Get the free Corporate Savings

Get, Create, Make and Sign corporate savings

Editing corporate savings online

Uncompromising security for your PDF editing and eSignature needs

How to fill out corporate savings

How to fill out corporate savings

Who needs corporate savings?

A Comprehensive Guide to Corporate Savings Form

Understanding corporate savings: An overview

Corporate savings refer to the strategies and methods businesses employ to set aside a portion of their revenue for future needs, often focusing on long-term financial health and growth. In essence, it is a systematic approach that enables companies to allocate funds efficiently, ensuring that they have resources to navigate unforeseen circumstances or to invest pleasantly in opportunities.

The importance of corporate savings cannot be overstated. Maintaining a buffer allows for operational flexibility, supporting business ventures and initiatives that arise unexpectedly. For businesses, the Corporate Savings Form serves as a vital tool in this process, capturing essential information regarding projected financial goals, growth strategies, and intended savings.

The Corporate Savings Form acts as a structured guideline for documenting savings objectives, providing a clear roadmap for company financial aspirations. By formalizing these goals through a singular document, teams can maintain focus on achieving their savings targets while also enhancing accountability and tracking progress.

Benefits of utilizing a corporate savings form

Adopting a Corporate Savings Form streamlines the documentation process, making it easier for teams and individuals to contribute towards their shared financial goals. One of the key benefits is the enhancement of collaboration among different departments. When a uniform form is utilized, all stakeholders are better equipped to contribute their insights and data, fostering a culture of teamwork.

The incorporation of secure eSigning capabilities further adds to the form's advantages, ensuring that approved documents are both legitimate and recognized. Furthermore, integrating cloud-based solutions means that the Corporate Savings Form can be accessed from any location at any time, making the process seamless, efficient, and user-friendly, which is essential for today's remote work environments.

Key features of the corporate savings form

Several key features make the Corporate Savings Form an indispensable tool for organizations. Its interactive tools provide easy editing and customization options, allowing users to modify sections in real-time to suit their specific requirements. This adaptability is crucial in a fast-paced corporate environment where change is the only constant.

Additionally, mobile and desktop accessibility ensures that users can fill out or edit the form from various devices, catering to the preferences of different team members. The support for multiple formats like PDF and DOCX ensures compatibility with existing documents, while robust security measures protect sensitive information, making the process trustworthy and compliant with legal regulations.

