Get the free Teacher Coverage Payroll Form

Get, Create, Make and Sign teacher coverage payroll form

Editing teacher coverage payroll form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out teacher coverage payroll form

How to fill out teacher coverage payroll form

Who needs teacher coverage payroll form?

Comprehensive Guide to the Teacher Coverage Payroll Form

Understanding the teacher coverage payroll form

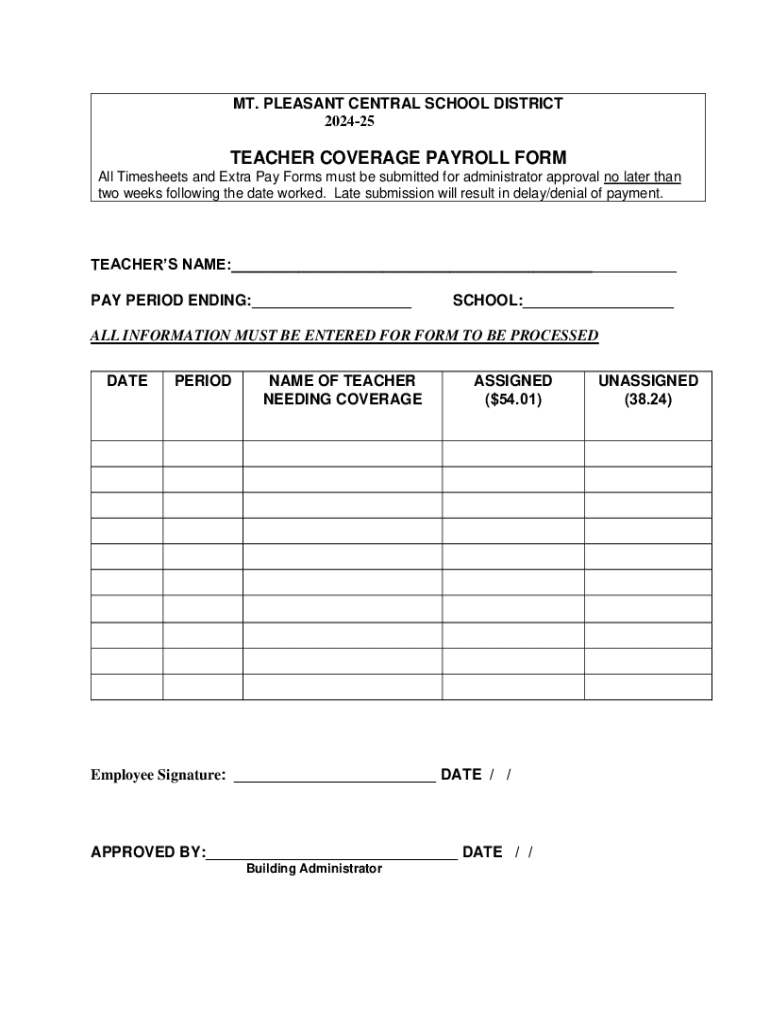

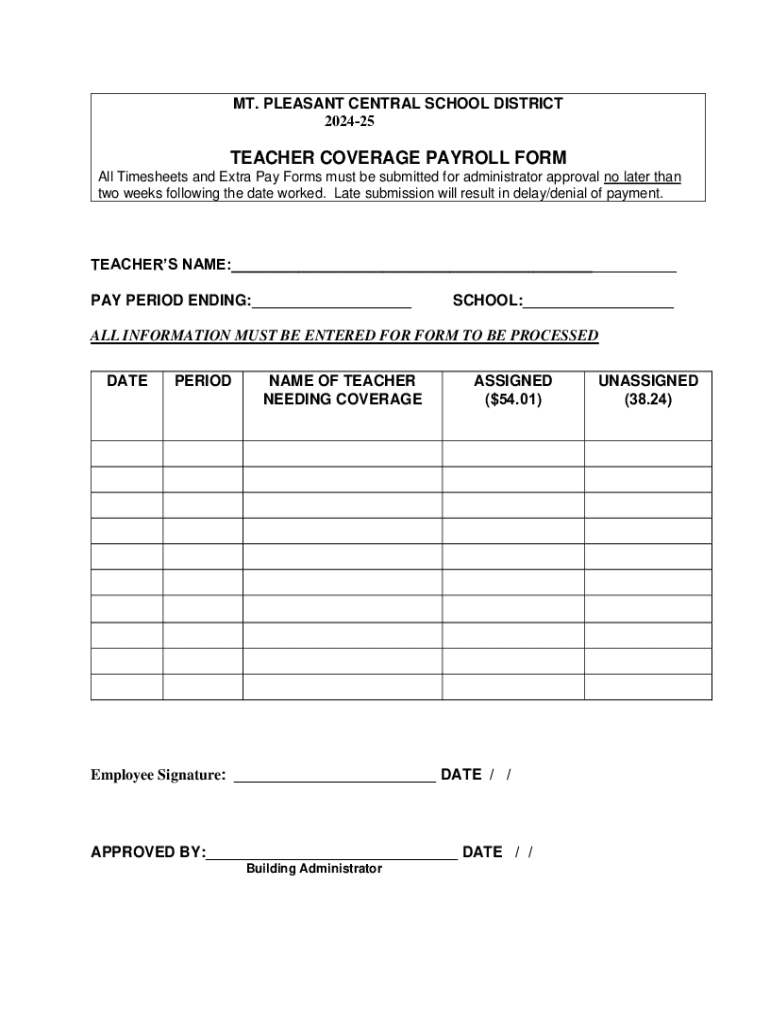

The teacher coverage payroll form is a crucial document used by educational institutions to manage the payroll implications of teacher absences. This form serves as an official record of the reasons for a teacher's absence, such as personal leave or illness, allowing schools to ensure that effective coverage is provided during those times.

