Get the free Business Savings Account – Adding or Removing an Individual

Get, Create, Make and Sign business savings account adding

Editing business savings account adding online

Uncompromising security for your PDF editing and eSignature needs

How to fill out business savings account adding

How to fill out business savings account adding

Who needs business savings account adding?

Understanding and Filling Out a Business Savings Account Adding Form

Understanding business savings accounts

A business savings account is a financial tool designed to help businesses save money while earning interest on their reserves. Its primary purpose is to separate liquid assets from operational funds, providing a secure financial buffer for unexpected expenses or future investments.

Having a dedicated business savings account comes with multiple advantages. First, it allows for interest accrual, enabling businesses to earn returns on their savings. Second, by separating savings from checking accounts, it aids in better financial organization, contributing to clearer budgeting and financial planning.

Why you need a business savings account adding form

The business savings account adding form is critical for several reasons. First, accurate documentation is essential for the legal and operational integrity of your business. Each section of the form plays a part in confirming your business's identity and purpose.

Additionally, filling this form streamlines the account opening process. By providing all necessary information in one go, businesses can avoid delays, ensuring they access their funds quickly and efficiently.

Preparing to fill out the business savings account adding form

Before you start filling out the business savings account adding form, ensure you have all the required documents. This includes identification such as a driver’s license or passport, as well as business-specific documentation like the articles of incorporation or business license.

You also need to prepare information about your business, such as its legal name, physical address, and employer identification number (EIN). Lastly, be ready with details regarding the initial deposit you intend to make to the account to avoid any hiccups during the submission process.

