Get the free Cushon Master Trust Annual Governance Statement Year ...

Get, Create, Make and Sign cushon master trust annual

How to edit cushon master trust annual online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cushon master trust annual

How to fill out cushon master trust annual

Who needs cushon master trust annual?

How to Complete the Cushon Master Trust Annual Form

Understanding the Cushon Master Trust Annual Form

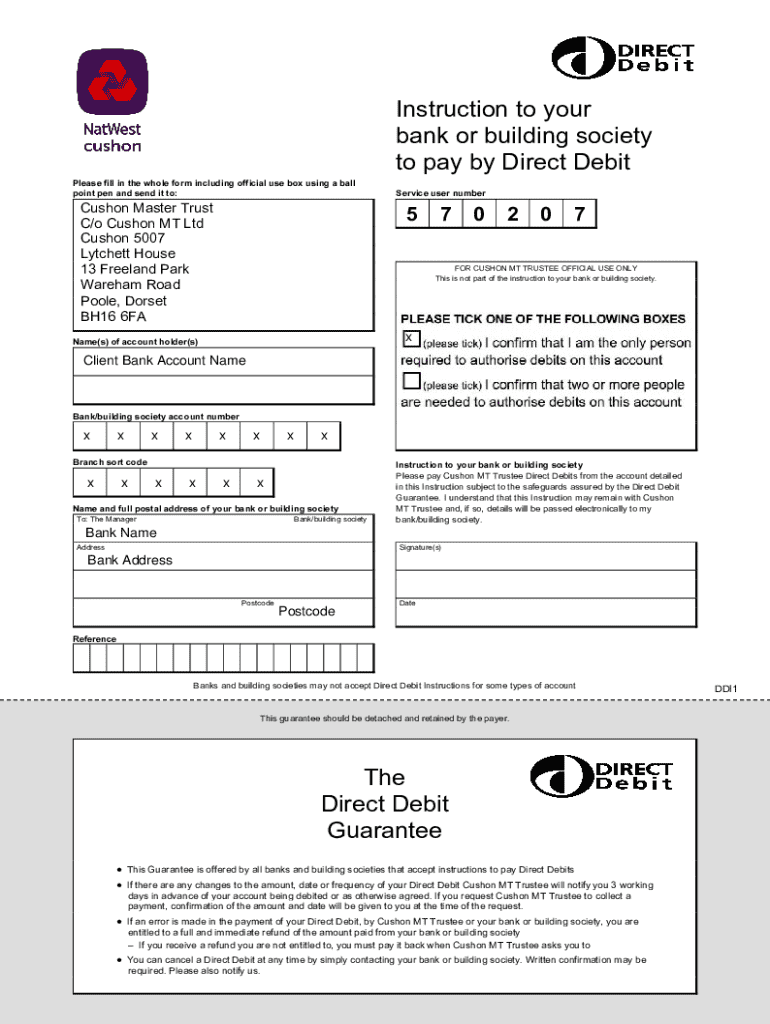

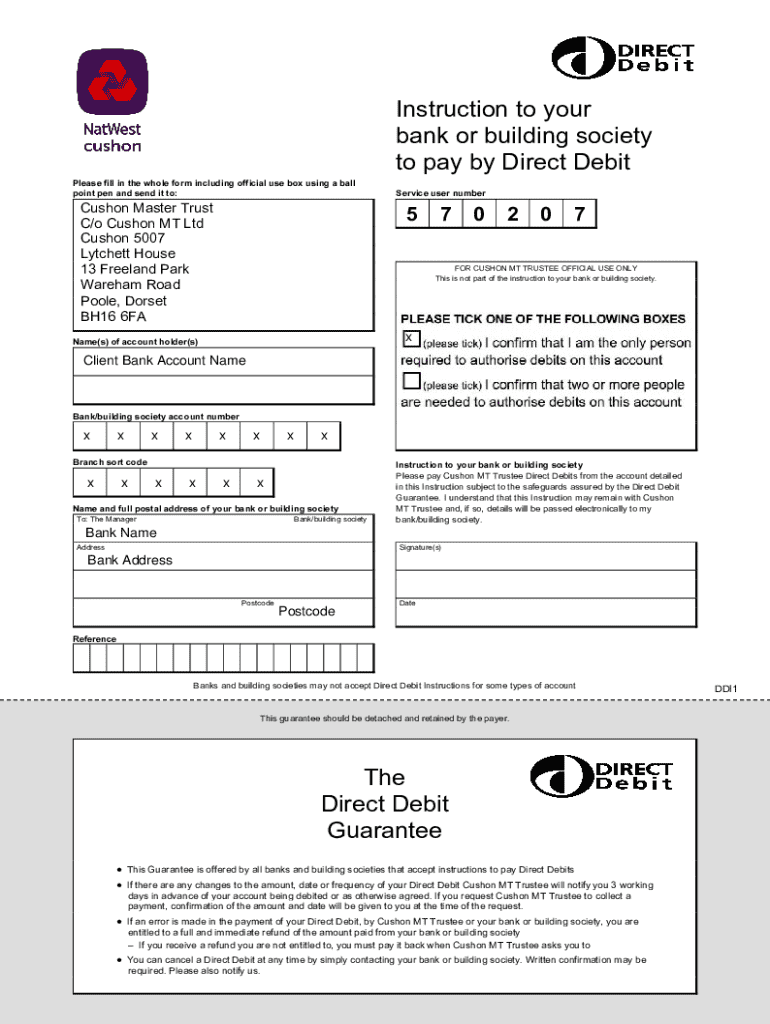

The Cushon Master Trust Annual Form is essential for employers participating in a pension scheme administered under the Cushon Master Trust framework. This form serves not only as a legal document but also as a reflection of compliance with established pension regulations. Understanding the significance of this form helps ensure that employers meet their obligations and maintain the trust of their employees.

The Cushon Master Trust is designed to facilitate smoother pension contributions for both employers and employees. Its structure allows individuals to accrue retirement savings in a flexible and transparent manner. Completing the annual form accurately is crucial; it lays the groundwork for the overall management of pension contributions and ensures that employees receive their entitled benefits in a timely manner.

Preparing to fill out the form

Before you begin filling out the Cushon Master Trust Annual Form, it’s crucial to prepare adequately. Gathering all required information and utilizing the right tools can simplify the process immensely. Having a clear understanding of what information is needed will prevent any potential delays or inaccuracies.

Gathering required information

