Get the free Non-participating Manufacturer or Importer Bond

Get, Create, Make and Sign non-participating manufacturer or importer

How to edit non-participating manufacturer or importer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-participating manufacturer or importer

How to fill out non-participating manufacturer or importer

Who needs non-participating manufacturer or importer?

A Complete Guide to the Non-Participating Manufacturer or Importer Form

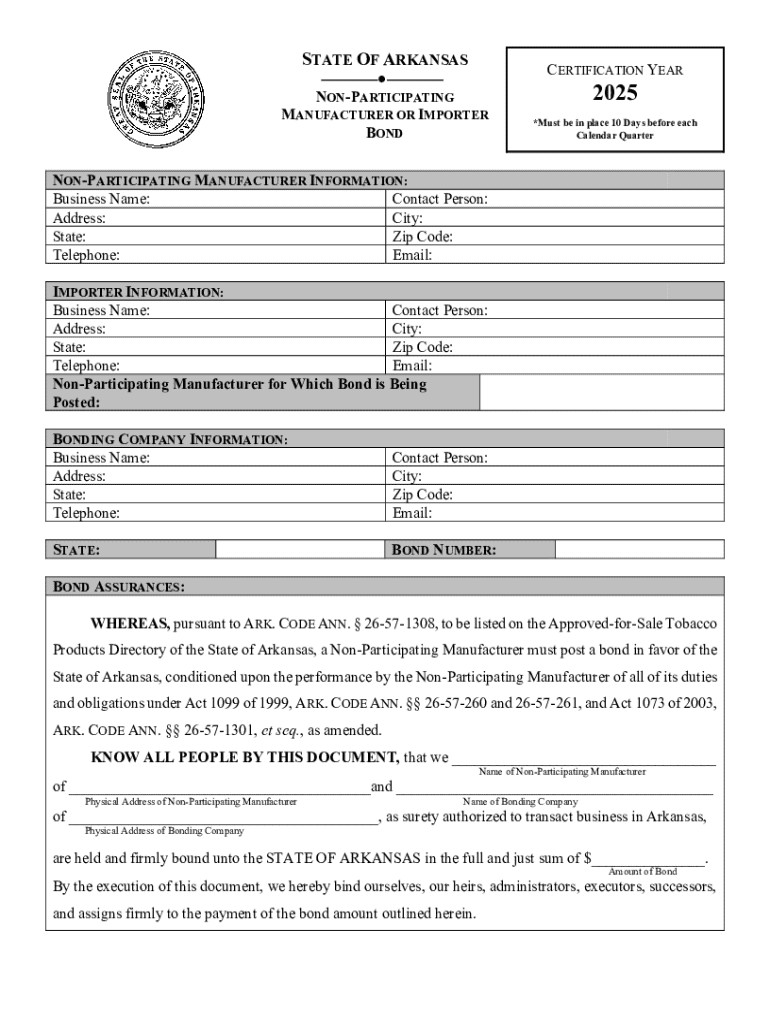

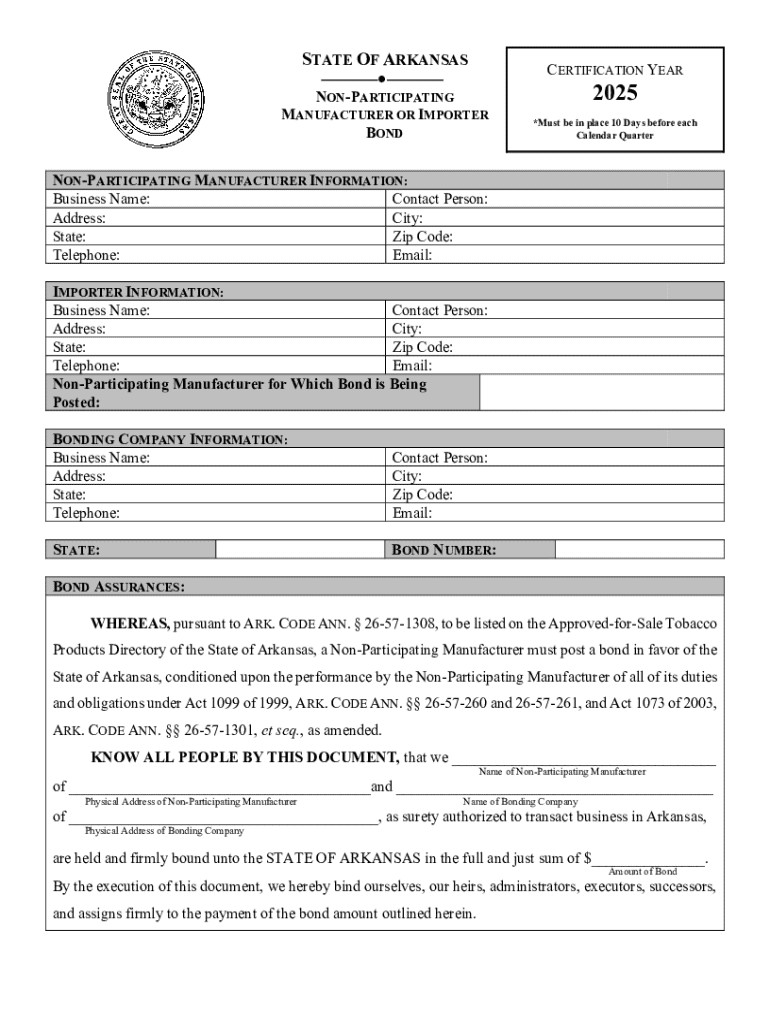

Understanding the non-participating manufacturer or importer form

The non-participating manufacturer or importer form is a critical document for businesses that manufacture or import tobacco products but do not participate in certain state tobacco tax programs. This form is essential for ensuring compliance with regulations that govern tobacco manufacturing and sale, especially in jurisdictions where specific disclosures and financial commitments are mandated.

