Get the free University of Alaska Vendor Direct Deposit Agreement

Get, Create, Make and Sign university of alaska vendor

How to edit university of alaska vendor online

Uncompromising security for your PDF editing and eSignature needs

How to fill out university of alaska vendor

How to fill out university of alaska vendor

Who needs university of alaska vendor?

The comprehensive guide to the University of Alaska vendor form

Understanding the University of Alaska vendor form

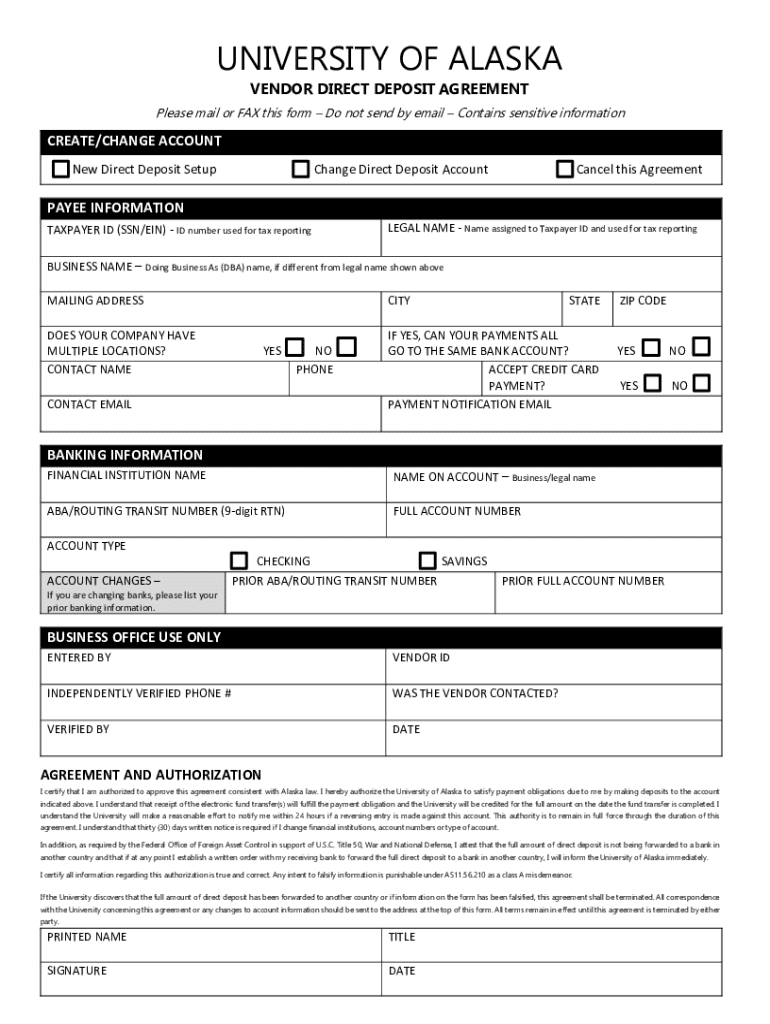

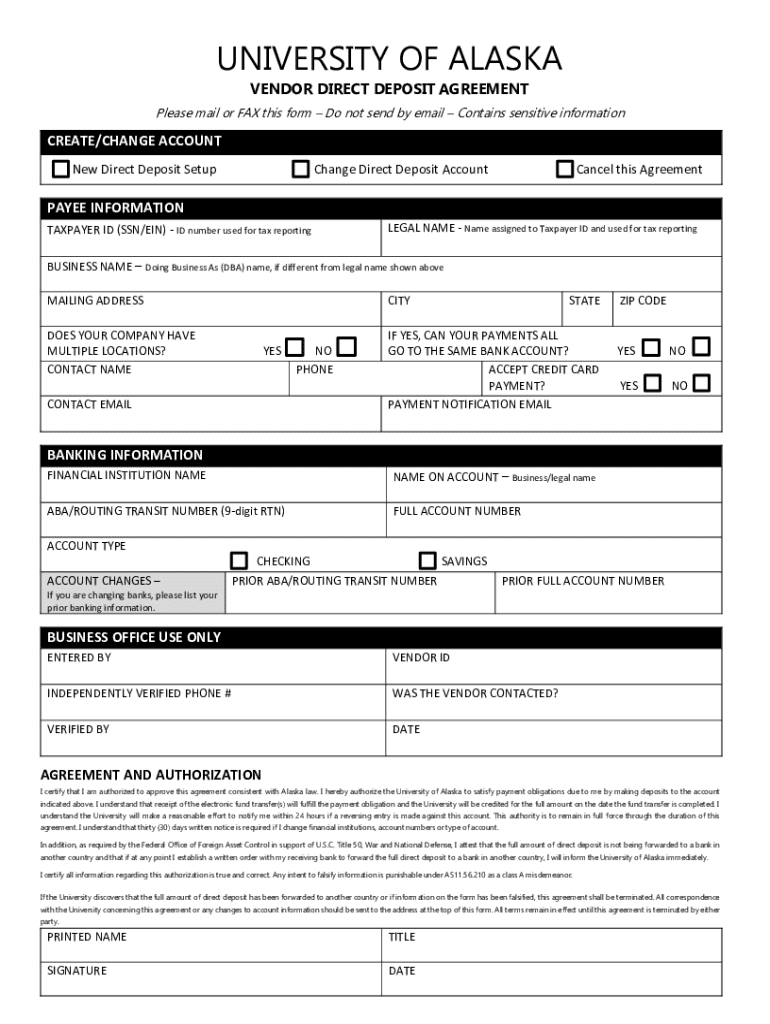

The University of Alaska vendor form is a crucial document used by the university to establish an official record of vendors who provide goods and services. It serves multiple purposes, including ensuring compliance with procurement policies and facilitating efficient payment processes. This form acts as a gateway for vendors to engage in transactions with the university. Without it, vendors would struggle to navigate the university's purchasing framework, which could delay payments and complicate service agreements.

