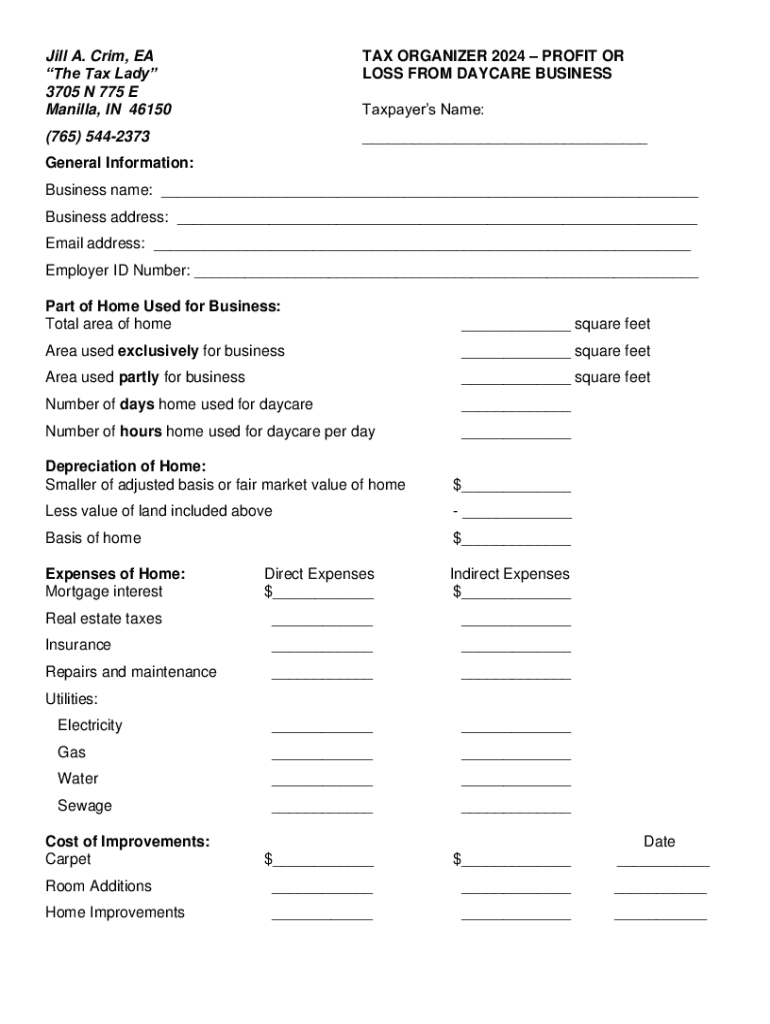

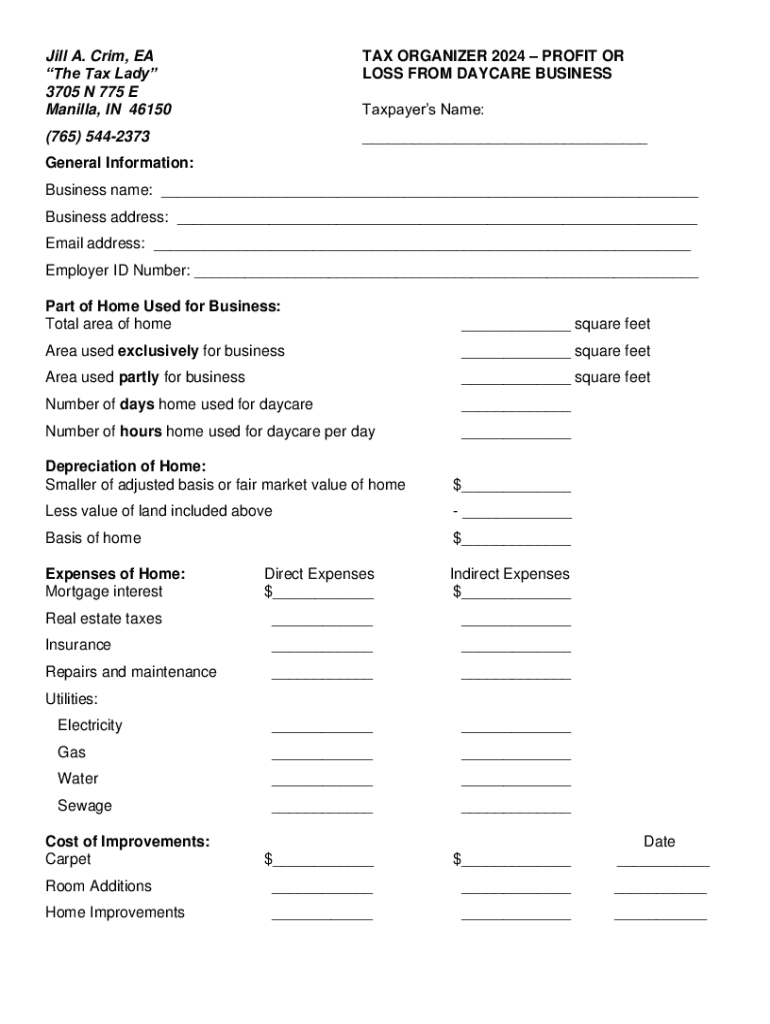

Get the free Tax Organizer 2024 – Profit or Loss From Daycare Business

Get, Create, Make and Sign tax organizer 2024 profit

How to edit tax organizer 2024 profit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax organizer 2024 profit

How to fill out tax organizer 2024 profit

Who needs tax organizer 2024 profit?

