Get the free Monthly Statement of Business Income and Expenses

Get, Create, Make and Sign monthly statement of business

Editing monthly statement of business online

Uncompromising security for your PDF editing and eSignature needs

How to fill out monthly statement of business

How to fill out monthly statement of business

Who needs monthly statement of business?

A Comprehensive Guide to the Monthly Statement of Business Form

Understanding the monthly statement of business form

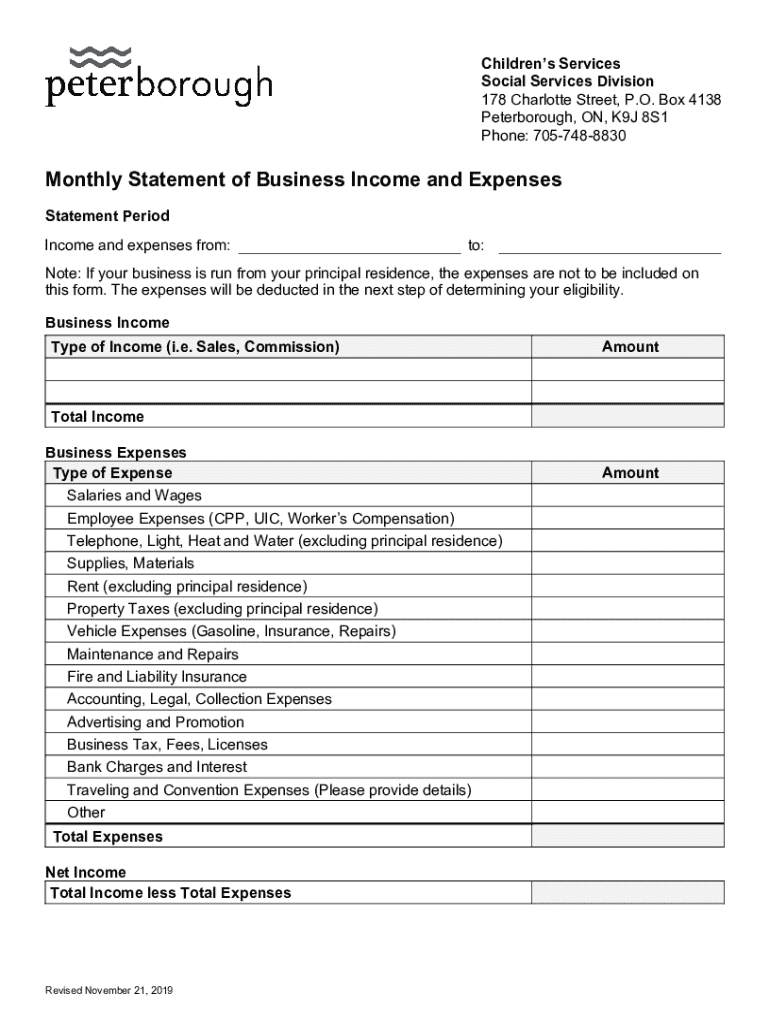

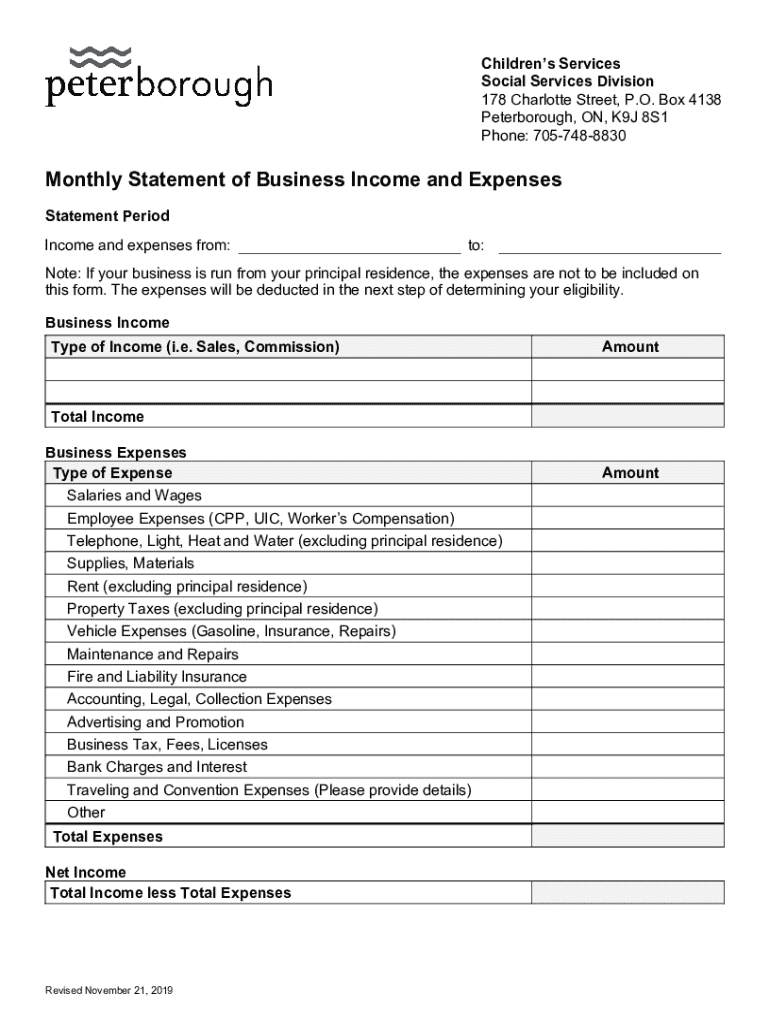

The monthly statement of business form is an essential document that consolidates all financial activities within a specific month. Designed primarily for tracking income, expenses, and overall financial health, this form serves as a pivotal tool for business managers and owners. By offering a clear snapshot of financial performance, it lays the groundwork for informed decision-making.

