Get the free Matching Gift Form

Get, Create, Make and Sign matching gift form

How to edit matching gift form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out matching gift form

How to fill out matching gift form

Who needs matching gift form?

Matching Gift Form – How-to Guide Long-Read

Understanding matching gift forms

A matching gift form is a document that allows employees to request their employers to match the charitable donations they made to eligible nonprofits. This process not only amplifies the impact of individual contributions but also engages corporations in supporting social causes. The key stakeholders involved include the donor, the nonprofit organization, and the corporate entity, each of which plays a vital role in the matching gift process.

When a donor submits their matching gift form, nonprofits receive additional funds that enhance their fundraising capabilities. This synergy between employees, companies, and charitable organizations is crucial for maximizing philanthropic efforts.

Importance of matching gift forms

Matching gift forms are pivotal in maximizing overall donations. Many companies have established matching gift programs that encourage employees to give more, knowing their employer will double or even triple the contribution. This alignment not only strengthens corporate social responsibility (CSR) but also bolsters the ability of nonprofits to achieve their fundraising goals.

For nonprofits, the financial uplift derived from matching gifts can mean the difference between achieving program objectives or falling short. Engaging with matching gift programs is therefore essential for nonprofits, enabling them to optimize their resources and reach more individuals in need.

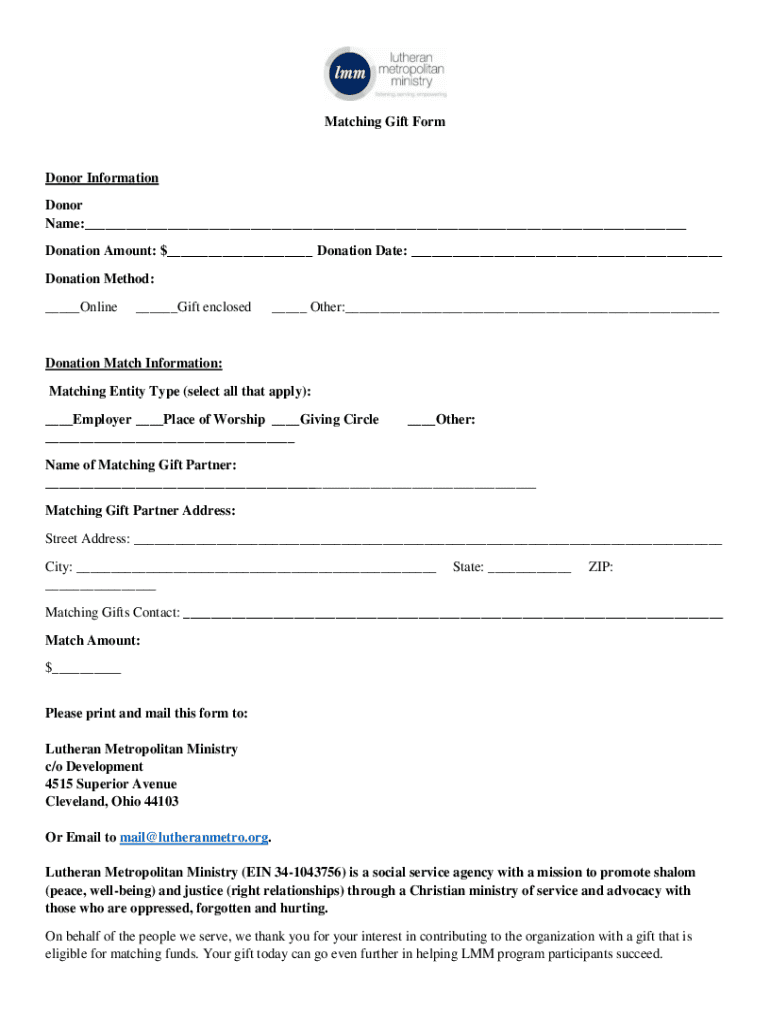

Elements of a matching gift form

A well-structured matching gift form should contain specific elements to ensure successful processing. Firstly, it must collect essential donor information, including the name, contact details, and employee ID number. Furthermore, the organization receiving the donation should be identifiable, including its official name and IRS designation. Lastly, donation details must be accurate, specifying the contribution amount and date.

While many companies still utilize paper forms for matching gifts, electronic forms are becoming increasingly popular due to convenience and speed. Each format has its pros and cons, and it's crucial for donors to consider which method aligns best with their preferences and their employer’s policies.

