Get the free Broker Compensation Agreement

Get, Create, Make and Sign broker compensation agreement

How to edit broker compensation agreement online

Uncompromising security for your PDF editing and eSignature needs

How to fill out broker compensation agreement

How to fill out broker compensation agreement

Who needs broker compensation agreement?

Understanding Broker Compensation Agreement Forms

Understanding broker compensation agreements

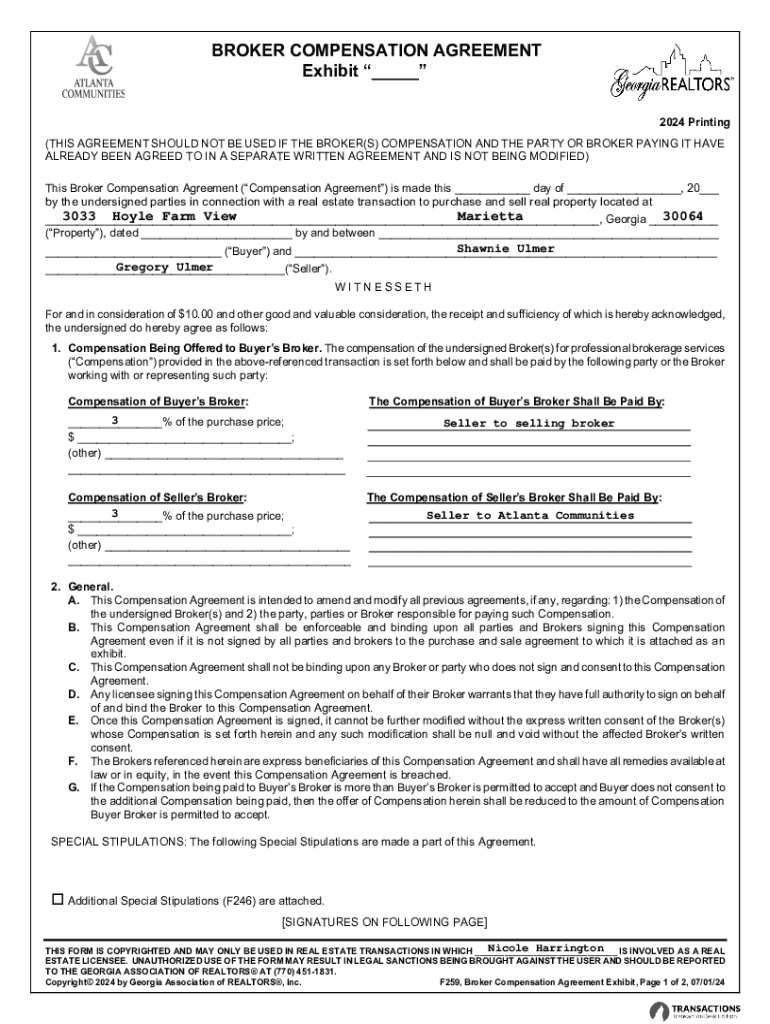

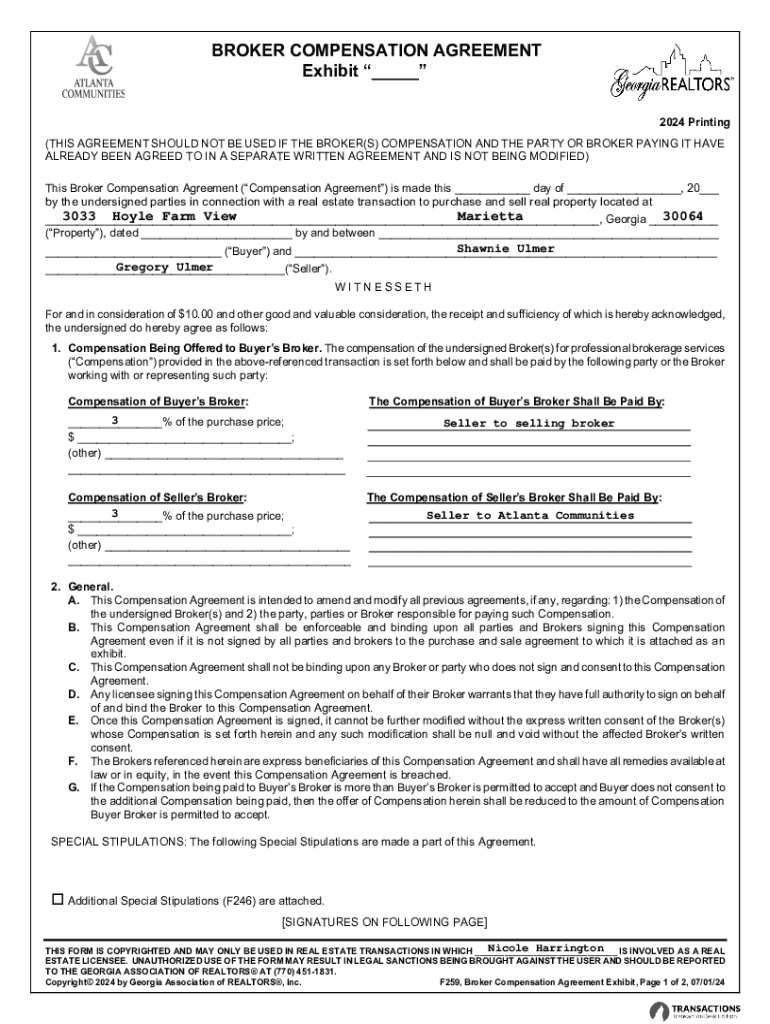

A broker compensation agreement form is a crucial document that delineates the financial relationship between real estate brokers and their clients. This agreement specifies the commission structure that the broker will earn for services rendered, including assistance in buying or selling properties. It is essential for providing clarity and transparency in real estate transactions, ensuring that all parties understand their financial obligations. The key stakeholders involved in these agreements typically include brokers, agents, and clients, each playing a distinct role in facilitating real estate transactions.

In real estate, where large financial decisions are made, having a well-defined broker compensation agreement form is vital. It not only acts as a safeguard for brokers and agents by ensuring they are compensated fairly for their work but also protects clients by outlining what services they can expect. The document, therefore, fosters trust and professionalism in what can be a complex and sometimes contentious industry.

Key components of a broker compensation agreement

A typical broker compensation agreement form includes several key components that ensure it covers all necessary legal and financial aspects of the relationship between the broker and the client. Essential elements include:

It's important to note that there may be variations in these agreements depending on state or regional regulations, which can dictate specific legal requirements that must be met. Understanding these local nuances is key for anyone involved in real estate transactions.

Differences between broker compensation agreements and other contracts

Broker compensation agreements, while similar in nature to other real estate contracts, serve distinct purposes. For example, they differ significantly from listing agreements, which are typically focused on the details of property listing, including marketing strategies and terms of sale. Listing agreements often outline the broker's responsibilities for marketing a property, while the broker compensation agreement more specifically addresses how the broker will be compensated for those efforts.

Another area of distinction can be found in buyer representation agreements. These documents establish a fiduciary relationship between the buyer and the broker, outlining how the broker will assist the buyer in their property search and negotiations. While there may be overlapping details, clarity in each document's purpose is essential for managing expectations and legal obligations.

Step-by-step guide to completing a broker compensation agreement form

Completing a broker compensation agreement form can be straightforward if you follow a structured approach. Here’s a step-by-step guide:

Tips for effective broker compensation agreements

To ensure a broker compensation agreement is effective and minimizes potential disputes, clarity is essential. Here are some tips for crafting such agreements:

Common mistakes to avoid in broker compensation agreements

Mistakes in drafting broker compensation agreements can lead to serious conflicts. Here are some common pitfalls to avoid:

Utilizing interactive tools for broker compensation agreements with pdfFiller

pdfFiller provides a robust platform for managing broker compensation agreements effectively. Its features enhance agreement management in several ways:

Case studies: Successful broker compensation agreements

Analyzing real-world examples of effective broker compensation agreements provides key insights into what works and what doesn't. Successful agreements typically involve:

Conversely, poorly drafted agreements often lead to disputes over commission payments and misunderstandings about responsibilities. Analyzing these outcomes highlights the importance of clarity in every component of the agreement.

Frequently asked questions about broker compensation agreements

Several common queries arise regarding broker compensation agreements. Addressing these concerns can provide clarity:

Trends and changes in broker compensation structures

The landscape of broker compensation is continuously evolving due to shifts in market dynamics and consumer expectations. Recently, there has been a noticeable trend toward more flexible commission structures. For instance, some brokers now offer tiered commission models where fees may decrease based on higher transaction volumes or specific sales benchmarks.

Additionally, the growing emphasis on transparency in real estate transactions has led many brokers to adopt flat-fee services that allow clients to know their costs upfront. These innovations reflect broader changes in consumer behavior and highlight the importance of staying adaptable in an evolving marketplace.

Feedback and community insights

Engaging with community feedback offers valuable insights into experiences with broker compensation agreements. Testimonials from users can reveal how the ease of using pdfFiller's platform simplifies document management. Users frequently appreciate the ability to edit, eSign, and collaborate on agreements from anywhere, showcasing the utility and accessibility of the tool.

Fostering discussions about individual experiences with broker compensation agreements also provides learning opportunities for others navigating this aspect of real estate. Sharing stories of success and challenges helps build a stronger community of informed participants in the real estate market.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find broker compensation agreement?

How do I edit broker compensation agreement online?

Can I edit broker compensation agreement on an iOS device?

What is broker compensation agreement?

Who is required to file broker compensation agreement?

How to fill out broker compensation agreement?

What is the purpose of broker compensation agreement?

What information must be reported on broker compensation agreement?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.