Steps for filling out the corporate savings form

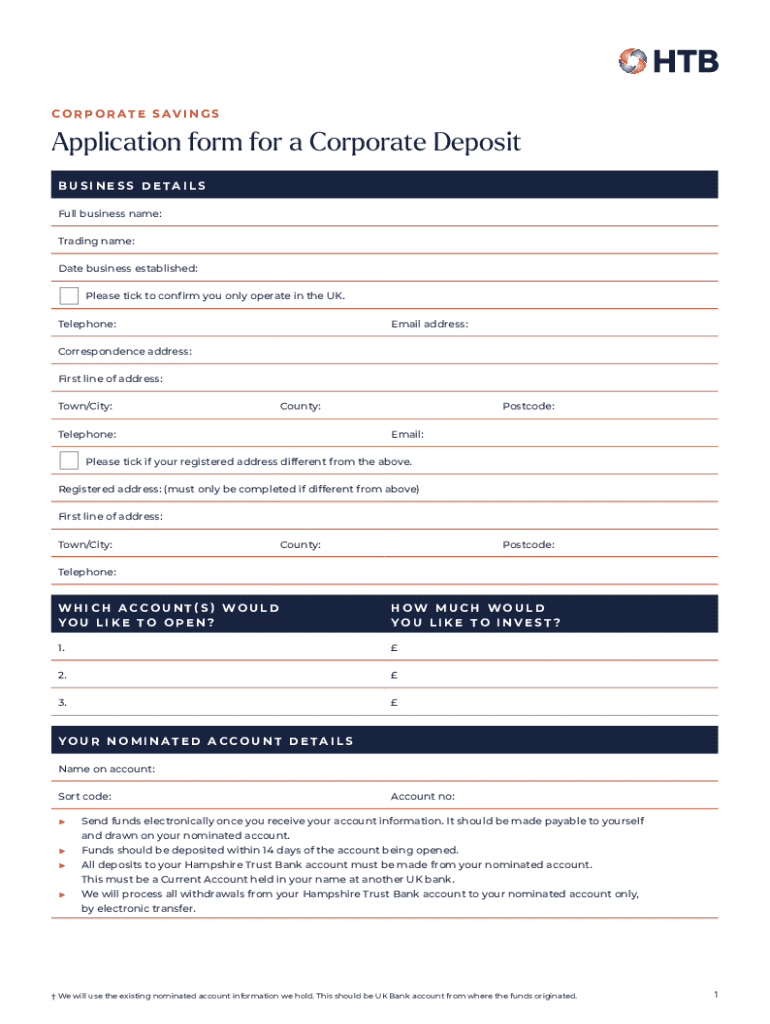

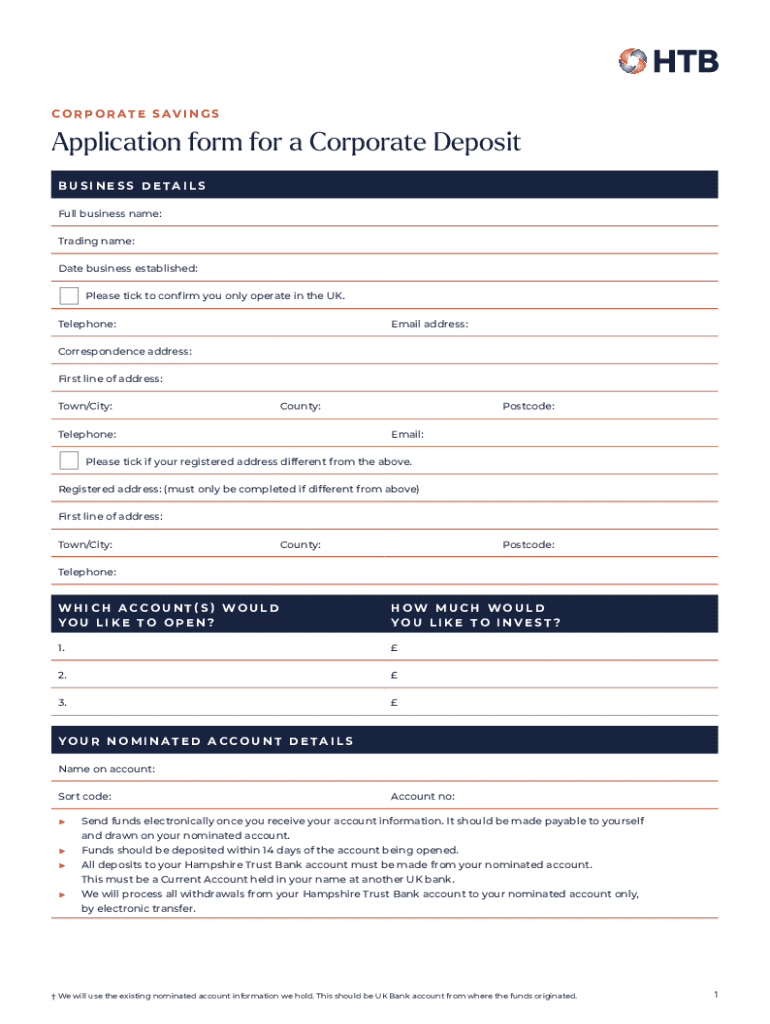

Filling out a Corporate Savings Form begins with proper preparation. It is vital to gather all required information, including essential business details such as company name, contact information, and tax identification number. Furthermore, financial information and projections regarding expected savings contributions must be accurately collected to provide a clear picture of the organization's financial health.

With the necessary information at hand, the next step is filling out the form. There are several sections to complete: Company Information, Savings Goals and Objectives, and Authorized Signatories. Here are some important tips for ensuring accurate and complete entries: - Make sure all information is current and verified. - Use precise financial data to reflect realistic savings goals. - Clearly identify individuals who have the authority to sign off on the form.

