Get the free Income Tax Return Declaration

Get, Create, Make and Sign income tax return declaration

Editing income tax return declaration online

Uncompromising security for your PDF editing and eSignature needs

How to fill out income tax return declaration

How to fill out income tax return declaration

Who needs income tax return declaration?

Comprehensive Guide to the Income Tax Return Declaration Form

Overview of the income tax return declaration form

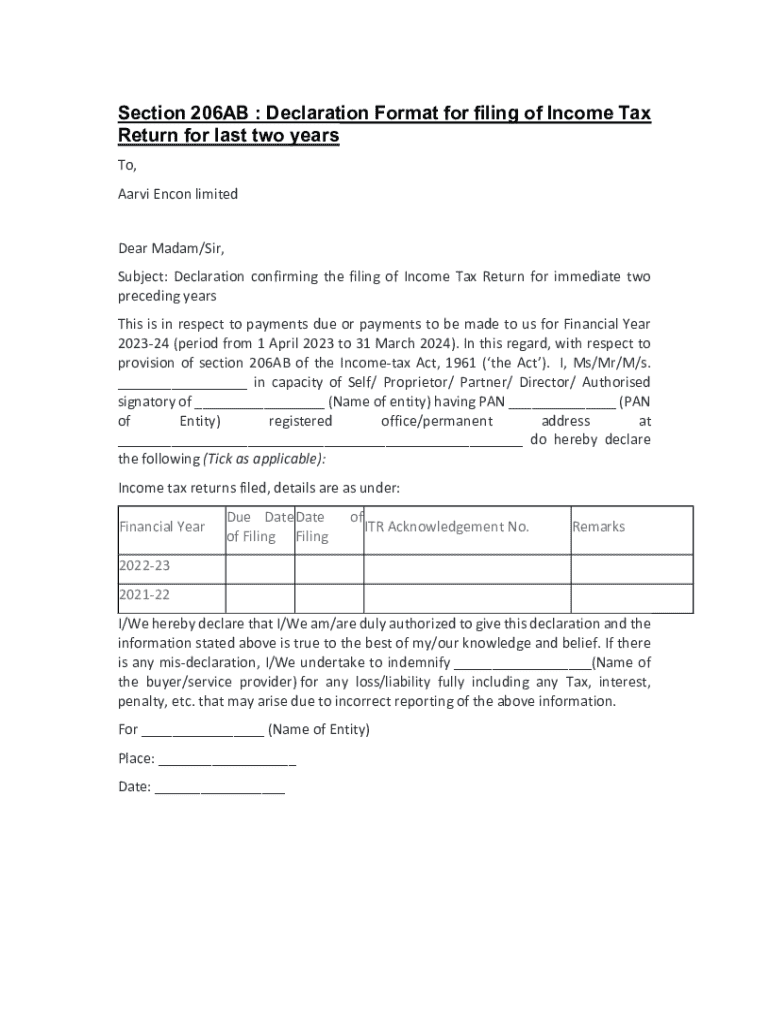

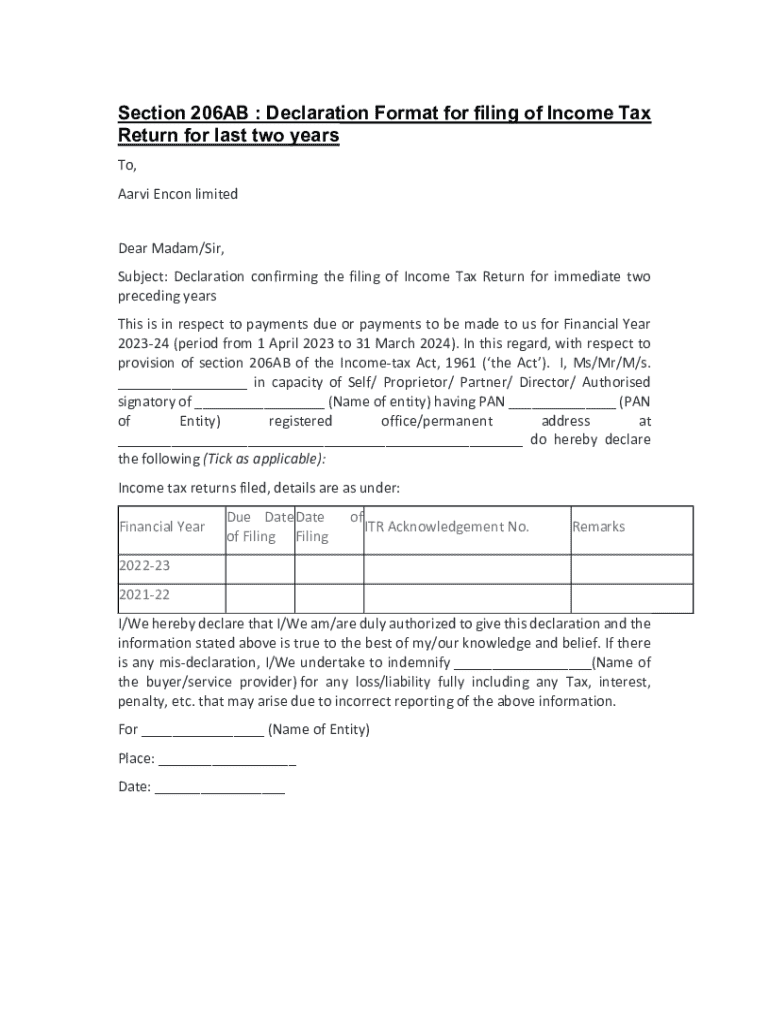

The income tax return declaration form is a crucial document that individuals and businesses must complete to report their income and calculate the taxes owed to the government. Its primary purpose is to ensure tax compliance, allowing both taxpayers and tax authorities to accurately assess tax liabilities. For individuals, this form serves as an opportunity to declare various sources of income, disclose deductions, and ultimately determine any tax refunds or dues.

Submitting the income tax return declaration form is of paramount importance not only for complying with legal requirements but also for maintaining a clean financial record. This is particularly significant for teams and organizations, as managing tax compliance can have implications on audits, operational risks, and overall financial health. Missing deadlines or inaccurately filing can lead to penalties, underscoring the importance of timely and accurate submissions.

Types of income tax return forms

Different income tax return forms cater to various types of taxpayers, each designed to accommodate specific financial situations. For example, ITR-1 is generally for individuals with a salary income, while ITR-2 is suited for those having income from house property or capital gains. Understanding these distinctions is crucial for selecting the right form.

