Get the free Mortgagee Consent Form

Get, Create, Make and Sign mortgagee consent form

How to edit mortgagee consent form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mortgagee consent form

How to fill out mortgagee consent form

Who needs mortgagee consent form?

Mortgagee Consent Form: How-to Guide Long-Read

Understanding the mortgagee consent form

A mortgagee consent form is a critical document in the mortgage process, ensuring that all parties involved in a mortgage transaction understand and agree to the terms regarding changes to the mortgaged property. Its primary function is to provide formal approval from lenders, allowing certain actions to be taken by the borrower that could affect the loan agreement.

The necessity of a mortgagee consent form extends beyond mere formality. It protects the rights of the lender while also providing clarity and transparency for the borrower. This document is essential throughout various stages of homeownership, including refinancing, selling, or leasing a property.

Who needs a mortgagee consent form?

Several parties may require a mortgagee consent form. Homeowners and borrowers need it when considering actions like refinancing or selling their mortgaged property, as it ensures they comply with lender guidelines and maintain good standing on their mortgage.

Lenders and financial institutions use the form to document their consent for various requests made by borrowers. Real estate agents and legal professionals may also require it during property transactions to ensure that all necessary approvals have been obtained before proceeding.

Situations requiring a mortgagee consent form

Certain situations necessitate the creation and submission of a mortgagee consent form. In the case of modifications or refinancing, homeowners must seek consent from their mortgage lender before altering the terms of their existing loan. This protection ensures that lenders retain control over the conditions under which their loans are issued.

For example, if a borrower wants to reduce their interest rate through a refinance, failing to obtain consent may lead to unintended breaches of the mortgage agreement. Similarly, a property sale often requires consent, especially if the home is still under a mortgage. Without proper consent, a sale could become problematic, leading to potential legal disputes.

Additionally, in lease agreements, property owners may be required to obtain consent from their mortgagee to lease out a mortgaged property. This consent is vital to ensuring that the terms of the lease do not violate the mortgage agreement.

