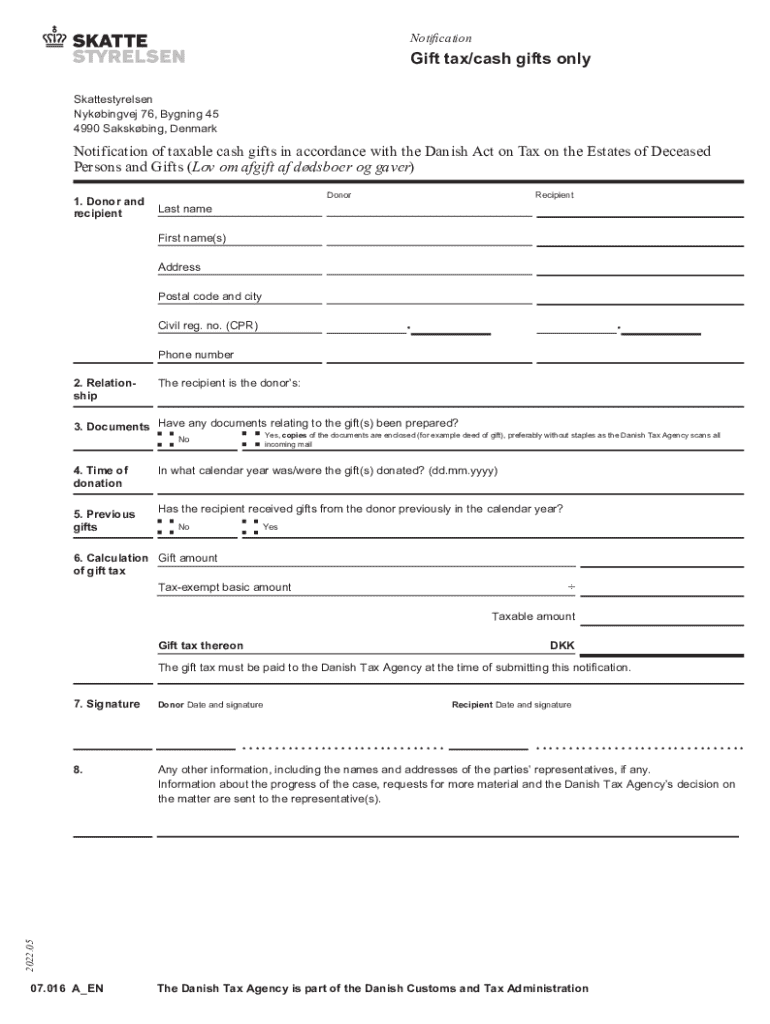

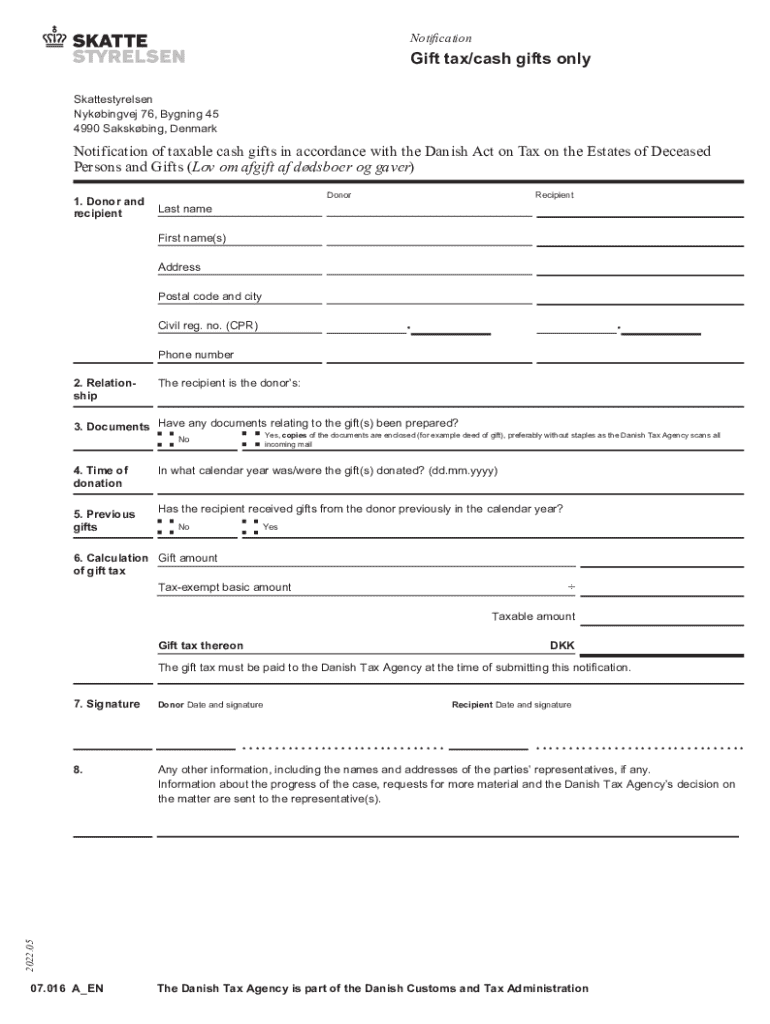

Get the free Notification - Gift tax/other gifts than cash gifts

Get, Create, Make and Sign notification - gift taxoformr

Editing notification - gift taxoformr online

Uncompromising security for your PDF editing and eSignature needs

How to fill out notification - gift taxoformr

How to fill out notification - gift taxoformr

Who needs notification - gift taxoformr?

