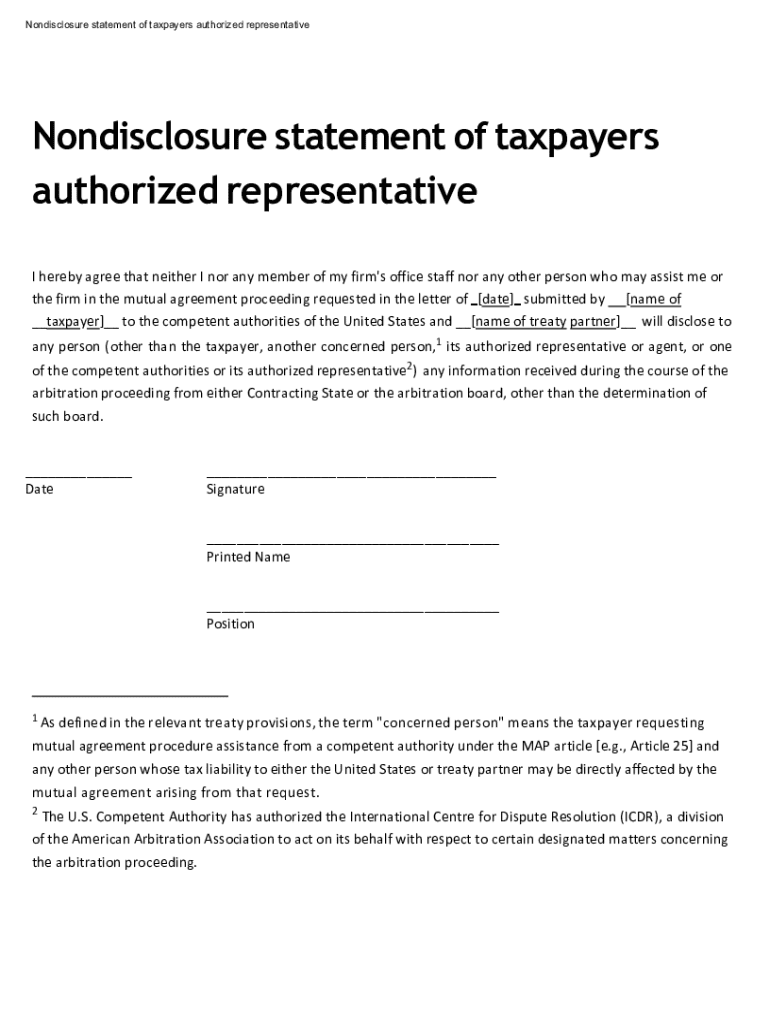

Get the free Nondisclosure Statement of Taxpayers Authorized Representative

Get, Create, Make and Sign nondisclosure statement of taxpayers

How to edit nondisclosure statement of taxpayers online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nondisclosure statement of taxpayers

How to fill out nondisclosure statement of taxpayers

Who needs nondisclosure statement of taxpayers?

Your Guide to the Nondisclosure Statement of Taxpayers Form

Understanding nondisclosure statements

A nondisclosure statement, often referred to in tax contexts as an NDA (non-disclosure agreement), serves as a legal document devoted to protecting sensitive taxpayer information from unauthorized access or disclosure. Taxpayers frequently encounter scenarios where they must disclose personal financial information, and this form is an essential safeguard ensuring that such divulged data is not improperly shared. Given the potential for identity theft or fraud, understanding the significance and utility of a nondisclosure statement is crucial for every taxpayer.

From promises of confidentiality to the legal consequences of breach, nondisclosure statements provide a sense of security. Taxpayers can confidently engage with tax advisors, accountants, or other professionals, knowing that their sensitive information isn't at risk of being disseminated without their consent.

Legal implications for taxpayers

Confidentiality is paramount in tax documentation. Personal tax information often includes details that could lead to identity fraud or unwarranted financial scrutiny. A nondisclosure statement creates a legally binding agreement aimed at ensuring that individuals or entities who receive your sensitive information are obligated not to share it without permission. Failure to adhere to these agreements can lead to significant legal repercussions, including claims for damages and the potential for criminal liability.

Essentially, any breach of a nondisclosure agreement can erode trust and may result in a loss of business relationships, or entail costly legal battles. Understanding these implications is crucial for both individuals and businesses that handle personal or sensitive tax information.

Key components of the nondisclosure statement

Creating an effective nondisclosure statement requires careful consideration of its key components. The first essential aspect is comprehensive personal identification details, which typically include the taxpayer's full name, address, and Social Security Number or Tax ID. Collectively, these elements help establish the identity of the taxpayer involved in the disclosure process.

The statement must also include a clear description of the sensitive information being protected. This can encompass personal financial data, tax filings, bank statements, or any other documentation deemed confidential. Furthermore, the obligations of the signatory are vital—they must agree to the terms regarding what information can be disclosed and under what circumstances. On the other hand, the taxpayer retains rights associated with their information, ensuring they have control over who sees their data.

When is a nondisclosure statement needed?

Taxpayers may find themselves needing to share information under certain circumstances. Situations that may warrant disclosure often include working with accountants, financial consultants, or legal advisors who require access to specific tax information to provide services. Additionally, prospective employers may ask for tax information during the hiring process, further complicating the need for confidentiality.