Choosing the appropriate form impacts not only the filing process but also potential refunds or tax liabilities. Each form comes with distinct eligibility criteria, guiding taxpayers to ensure they are using the correct documentation. For instance, ITR-3 is for individuals and Hindu Undivided Families (HUFs) who have income from a business or profession, while ITR-4 is for those who prefer the presumptive taxation scheme.

Step-by-step guide for completing the income tax return declaration form

Completing the income tax return declaration form can seem daunting, but breaking it down into manageable steps simplifies the process. The first step is gathering all necessary documentation, such as Form 16, which summarizes salary details, and bank statements that reflect interest income. Additionally, investment proof for tax deductions, such as contributions to retirement accounts, should also be collated.

Once documentation is organized, accessing the form is the next crucial step. The income tax return declaration form can typically be found on the official government portal or pdfFiller, which provides an efficient platform for form access and completion. Users can navigate to the specific section of the form corresponding to their income type, ensuring the correct details are addressed.

Reviewing your information is critical to avoid errors that can delay processing or trigger audits. Common mistakes include incorrect personal details or miscalculated income. It’s advisable to double-check all entries against supporting documentation for accuracy.

Editing and customizing your form in pdfFiller

pdfFiller offers robust editing tools that enable users to customize their income tax return declaration forms efficiently. Users can add or modify text easily, ensuring that all information is current and accurate. Moreover, pdfFiller allows for the insertion of images and digital signatures, streamlining the paperwork process.

