Get the free Form 8-k

Get, Create, Make and Sign form 8-k

Editing form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

Form 8-K Form: Comprehensive How-To Guide

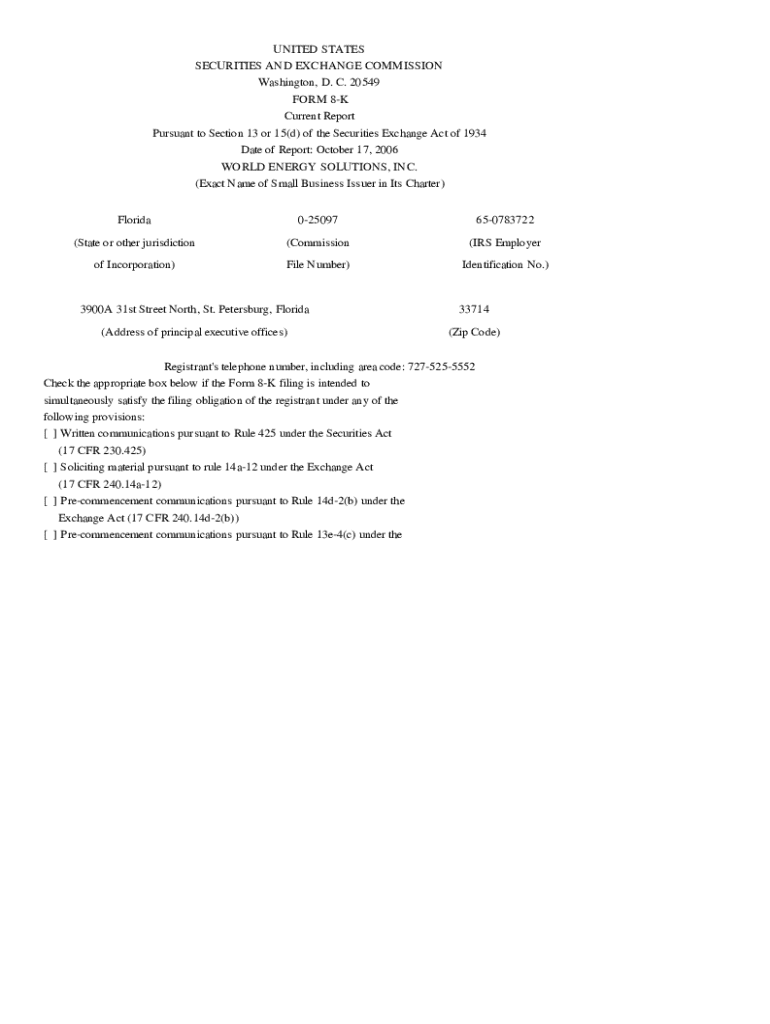

Understanding the Form 8-K

Form 8-K is a crucial component in the realm of corporate finance and governance. It serves as a report that publicly traded companies must file with the U.S. Securities and Exchange Commission (SEC) to disclose significant events that shareholders should know about. This form focuses on major occurrences at a company that could influence an investor's decision-making. Its timely filing is essential, as it aids in maintaining transparency within the market.

The importance of Form 8-K cannot be overstated; it serves as a critical tool for corporate accountability. This form ensures that investors and stakeholders are kept in the loop about events that could affect the company's performance or stock price, making it a vital aspect of corporate governance.

Purpose of filing Form 8-K

The primary purpose of filing Form 8-K is to disclose material events that can impact a company's financial health or operational capabilities. This disclosure protects investors by keeping them informed about critical changes within the company, enabling them to make well-informed investment decisions. The proactive approach of reporting significant events fosters a climate of trust and transparency, essential for a functioning securities market.

When is Form 8-K required?

Various events trigger the requirement for filing Form 8-K, each reflecting significant changes within a corporation. For example, if a company undergoes an acquisition or divestiture of a substantial asset, it must be reported promptly. Similarly, changes in control of the registrant, including mergers or new ownership, require disclosure to maintain investor awareness.

Other key events include the departure of directors or specific officers and amendments to corporate bylaws. By ensuring timely filings, companies uphold their responsibility to investors and maintain the integrity of financial markets.

Key components of Form 8-K

Form 8-K consists of several labeled sections, each designed to capture specific information relevant to the events being reported. Section 1 typically discusses the registrant's business and operational context, while Section 2 delves into financial information and significant metrics. Another key section is Section 4, which relates to accountants and financial statement matters critical for audit transparency.