Recognizing these situations is pivotal in determining when to implement a nondisclosure statement. To protect sensitive information, taxpayers should evaluate the relevance and necessity of sharing their details. Often, consulting a legal expert can provide guidance on how best to navigate complex disclosure scenarios.

How to create a nondisclosure statement for taxpayers

Drafting an effective nondisclosure statement starts with a clear purpose and understanding of involved parties. Here’s a step-by-step guide to creating one: First, clearly identify the parties involved—the taxpayer and the recipient of the information. Next, delineate the purpose of the nondisclosure, providing context for why the sensitive data needs protection. Finally, establish the duration for which the information should remain confidential, setting a defined time frame for the agreement.

Using templates can be a great way to start, offering structure while allowing for customization to fit specific needs. It's important to adhere to legal language and terms, ensuring clarity and specificity; vague terms can lead to misunderstandings and potential breaches of agreement. Clear definitions of terms related to sensitive information can also strengthen a nondisclosure statement.

Editing and finalizing your nondisclosure statement

Reviewing the nondisclosure statement for accuracy is imperative. Begin with a comprehensive checklist to ensure that all required information and terms have been included—especially personal identification, the description of sensitive information, and signatory obligations. In addition, double-check the terms to ensure they are reasonable and clear. This accuracy forms the foundation of a strong legal agreement.

Securing signatures is the next step, and one must consider the methods of signing—whether to employ traditional handwritten signatures or leverage e-signatures for convenience and efficiency. Certain cases might also benefit from additional measures, like having witnesses or opting for notarization, further solidifying the agreement's integrity.

Managing your nondisclosure statement

Once your nondisclosure statement is finalized, secure storage for the document is essential. Traditional filing systems can be risky, thus digital solutions like cloud-based storage options can provide enhanced security, making documents easily accessible while keeping sensitive data safe. Platforms such as pdfFiller are excellent for securely managing your documents, enabling you to store and retrieve your nondisclosure statements whenever needed.

After securing the signed statement, it's imperative to share it only with the necessary concerned parties, staying compliant with privacy provisions within the agreement. Always follow protocols and maintain communication about the significance of the document to uphold privacy standards.

Common questions and troubleshooting

There are several frequently asked questions regarding nondisclosure statements that can benefit taxpayers. For instance, one common concern is, "What happens if the agreement is breached?" Typically, any breach can lead to legal ramifications, which might include claims for damages or even judicial action. Another common question revolves around the necessity of having a statement signed before sharing sensitive information; the consensus is always to err on the side of caution to protect against unintentional disclosure.

If someone inadvertently forgets to have a nondisclosure statement signed, it's crucial to engage with the other party immediately to mitigate risks. Maintaining open communication can help rectify any oversights, emphasizing the importance of privacy and confidentiality moving forward.

Additional considerations in special cases

Depending on the industry, specific requirements for nondisclosure statements may vary. For example, freelancers may need to customize their agreements to align with client demands, whereas corporate employees might deal with overarching company policies that govern such disclosures. Understanding your industry's nuances is essential to enforce the right protections effectively.

Moreover, taxpayers working across borders must understand differing regulations regarding privacy and nondisclosure. It’s vital to comprehend how compliance may differ internationally, particularly when dealing with clients or entities outside the United States. Familiarity with these key considerations can enhance the effectiveness of a nondisclosure statement in protecting taxpayer information across diverse jurisdictions.

Integrating nondisclosure statements into your document workflow

Leveraging tools like pdfFiller can streamline the process of creating and managing nondisclosure statements. By utilizing features such as editing, eSigning, and storage within a single, cloud-based platform, taxpayers and their teams can efficiently handle sensitive documents while emphasizing security and ease of access.

Ingraining nondisclosure statements into your regular documentation workflow can save time and avoid potential legal troubles down the line. Automating the creation of these statements for recurring needs helps ensure that taxpayers consistently uphold privacy standards, allowing them to focus on their core financial responsibilities.

Real-world applications of nondisclosure statements

Understanding the real-world relevance of nondisclosure statements can illuminate their necessity. For instance, a small business owner sharing sensitive tax data with an accountant found that taking the time to draw up a nondisclosure agreement before sharing information helped establish trust and protect against unintentional disclosure. By taking these steps, they created a professional, transparent relationship with their accountant that ultimately benefited both parties.

Conversely, companies that failed to secure nondisclosure agreements often faced detrimental data breaches, leading to financial loss and reputation damage. Lessons learned from these experiences emphasize the importance of implementing proper procedures, particularly in the management of sensitive taxpayer information.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my nondisclosure statement of taxpayers directly from Gmail?

Can I create an eSignature for the nondisclosure statement of taxpayers in Gmail?

How do I edit nondisclosure statement of taxpayers straight from my smartphone?

What is nondisclosure statement of taxpayers?

Who is required to file nondisclosure statement of taxpayers?

How to fill out nondisclosure statement of taxpayers?

What is the purpose of nondisclosure statement of taxpayers?

What information must be reported on nondisclosure statement of taxpayers?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.