The significance of this form cannot be overstated. It serves as a formal acknowledgment by manufacturers and importers of their obligations under state laws, particularly those related to escrow payments and tax compliance. If companies fail to file this form correctly or within the stipulated time frame, they can face substantial fines and legal repercussions.

Preparing to fill out the non-participating manufacturer or importer form

Before you start filling out the non-participating manufacturer or importer form, it's pivotal to gather all necessary documentation. This includes your identification details, financial statements, and any other relevant business information. Proper preparation not only streamlines the application process but also minimizes the risk of errors.

Common mistakes that applicants make often include leaving fields incomplete or providing inaccurate information. To enhance the accuracy of your submission, double-check all entered data against your documents and existing records.

Detailed instructions for completing each section of the form

Completing the non-participating manufacturer or importer form requires meticulous attention to detail. Below is a breakdown of each section of the form and key considerations for each.

PART : Manufacturer identification

In this section, you must provide specific details about the tobacco manufacturer or importer, including name, address, and contact information. Make sure all data aligns with your business registration documents to prevent discrepancies during processing.

PART : General questions for the manufacturer

Answering general questions accurately is crucial. These queries typically address the nature of your business operations, compliance history, and any existing legal issues. Transparency here fosters a positive relationship with regulatory authorities.

PART : Brand and style identification

When listing brands and styles, you must adhere to brand registration standards laid out by relevant authorities. It's essential to correctly categorize your products to avoid incorrect tax calculations.

PART : Residency status

Manufacturers must provide accurate residency information, which may influence tax liabilities and compliance requirements. Ensure that your residency details align not just with your business setup but also with state laws.

PART : Escrow account information

This part is divided into several subsections where you will report on your escrow account for tobacco tax payment.

Section A: Qualified escrow fund – Financial institution

Choosing an appropriate financial institution for your escrow fund is critical. Look for accredited institutions that meet state regulations.

Section B: Escrow fund deposit/withdrawal history for Pennsylvania

You must provide detailed transaction history related to your escrow fund to ensure transparency and accountability.

Section : Surety bond status

Understanding your surety bond responsibilities is vital. Ensure that you are compliant with the bond’s terms to avoid future legal complications.

Section : Required certification checklist form TES-016

Reviewing the certification checklist thoroughly is paramount. Make sure that all required documents accompany your submission to avoid delays.

PART : Execution by corporate officer or director

A designated corporate officer or director must sign the form, affirming the accuracy of the provided information. Verification steps are crucial at this stage to maintain the integrity of your submission.

Editing and managing your non-participating manufacturer or importer form

Once you've completed the form, managing it is equally important. Using tools such as pdfFiller enables you to edit your form easily and update details as needed without starting from scratch.

Collaborative features allow multiple team members to contribute to the completion process, enhancing accuracy and efficiency.

eSigning your non-participating manufacturer or importer form

The eSigning process provides a seamless way to sign your non-participating manufacturer or importer form digitally. This not only simplifies the signing procedure but also guarantees compliance with legal standards for digital signatures.

By utilizing pdfFiller’s eSigning features, users can expedite their submission process and maintain a record of signed documents, greatly enhancing organizational efficiency.

Frequently asked questions (FAQs) about the form

It's common to encounter several questions when dealing with the non-participating manufacturer or importer form. Many applicants inquire about the submission process, including how to amend submitted information or address potential issues.

Additionally, questions regarding the required information frequently arise. Clarifications on these points can help streamline the application process and foster a clearer understanding of requirements.

Managing compliance after submission

After submitting the non-participating manufacturer or importer form, monitoring your submission status is crucial. Stay informed about any communications from regulatory bodies and be prepared to respond to follow-up requests promptly.

Moreover, maintain meticulous records of all activities related to compliance for future reference. This careful management of documents not only supports ongoing compliance but also prepares your business for any future submissions.

Leveraging pdfFiller for your document management needs

pdfFiller stands out as a comprehensive solution for document management, especially for tasks involving the non-participating manufacturer or importer form. Its cloud-based platform allows users to edit, sign, and store documents securely and accessibly.

With features tailored for efficiency, pdfFiller enhances collaboration and organization, making it easier for teams to manage their documentation needs effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send non-participating manufacturer or importer to be eSigned by others?

How do I edit non-participating manufacturer or importer online?

Can I sign the non-participating manufacturer or importer electronically in Chrome?

What is non-participating manufacturer or importer?

Who is required to file non-participating manufacturer or importer?

How to fill out non-participating manufacturer or importer?

What is the purpose of non-participating manufacturer or importer?

What information must be reported on non-participating manufacturer or importer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.