To start, you will need to collect your personal and employment details, as well as specific pension scheme information. This includes the company name, registration number, employee numbers, and the relevant details of the pension scheme under which employees are enrolled. It's important for employers to double-check that all information is current and accurate to avoid any compliance issues later on.

Choosing the right tools

Utilizing digital tools, such as pdfFiller, can greatly enhance your form-filling experience. pdfFiller offers various features including document editing, eSignature capabilities, and collaboration tools, which streamline the process for both the employer and employees. This cloud-based platform not only ensures that the form can be accessed from anywhere but also allows for real-time collaboration, making it an ideal choice for team-oriented environments.

Step-by-step guide to completing the form

Filling out the Cushon Master Trust Annual Form can be straightforward if approached methodically. First, you will need to select your duties start date — this is crucial, as it establishes the timeline for your pension obligations. Next, proceed to enter your pension scheme details, making sure to include accurate and complete information.

Assessing employee information

It's essential to identify eligible employees, as their information must be documented for compliance reasons. Ensure to enter key employment dates, such as hire dates and leaver dates, to maintain accurate records. This information is pivotal for calculating contributions and ensuring that each employee’s pension rights are protected.

Enrolling your employees

Enrolling employees can be done either through automatic processes or manually. For automatic enrollment, you must establish a system that triggers enrollment for eligible employees as soon as they meet the criteria. If opting for manual enrollment, carefully follow the established protocol to ensure compliance, adjusting to include any new hires or changes in employment status.