Moreover, Section 5 focuses on corporate governance and management changes, ensuring shareholders are informed about leadership dynamics. Other sections cover areas such as asset-backed securities, regulatory disclosures, and miscellaneous matters, creating a comprehensive picture of the registrant's financial health and operational status.

Reading and interpreting a Form 8-K

Navigating a Form 8-K document may seem challenging at first, but understanding its structure can simplify the process. The document is organized into sections, each featuring relevant headings that allow readers to quickly identify key points. It usually starts with a summary of significant events, followed by detailed explanations in structured sections.

When analyzing the information presented, focus on identifying the implications of significant events and changes. This includes understanding how these disclosures may affect the company's financial performance or strategic direction. Effective interpretation requires context, so it’s beneficial to compare the newly reported events with past filings.

Benefits of filing Form 8-K

Filing Form 8-K brings several benefits for both issuers and investors. For issuers, timely disclosures not only enhance investor confidence but also ensure compliance with SEC regulations, protecting the corporation from potential legal ramifications arising from undisclosed material facts. This practice fosters a positive corporate image and builds trust with stakeholders.

For investors, Form 8-K provides timely access to critical developments within a corporation. This continuous flow of information allows investors to assess the health of a company more accurately and to make informed decisions regarding their investments.

Filing process for Form 8-K

The filing process for Form 8-K requires careful preparation and attention to detail. Companies must gather all the necessary information, ensuring that every material event is appropriately documented. This includes confirming the accuracy of details and compiling any required exhibits to support the disclosures.

After preparation, the form is submitted electronically to the SEC via their EDGAR database. Companies must be diligent about deadlines, as failing to file within the required timeframe can result in penalties or scrutiny from regulators. It's essential to keep in mind the common mistakes that filers often encounter, such as omissions and inaccuracies, which can undermine the document's integrity.

Historical context of Form 8-K items

The reporting standards underlying Form 8-K have evolved considerably over the years. Changes in regulatory frameworks have shaped the types of events that provoke a filing. For instance, major regulatory reforms following financial crises have placed greater emphasis on corporate governance and the need for timely disclosures.

Examining historical data trends, we can observe how the frequency and nature of Form 8-K filings have shifted. Certain prominent filings stand out in this evolution, teaching valuable lessons about the implications of corporate transparency on market stability and investor trust.

Frequently asked questions about Form 8-K

Investors and issuers often have questions regarding essential details about Form 8-K. One common inquiry is, 'What must be disclosed in a Form 8-K?' Essentially, it includes any relevant material events that may affect the company's financial standing or operations. Another pressing issue is, 'What happens if a Form 8-K is not filed?' Failing to file can lead to fines, penalties, and a loss of investor confidence.

Investors looking to access filed Form 8-K documents can easily do so through the SEC's EDGAR database, where filings are publicly available contemporaneously. Additionally, it is important to understand how Form 8-K relates to other SEC filings, as these documents together contribute to the overall narrative of a company's health and transparency.

Interactive tools for managing Form 8-K

Utilizing tools like pdfFiller can transform the filing process for Form 8-K into a more efficient and streamlined experience. With pdfFiller, users can edit and customize their Form 8-K effectively, ensuring all essential information is captured accurately. The platform also offers eSignature features that facilitate swift compliance with submission requirements.

Collaboration tools within pdfFiller enable teams to work together seamlessly, sharing documents and tracking changes in real time. Such capabilities not only enhance productivity but also minimize the risk of errors, ultimately leading to more reliable filings.

Sector-specific considerations

Different industries may have variations in how they report similar events via Form 8-K filings. For example, financial institutions may highlight regulatory changes or legal investigations more prominently compared to manufacturing companies, which might focus on operational metrics or acquisitions. Understanding these nuances can provide investors with deeper insights into how specific sectors navigate significant changes.

Best practices for filing Form 8-K vary across industries, but commonalities include emphasizing the clarity of disclosures and ensuring compliance with all applicable regulations. Maintaining consistency in format and readability will greatly improve the effectiveness of the filing, making it easier for investors to access the sought-after information.

Resources for staying updated

Staying abreast of news and updates on SEC regulations is essential for compliant filing of Form 8-K. Registrants can subscribe to notifications from the SEC, ensuring they are informed of relevant changes and new guidelines. This proactive approach enables companies to remain in good standing with regulatory requirements.

Additionally, accessing educational materials and attending webinars conducted by experts in corporate governance can further deepen understanding of best practices and emerging trends regarding Form 8-K and its implications in the investment landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete form 8-k online?

How can I edit form 8-k on a smartphone?

How do I complete form 8-k on an Android device?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.