Understanding the Financial Approval for Expenses Form

Understanding financial approval for expenses

A financial approval for expenses form is a crucial document utilized by organizations to manage and control their spending. It serves as a formal request that details anticipated expenses and seeks authorization to incur them. By requiring approval before spending occurs, organizations can safeguard their budgets and ensure that expenses align with strategic goals.

The importance of financial approval lies in its role in budget management. It not only helps maintain financial discipline but also provides a means for tracking expenditures and assessing the financial health of the organization. This structured approach minimizes waste and promotes accountability among employees tasked with spending company resources.

However, navigating the expense approval process can present challenges. Common difficulties include differing interpretations of policies, delays in communication, and inadequate documentation, which can lead to frustration among team members and delayed reimbursement processes.

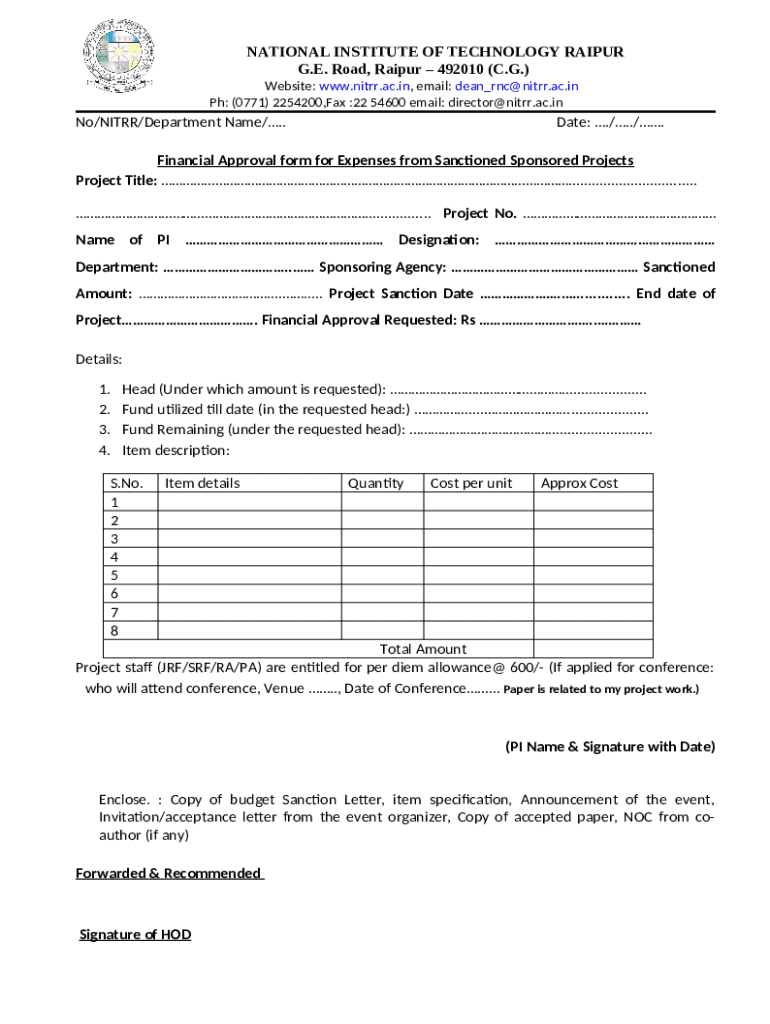

Key components of a financial approval for expenses form

A comprehensive financial approval for expenses form encompasses several key components that must be accurately filled out to ensure an effective review and approval process. These components include:

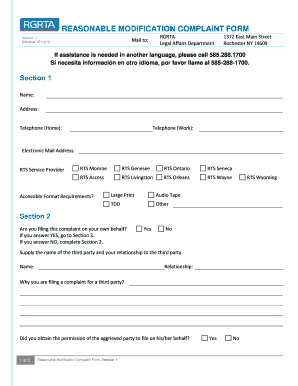

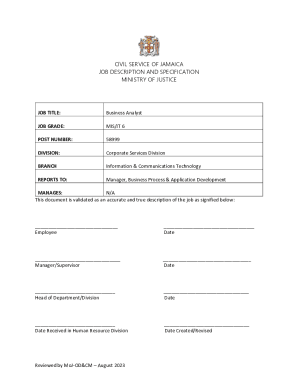

Details about the individual requesting the expense approval, including name, position, and contact information.

Classification of the expense, such as travel, supplies, or marketing, which helps in budget alignment.

A detailed account of what the expenses pertain to; clarity is essential for the approvers.

An approximation of the total anticipated costs associated with the request.

A rationale explaining why these expenses are necessary and how they will benefit the organization.

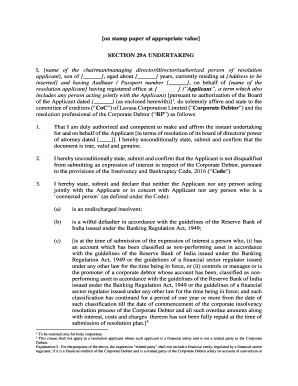

Additionally, establishing clear approval workflows and hierarchies ensures that requests are directed to the appropriate decision-makers, while required signatures and documentation reinforce accountability and legitimacy.

Designing your financial approval for expenses form

Designing an effective financial approval for expenses form is more than just aesthetics; it involves creating a user-friendly tool that streamlines the approval process. Following best practices can significantly enhance both the submission experience and approval efficiency.