The importance of the vendor form cannot be understated. It enables the university to verify vendor credentials, ensuring that all suppliers meet necessary legal and regulatory requirements. Additionally, having a standardized form helps streamline the vendor onboarding process, making it easier for financial departments to process transactions and maintain accurate records.

Any individual or organization looking to provide products or services to the University of Alaska must fill out this vendor form. This applies to small local businesses offering consulting services or large corporations supplying construction materials. Understanding the correct procedures for completing the form is essential for prospective vendors aiming for a smooth engagement with the university.

Key information required on the vendor form

The University of Alaska vendor form requires specific information to ensure that all financial transactions can be efficiently managed. The first section typically requests the business name and primary contact details, allowing the university to connect with the vendor swiftly. This foundational information is crucial for establishing a formal association between the vendor and the university.

Another essential component is the Tax Identification Number (TIN) requirements. Each vendor must provide their TIN to comply with IRS regulations, ensuring that the university can report accurate financial information for tax purposes. Lastly, understanding payment preferences and instructions is critical, as this section allows vendors to specify how they would like to receive payments, whether by check, direct deposit, or electronic payment systems.

Common mistakes include incomplete sections or inaccuracies in TIN submissions, which can prolong the approval process. Therefore, vendors must take special care to double-check their entries to avoid unnecessary delays.

Step-by-step guide to completing the University of Alaska vendor form

Completing the University of Alaska vendor form can be straightforward if vendor preparation is handled systematically. The first step involves gathering necessary documentation. Vendors should prepare a list of essential documents, including their business license, TIN, and any relevant certificates that strengthen their application. This preparation not only eases the filling out of the form but also ensures that all required information is readily available.

Next, to access the vendor form online, visit the University of Alaska’s official website or the specific finance section. Instructions for each segment of the form can be found on the site, guiding vendors through what information is required per section, thereby ensuring completeness. It's beneficial to fill this form digitally, as it can minimize errors associated with handwriting.

Lastly, vendors have multiple submission methods available. They can choose to submit their forms online or send a paper version via mail. For those opting for paper submissions, it's crucial to ensure the form is correctly addressed and labeled, directing it to the Vendor Management Office at the university.

Frequently Asked Questions (FAQs) about the vendor form

Errors on submissions can cause setbacks. If a vendor realizes an error after submission, they should contact the university’s vendor management team immediately to rectify any issues. Further, vendors can check the status of their applications by reaching out to the same team, who manages all communications regarding vendor applications.

After submission, the university typically conducts a review of the provided information. Vendors will receive a notification once their application has been successfully processed, and they will be provided with pertinent details regarding their vendor status.

Regulatory and compliance information

The University of Alaska adheres to strict procurement policies designed to ensure fairness and transparency in vendor selection. Vendors must comply not only with university policies but also with state and federal regulations concerning procurement practices. This compliance protects both the university and its vendors from legal repercussions and ensures ethical transactions.

Terms and conditions of vendor agreements outline the expectations from both parties involved. Understanding these terms ensures that vendors are aware of their rights and responsibilities, furthering a smooth operational process.

Payments and financial information for vendors

Vendors working with the University of Alaska need to understand the payment processes established by the university. Payments are typically processed through a schedule set by the university’s finance department, ensuring that vendors receive payments in a timely manner. Understanding this schedule can assist vendors in managing their cash flow effectively.

Vendors may choose to set up electronic payment systems, which can streamline their payment processes. Such systems not only speed up payment but also minimize the risks associated with lost checks and help in keeping accurate financial records. Setting up electronic payments is usually a straightforward process and can be discussed in detail with the university’s finance office.

Additional resources and tools

For vendors looking to complete their forms, downloadable vendor forms are typically available on the university's finance and accounting website. Accessing forms in this manner ensures users have the most up-to-date documents. Additionally, the University’s Finance & Accounting Office can serve as a vital resource, providing support and answering queries about the vendor process.

External resources can further enhance vendor understanding of procurement guidelines and tax compliance. Familiarizing yourself with the University’s procurement guidelines and available tax resources can improve relationships and compliance with contractual obligations.

Contact information for support

For individuals needing assistance with the University of Alaska vendor form, the vendor management team within the Office of Finance & Accounting is a primary contact point. They are equipped to address queries regarding form completion, document submissions, and any concerns regarding vendor applications. Their expertise will guide potential vendors through the process smoothly.

Help desk resources are also available, which include FAQs and quick support options. Utilizing these resources enables vendors to find answers more efficiently, thus reducing the time required to complete submissions and resolve issues.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit university of alaska vendor on a smartphone?

How do I complete university of alaska vendor on an iOS device?

Can I edit university of alaska vendor on an Android device?

What is university of alaska vendor?

Who is required to file university of alaska vendor?

How to fill out university of alaska vendor?

What is the purpose of university of alaska vendor?

What information must be reported on university of alaska vendor?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.