Get the free Business Loan Application

Get, Create, Make and Sign business loan application

Editing business loan application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business loan application

How to fill out business loan application

Who needs business loan application?

Business Loan Application Form: A Comprehensive How-To Guide

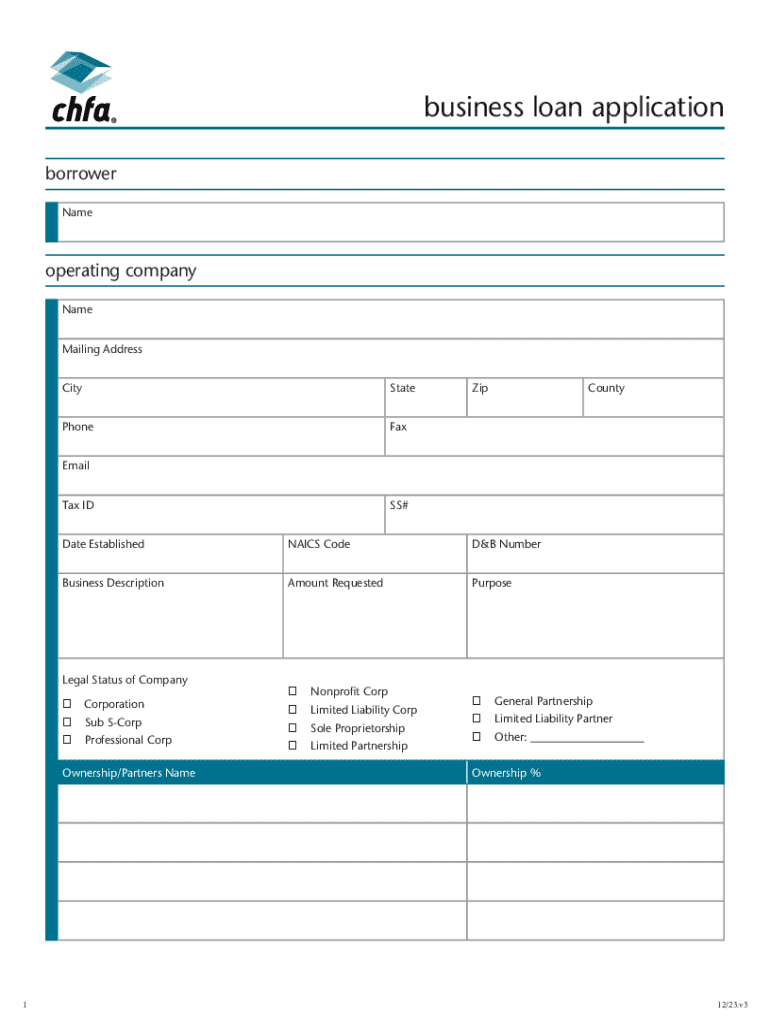

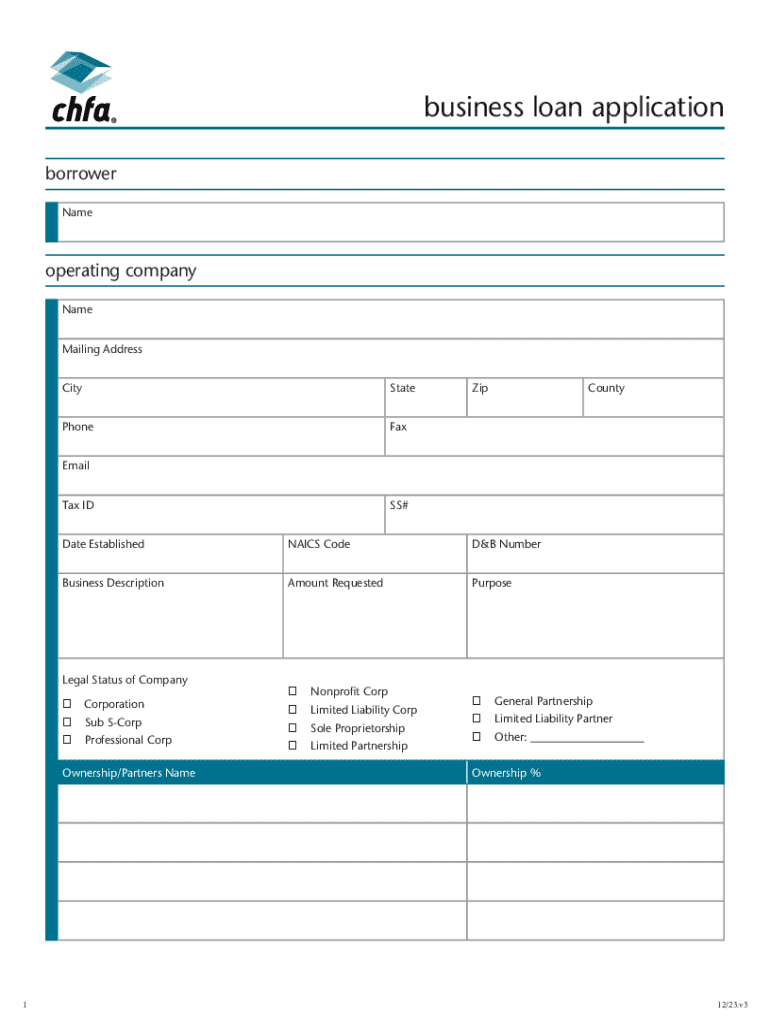

Understanding the business loan application form

A business loan application form serves as a crucial document for businesses seeking financial assistance. It outlines the details of the business, including its structure, funding requirements, and repayment plans. By completing this form, businesses provide potential lenders with necessary information to assess their creditworthiness and determine their eligibility for loans.

The importance of this form cannot be overstated, as it sets the foundation for securing the required funding. It acts as a formal request for financial support and assists lenders in evaluating the risk associated with lending to a particular business.

Who needs to complete this form?

Any business, whether a startup or an established firm, can benefit from a loan application form. Startups may require initial funds to set up operations, while established businesses could seek loans for expansion, equipment purchase, or operational costs. Specific scenarios that necessitate filling out this form include launching a new product, entering a new market, or managing unexpected expenses.

Preparing for the business loan application

Preparation is key to a successful business loan application. Start by gathering all required documentation, as lenders will want to see a range of financial documents to assess your business's viability. Essential documents typically include:

Having accurate and up-to-date information is vital. Additionally, assessing your business's financial health is critical before applying. Key metrics to evaluate include your credit score, cash flow, and debt-to-equity ratio. Conducting a self-assessment helps identify areas for improvement and can increase your chances of obtaining the loan.

Step-by-step guide to filling out the application form

Filling out the business loan application form can seem overwhelming, but breaking it down into sections makes it manageable. Some key sections include:

Be cautious of common mistakes such as overlooking important details, which can hinder your approval chances. Providing inaccurate or misleading information can lead to a decline, so ensure all entries are truthful and precise.

Editing and reviewing your application form

Once your application form is filled out, it’s crucial to review and edit it for clarity and professionalism. Utilizing pdfFiller can greatly enhance this process, allowing you to modify PDF content seamlessly. The platform also offers tools to highlight important sections and ensure proper formatting.

