Get the free Tax Forms - DELANEY'S TAX AND ACCOUNTING SERVICE

Get, Create, Make and Sign tax forms - delaneys

Editing tax forms - delaneys online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax forms - delaneys

How to fill out tax forms - delaneys

Who needs tax forms - delaneys?

Tax Forms - Delaney's Form: A Comprehensive Guide

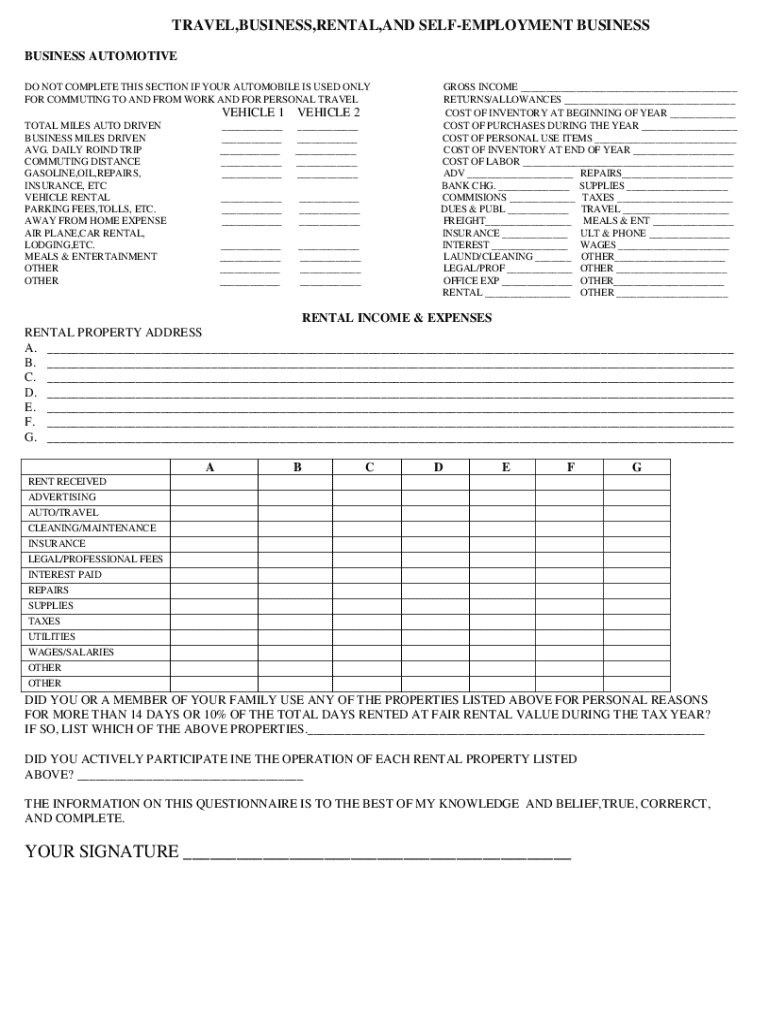

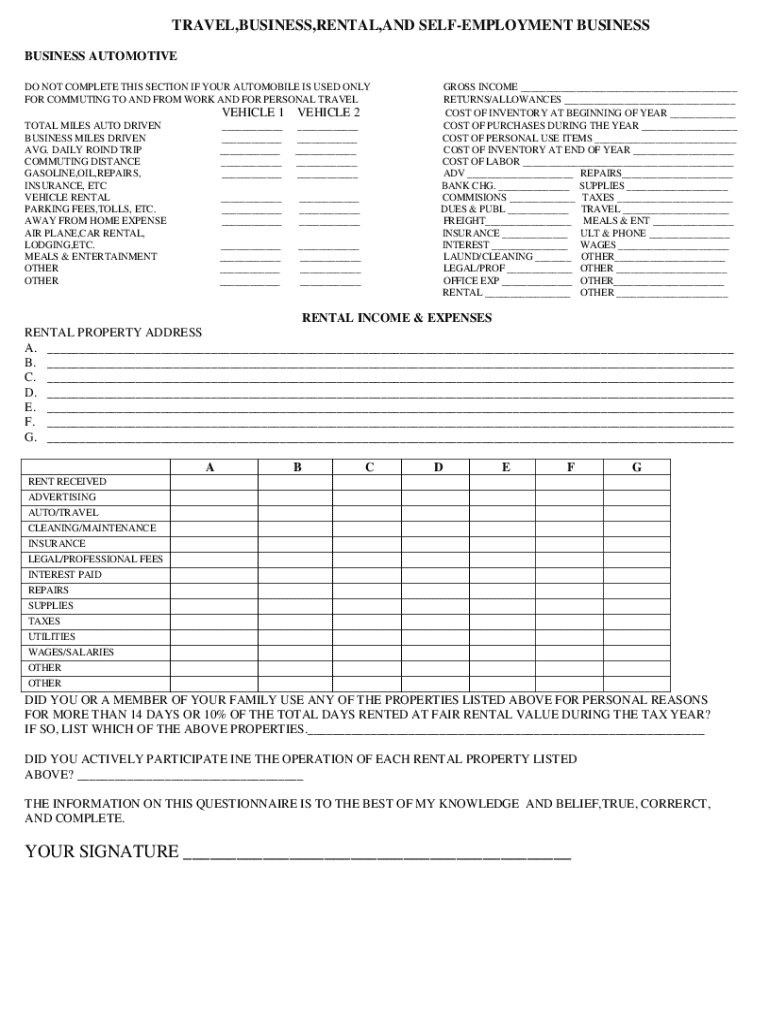

Understanding Delaney's Form

Delaney's Form is a crucial document within the realm of tax filing, serving as a structured way to report various financial activities related to specific tax scenarios. This form is particularly important in ensuring compliance and accuracy during tax submissions.

Its primary purpose is to capture detailed financial data necessary for accurate tax calculation, making it essential for individuals and businesses alike. By using Delaney's Form, taxpayers can avoid complications that may arise from incomplete or erroneous submissions.

Navigating the tax filing process with Delaney's Form

Determining who needs Delaney's Form is essential for efficient tax preparation. Generally, individuals with specific income types, businesses filing certain income reports, or those claiming particular deductions will find this form necessary. Various scenarios trigger the requirement for this document, including self-employment income, investment income, and certain deductions.

When filling out Delaney's Form, it is critical to gather all necessary information beforehand. Essential data includes income sources, deductions, and allowable credits, which must be aggregated accurately for the best results. This preparation can greatly enhance the efficiency of the filing process.

Step-by-step guide to filling out Delaney's Form

Preparation is key when filling out Delaney's Form. Before commencing, gather all relevant documents like W-2s, 1099s, and receipts pertinent to your deductions. Utilizing tools like pdfFiller simplifies this process, allowing users to fill, edit, and manage their forms effortlessly.

The sections of Delaney’s Form can be complex, but breaking them down into manageable parts makes it less intimidating. Each part requires specific information, and clarity on what is needed helps minimize errors.

Common errors include miscalculating total income or forgetting to include waivers. By paying attention to details and using pdfFiller's interactive tools, users can check their work and collaborate directly for accuracy.

Editing and managing your Delaney's Form

Upon completing your Delaney's Form, scenarios may arise where adjustments are necessary. Using pdfFiller allows for easy edits to your saved forms without starting from scratch. This agility can save time and reduce stress while managing tax documents.

Best practices for updating information include keeping detailed records of changes made and having supporting documents available for reference. After making edits, exporting and printing the form correctly is crucial, ensuring it adheres to filing requirements.

E-signing Delaney's Form