The importance of this form extends beyond documentation; it directly impacts the payroll process by ensuring that substitute teachers are paid for their services and that full-time educators are compensated accurately. By maintaining organized records through the teacher coverage payroll form, schools can streamline administrative processes, uphold budgetary constraints, and promote transparency in compensation practices.

Navigating the payroll process

In the context of education, payroll processing is a multifaceted operation involving the collection of data on hours worked, types of leave taken, and coverage requirements. Each school district may have specific protocols to follow, but the general principles remain consistent. Teacher coverage forms play a pivotal role in this process as they provide the necessary information to make informed decisions about payroll allocations.

When a teacher submits a coverage payroll form, it prompts the district's payroll department to review the request and determine the appropriate adjustments. Factors that influence these calculations include the type of absence, the duration of coverage required, and whether the teacher's compensation is based on an hourly wage or a salaried position. Most schools typically process payroll on a bi-weekly or monthly basis, aligning these payments with the coverage forms to ensure accurate and timely compensation.

Detailed breakdown of the teacher coverage payroll form

The teacher coverage payroll form is organized into several key sections, each designed to capture specific information necessary for processing teacher absences and related payments. Understanding these sections can aid educators and administrators in submitting accurate forms efficiently.

Section 1 focuses on employee information, where teachers must provide their names, contact details, and details about their roles and responsibilities. This section sets the foundation for the entire form, allowing payroll to identify which educator is affected.

In Section 2, the form captures coverage details, such as the type of leave (sick leave, personal leave, etc.) and the dates coverage is needed. This section is critical as it helps schools identify the timeframe in which a substitute teacher is required, ensuring that classes continue without interruption.

Sections 3 and 4 handle payroll adjustments and the required approvals. Section 3 outlines how pay adjustments will be calculated—factoring in hourly rates versus salaried positions based on the amount of coverage required. Finally, Section 4 necessitates signatures from both the employee and their supervisor to validate the request and ensure compliance with school policy.

Filling out the teacher coverage payroll form

Accurate completion of the teacher coverage payroll form is imperative for preventing payroll discrepancies and ensuring smooth operational workflows. To effectively fill out the form, follow these step-by-step instructions for each section, so that all necessary information is captured correctly.

Paying attention to detail when filling out the form can help prevent common mistakes, such as omitting essential details or submitting the form after deadlines. Double-checking inputted information, such as dates and pay rates, ensures that the document is processed without delay.

Editing and managing your teacher coverage payroll form

With the evolution of technology, managing the teacher coverage payroll form has become more accessible through digital tools like pdfFiller. Educators can utilize PDF editing capabilities to fill out, edit, and manage their teacher coverage payroll forms effectively within a cloud-based platform.

For instance, users can employ pdfFiller to sign the document electronically, thus expediting the approval process. This platform also offers collaboration features, meaning multiple stakeholders, such as HR and administrators, can view and edit the document as needed. This level of accessibility simplifies the process of managing teacher coverage requests and ensures all parties are on the same page.

Best practices for teacher coverage management

Effectively managing teacher absences is crucial for maintaining educational standards and ensuring smooth operations within schools. Here are several best practices for managing teacher coverage:

By adopting these practices, schools can enhance their coverage strategies, minimize disruptions, and ensure ongoing support for both teachers and students in the classroom.

Interactive tools for enhancing payroll management

In an effort to modernize and streamline payroll processes, various interactive tools are now available to assist schools and educators with calculating pay and managing coverage needs. These tools can be vital in enhancing overall payroll efficiency and accuracy.

Using these interactive resources not only enhances the efficiency of the payroll system but also supports better communication within staffing needs and requirements.

FAQs about teacher coverage payroll forms

As schools implement the teacher coverage payroll form, various questions may arise. Here are some frequently asked questions and their corresponding answers that can help alleviate confusion:

Real-world examples of teacher coverage payroll forms in action

Several school districts have successfully implemented teacher coverage payroll forms, each tailoring the process to fit their unique administrative needs. For instance, District A adopted a cloud-based system that allows teachers to fill out their coverage forms on-the-go, drastically reducing errors and improving processing times.

Feedback from educators participating in these revised procedures highlights a more efficient workflow and better communication with administration, resulting in heightened satisfaction for both teachers and substitute staff.

Conclusion: maximizing the use of the teacher coverage payroll form

Integrating best practices for filling out and managing the teacher coverage payroll form promotes efficiency and clarity in handling payroll processing. Educators are encouraged to familiarize themselves with their district’s specific requirements and leverage pdfFiller’s robust document management tools to simplify the process.

By ensuring a smooth and efficient submission process, schools unlock the full potential of their staffing strategies, leading to enhanced educational experiences for students and a more effective working environment for educators.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in teacher coverage payroll form?

How do I edit teacher coverage payroll form straight from my smartphone?

How do I edit teacher coverage payroll form on an iOS device?

What is teacher coverage payroll form?

Who is required to file teacher coverage payroll form?

How to fill out teacher coverage payroll form?

What is the purpose of teacher coverage payroll form?

What information must be reported on teacher coverage payroll form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.