Get the free Beneficiary Designation

Get, Create, Make and Sign beneficiary designation

How to edit beneficiary designation online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary designation

How to fill out beneficiary designation

Who needs beneficiary designation?

Beneficiary designation form: A comprehensive guide

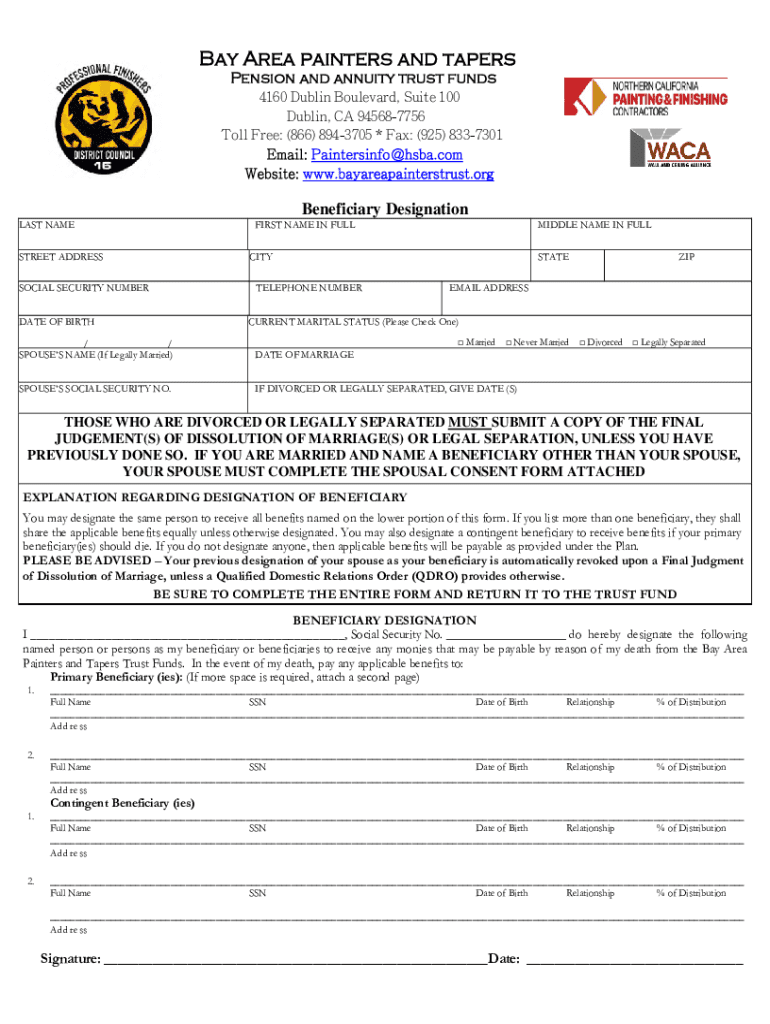

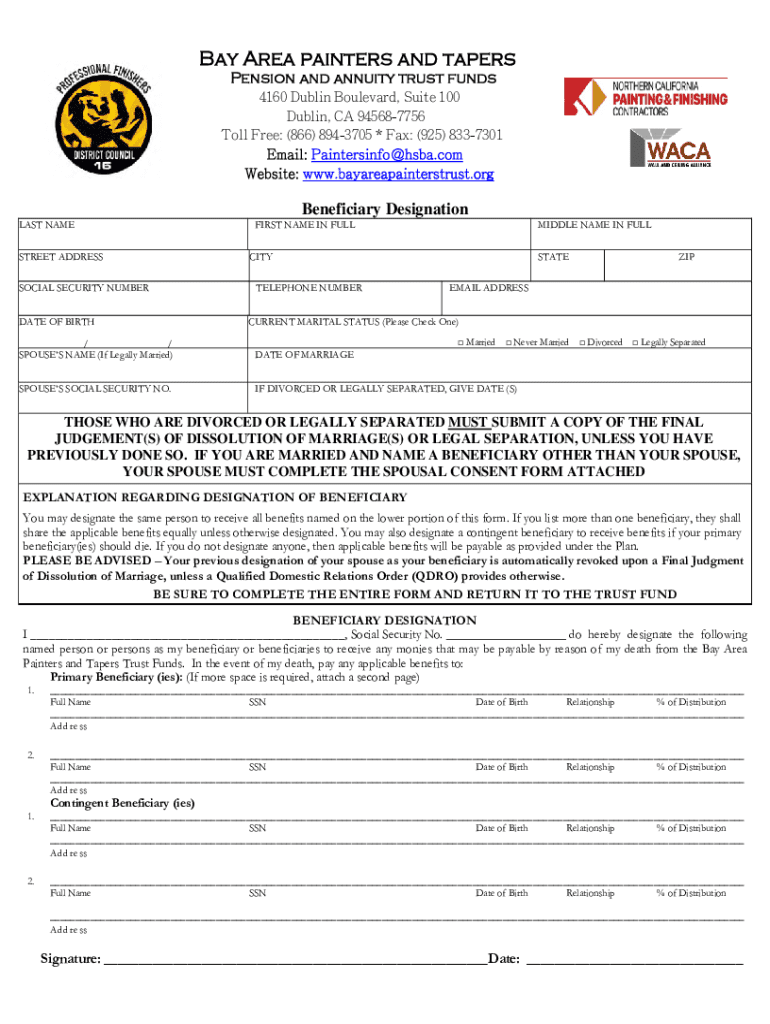

Understanding the beneficiary designation form

A beneficiary designation form is a crucial legal document used to specify who will receive assets from an account, policy, or trust after the holder's death. This form plays a pivotal role in estate planning as it allows individuals to decisively designate beneficiaries for various financial accounts, including life insurance policies, retirement accounts, and bank accounts.