Differentiating between paper and electronic forms

Paper forms, while traditional, can be cumbersome and often delay the matching process due to mailing times. In contrast, electronic forms expedite submissions and, in many cases, allow for automated processing. However, some individuals may find paper forms easier to navigate without the distractions of a digital interface.

Types of matching gift submission forms

There are several common variants of matching gift forms that differ primarily based on employer policies. Corporate matching gift forms are specifically tailored for each company’s matching program. Additionally, alternative submission methods, such as mobile apps and online portals, have gained traction as they simplify the process for both donors and nonprofits.

Choosing the right form type hinges on factors like your employer's matching policy, the size of your donation, and specific nonprofit requirements. Be sure to review your company’s guidelines to select the most appropriate form.

The role of a matching gift database

A matching gift database is an essential tool that helps donors track employer matching gift programs and identify eligible nonprofits. These databases provide up-to-date information on various companies’ matching policies and can guide users in effectively filling out and submitting their matching gift forms.

Using a matching gift database is straightforward. Donors can search for their employer’s matching gift guidelines, access downloadable forms, and sometimes even initiate the matching process directly through the database.

Step-by-step guide to completing a matching gift form

To complete a matching gift form efficiently, gather all necessary information beforehand. This may include your recent pay stub, donor ID, and details about the charity, such as their tax identification number. Having these documents at hand streamlines the process.

When filling out the form, ensure every section is addressed carefully. Common mistakes to avoid include omitting required information and misinterpreting company guidelines for matching. After completing the form, you can submit it either electronically or by postal mail, depending on your preference and company policy.

Maximizing the impact of your matching gift

Communicating with your employer about your intent to utilize matching gifts is key. Consider discussing the process with your HR department to understand any nuances or specific requirements they might have.

Engaging with the nonprofit organization is also beneficial. Keeping them informed about your matching gift intent can foster transparency and ensure your contributions are correctly allocated. Continue tracking your donations, noting both the original and matching amounts to maintain a clear record.

Best practices for nonprofits

Nonprofits play a crucial role in facilitating the matching gift process. Effective communication strategies, such as informing donors about matching gift opportunities in newsletters or social media, can significantly increase participation rates.

Creating an easy user experience is vital. Simplifying their matching gift form process through online tools or clear instructions helps minimize confusion for donors. Utilizing matching gift software can also streamline submission and tracking, making it easier for both donors and nonprofits to navigate the matching gift landscape.

Frequently asked questions

There are common concerns surrounding matching gift forms, particularly regarding eligibility and processing times. Many donors worry if their donations qualify or how long it takes for matching gifts to be processed. Addressing these issues typically involves reviewing your employer's matching guidelines and the nonprofit's IRS status.

Challenges may arise when completing forms, such as misunderstanding what documentation is necessary. To overcome these hurdles, always refer to the specific guidelines provided by the employer and engage directly with nonprofit representatives if further clarification is needed.

Inspiring examples of successful matching gifts

Many nonprofits have transformed their fundraising capabilities through effective matching gift campaigns. For instance, organizations like Habitat for Humanity have seen exponential growth thanks to corporate matching programs. These initiatives not only draw more donations but also engage employees in community service.

Testimonials from donors often share the positive impact of matching gifts, highlighting personal experiences where their charitable contributions significantly multiplied due to employer matching. These narratives reinforce the power of matching gifts as a formidable fundraising tool.

Future trends in matching gift forms

The landscape of matching gifts is evolving, with emerging technologies set to enhance the process further. For example, advancements in mobile applications and integrated platforms may streamline form submissions and tracking considerably.

Corporate responsibility is also becoming more prevalent, with more companies adopting matching gift programs as part of their CSR initiatives. As corporate cultures shift, the role of matching gifts in fundraising strategies will likely grow, making it even more essential for organizations and donors to stay informed.

Engaging with pdfFiller for your matching gift needs

pdfFiller simplifies document management, enabling users to create and edit matching gift forms with ease. Users can leverage features such as templates to streamline the process, allowing for a quick turnaround when submitting requests to employers.

With pdfFiller's eSigning options, users can effortlessly sign and send matching gift forms electronically, further enhancing the speed and efficiency of the matching gift process. The platform’s cloud-based features ensure that documents are accessible from anywhere, empowering users to manage their philanthropy efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit matching gift form from Google Drive?

How can I send matching gift form for eSignature?

How can I edit matching gift form on a smartphone?

What is matching gift form?

Who is required to file matching gift form?

How to fill out matching gift form?

What is the purpose of matching gift form?

What information must be reported on matching gift form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.