Get the free Pc-e-10.4a (rev. 1-2021)

Get, Create, Make and Sign pc-e-104a rev 1-2021

How to edit pc-e-104a rev 1-2021 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pc-e-104a rev 1-2021

How to fill out pc-e-104a rev 1-2021

Who needs pc-e-104a rev 1-2021?

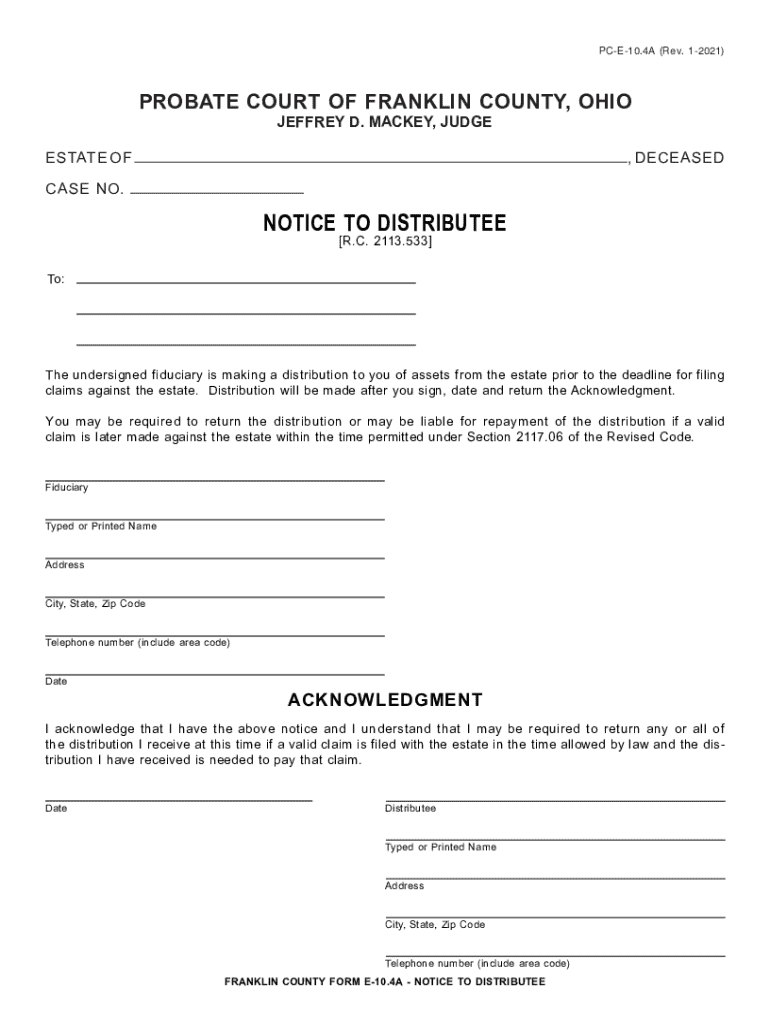

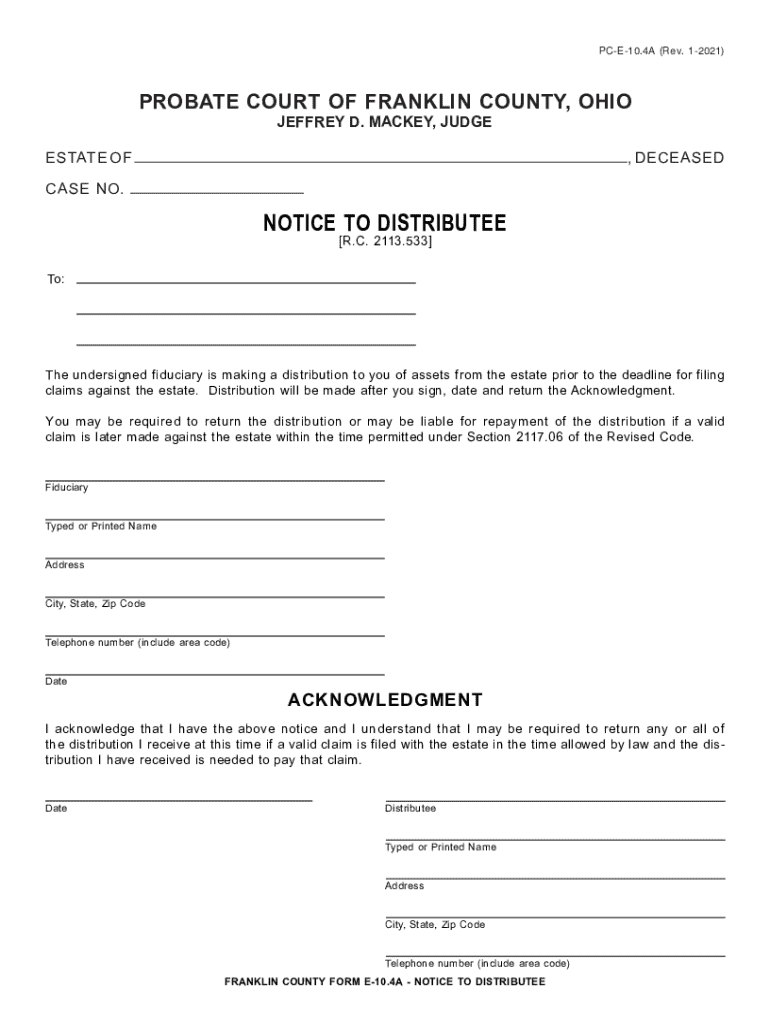

Comprehensive Guide to the PC-E-104A Rev 1-2021 Form

Overview of the PC-E-104A Rev 1-2021 Form

The PC-E-104A Rev 1-2021 form serves as a critical document primarily used for reporting various employment and income information, particularly in the context of compliance with tax regulations. With its significant implications for individuals and organizations, this form allows for accurate reporting and can streamline the process of financial assessment.