Communicating form details with employees

Maintaining transparent communication about the completion of the Cushon Master Trust Annual Form is essential. Employers should inform employees about how their information will be used and the benefits of participating in the pension scheme. This promotes trust and encourages employees to engage with their pension planning actively.

Employers can utilize templates for employee notifications to standardize communication about the annual form submission. This can simplify the process significantly; clearly outlining key points ensures employees understand their rights and responsibilities under the scheme.

Handling employee queries regarding form submission

It’s crucial for employers to be prepared for questions that may arise from employees regarding the form submission process. Having a dedicated resource or FAQ section can assist employees in understanding the details surrounding their pension contributions, thus minimizing uncertainty and fostering a supportive workplace environment.

Managing changes and postponements

In an evolving workplace environment, managing changes to employee status is a regular occurrence. It's important to have guidelines for postponing enrollment when necessary and ensuring that proper documentation is kept for any changes. This could include changes in job titles, reductions in hours, or leaves of absences, all of which need accurate recording to maintain compliance and protect employees’ pension rights.

Employers need to be vigilant in documenting all changes. Having a systematic approach to record-keeping can help streamline this process, facilitating easier updates and compliance with pension regulations.

Processing pension contributions

Managing contributions is an essential part of running a pension scheme successfully. Employers are responsible for accurately calculating and documenting contributions in the Cushon Master Trust Annual Form. This includes understanding contribution rates that align with regulatory standards and managing any additional contributions that may be desired by the employees.

Report contributions through the annual form methodically. Documenting these contributions ensures that both the employer and employee fulfill their obligations under the pension scheme, protecting everyone involved.

Submitting your form

The submission process for the Cushon Master Trust Annual Form can be approached in various ways. Online submissions through pdfFiller typically enhance accuracy and save time due to the automated system that checks for missing information prior to submission. Alternatively, you can choose traditional submission methods, though it may require more time to process.

Verifying submission success

Always verify the success of your submission. This step is crucial to ensure that your contributions are processed correctly and that there are no compliance issues later on. pdfFiller’s dashboard can help track submission status, thus providing peace of mind.

Ongoing assessment and compliance

Once your form is submitted, the work isn’t entirely over. Regularly reviewing eligible jobholders is vital to ensure compliance with pension scheme regulations. This includes assessing any new hires or changes in employee status that may affect eligibility.

Notifying non-eligible jobholders

Employers have the obligation to inform non-eligible jobholders about their options. Communication should focus on help available to entitled workers so they can make informed decisions regarding pensions.

Utilizing tools for documentation and record-keeping

Employers can leverage tools offered by pdfFiller for better documentation and record-keeping. The platform’s eSigning and collaboration tools allow for a seamless process, enabling all parties to review and approve documents efficiently. This eliminates paper trails, making the entire process eco-friendly and more organized.

Efficient document organization and retrieval

Organizing your documents effectively is crucial, particularly when it comes time for audits or reviews. With pdfFiller, employers can quickly retrieve documents, manage access, and maintain a comprehensive record of submissions, ensuring that every detail is accounted for.

Understanding your rights and responsibilities

Both employees and employers have rights and responsibilities under the Cushon Master Trust. Employees are entitled to understand contributions and access their pension information easily. Employers, on the other hand, must ensure compliance with all regulations surrounding pension contributions and reporting.

Understanding these rights and responsibilities will cultivate a healthier relationship between employers and employees, encouraging a collaborative approach to pension planning and compliance.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get cushon master trust annual?

How do I make edits in cushon master trust annual without leaving Chrome?

Can I sign the cushon master trust annual electronically in Chrome?

What is cushon master trust annual?

Who is required to file cushon master trust annual?

How to fill out cushon master trust annual?

What is the purpose of cushon master trust annual?

What information must be reported on cushon master trust annual?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.