Get the free Form 4

Get, Create, Make and Sign form 4

Editing form 4 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 4

How to fill out form 4

Who needs form 4?

A Comprehensive Guide to the Form 4 Form

Understanding Form 4: What you need to know

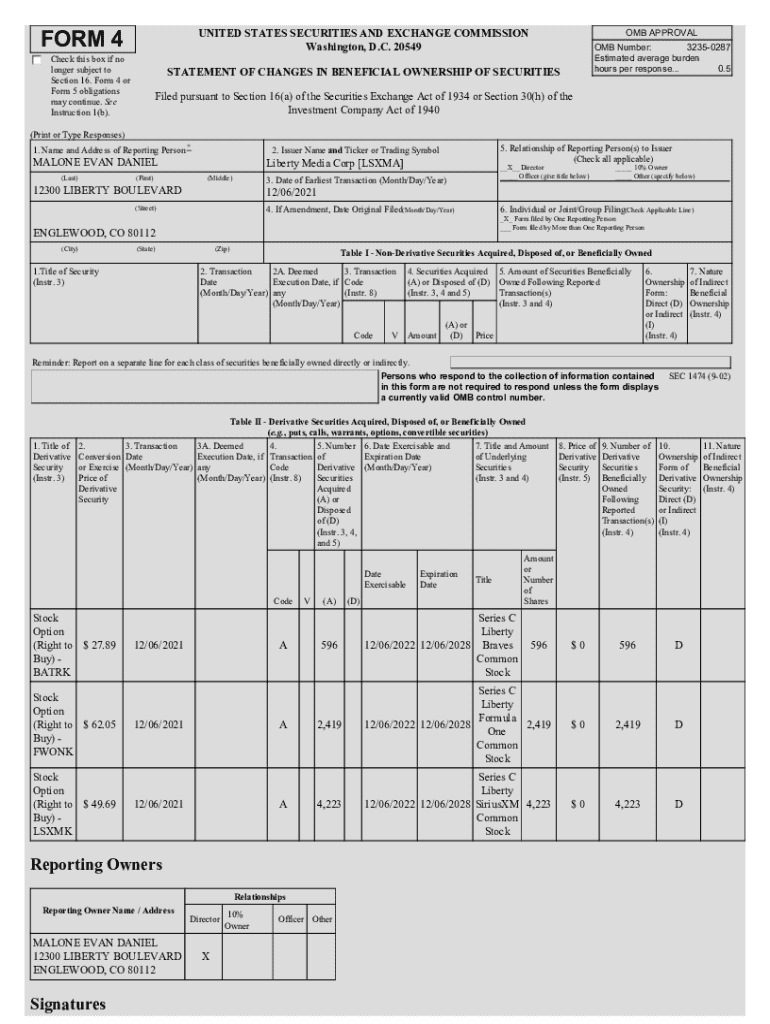

Form 4 is a crucial document primarily used in legal, financial, and tax contexts, designed for individuals or entities to report specific information to regulatory bodies or institutions. This form streamlines the data-gathering process, making it easy to compile essential details needed for various purposes, including income declaration, financial transparency, or compliance with legal obligations.

One of the key features of Form 4 is its focus on clarity and concise reporting. Users appreciate that it prompts them to provide necessary details without over-complicating the process, ensuring that they don't miss critical elements. The advantages of effectively utilizing Form 4 include compliance with regulations, potential tax benefits, and maintaining a trustworthy relationship with financial institutions or governing bodies.

Preparing to fill out Form 4

Before diving into filling out Form 4, it's essential to gather all required information and documents. This preparation step significantly reduces errors and ensures a smoother experience. Key information typically includes personal identification details, income statements, and supporting documentation that verify the claims made within the form.

One effective method for ensuring you have everything you need is to create an interactive checklist tailored to the requirements of Form 4. This checklist can help track the necessary details as you prepare. Furthermore, leveraging document scanning options can significantly ease the process of gathering and organizing the required paperwork, enabling you to upload documents directly into your filing system.

Step-by-step instructions for completing Form 4

Completing Form 4 involves careful attention to each section, starting with personal identification information. This section typically requires your full name, address, Social Security number (or applicable identification), and any relevant identification numbers. You can usually find this information on government-issued documents or previous tax forms.

The next segment focuses on financial information, where you need to report income sources. Be meticulous in detailing any salary, self-employment income, dividends, or interest. Understanding the nuances of each income type will help you avoid common mistakes such as misreporting or omitting sources which can lead to delays or audits.

The section for declarative statements is next, which often includes signature requirements. This part confirms that the information provided is accurate and truthful, thus legally binding you to the content of Form 4. After filling out each section, a final review is crucial. Before submission, use a checklist to ensure completeness and accuracy, and confirm that you have signed where necessary.

Editing and customizing Form 4

Once you've filled out your Form 4, editing can enhance clarity and correctness. Utilizing pdfFiller tools to edit the form is straightforward and user-friendly, offering functionalities such as highlighting important sections, adding comments, and making text adjustments. This flexibility allows for personalized insights or notes that could be pivotal for your records.

For teams collaborating on filling out Form 4, pdfFiller offers collaborative features enabling multiple users to access and edit the document in real-time. This collaborative approach ensures that everyone is on the same page and can share feedback instantly, streamlining the editing process and ensuring all viewpoints are included.

Signing and submitting your form

Once your Form 4 is filled and edited, it's time for the signing process. There are multiple options for eSigning documents, which provide a secure and convenient way to authenticate your submissions. Choose whichever method you prefer: drawing, typing your signature, or uploading a photo of your signature directly to pdfFiller.