Common scenarios where the PC-E-104A form is required include job applications and income verification for loans, which are essential for both employers assessing candidate suitability and financial institutions evaluating loan applications. Understanding its purpose is fundamental for anyone involved in these processes.

The PC-E-104A form has several key features that enhance its utility. It includes clearly defined sections, prompts for necessary information, and a structured format that supports ease of completion. Compared to previous revisions, the 2021 edition introduces updates aimed at reflecting recent regulatory changes and improving user experience.

Getting started with the PC-E-104A form

To effectively use the PC-E-104A form, the first step is accessing it. You can find and download the form directly from pdfFiller’s website, which provides an optimized user interface that simplifies the retrieval process. Navigate to the pdfFiller platform and use the search function to locate the PC-E-104A Rev 1-2021 form. After locating it, you can easily download it in a PDF format.

Understanding the layout of the form is key to successful completion. The PC-E-104A is divided into several sections, including personal information, employment, and tax information. Each section has designated fields requiring specific data, which facilitates the organization of the information you provide.

Before filling out the form, prepare a checklist of required information and documents. Typically, you’ll need your Social Security number, details about your employment history, income statements, and any relevant tax information. Having this information readily available can speed up the process.

Step-by-step guide to filling out the PC-E-104A form

Filling out the PC-E-104A form can be straightforward if you follow a structured approach. Start with the personal information section, where you’ll be required to enter your full name, address, phone number, and email. Ensure that all details are accurate, as this information is critical for identification.

Personal Information Section

This section mandates details like your Social Security number and date of birth. Accuracy is paramount here, as discrepancies can lead to complications in processing.

Employment and Income Information

Next, you’ll report your employment and income information. Here, you should specify your current occupation, employer details, and income level. It’s essential to be precise and include any additional income sources. Misreporting can lead to penalties or delays.

Tax Information

If applicable, complete the tax information section by detailing your tax filing status and any relevant deductions or exemptions. This part can often be complex, so consider seeking guidance if you’re unsure.

Additional Sections

Finally, review any additional sections that might require information, such as agreements or attestations. Ensure each box is checked or filled as needed to avoid processing issues.

Common mistakes to avoid while completing the form include overlooking required fields and submitting without full validation. Always double-check your entries for accuracy.

Editing and customizing the PC-E-104A form with pdfFiller

Once you have the form completed, you may wish to edit or customize it further. To do this, upload the completed PC-E-104A form to pdfFiller. The platform supports various upload methods, including direct upload or integrating with cloud storage services.

Within pdfFiller, you can utilize an array of editing tools designed to enhance your document. These tools allow you to add text, insert signature fields, and annotate your form as needed, ensuring that it meets all your specific requirements.

Once editing is complete, saving your changes is straightforward. pdfFiller provides multiple options, enabling you to save, download, or share the edited form effortlessly.

Signing and submitting the PC-E-104A form

Submitting the completed PC-E-104A form involves signing it electronically, which is a convenient feature offered by pdfFiller. To eSign, simply use the electronic signature tool and follow the prompts to create or insert your signature.

After signing, you have various submission options at your disposal. You can email the form directly from pdfFiller, print it for physical submission, or save it for your records. Choose the method that best suits your requirements.

Monitoring the status of your submitted form is also possible. pdfFiller provides tools to track the progress of your submission, ensuring you are informed throughout the process.

Managing your PC-E-104A form

Effective management of the PC-E-104A form is crucial, especially for collaboration and future reference. Within pdfFiller, you can categorize and store your forms systematically, allowing for easy access whenever needed.

The platform also features robust collaboration tools. If you are part of a team, sharing the form for review is seamless, facilitating feedback and necessary adjustments before final submission.

Security is a top priority within pdfFiller. The platform employs advanced security features to protect your data, ensuring that all information in your documents remains confidential and secure from unauthorized access.

FAQs about the PC-E-104A Rev 1-2021 form

The most frequently asked questions about the PC-E-104A form often revolve around its purpose and proper completion. Common inquiries include what types of income should be reported and how to handle discrepancies in information.

Troubleshooting issues may include problems accessing the form or understanding specific sections. pdfFiller's extensive support documentation can guide users through these challenges, but reaching out to customer service is also encouraged when issues arise.

Additional support and resources

For those needing extra assistance, pdfFiller offers customer support services that can guide users in filling out the PC-E-104A form. Whether you have questions on specific requirements or troubleshooting issues, reaching out to their support team can provide valuable solutions.

Furthermore, pdfFiller provides related tutorials and webinars aimed at enhancing user understanding of the form and its functionalities. Engaging with these resources can improve your efficiency and confidence in using the platform.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my pc-e-104a rev 1-2021 directly from Gmail?

How do I fill out the pc-e-104a rev 1-2021 form on my smartphone?

How can I fill out pc-e-104a rev 1-2021 on an iOS device?

What is pc-e-104a rev 1-2021?

Who is required to file pc-e-104a rev 1-2021?

How to fill out pc-e-104a rev 1-2021?

What is the purpose of pc-e-104a rev 1-2021?

What information must be reported on pc-e-104a rev 1-2021?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.