Collaboration is also a key feature of pdfFiller, allowing team members to share the form for input and suggestions. This can enhance accuracy and collective input in preparing tax documentation, making it ideal for teams managing business tax returns. Utilizing comment and suggestion features can foster effective communication among stakeholders.

eSigning your income tax return declaration form

eSigning has transformed the way we finalize documentation, making the process quicker and more secure. In the context of the income tax return declaration form, eSigning verifies the integrity of the document and affirms that the signatory has authored the information asserted within. The step-by-step process in pdfFiller allows users to securely eSign their forms, adding a layer of convenience.

Understanding the validity of eSignatures in legal contexts is essential. Electronic signatures are recognized legally in many jurisdictions, providing trust in transactions and fostering greater acceptance in digital documentation.

Submitting your income tax return

After completing your income tax return declaration form, the next important step is submission. Options for submission include online avenues through government portals or offline methods like postal mail. The online submission process is typically more efficient. To submit digitally, navigate to the government tax portal where you can upload your completed form securely.

Tracking your submission status is essential for peace of mind. After submission, users can check the status through the tax portal, ensuring that the form has been received and is under processing. This proactive approach helps address any potential issues promptly.

Managing your tax documentation

Proper management of tax documentation is critical for both current and future filings. pdfFiller provides a cloud storage solution, allowing users to securely store and organize documents related to their income tax return declaration form. This ensures that all necessary materials are accessible at any time, enhancing organization.

Setting reminders for future filings and deadlines can help streamline the filing process. By utilizing digital calendar tools in conjunction with pdfFiller, individuals can keep track of important tax-related dates, minimizing the risk of late submissions and ensuring compliance.

Frequently asked questions (FAQs)

Navigating the intricacies of the income tax return declaration form can give rise to questions. Common queries arise concerning eligibility, required documentation, and submission strategies. For instance, taxpayers often ask which income types are taxable or how to report deductions accurately.

Troubleshooting common issues can also enhance the filing experience. Many individuals experience confusion when filling out certain sections of the form, especially around deductions or tax calculations. Understanding these common hurdles empowers taxpayers to file correctly and confidently.

Related services and tools available through pdfFiller

pdfFiller is not just a platform for income tax return declaration forms; it offers integration with various accounting and financial software, enhancing the overall tax preparation experience. This integration allows for easy data transfer, ensuring that information is consistently accurate across platforms.

Furthermore, pdfFiller provides additional templates for related documentation, such as expense forms and financial statements. These templates can be essential for business tax returns and are designed to facilitate teamwork, ensuring that all necessary parties can contribute effectively.

Contacting support for assistance

When challenges arise during the completion and submission of your income tax return declaration form, reaching out for assistance can help alleviate stress. pdfFiller offers multiple support options, including live chat, email, and phone support. This multifaceted approach ensures that users can find help in a manner that suits their preferences.

Additionally, community forums and blogs offer user insights and shared experiences that can guide individuals through common issues, enriching the collective knowledge base surrounding tax preparation.

Upcoming changes and updates to tax regulations

Staying informed about changes in tax regulations is vital for accurate filings and strategic financial planning. Important legislative changes may alter deduction limits, tax rates, or eligibility criteria for various return forms. Keeping abreast of these updates allows taxpayers to align their financial strategies accordingly.

Resources for maintaining awareness include subscribing to newsletters from tax agencies, attending webinars, or following trusted tax advisors. Engaging with resources that provide timely updates ensures that you are well-prepared for future tax seasons.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the income tax return declaration in Chrome?

Can I create an electronic signature for signing my income tax return declaration in Gmail?

How do I fill out the income tax return declaration form on my smartphone?

What is income tax return declaration?

Who is required to file income tax return declaration?

How to fill out income tax return declaration?

What is the purpose of income tax return declaration?

What information must be reported on income tax return declaration?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.