E-signing is a modern approach securing the completion of Delaney's Form while offering legal validity. Electronic signatures are widely accepted, streamlining the submission process and promoting efficiency.

To e-sign your Delaney's Form using pdfFiller, simply navigate to the e-sign feature, where you can add your signature effortlessly. This user-friendly process ensures you can validate the document swiftly without unnecessary delays.

Troubleshooting common issues with Delaney's Form

Common questions regarding Delaney's Form often pertain to specific filing deadlines, legal implications of errors, and technical difficulties experienced while completing the form. Addressing these concerns proactively can mitigate confusion and foster a smoother filing experience.

Resources available through pdfFiller's support can assist users in understanding the nuances of tax forms, as well as provide guidance on legal aspects related to submissions.

Best practices for managing your tax documents

Successfully managing tax documents extends beyond the filing season. An effective storage and organization system helps ensure that important forms, like Delaney's Form, are easily accessible when needed. A digital filing system is advisable, keeping all documents categorized and stored securely in the cloud.

Employing pdfFiller as a solution for year-round document management further simplifies this process. Its cloud-based features provide a secure environment to store documents, organize them categorically, and streamline access during tax season.

Understanding the impact of accurate filing

The importance of accurately filling out Delaney's Form cannot be overstated. Errors can lead to penalties, audits, and challenges that complicate the filing process. Each detail can impact overall tax liabilities, emphasizing the necessity for precision when completing forms.

While the repercussions of mistakes on Delaney’s Form can be significant, the long-term benefits of effective tax management include peace of mind, reduced stress during tax season, and potential savings through optimized tax credits and deductions.

Getting started with pdfFiller

Setting up your pdfFiller account is a straightforward process that opens the door to a suite of features designed to enhance your document-filing experience. The initial steps involve providing your email, creating a secure password, and verifying your account.

Once established, exploring features tailored specifically for tax forms, including Delaney's Form, allows users to make the most of their document preparation. Leveraging pdfFiller’s tools, you can not only fill out forms but also track changes, collaborate with team members, and streamline your filing strategy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my tax forms - delaneys in Gmail?

How can I modify tax forms - delaneys without leaving Google Drive?

How do I edit tax forms - delaneys on an Android device?

What is tax forms - delaneys?

Who is required to file tax forms - delaneys?

How to fill out tax forms - delaneys?

What is the purpose of tax forms - delaneys?

What information must be reported on tax forms - delaneys?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.