Get the free Mtpl Insurance

Get, Create, Make and Sign mtpl insurance

How to edit mtpl insurance online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mtpl insurance

How to fill out mtpl insurance

Who needs mtpl insurance?

MTPL Insurance Form - How-to Guide

Understanding MTPL Insurance

MTPL insurance, or Motor Third Party Liability insurance, is a mandatory insurance requirement for vehicle owners in many jurisdictions. It primarily serves to protect third parties from damages or injuries caused by the insured vehicle. The purpose of MTPL insurance is to ensure that in the event of an accident, victims of vehicle-related incidents receive compensation for damages incurred, thus promoting road safety and reducing the financial burden on drivers.

For vehicle owners, having MTPL insurance is essential not just for compliance with legal requirements but also for peace of mind. In the event of an accident, it covers personal injury and property damage claims, alleviating the driver's financial responsibility. This type of insurance prevents potentially devastating situations where the driver must pay out of pocket for damages caused to others.

Legal requirements for MTPL insurance

In most countries, possessing MTPL insurance is a legal necessity. Failing to secure this insurance can lead to serious consequences, including hefty fines, license suspension, or even vehicle impoundment. The laws vary by region, so understanding local regulations is crucial. For instance, in many EU countries, the minimum liability coverage requirements are strictly enforced, and law enforcement agencies routinely check for valid insurance during traffic stops.

Consequences of not having MTPL insurance extend beyond legal penalties; they also involve significant financial risks. In case of an accident, without insurance, individuals may find themselves liable for all damages incurred, including medical bills, property repairs, and legal fees. This can lead to substantial debt and financial instability.

