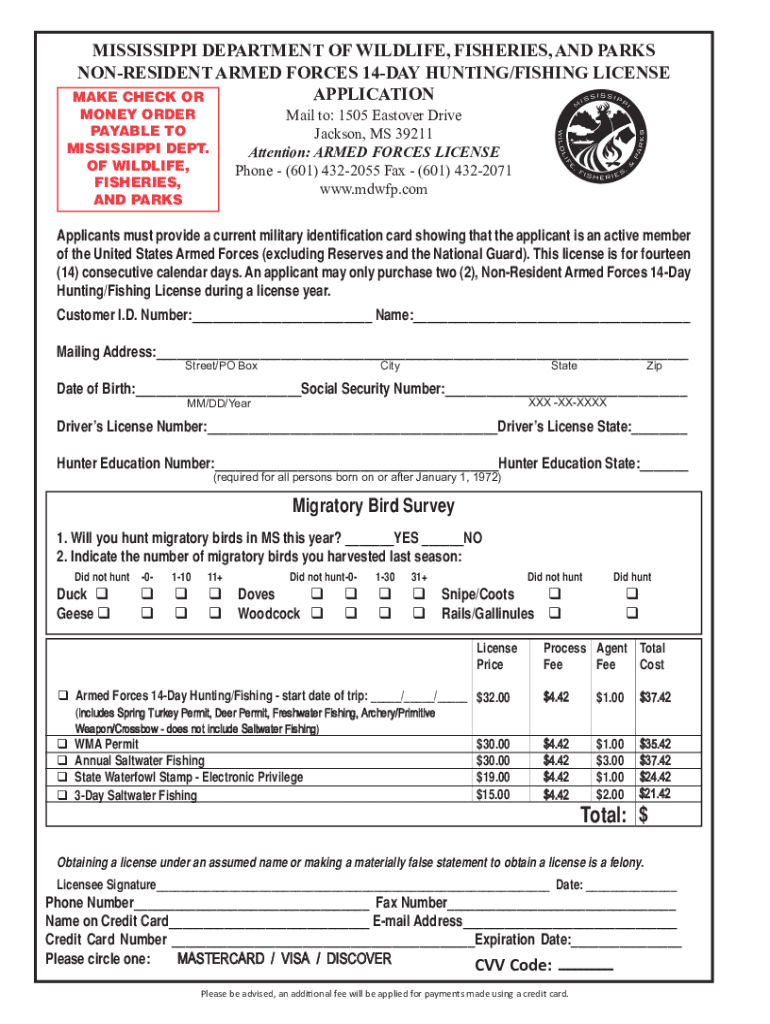

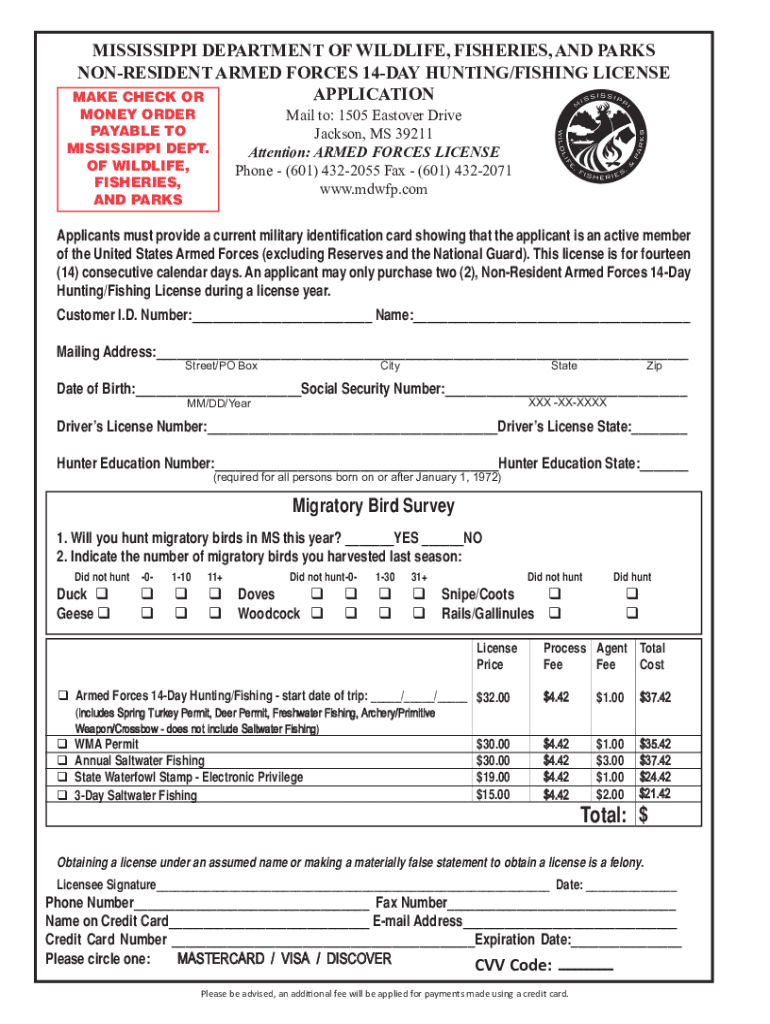

Get the free Non-resident Armed Forces 14-day Hunting/fishing License Application

Get, Create, Make and Sign non-resident armed forces 14-day

Editing non-resident armed forces 14-day online

Uncompromising security for your PDF editing and eSignature needs

How to fill out non-resident armed forces 14-day

How to fill out non-resident armed forces 14-day

Who needs non-resident armed forces 14-day?

