Get the free Decline in Value Reassessment Application Form

Get, Create, Make and Sign decline in value reassessment

Editing decline in value reassessment online

Uncompromising security for your PDF editing and eSignature needs

How to fill out decline in value reassessment

How to fill out decline in value reassessment

Who needs decline in value reassessment?

Decline in Value Reassessment Form: A Comprehensive How-to Guide

Understanding decline in value reassessment

A decline in value reassessment is a formal request made by property owners to adjust the assessed value of their property downwards. This can occur when market conditions lead to a significant decrease in property values, often influenced by economic downturns, changes in local development, or an oversupply of similar properties. For homeowners and property investors, understanding this process is critical as it directly impacts property taxes, potentially leading to substantial savings.

The importance of property value reassessments cannot be overstated. When property values decline, corresponding property taxes should also reflect this decrease. For many homeowners, a successful reassessment can ease financial burdens, while investors may benefit from lower taxes on their rental properties. Proposition 8, which allows for temporary reductions in property value assessments, serves as a vital resource for property owners facing diminishing property values during challenging economic times.

Eligibility for reassessment

To apply for a decline in value reassessment, property owners must meet specific criteria. The primary condition is evidence of a significant change in market conditions that negatively affects the property’s value. This may include factors such as a spike in local foreclosures, increased vacancy rates, or diminished property demand. Understanding comparable sales—recent sales of similar properties in the area—is essential to substantiate your request.