The importance of completing a beneficiary designation form cannot be overstated; without it, your assets might be subject to probate, which can be a lengthy and expensive process. By naming specific beneficiaries, you ensure that your wishes are honored and that your loved ones receive their inheritance in a timely manner.

Key elements of a beneficiary designation form

Filling out a beneficiary designation form requires several key elements. First, you must provide personal information about the beneficiary, including their full name, address, and date of birth. This information ensures that there is no ambiguity regarding the identity of the designated individuals.

Next, specifying the exact assets to be designated is vital. This could include details about financial accounts, insurance policies, real estate, or any other items of value. Furthermore, understanding your relation to the beneficiary helps ensure that your intentions are clear. Additional optional information, such as contact details or email, can help clarify your designations further.

Step-by-step guide to filling out the beneficiary designation form

Filling out a beneficiary designation form can seem daunting, but it can be simplified with the right approach. Start by gathering necessary documents such as identification and proof of relationship to the beneficiary. Identification could include a driver's license or state ID, while proof of relationship might require marriage certificates, birth certificates, or court documents.

Once you have your documents ready, proceed to complete the form accurately. Focus on each section, ensuring that all requested details are filled out thoroughly. Be mindful of common mistakes, such as misspelling names or entering incorrect social security numbers. After completing the form, double-check all information for errors and ensure clarity in your designations.

Editing and modifying your beneficiary designation

Life circumstances often change, which means it's essential to periodically review and modify your beneficiary designation. Major life events such as marriage, divorce, or the birth of a child typically warrant an update to ensure your designation aligns with your current wishes.

Using pdfFiller can significantly streamline this process. By uploading existing forms, you can utilize interactive tools to easily make changes to your beneficiary designations without starting from scratch. This platform allows for seamless editing and updating of your forms in a user-friendly environment.

Signing and finalizing the form

Once your beneficiary designation form is completed, signing and finalizing the document is the next step. Understanding the eSignature process is crucial, especially if you choose to submit the form electronically. Many institutions accept electronic signatures, but it’s vital to confirm their requirements.

To ensure the validity of your signature, follow all necessary steps outlined by the institution or legal entity. In some cases, notarization may be required to attest to your identity and the authenticity of your signature, especially if the document involves significant assets. Always check with relevant authorities to clarify whether notarization is necessary for your situation.

Managing your completed beneficiary designation form

After signing your beneficiary designation form, managing it appropriately is essential. Secure digital storage solutions, such as pdfFiller, allow you to store and manage your documents safely. By keeping your information in an organized digital format, you can easily access or retrieve your asset plans whenever necessary.

Moreover, sharing your completed form with trusted family members or advisors can promote transparency and ensure everyone is informed of your decisions. Establishing a regular review schedule can help you stay on top of any necessary updates, ensuring your designations remain current as your life evolves.

Alternative scenarios involving beneficiary designation

There are unique considerations when it comes to designating beneficiaries. For instance, if minors are named as beneficiaries, you might require a trust or custodian to manage their inheritance until they reach adulthood. This will not only protect the funds but also ensure they are distributed responsibly.

Similarly, naming a trust as a beneficiary can provide significant estate planning advantages. It allows for more extensive control over asset distribution beyond your lifetime. Additionally, events like divorce or remarriage can dramatically affect your beneficiary designations. It is crucial to revisit and possibly revise your designations in light of such changes to ensure they reflect your current wishes.

Legal implications of beneficiary designation

Understanding the legal binding nature of your beneficiary designation is critical. This document serves as a directive that financial institutions and courts are bound to honor upon your death. However, potential challenges and disputes can arise, especially if there are discrepancies or conflicting claims by family members.

Due to these possible legal ramifications, seeking professional legal advice can help you navigate the complexities of your designations. An estate planning attorney can provide insights into how to protect your wishes and ensure that your designation withstands scrutiny in the event of disputes.

Frequently asked questions about beneficiary designation forms

Many users have questions about the implications of their beneficiary designations. For example, what happens if you change your mind after submitting? Generally, you can revoke or modify your designation at any time by submitting a new form, but ensure that the new designation explicitly states that it overrides any previous forms.

A common query is how often individuals should review their beneficiary designations. Experts recommend at least an annual review or immediately following significant life changes. Additionally, it’s important to consider whether a beneficiary can refuse a designation; while it is rare, beneficiaries can opt not to accept their inheritance, and understanding these nuances is crucial.

Using pdfFiller for your document needs

pdfFiller provides unique features that enhance your experience in handling beneficiary designation forms. With its collaboration tools, multiple parties can work together on a document, ensuring that all necessary changes and approvals occur smoothly in one cloud-based platform.

Additionally, pdfFiller's cloud-based access means you can manage your beneficiary designation form anytime and anywhere. This flexibility is particularly useful when you need to review or share your documents quickly, making the process not only efficient but also secure.

Inspiration for related documentation

In addition to the beneficiary designation form, several essential documents play roles in effective estate planning. For instance, a last will and testament outlines how all of your assets are to be distributed after your death, providing further certainty and clarity for your heirs.

Another important document is the power of attorney, which allows someone to act on your behalf regarding financial or healthcare decisions in the event you are unable to do so yourself. By having these documents in place alongside your beneficiary designations, you equip your loved ones with clear directives on your wishes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit beneficiary designation straight from my smartphone?

How can I fill out beneficiary designation on an iOS device?

How do I fill out beneficiary designation on an Android device?

What is beneficiary designation?

Who is required to file beneficiary designation?

How to fill out beneficiary designation?

What is the purpose of beneficiary designation?

What information must be reported on beneficiary designation?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.