.

Interactive tools for Schedule 13G management

In today’s fast-paced financial landscape, utilizing digital tools is essential for managing Schedule 13G filings effectively. Platforms like pdfFiller offer intuitive solutions that allow users to easily edit, eSign, and store their documents securely. These tools can simplify the filing process, providing templates and guides that make compliance straightforward and stress-free.

Moreover, cloud-based platforms enable investors to track their filings in real-time, ensuring they're always ahead of regulatory requirements. Implementing these tools not only enhances filing accuracy but also helps in maintaining organized documentation—a key factor in compliance.

Further learning and insights

To deepen your understanding of the regulations and requirements surrounding the Schedule 13G form, exploring related topics such as Schedule 13D, insider trading regulations, and SEC disclosure requirements can provide valuable context. Various academic and industry resources are available, including SEC guidelines and financial compliance literature that can enhance an investor's knowledge base.

Furthermore, keeping abreast of current financial news and updates on SEC regulations ensures continued compliance and a well-informed investment strategy. Recognizing new trends or legislative changes in the market can position investors favorably.

Shareholder communications and corporate compliance

Effective communication with shareholders post-filing is crucial for sustaining shareholder trust and engagement. After a Schedule 13G filing, companies must ensure they provide adequate context around significant ownership stakes, fostering transparency regarding their implications on corporate governance. Such transparency not only helps in maintaining compliance but also strengthens relationships with current and potential investors.

Moreover, as part of corporate obligations, timely notifications of any changes in ownership or intentions to the shareholders must be a priority. Maintaining a proactive approach to shareholder communication helps manage expectations and mitigates any uncertainties that may arise from ownership changes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find schedule 13g?

How do I fill out schedule 13g using my mobile device?

How do I edit schedule 13g on an iOS device?

What is schedule 13g?

Who is required to file schedule 13g?

How to fill out schedule 13g?

What is the purpose of schedule 13g?

What information must be reported on schedule 13g?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.