Collaboration is another important part of the reviewing process. Inviting team members to provide feedback can unveil overlooked details and improve the application’s overall quality. Establishing best practices for peer reviews before submission can lead to a stronger application.

Signing and submitting your business loan application

Before submission, it's essential to understand the importance of eSigning your application. Electronic signatures offer security and convenience, streamlining the process. With pdfFiller’s eSign features, you can sign documents electronically, ensuring a fast and efficient submission process.

Methods of submission can vary; you may send your application through online portals, email, or physical mail. Make sure to follow the lender’s instructions closely and confirm that your application has been received, keeping a record of all communications.

Managing your application after submission

Once you've submitted your application, tracking its status is essential. There are various tools and methods available that can keep you informed about your application’s journey. Lenders may reach out for additional information or clarify details, so being responsive is crucial.

If additional inquiries arise, respond promptly and provide the requested information to maintain credibility. Should your application require revisions, be prepared to resubmit with the necessary changes, ensuring that your responses are thorough and addressed to the lender’s concerns.

Conclusion: Increasing your chances of approval

To enhance your chances of loan approval, it's vital to understand what factors lenders consider. Key elements include your creditworthiness, business plan viability, and financial health. Addressing these areas effectively in your application can significantly improve your prospects.

Moreover, pdfFiller isn't just a tool for this application—it's a comprehensive solution for all your document management needs. Utilize its features to create various essential documents, ensuring you are well-prepared for future business endeavors, from loan applications to contracts and beyond.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send business loan application to be eSigned by others?

How do I edit business loan application straight from my smartphone?

How can I fill out business loan application on an iOS device?

What is business loan application?

Who is required to file business loan application?

How to fill out business loan application?

What is the purpose of business loan application?

What information must be reported on business loan application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.