Key components of a monthly statement often include revenue sections detailing sales and income sources, expenses that categorize outgoing funds, and a final net profit or loss calculation. These elements not only assist individuals in examining past performances but also play a crucial role in setting future financial goals. Establishing clarity in financial reporting enables teams to effectively manage resources and strategize accordingly.

Types of monthly statements

There are various types of monthly statements tailored to fit different financial tracking needs. One common distinction is between the income statement and the expense statement. The income statement showcases total revenues earned, while the expense statement highlights all incurred costs throughout the month. Understanding these variations helps businesses choose the statement that best meets their needs.

Another useful type is the comparative monthly statement, which juxtaposes current month data against previous months to identify trends and anomalies. For industry-specific requirements, designated monthly statements can be created. For instance, a retail business may have a different format than a service-based business. It is crucial to assess your specific business needs when selecting the appropriate statement format.

Essential features of a monthly statement

An effective monthly statement incorporates key elements that ensure clarity in financial reporting. The revenue section delineates all incoming funds, while the expenses section categorizes outgoing payments. The net profit or loss calculation helps quickly assess the company's financial standing, making it a critical feature of any monthly statement.

Formatting options play a role in enhancing readability. Users can choose between grid and list views based on what presents the data most effectively for their particular needs. The use of colors and highlights can also facilitate quick understanding by drawing attention to significant figures. Sample layouts and templates available at pdfFiller can help users visualize different options for designing their monthly statements.

Step-by-step guide to creating your monthly statement

Crafting a monthly statement requires a systematic approach. Here’s a step-by-step guide to ensure you produce an accurate, informative document.

Best practices for managing your monthly statement

Managing your monthly statement effectively involves regular updates and strategic oversight. It's essential to keep the document current and accurate. Establish a routine for monthly reviews to assess financial performance and discuss findings with your team.

Leveraging cloud-based tools, such as pdfFiller, allows for seamless collaboration among team members, enabling real-time updates and edits. Tracking changes is also vital to maintaining the accuracy of your monthly statements — employ version control features to ensure you're referencing the latest data.

Advanced features of pdfFiller for monthly statements

pdfFiller enhances the process of managing your monthly statements through various advanced features. One notable option is the integration of eSignatures, ensuring legal compliance while expediting the signing process. Team collaboration is also made effective through real-time editing features, allowing different members to contribute to the document simultaneously.

Furthermore, pdfFiller provides the capability to access historical data, enabling users to create financial trends that can inform business strategies. Exporting options allow for flexibility, as users can convert their monthly statements into formats such as PDF or Excel for further analysis.

Common pitfalls to avoid

While creating monthly statements, businesses should be mindful of common pitfalls that can arise. Mistakes in data entry can lead to inaccurate financial analysis, potentially resulting in poor decision-making. It's paramount to cross-check figures for correctness before finalizing the document.

Incomplete statements can misrepresent the financial status of a business, complicating efforts to secure funding or partnerships. Lastly, neglecting regulatory reporting requirements could have financial consequences, making it essential to be informed about necessary compliance measures.

FAQs regarding monthly statements

1. What if I make a mistake on my monthly statement? If an error is found, it’s essential to make corrections promptly and notify any stakeholders involved. Utilize editing tools in pdfFiller to amend entries as required.

2. How often should I update my monthly statement? It's recommended to update your monthly statement at the end of each month as part of your regular financial review process.

3. Can I convert a monthly statement to a different format? Yes, pdfFiller offers options to export your monthly statements to various formats like PDF or Excel for external sharing or further analysis.

Success stories: How businesses improved with effective monthly statements

Case studies highlight the transformative impact of well-managed monthly statements on several businesses. For example, a small business owner reported that after instituting monthly statements, they could identify unnecessary expenses and redirect funds towards growth opportunities.

Similarly, a collaborative team found that regular monthly reviews facilitated increased transparency among members, resulting in enhanced efficiency and trust. These anecdotes underscore the importance of maintaining regular and accurate financial tracking through the monthly statement of business forms.

Quick links to related templates and tools

For those looking to enhance their financial document management, pdfFiller offers a range of related templates and tools including:

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit monthly statement of business online?

Can I create an eSignature for the monthly statement of business in Gmail?

How do I fill out the monthly statement of business form on my smartphone?

What is monthly statement of business?

Who is required to file monthly statement of business?

How to fill out monthly statement of business?

What is the purpose of monthly statement of business?

What information must be reported on monthly statement of business?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.