A well-structured form should prioritize clarity. Use clear headings, concise instructions, and avoid technical jargon. The layout should encourage easy navigation, ideally utilizing a logical flow that aligns with the approval steps. Make sure to leave adequate space for handwritten notes when necessary, and consider including guiding details for each section, especially for complex categories.

In today’s digital age, accessibility matters. If you opt for a digital form, ensure it is accessible across devices and formats. Features like dropdown menus and checkboxes can simplify the input process and reduce errors.

Filling out the financial approval for expenses form

Filling out the financial approval for expenses form correctly is vital. Here's a step-by-step guide to help you navigate the process seamlessly:

Before starting, compile all relevant data, such as expense receipts and budget allowances, to ensure comprehensive and accurate completion.

Visit pdfFiller to access or create your financial approval for expenses form. Their platform offers a range of templates that can be tailored to your organization’s needs.

Provide accurate details about yourself, ensuring that approvers know whom to contact for further clarification.

Carefully describe each expense, ensuring that all fields are filled out completely and accurately to avoid delays in approval.

Once completed, submit the form through the appropriate channels, ensuring that all required documents are attached.

Be mindful of common errors during submission, such as missing signatures, underestimating costs, or failing to provide adequate justification, as these can lead to unnecessary rejections.

Managing and editing the financial approval for expenses form

Managing the financial approval for expenses form efficiently can enhance overall workflow within your organization. pdfFiller offers exceptional editing features that streamline the management of forms.

Editing fields allows for quick adjustments to information on the form, ensuring accuracy. Moreover, pdfFiller's tools facilitate the addition of signatures and initials, making the document legally binding and authentic. Users can also utilize collaboration tools, inviting team members to offer input and feedback before finalizing submissions. This collaborative environment increases the quality of the information submitted and reduces the chances of back-and-forth revisions.

Submitting and tracking approval

Once the financial approval for expenses form is completed and submitted, the next step is tracking its approval status. Various methods can be employed to ensure that these requests do not fall through the cracks.

Submitting the form typically involves emailing it to the designated approver or uploading it to a centralized digital platform like pdfFiller, which offers tracking functionality. It's crucial to keep an eye on the approval process, as understanding how to monitor the request can promote timely follow-ups when necessary.

In cases where expenses are rejected, handling the situation professionally is essential. Identify the reasons for rejection, address any concerns raised, and resubmit the form with the appropriate modifications. Being proactive and responsive to feedback can greatly enhance the likelihood of approval on the second attempt.

Best practices for efficient expense approval processes

Establishing robust processes for expense approval is critical for organizational efficiency. First, clearly defined policies should be communicated to all employees regarding what constitutes allowable expenses, how to fill out the form, and the expectations for timely submission.

Automating approval workflows can also foster efficiency. Implementing tools that allow automatic notifications and approvals minimizes bureaucratic delays. Regular reviews of the approval process can identify bottlenecks and areas for improvement, ensuring that it evolves with the organization’s financial management needs.

FAQs about financial approval for expenses forms

As organizations navigate the maze of financial transactions, several FAQs often arise surrounding the financial approval for expenses form. Understanding these can foster a smoother approval process.

Typically, significant expenditures that exceed a specified limit, travel expenses, and discretionary spending may require approval.

The timeframe for approval can vary based on workflow; however, a standard review period is often 2-5 business days.

Generally, once submitted, modifications are not recommended, and all amendments should be communicated separately to approvers.

Review the rejection reasons, adjust your form accordingly, and resubmit promptly while addressing any concerns raised.

Consider grouping similar expenses by project or category and submitting them together for efficiency.

Industry-specific considerations

Financial approval processes can vary significantly across industries. In the corporate sector, stringent controls and documentation are often required due to compliance regulations. Non-profit organizations, while also needing to manage spending, may require more flexible approaches due to donor restrictions. Educational institutions often have distinct protocols for student-initiated expenses, necessitating tailored forms that address specific needs pertinent to students and staff alike.

Adapting financial approval forms to meet the unique needs of each sector can lead to improved compliance and satisfaction among stakeholders. Leveraging tools like pdfFiller allows organizations across industries to customize forms effectively while ensuring consistency within approval workflows.

Utilizing pdfFiller for managing financial approval for expenses forms

pdfFiller provides a robust platform for managing financial approval for expenses forms. It allows users to carry out document creation, editing, and signing in a seamless manner. The advantages of using a cloud-based platform such as pdfFiller include easy access from any location, real-time collaboration, and enhanced security for sensitive financial documents.

The real-time collaboration features facilitate an inclusive process, allowing multiple approvers to view and comment on submissions, thus streamlining feedback. With its intuitive interface and capability to manage documents efficiently, pdfFiller positions itself as an essential tool for organizations seeking to enhance their expense approval processes.

Conclusion: The value of an efficient financial approval for expenses process

An efficient financial approval for expenses process is vital to sound financial management within organizations, ensuring resources are allocated appropriately and effectively. From understanding the key components of the form to utilizing advanced tools like pdfFiller for submission and tracking, organizations can foster a culture of accountability and transparency in their financial dealings.

It is essential for teams and individuals to leverage the functionalities of pdfFiller, thereby streamlining document management and improving collaboration. Implementing these strategies can ultimately lead to enhanced financial governance and a more empowered workforce.