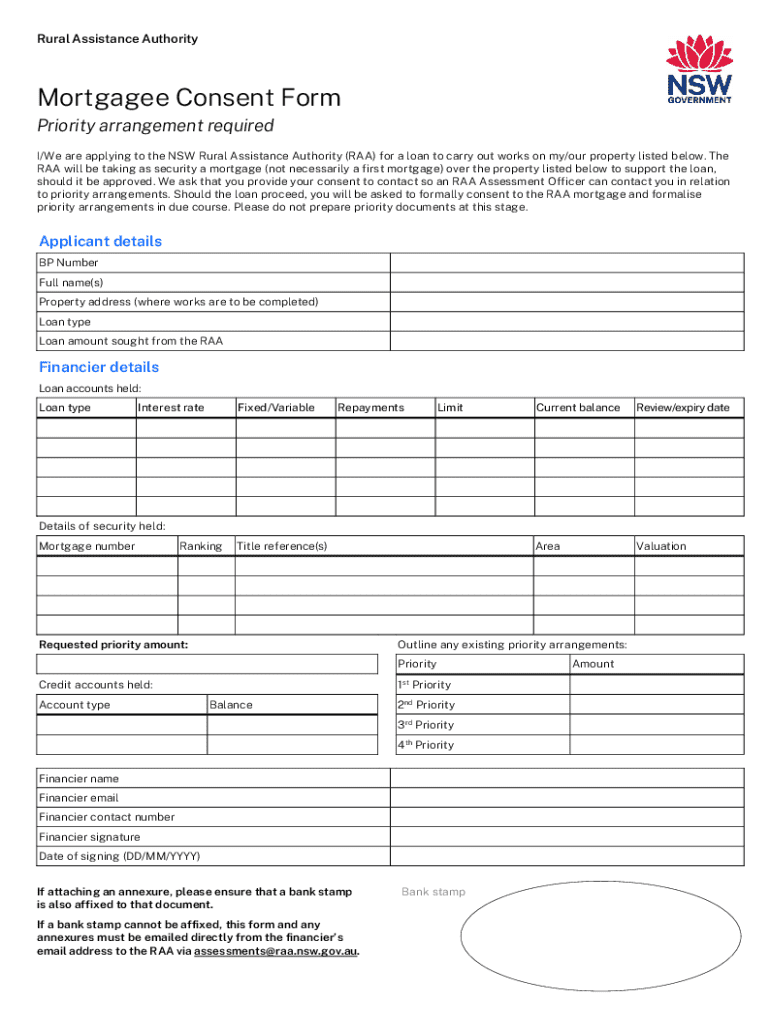

Key components of a mortgagee consent form

When filling out a mortgagee consent form, several essential pieces of information must be included to ensure its validity. This includes details such as the names of the borrower and the mortgagee, the address of the property in question, and its legal description. Clear specification of the terms under which consent is granted is also crucial.

Using a digital form via platforms like pdfFiller can streamline this process. Digital forms offer benefits such as ease of editing and accessibility. Conversely, traditional paper forms have their advantages, including tangible documentation, but may lack the efficiency that digital tools provide.

How to fill out the mortgagee consent form

Filling out the mortgagee consent form may seem daunting, but following these steps can simplify the process. Start by entering personal information, ensuring that both borrower and mortgagee details are accurate.

Next, provide details about the property, including its complete address and legal description. Once this information is filled in, specify the consent terms, clearly stating the purpose and conditions under which consent is granted.

Finally, don't forget to include signature fields for both parties. Signatures are critical as they signify agreement and must be dated. Common mistakes to avoid include overlooking critical fields and misunderstanding the conditions of the consent which could lead to complications down the line.

Tools for creating and managing the mortgagee consent form

Utilizing platforms such as pdfFiller can greatly enhance the experience of creating a mortgagee consent form. With robust functions for editing documents online, users can easily generate and customize their forms to meet specific requirements.

Collaboration features included in such tools allow for effortless sharing of the form for feedback and approvals. Moreover, the ability to manage documents in the cloud ensures that individuals can access their forms from anywhere and track the status and history of their submissions.

After submission: what to expect

Once your mortgagee consent form is submitted, understanding the processing timeline is vital. Lenders will review the form to ensure that all requirements are met. Depending on the lender's guidelines, this can take several days to weeks.

Potential outcomes of this review can include approval, requests for further adjustments, or outright denial. For those receiving a denial, it is essential to know the next steps, which may involve discussing alternative solutions or amendments to the original consent request.

Going beyond the basics: advanced considerations

The legal implications associated with a mortgagee consent form can be significant. Understanding the responsibilities tied to the form is crucial, and in complex situations, involving legal counsel can provide additional clarity and protection.

Furthermore, exploring alternative solutions beyond a simple consent form may sometimes be necessary. These could include modifications to the mortgage or exploring different financing options. Keeping abreast of trends and changes in mortgage practices, particularly those influenced by evolving technology, can also inform how consent requirements may shift.

Real-life examples and case studies

Examining real-life case studies can provide valuable insights into the effective use of a mortgagee consent form. For instance, a homeowner seeking to refinance successfully navigated the process by obtaining clear consent, ultimately securing a lower interest rate and improving their financial position.

Conversely, a different case illustrates the dangers of neglecting to submit a mortgagee consent form. A property owner who attempted to lease their home without approval faced legal challenges that delayed their rental income and created significant stress. Analyzing these scenarios can reveal the importance of proper compliance in mortgage agreements.

Frequently asked questions (FAQs)

Many borrowers and lenders have common queries regarding mortgagee consent forms. One frequent question involves whether consent is always necessary for every transaction; generally, it is required in situations involving modification or transfer of the property.

Another common concern pertains to legal terminology used in these forms. Simplifying complicated language and providing clear explanations can enhance understanding and ensure that all parties are fully informed before signing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send mortgagee consent form to be eSigned by others?

Can I create an eSignature for the mortgagee consent form in Gmail?

How do I edit mortgagee consent form straight from my smartphone?

What is mortgagee consent form?

Who is required to file mortgagee consent form?

How to fill out mortgagee consent form?

What is the purpose of mortgagee consent form?

What information must be reported on mortgagee consent form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.