Understanding Notification - Gift Tax Form: A Comprehensive How-to Guide

Understanding gift tax notifications

Gift tax notifications serve as a crucial mechanism through which individuals report the transfer of assets as gifts to the Internal Revenue Service (IRS). Their primary purpose is to ensure compliance with federal gift tax regulations, protecting both donors and recipients from potential legal ramifications and tax liabilities. When a gift is made, it is essential that all parties involved understand their responsibilities, including the necessity to notify the IRS of such transactions.

Compliance with gift tax regulations is vital for several reasons. First, it helps to maintain transparency in financial transactions, which can prevent disputes between family members or business partners regarding asset distribution. Additionally, failure to report gifts can lead to penalties and additional taxes owed, ultimately costing more than the gift itself. Both donors and recipients need to understand when and how to notify the IRS about gifts exchanged, ensuring a hassle-free experience.

Key terms and concepts related to gift tax

Understanding the terminology surrounding gift tax is essential in navigating the complex landscape of federal tax compliance. First, it is crucial to differentiate between taxable gifts and exclusions. Taxable gifts are those that exceed the annual exclusion amount, meaning that the donor may incur gift tax if the gift surpasses this limit. On the other hand, certain gifts are exempt from taxation, including those made to qualified charities or gifts to cover educational expenses.

Step-by-step guide to completing the gift tax form

Completing the Gift Tax Form 709 can seem daunting; however, breaking it down into manageable steps simplifies the process considerably. This form serves as the official statement submitted to the IRS regarding gifts made within the tax year. Familiarizing yourself with the main sections, alongside the supporting documentation required, will facilitate accurate and efficient completion.

Common mistakes to avoid in gift tax notifications

When filling out the Gift Tax Form 709, several common pitfalls can lead to complications or even enforcement actions from the IRS. The most frequent mistake involves providing incomplete or incorrect information. One missing detail could result in the need for amended returns and potential penalties. Another major issue arises when donors fail to report all gifts qualifying under IRS regulations, leading to unintentional tax evasion.

Moreover, it's essential to adhere to filing deadlines. Missing the deadline could incur interest and penalties and complicate future filings. By maintaining accurate records and diligently reviewing all entries before submission, donors can minimize errors and navigate the process smoothly.

Navigating the IRS requirements for gift tax forms

The IRS sets specific filing deadlines and guidelines for submitting the Gift Tax Form 709. Knowing when to file is essential, as late submissions may incur penalties that are often a percentage of the total tax owed. Generally, the form must be submitted by April 15 of the year following the gift. Understanding these deadlines is vital for maintaining compliance and avoiding unnecessary fees.

Another essential aspect is diligent record-keeping. Keeping detailed documentation of all gifts made and received not only assists in accurately completing the form but also serves as protection if the IRS audits your return. If you find you’ve made an error on your gift tax return, knowing how to amend it is crucial. The IRS allows for the submission of an amended return, which must also be submitted by the established deadline to avoid further complications.

Interactive tools for gift tax form management

To streamline the process of completing the Gift Tax Form 709, utilizing interactive tools can significantly ease the burden. Platforms like pdfFiller empower users to efficiently manage their document needs, allowing for real-time editing and customization of forms. Users can take advantage of integrated eSigning capabilities to facilitate faster submissions.

Frequently asked questions about gift tax notifications

Potential donors often have numerous questions about gift tax regulations. One common inquiry is: what qualifies as a gift for tax purposes? Generally, any transfer of money or property for which the giver does not receive equal value in return is considered a gift. Another prevalent question centers around how gift tax impacts estate tax; gifts made within three years of death can impact estate tax calculations.

Real-life scenarios and case studies

Examining practical examples helps contextualize the complexities of gift tax issues. In one scenario, a parent may gift their child a significant sum for a down payment on a home. It’s important that the parent files Form 709 to report the transaction, especially if it exceeds the annual exclusion amount for the tax year.

Conversely, charitable organizations can provide avenues for tax-deductible gifts, enhancing the financial strategy for both the donor and the receiving organization. Gifts made to employees as part of a company’s appreciation program also come under scrutiny; understanding the tax implications here can help mitigate risks associated with employer-employee transactions.

Professional guidance on gift tax planning

As gift tax regulations can be intricate, seeking professional guidance is advisable, particularly when dealing with substantial gifts or complicated family dynamics. Tax professionals can offer personalized advice tailored to your specific situation, helping you navigate the complexities of gift and estate taxes effectively.

Furthermore, leveraging resources for legal and tax advice can sharpen your understanding of the implications of your gifting strategy. Developing a strategic approach to tax planning not only protects your interests but can also enhance your financial legacy.

Related topics and further reading

To deepen your comprehension of gift taxation, consider exploring related topics such as estate taxes and their relationship to gift taxes. Many individuals overlook the interconnected nature of these two areas, which can significantly influence overall tax liability.

Additionally, understanding charitable giving and associated tax benefits can lead to more effective financial decision-making. Finally, staying informed about ongoing changes in tax laws affecting gifts and estates can help maintain compliance and optimize tax strategies, ensuring that you and your beneficiaries remain protected.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit notification - gift taxoformr in Chrome?

How do I fill out the notification - gift taxoformr form on my smartphone?

Can I edit notification - gift taxoformr on an Android device?

What is notification - gift taxoformr?

Who is required to file notification - gift taxoformr?

How to fill out notification - gift taxoformr?

What is the purpose of notification - gift taxoformr?

What information must be reported on notification - gift taxoformr?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.