Understanding the Non-Resident Armed Forces 14-Day Form

Overview of the non-resident armed forces 14-day form

The non-resident armed forces 14-day form is a specialized document designed to assist active duty military members who are not residents of the state where they serve. This form's main goal is to aid military personnel in declaring their non-resident status for tax purposes. In the context of U.S. military service, this form is crucial as it helps prevent double taxation on military income, allowing service members to focus on their duties without the added burden of unnecessary tax liabilities.

Understanding this form is essential for active duty military personnel and their families. Given the frequent relocation involved in military life, ensuring proper tax compliance while maintaining financial benefits is paramount. The 14-day form acts as a safeguard, particularly for service members stationed away from their legal residence.

Eligibility requirements

To qualify for the non-resident armed forces 14-day form, individuals must meet specific criteria. Primarily, a non-resident is someone who resides outside the state where they are stationed for duty. For military personnel, being on active duty in a different state than their home of record is a key factor. This means a soldier stationed in California but legally residing in Texas would be considered a non-resident of California for tax purposes.

The eligibility criteria include:

Documentation can include state-issued identification, tax returns, or other forms confirming residency. Collecting these documents is crucial before filling out the form to avoid delays.

Step-by-step guide to completing the form

Filling out the non-resident armed forces 14-day form can seem daunting at first. However, following a systematic approach can make the process easier. Here’s a breakdown of the steps.

Step 1: Gather required information

Begin by collecting necessary personal and military identification details. This includes your full name, service number, and branch of service. Also, gather your documentation regarding residency status.

Step 2: Fill out the form

Ensure all requested information is filled in accurately. Each section of the form requires meticulous attention. Common mistakes include skipping fields or incorrect entry of personal information.

Step 3: Review the form for accuracy

Before submission, double-check your form for any errors or omissions. Create a checklist to ensure no details are overlooked and that all required fields are completed.

Step 4: Sign and date the form

Once reviewed, make sure to sign and date the form as a service member. This is a crucial step as it validates your submission.

Step 5: Submission options

You can submit the form either through e-filing or via paper submission. If using e-filing, ensure you have all digital requirements in order. For paper submissions, mailing details must be confirmed. Expected processing times can vary, so check local regulations to stay informed.

Interactive tools and resources

pdfFiller provides various tools to facilitate filling out the non-resident armed forces 14-day form. For instance, the form-filling assistant can offer step-by-step guidance to avoid errors. Additionally, FAQs on common issues faced during form completion can help clarify doubts.

Understanding key terms and legal aspects

When dealing with the non-resident armed forces 14-day form, it's crucial to understand relevant tax terms such as 'non-resident' and 'domicile'. These terms can greatly affect your tax obligations and eligibility for benefits.

Legal implications of submitting inaccurate information can lead to penalties or loss of benefits. Consulting with legal experts or resources like pdfFiller can ensure compliance and accuracy in your documentation.

Special considerations for military personnel

Military members may enjoy unique tax deductions and exemptions. Understanding these can help in maximizing benefits and minimizing liabilities, particularly as military transfers can complicate residency status.

Additionally, service members have specific rights regarding filing claims and returns that may be different from civilian taxpayers. Familiarity with these rights can enhance compliance and efficiency during tax season.

Related forms and documentation

Several other forms are relevant to non-residents that may be necessary depending on individual circumstances. Understanding the differences between the non-resident armed forces 14-day form and similar forms can clarify what is required for your specific situation.

Further, providing a link to additional supporting documentation and templates can be beneficial for users.

Frequently asked questions

You may have many questions about the non-resident armed forces 14-day form. Clarifications around filing deadlines, penalties for late submissions, or troubleshooting mistakes during submission are commonly raised.

Staying informed about changes in tax regulations

Staying updated on tax law changes is vital, especially for military personnel. For 2024, specific updates to residency and taxation rules may affect how the non-resident armed forces 14-day form is filled out and submitted.

Conclusion and next steps

Successfully managing the non-resident armed forces 14-day form requires attention to detail and timely submission. By leveraging the interactive tools and resources available on pdfFiller, you can ensure a seamless experience from form filling to submission.

Utilizing these resources not only simplifies the paperwork involved but also empowers military personnel to focus on their service without tax-related distractions. Ensure that you capitalize on the tools available to streamline the process, enhancing both efficiency and accuracy.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit non-resident armed forces 14-day online?

How do I make edits in non-resident armed forces 14-day without leaving Chrome?

How do I edit non-resident armed forces 14-day on an iOS device?

What is non-resident armed forces 14-day?

Who is required to file non-resident armed forces 14-day?

How to fill out non-resident armed forces 14-day?

What is the purpose of non-resident armed forces 14-day?

What information must be reported on non-resident armed forces 14-day?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.