Tax Organizer 2024 Profit Form: Your Comprehensive Guide

Overview of the Tax Organizer 2024 Profit Form

The Tax Organizer 2024 Profit Form is a vital document designed to streamline tax preparation for individuals and businesses. This organizer acts as a comprehensive checklist, systematizing the collection of essential financial information to ensure accurate tax filing. Properly utilizing this form not only aids in preventing unnecessary delays but helps taxpayers maximize deductions and credits available to them.

The importance of using a Tax Organizer cannot be overstated. A well-organized profit form assists in avoiding errors during tax filing, which can lead to audits or penalties. Moreover, it helps taxpayers keep track of changes in their income, expenses, and financial status throughout the year, making it easier to prepare for tax season.

Understanding the structure of the Tax Organizer

The Tax Organizer 2024 Profit Form consists of several key sections, each tailored to gather specific financial data. Understanding the structure can significantly enhance the efficiency of completing the form.

The primary sections include: Income Reporting, Deduction Categories, and Credits and Adjustments. Each section serves a distinct purpose and requires careful attention. By preparing your data according to these sections, you will find the completion of the form much more manageable.

Key information to gather before filling out the Profit Form

Before diving into the details of the Tax Organizer 2024 Profit Form, gathering essential financial documents is crucial. This preparation step facilitates a smoother experience when filling out the form, ensuring you possess all necessary information.

Key documents to collect include:

Alongside financial documents, personal information, and dependent details such as Social Security numbers are necessary. Additionally, estimating any quarterly tax payments made throughout the year will aid in completing the Profit Form accurately.

Step-by-step instructions for completing the Tax Organizer

Completing the Tax Organizer 2024 Profit Form can seem daunting at first, but with organized steps, it can be accomplished efficiently. Let’s break it down by sections.

Section 1: Income details

In the Income Reporting section, include a comprehensive list of all income sources. This involves:

Double-check the amounts for accuracy, as misreporting can lead to issues with the IRS.

Section 2: Deductions and expenses

Deductible expenses can significantly reduce your taxable income. This section requires thorough accounting of all expenses incurred. Common deductible expenses include:

Proper documentation fosters clarity and supports any claims made on your tax return.

Section 3: Credits and adjustments

This section covers various tax credits that can lower tax liabilities. Examples include the Earned Income Tax Credit (EITC) and Child Tax Credit. Be sure to assess eligibility criteria and applicable limits meticulously.

Leveraging pdfFiller for streamlined document management

Utilizing pdfFiller for your Tax Organizer 2024 Profit Form can significantly ease the management process. The platform allows users to edit and customize their forms conveniently within a cloud-based environment, ensuring access from anywhere.

The eSign feature ensures all necessary signatures are acquired seamlessly, removing the need for printing and manual signing. Collaboration tools facilitate sharing the document for review with team members, making the tax preparation process a team effort.

Best practices for accurate and efficient filing

To prepare for tax season effectively, implementing best practices can lead to successful filing results. Start by organizing your financial data throughout the entire year rather than only during tax filing season.

Using digital tools to stay updated on changes to tax laws is crucial. The tax landscape can change annually, and being informed helps in a better understanding of what impacts your tax obligations.

Common pitfalls to avoid when using the Tax Organizer

While the Tax Organizer 2024 Profit Form is designed to simplify the tax process, there are common pitfalls that can compromise accuracy and efficiency.

Resources and tools to enhance your tax filing experience

To simplify and enhance your filing experience, consider leveraging various resources and tools. Recommended financial software, such as QuickBooks or TurboTax, can aid in managing your finances throughout the year.

Additionally, pdf guides and interactive tutorials can offer further insight into completing the Tax Organizer effectively. When deciding between professional services and do-it-yourself methods, weigh factors including cost, complexity of taxes, and personal comfort with the tax filing process.

FAQs about the Tax Organizer 2024 Profit Form

Understanding your tax responsibilities and processes fosters confidence when completing tax forms. Here, we will answer common queries related to the Tax Organizer 2024 Profit Form.

Related forms and documents

A comprehensive understanding of your tax obligations may also require familiarity with related forms. Besides the Tax Organizer, other relevant documents include business tax returns and personal exemption forms.

Understanding how these forms tie into the Tax Organizer helps in achieving better filing accuracy, ensuring that all pertinent aspects of your financial situation are captured correctly.

Final checklist before submission

Before submitting your Tax Organizer 2024 Profit Form, it's important to have a final review checklist in place. This step will help you confirm all information is accurate and complete.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify tax organizer 2024 profit without leaving Google Drive?

How do I edit tax organizer 2024 profit straight from my smartphone?

How do I complete tax organizer 2024 profit on an Android device?

What is tax organizer 2024 profit?

Who is required to file tax organizer 2024 profit?

How to fill out tax organizer 2024 profit?

What is the purpose of tax organizer 2024 profit?

What information must be reported on tax organizer 2024 profit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.