Understanding the submission guidelines is essential for ensuring that your Form 4 reaches the correct destination. You can submit it through various channels, whether online via a dedicated portal, by postal mail, or even in-person, depending on the requirements of the entity requesting it. After submission, keep track of its status to confirm receipt and address any follow-up actions promptly.

Managing your Form 4 after submission

Post-submission, it's essential to know how to access and retrieve your Form 4. pdfFiller’s cloud-based platform allows you to store and locate your submitted forms effortlessly. This feature ensures that you can return to important documents quickly, whether for personal reference or follow-up.

If necessary, amendments and corrections to your Form 4 may be required after submission. This process usually involves submitting an amendment form or following specific guidelines as stipulated by the authority to which you submitted your original form. Be mindful of important dates and deadlines applicable for any corrections to maintain compliance.

Troubleshooting common issues with Form 4

As with any document, issues can arise while handling Form 4. Common problems may include missing signatures, submission errors, or misfiled documents. If these challenges occur, having a troubleshooting guide can be beneficial. Ensure you check for any specific instructions provided by the relevant authority to address common pitfalls effectively.

If problems persist, contacting support can provide clarity. Utilizing pdfFiller’s Help Center is an excellent resource for assistance, with FAQs, tips, and direct customer service options that make resolving issues more manageable.

Additional tips for effective form management

To ensure efficient management of your forms, organizing them directly within pdfFiller is highly beneficial. This allows you to categorize forms by type, status, or submission deadlines, making retrieval simpler in the future. By leveraging cloud storage, you can always access your documents no matter where you are.

Additionally, staying updated with online resources regarding tax laws and document management can significantly improve your understanding and efficiency. Implementing best practices for document security, such as using strong passwords to protect sensitive files, can safeguard your information effectively.

Frequently asked questions about Form 4

Answering common inquiries about Form 4 can highlight vital points for users unfamiliar with its requirements. For instance, it typically includes questions about where to obtain the form, how to fix errors post-submission, or details about timelines related to the processing of submissions. Providing clear, concise answers to these questions can alleviate confusion and empower users to manage their forms confidently.

Additional resources are essential for continued support. Directing users to official websites, informative online articles, or forums dedicated to tax compliance can further enhance their understanding of Form 4.

Interactive tools and resources

pdfFiller enhances the experience with interactive features that allow users to fill out, edit, and manage their forms seamlessly. Users can easily access related templates and tools directly through the platform, which simplifies the process and enhances efficiency. By taking advantage of these resources, individuals and teams can navigate Form 4 and similar documents with confidence.

Providing access to related templates and forms can minimize redundancy and rework while ensuring compliance in completing documentation. Integrated tools that assist with these tasks can lead to more organized document management and better overall results.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 4 for eSignature?

Can I create an electronic signature for signing my form 4 in Gmail?

How do I complete form 4 on an iOS device?

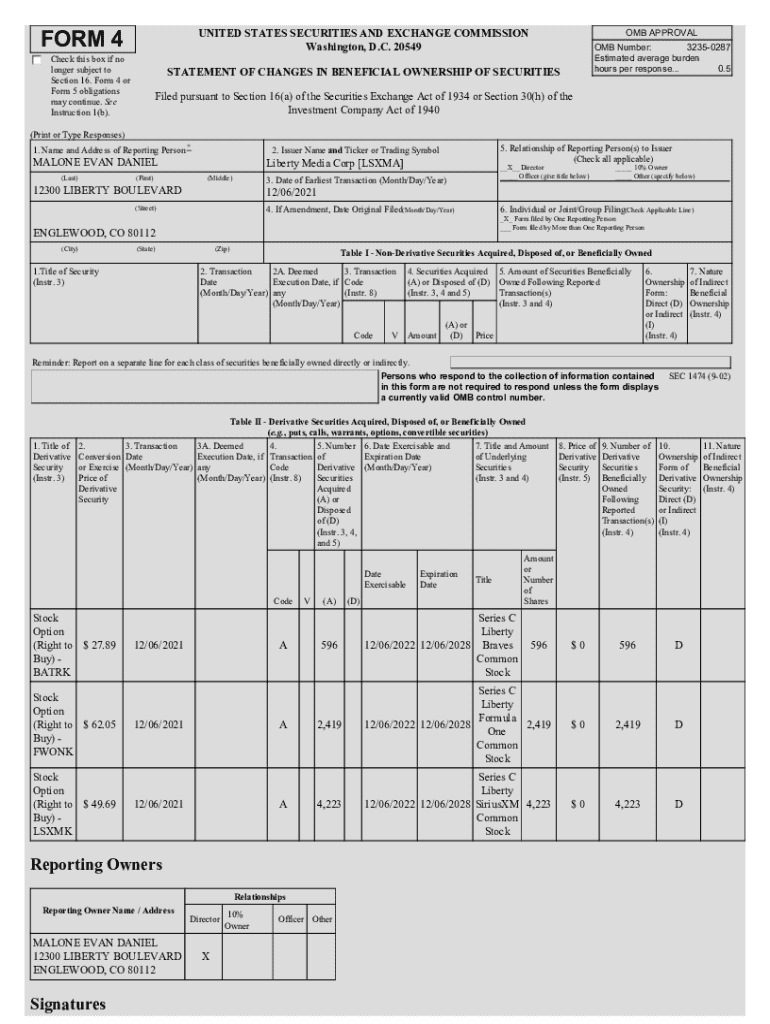

What is form 4?

Who is required to file form 4?

How to fill out form 4?

What is the purpose of form 4?

What information must be reported on form 4?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.