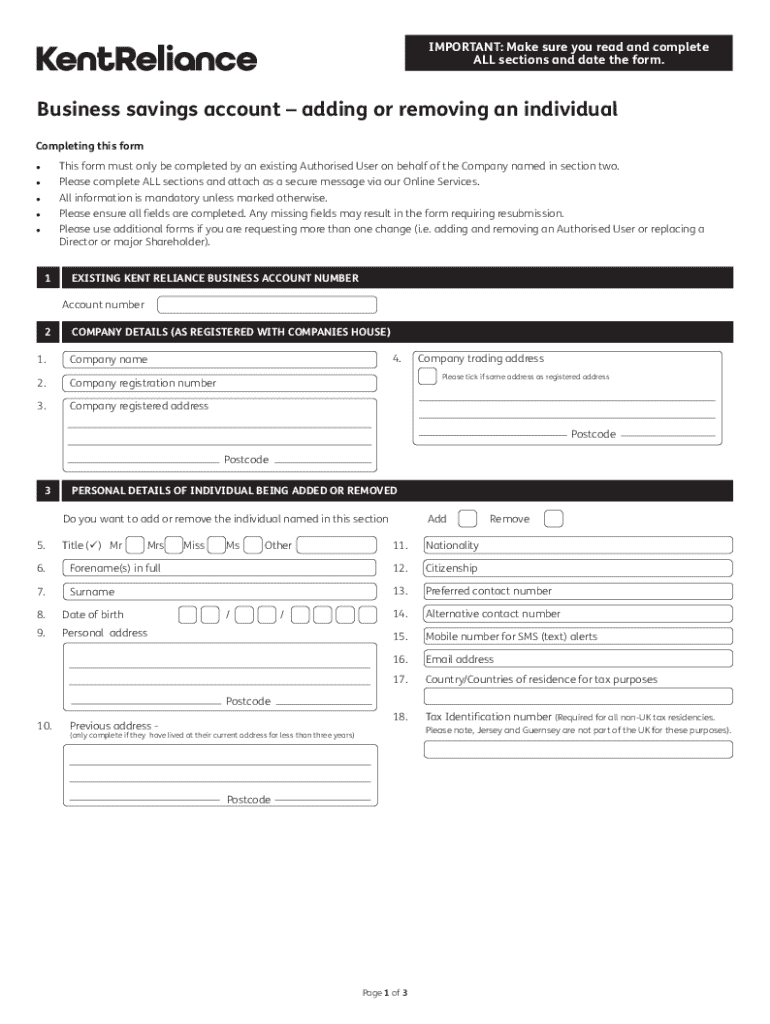

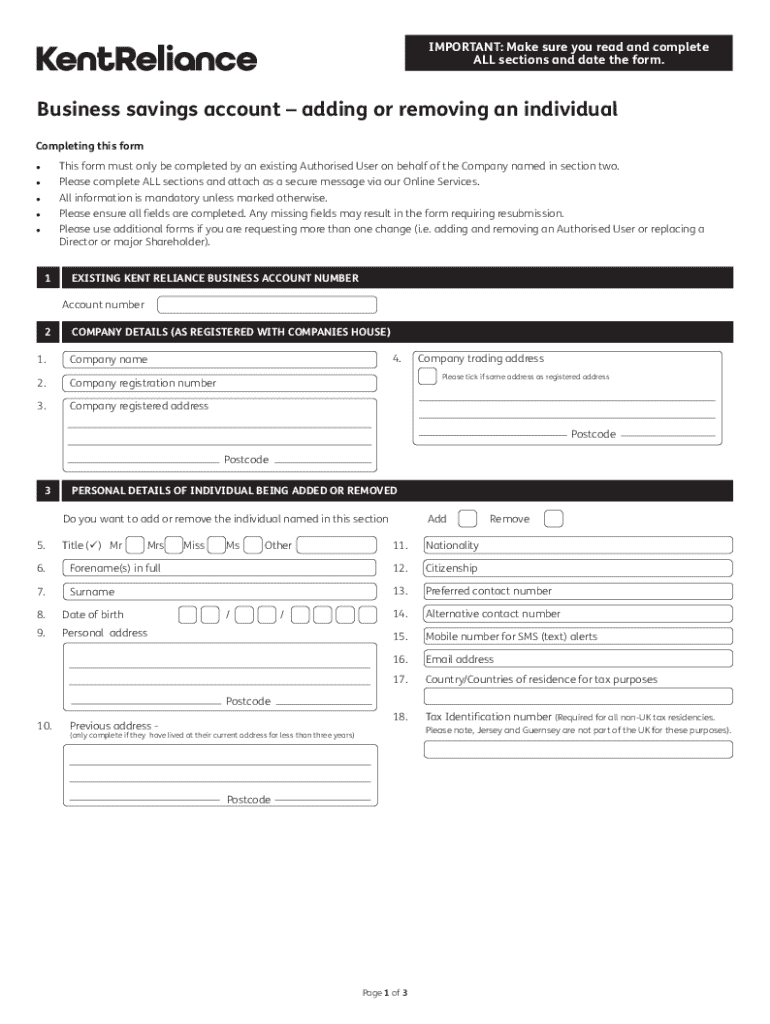

Detailed breakdown of the business savings account adding form

The business savings account adding form typically consists of crucial sections that must be filled out correctly. Each section requires specific information to ensure the account is appropriately set up.

Starting with 'Personal Information,' you'll need to include the owner’s name, address, and contact information. This section confirms the identity of the responsible party for the account.

The next section is 'Business Details,' where you must provide the business name, its structure—such as LLC or corporation—and your Employer Identification Number (EIN). This is vital for tax purposes and to verify your business's legitimacy.

In the 'Account Preferences' section, you'll specify the type of account you wish to open, alongside the initial deposit you want to make. Lastly, the 'Signatures and Authorizations' section requires necessary agreements and signatures from authorized individuals associated with the business.

FAQs about the business savings account adding process

As you prepare to add a business savings account, it’s common to have questions. For instance, many inquire about the minimum opening deposit required, which can vary among banks. Some financial institutions may have no minimum, while others might require several hundred dollars.

If your business has multiple owners, you’ll want to confirm how to handle the application and signatures. Documentation may differ based on your business structure, such as sole proprietorships versus partnerships, so it’s crucial to know what each partner needs to provide for smooth processing.

Tools and resources for managing your business savings account

Managing a business savings account efficiently becomes easier with the right tools. Most banks offer online banking features that allow you to monitor transactions, check balances, and conduct transfers at your convenience. Setting up alerts and notifications can give you timely updates about your account activity.

Additionally, interactive tools such as budget calculators and savings goal trackers can help you manage your finances more effectively. These resources aid in creating a plan for your savings and ensure you’re on track with your financial objectives.

Essential tips for a smooth addition process

To ensure a smooth process while adding a business savings account, double-check all the information you fill out on the form. Accuracy is critical, as mistakes could lead to processing delays or complications.

Moreover, keeping records of your submissions and any changes made is pivotal. Ensure you understand the time frame involved for account setup as well, as this varies by institution and could influence your financial planning.

Next steps after submitting the form

Once you’ve submitted the business savings account adding form, it's time to confirm the account opening and understand the benefits it offers. Banks typically send a confirmation email or letter detailing your account, so watch for that notification.

Setting up online access is another important next step. This allows you to monitor your account seamlessly and utilize additional features such as mobile banking capabilities and overdraft protection options.

Lifetime management of your business savings account

Effective management of your business savings account doesn't stop after the account is opened. Best practices include regularly reviewing account fees and ensuring they align with your financial strategies. Moreover, setting up automatic transfers to your savings can help you build reserves effortlessly.

As your business evolves, it’s essential to adapt your accounts accordingly. Upgrading your savings account or changing your banking strategy may be necessary as your funds grow. This adaptability will keep your financial health robust and aligned with your business goals.

How pdfFiller facilitates the process

pdfFiller streamlines the process of filling out your business savings account adding form by offering a robust platform to edit, customize, and sign documents securely. The platform allows you to quickly make necessary adjustments to the form before submission, ensuring that all information is accurate and complete.

Additionally, pdfFiller offers eSigning capabilities which help users sign documents digitally, accelerating the submission process. For teams, the collaboration features enhance teamwork by providing shared access, making it easier to coordinate and finalize submission efforts.

Continuous support and assistance

Once you have submitted your business savings account adding form, access to customer service is vital for any queries you may have. Most banks provide dedicated support lines or online chat to assist you with any concerns regarding your account.

Moreover, ongoing education resources regarding business financial management can further empower you to utilize your account efficiently. Engaging with financial education materials, webinars, or workshops can significantly enhance your financial acumen.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify business savings account adding without leaving Google Drive?

How do I edit business savings account adding in Chrome?

How do I fill out business savings account adding on an Android device?

What is business savings account adding?

Who is required to file business savings account adding?

How to fill out business savings account adding?

What is the purpose of business savings account adding?

What information must be reported on business savings account adding?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.