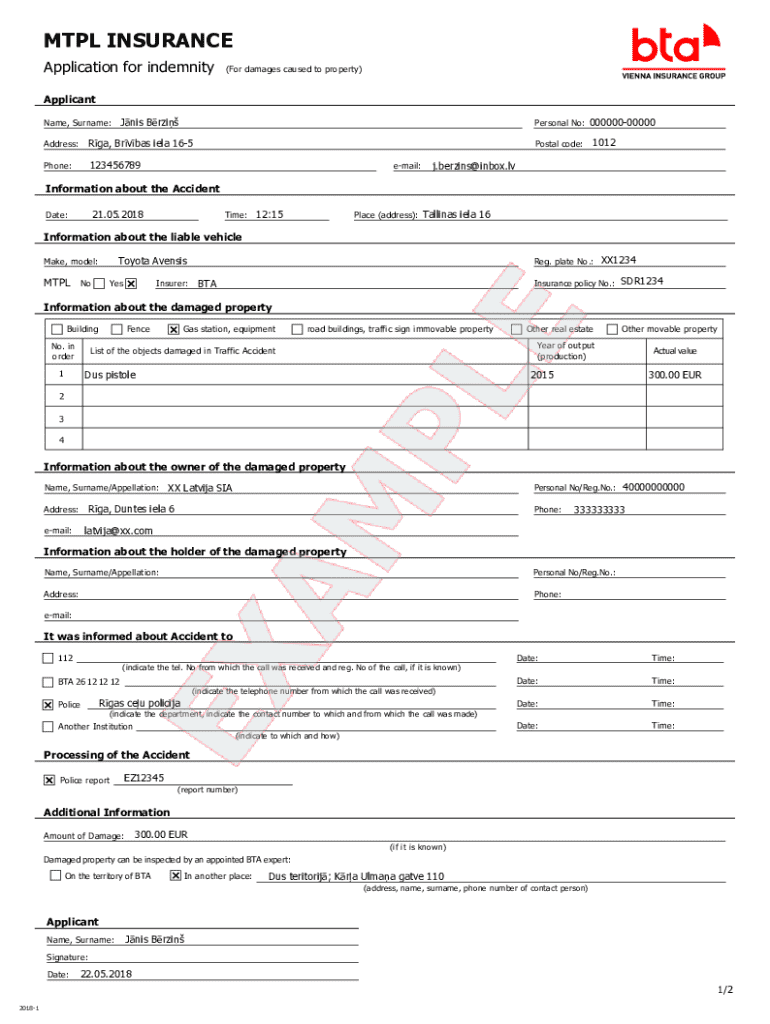

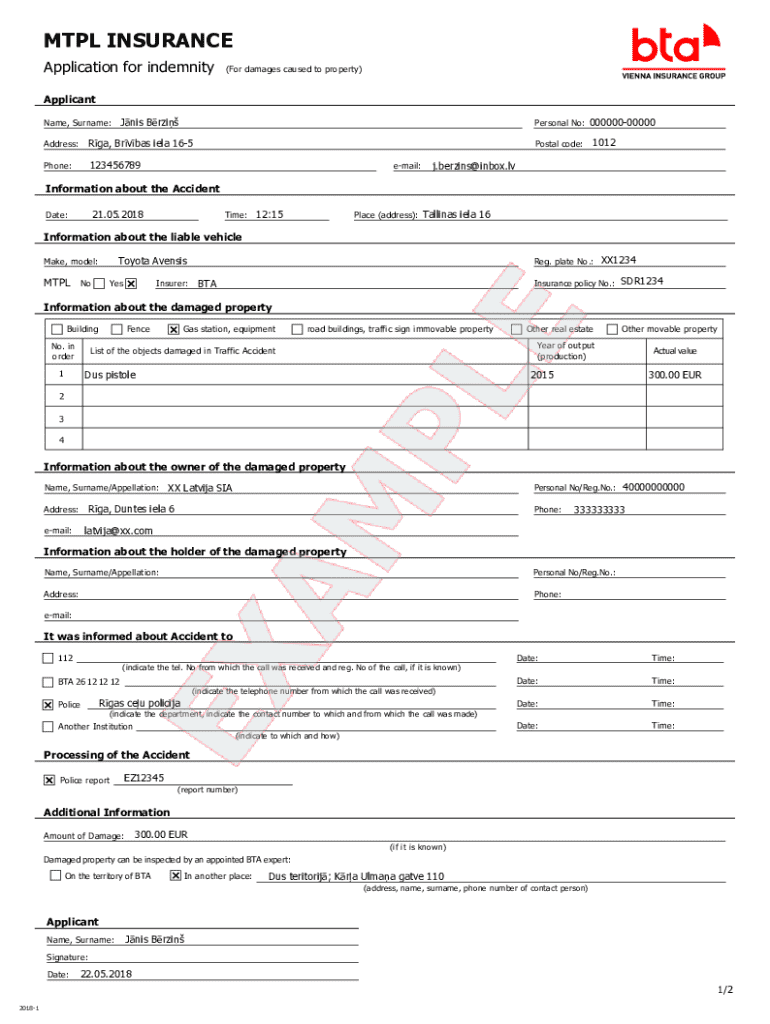

Overview of the MTPL insurance form

The MTPL insurance form is a critical document that vehicle owners must complete to obtain mandatory coverage. This form collects essential information about the applicant and the vehicle, ensuring that both the insurer and the insured are protected under the policy. It is commonly used when applying for insurance or renewing an existing policy.

There are various types of MTPL insurance forms, including individual applications for personal vehicles and corporate applications for companies with fleets. While the fundamental requirements remain consistent across different forms, specific details may vary depending on whether the applicant is an individual or a business entity.

Step-by-step guide to filling out the MTPL insurance form

To fill out the MTPL insurance form accurately, gather the necessary information beforehand. Required documents may include your driving license, vehicle registration details, and any previous insurance documents. Take the time to ensure all data you provide is current and correct, as inaccuracies can delay approval.

When navigating the MTPL insurance form, you'll typically encounter the following sections:

Common mistakes can lead to processing delays, such as mismatched vehicle identification numbers (VINs) or missing signatures. Double-check your information to avoid these pitfalls, as accuracy is vital in this process.

Editing and customizing your MTPL insurance form

Once you've filled out the MTPL insurance form, leveraging tools such as pdfFiller can enhance your editing experience. The platform offers interactive features that allow you to personalize your form. You can change text, add initials, or incorporate your signature with ease.

Using pdfFiller's templates simplifies the process, ensuring you meet all requirements while maintaining an organized layout. Before submitting, review your form carefully, looking for any necessary changes. Making real-time adjustments can be vital, as submitting a corrected form after transmission can often result in delays.

Signing and submitting the MTPL insurance form

With pdfFiller’s electronic signing features, the process of signing your MTPL insurance form becomes straightforward. E-signatures are not only convenient but legally binding, ensuring that your submission can be processed quickly.

To sign the form, follow these steps: select the signature area, create or upload your signature, and save the document. Afterwards, submitting the completed MTPL insurance form electronically through your insurer’s designated portal is typically the fastest method. Alternatively, if required, print the form for manual submission. Familiarize yourself with the submission method preferred by your insurer to ensure a seamless experience.

Tracking and managing your MTPL insurance application

Once you have submitted your MTPL insurance application, tracking its status can provide peace of mind. Many insurers offer online tracking tools that allow you to monitor your application’s progress, view any required documentation, and receive updates on approvals.

If you need to make modifications after submission, it’s crucial to contact your insurer as soon as possible. Each insurance provider will have guidelines for amendments, which might include submitting an amendment form or providing additional documentation.

Frequently asked questions (FAQs) about MTPL insurance forms

When navigating the MTPL insurance form process, many individuals have similar questions. Common queries include those related to coverage—such as what incidents qualify under MTPL insurance and whether it covers personal injuries. It is essential to read your policy’s terms thoroughly, as coverage may vary significantly.

Form-specific questions also arise, such as 'What if I made a mistake on my form?' or 'How long does processing take?' Generally, minor mistakes can often be corrected by contacting the insurer directly. The processing time can vary but usually takes anywhere from a few days to several weeks depending on the insurer's workload and the complexity of your application.

Contact information for further assistance

For any uncertainties or questions regarding your MTPL insurance form, reaching out to pdfFiller support is recommended. They offer assistance via various channels, providing users with options tailored to their preferences.

Useful contact details generally include email support, customer service phone lines, and live chat options for real-time assistance. Making use of these resources can enhance your experience and clarify any concerns you may have during the insurance form submission process.

Conclusion

Navigating the MTPL insurance form process is crucial for all vehicle owners. Understanding its components and how to efficiently fill it out can save time, reduce frustration, and ensure compliance with legal requirements. By leveraging tools available through pdfFiller, users can seamlessly edit, sign, and manage their documents in a straightforward manner. Securing MTPL insurance is a critical step in responsible vehicle ownership, making it essential to familiarize yourself with the process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in mtpl insurance?

Can I sign the mtpl insurance electronically in Chrome?

How do I edit mtpl insurance on an iOS device?

What is mtpl insurance?

Who is required to file mtpl insurance?

How to fill out mtpl insurance?

What is the purpose of mtpl insurance?

What information must be reported on mtpl insurance?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.