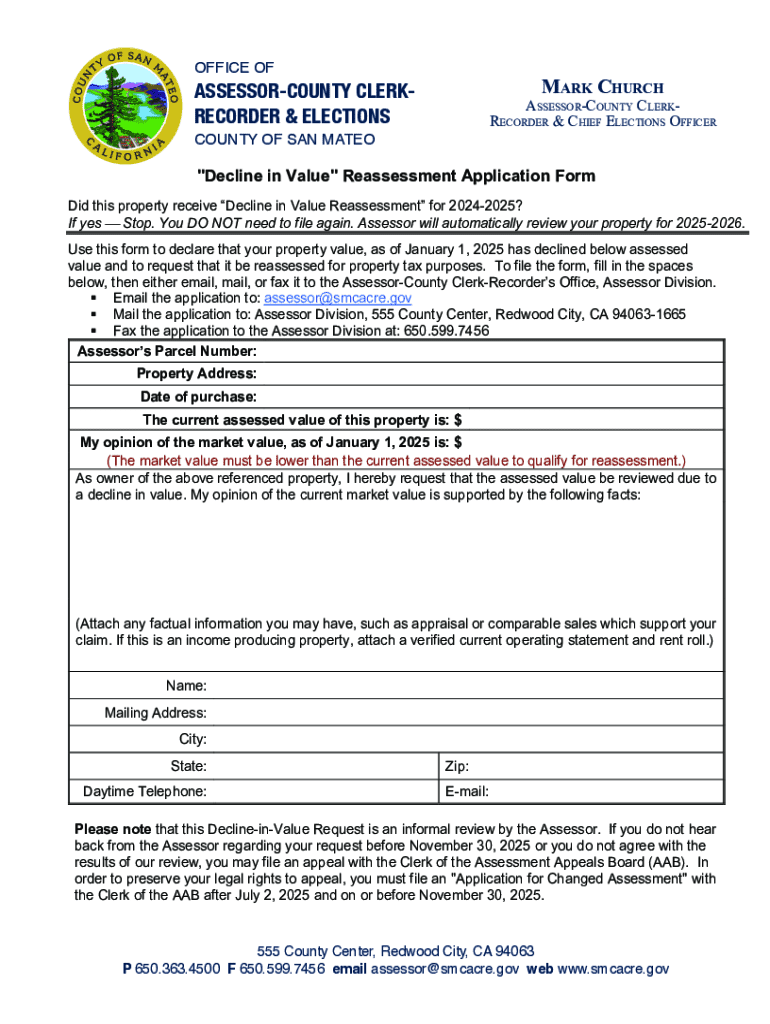

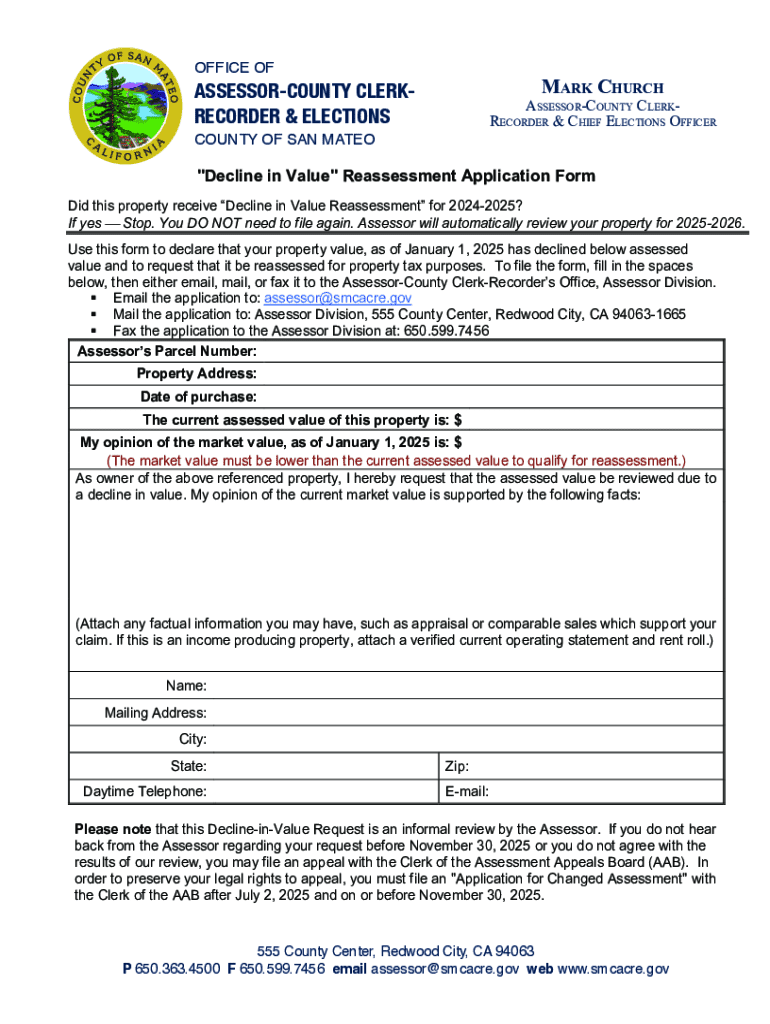

Additionally, there are important deadlines to keep in mind. Many jurisdictions require that reassessment requests be submitted within a set period following the change in value, often linked to property tax calendar dates. Carefully reviewing local regulations can help determine if your property qualifies for this reassessment, allowing you to take timely action.

Steps to file a decline in value reassessment

Filing for a decline in value reassessment involves several key steps. First, collecting necessary information is crucial. Prop owners need specific documents, such as the parcel number and property details. Gathering data on comparable sales from recent transactions in your neighborhood can significantly bolster your case by providing evidence of market trends.

Once you have all the required documents, the next step is to choose the right submission method. Many counties offer an online e-form submission process, allowing for quicker and more efficient filing. Electronic submissions often provide real-time confirmation of receipt, minimizing potential delays. However, in cases where electronic submission isn't available, or if you require special accommodations, a manual submission may be necessary.

How to fill out the decline in value reassessment form

Filling out the decline in value reassessment form can be straightforward when you know what to include. Begin with personal information such as your name, address, and contact details. This helps ensure that the assessor can reach you easily for any follow-up questions. Next, provide comprehensive property information, including your parcel number and the type of property. Be precise, as inaccuracies can lead to processing delays.

A crucial section of the form focuses on addressing specific market value concerns. Clearly articulate how local market conditions have affected your property’s value. Including supporting documentation, such as sales data from comparable properties, is essential to strengthen your case. To ensure your submission is error-free, avoid common mistakes, such as leaving sections blank or providing incomplete information. Each field matters; a completed form with accurate data can significantly enhance your chances of success.