After completing the form, it's crucial to review it thoroughly. Best practices include double-checking all information entered and collaborating with team members for additional input to affirm its accuracy before submission.

Editing and customizing the corporate savings form

Utilizing platforms like pdfFiller allows users to access editing tools specifically designed for efficient document management. These tools enable real-time modifications where you can add, remove, or modify content as necessary. Such functionality is vital for teams that may need to adapt their savings goals frequently based on market or operational changes.

Furthermore, employing templates for consistent document creation enhances organizational efficiency. These templates can ensure that critical components are not missed and standard formatting is adhered to, reinforcing professionalism and creating a seamless workflow whenever a new Corporate Savings Form is generated.

eSigning the corporate savings form

Setting up eSignatures for the Corporate Savings Form is a straightforward process that can be broken down into a few simple steps. First, ensure that all participants received the necessary information to add their signatures. Next, through a platform like pdfFiller, users can create signature fields and send the document to authorized signatories for their confirmation.

The benefits of eSigning for corporations are substantial. Not only does it expedite the process by reducing the need for physical presence, but it also enhances the security of the documents. Additionally, managing signature workflows can be streamlined to accommodate multiple signatories, allowing for a more efficient and organized approval process that helps businesses maintain momentum in achieving their savings goals.

Managing your corporate savings document

Once the Corporate Savings Form is complete, effective document management becomes crucial for ensuring its intended use over time. Organizing documents for easy retrieval is the first step; creating a structured filing system aids in quickly locating the necessary forms in the future. That way, teams can remain agile and versatile in their savings strategies.

Moreover, sharing options with team members and stakeholders are increasingly convenient through cloud-based platforms. This transparency fosters collaboration while also allowing stakeholders to track changes and document history, ensuring all parties remain informed about adjustments in savings strategies throughout the fiscal year.

Questions about corporate savings forms?

As with any business process, inquiries may arise about using the Corporate Savings Form appropriately and ensuring compliance with relevant regulations. Common queries often involve how to best fill out sections of the form, any necessary supporting documents, or specifics regarding deadlines for submission.

For troubleshooting, having clear guidance on handling common issues makes for a smoother experience. This includes tips for accurately filling and submitting forms and knowing how to reach out for further assistance should complications arise. Resources such as corporate compliance guidelines or document management best practices can enhance understanding and streamline the entire process.

Additional considerations

Managing corporate savings efficiently requires attention to various critical details. Implementing best practices for savings management can significantly influence a company's ability to achieve its financial objectives. Regularly evaluating the savings strategy against overall business performance ensures alignment and provides an opportunity for necessary adjustments.

Also important is adherence to legal and regulatory compliance, which varies by region. Companies must ensure that their savings processes satisfy local laws and financial regulations to mitigate risks. Understanding how corporate savings integrate into the broader business strategy can further empower organizations to construct well-informed decisions that consistently support their long-term goals.

Need help with your corporate savings form?

If you find yourself needing further assistance while navigating your Corporate Savings Form, support teams like pdfFiller's are readily available. They provide a variety of channels for reaching out, whether it’s through email support, live chat, or structured tutorials designed for ongoing learning.

Interactive support options ensure that users can engage directly with experts who can guide them through specific forms or common challenges, making the document management process as straightforward and efficient as possible.

About pdfFiller

pdfFiller stands committed to providing an innovative solution for document management that empowers users to edit PDFs, eSign, collaborate, and manage documents all from one cloud-based platform. Their mission has always been to simplify the complexities involved in document workflows, allowing individuals and teams to maintain productivity effortlessly.

With a wide array of services and features tailored to enhance efficiency, pdfFiller has garnered numerous user testimonials and success stories that attest to the effectiveness of their platform. Adopting pdfFiller means choosing a modern approach to managing corporate savings and other business documents, driving organizations towards elevated standards of performance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send corporate savings for eSignature?

How can I edit corporate savings on a smartphone?

How can I fill out corporate savings on an iOS device?

What is corporate savings?

Who is required to file corporate savings?

How to fill out corporate savings?

What is the purpose of corporate savings?

What information must be reported on corporate savings?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.