After submission: what to expect

After submitting your decline in value reassessment form, it's important to know what to expect next. Generally, property owners will receive feedback or a decision regarding their request within a few weeks to several months, depending on the jurisdiction's workload and processing times. The outcome can vary: a successful reassessment may lead to a reduction in your property's assessed value and, consequently, lower property taxes. Alternatively, if your request is denied, it’s crucial to understand the reasoning behind it.

If you disagree with the findings, there are next steps available. You can appeal the decision by following your local area's protocol for disputes, which may involve attending a hearing or submitting further documentation, underscoring the importance of maintaining comprehensive records throughout the process.

Resources and support for property owners

Utilizing tools like pdfFiller can greatly assist in managing your documentation related to the decline in value reassessment form. The platform allows users to easily edit, sign, and store forms digitally, ensuring you have everything in one place. PDF files can be manipulated easily to include changes or additions as needed, making it a practical choice for property owners navigating through the reassessment process.

Property owners can also contact their local assessor's office for guidance. Many offices provide resources, including FAQs and helplines, to assist you further. Moreover, monitoring online resources and tools that track property values can help you stay informed about your property and local market trends, aiding your decision on whether to file for reassessment.

FAQs about decline in value reassessment

Several common questions arise concerning the decline in value reassessment process. One frequently asked question is, 'What should I do if my property has not been reassessed recently?' In such cases, you may still file for reassessment if you can demonstrate a decline in value, supported by recent market evidence. Another common query is about the appeals process: 'Can I appeal if my request is denied?' Yes, appeals are typically permitted, and you can provide additional information to support your claim.

Regarding the frequency of filing reassessments, property owners can generally submit a request annually if values drop significantly. Lastly, understanding the role of the Board of Equalization (BOE) in this process is vital; the BOE serves to ensure fair assessments and may provide guidance on local tax appeals.

Additional considerations for different property types

When filing a decline in value reassessment, property types come into play: residential properties often have more straightforward guidelines compared to commercial or investment properties. Homeowners might focus more on personal market factors, while commercial properties may be influenced by broader economic trends and occupancy rates. Investors should be particularly proactive, as reassessing their rental properties can directly affect their cash flow and profitability.

For commercial properties, understanding zoning laws and local market conditions is essential, as these aspects can significantly impact property value. Key considerations may also include lease agreements and tenant vacancies. Each property type presents unique challenges, but the reassessment form can cater to all, provided the right information is included.

Legal framework and resources related to property tax

Understanding the legal landscape surrounding property tax assessments is key to navigating the decline in value reassessment form effectively. Notably, Proposition 13 established a complex framework for property tax rates in California, while Proposition 8 provides for temporary reductions in assessed value when property values decrease. These propositions underscore the need for awareness of state laws affecting property assessments, ensuring property owners can advocate for themselves when values decline.

Additional local and state laws may impact the assessment process, making it beneficial to familiarize yourself with official resources. Key documents, links to state and local tax agencies, and instructional materials can offer significant insights. Educating yourself about these laws can pave the way for more effective engagement with local assessors and better outcomes in the reassessment process.

Engaging with local tax authorities

Effectively communicating with assessors can greatly influence the reassessment process. Being prepared with comprehensive records and documentation, including property appraisals and tax history, can help in discussions with local tax authorities. Approach these conversations with clarity and confidence—being respectful yet assertive can foster a productive rapport with assessors who can play a vital role in your reassessment request.

Keep records meticulously, as they serve as the backbone of your reassessment case. Create a dedicated folder for any communication or documents related to your property and its assessed value. Additionally, exploring partnerships with local agencies may provide additional support systems, whether through community resources, local advocacy groups, or collaboration with real estate professionals, all aimed at providing a more robust support structure for navigating property tax assessments.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in decline in value reassessment?

How do I fill out the decline in value reassessment form on my smartphone?

How can I fill out decline in value reassessment on an iOS device?

What is decline in value reassessment?

Who is required to file decline in value reassessment?

How to fill out decline in value reassessment?

What is the purpose of decline in value reassessment?

What information must be reported on decline in value reassessment?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.