Get the free Eligibility Criteria for Dependents in a Parent-Child ...

Get, Create, Make and Sign eligibility criteria for dependents

Editing eligibility criteria for dependents online

Uncompromising security for your PDF editing and eSignature needs

How to fill out eligibility criteria for dependents

How to fill out eligibility criteria for dependents

Who needs eligibility criteria for dependents?

Eligibility criteria for dependents form: A comprehensive guide

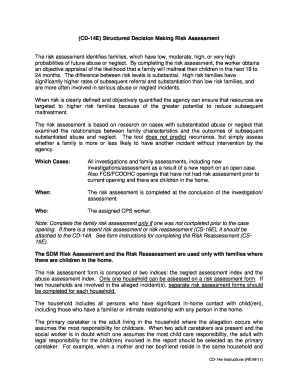

Understanding dependent eligibility

A dependent is typically defined as a person who relies on another individual, usually a taxpayer, for financial support. This classification is crucial for tax purposes, healthcare benefits, and even educational aid, as it influences various financial benefits that individuals or families may qualify for. Understanding the eligibility criteria for dependents is essential, as mistakes can lead to complications or denied claims.

Types of dependents

There are several types of dependents recognized under the eligibility criteria for dependents form. Broadly, they can be classified into Type A and Type C dependents. Each classification has unique characteristics and requirements that dictate whether someone qualifies to be claimed as a dependent.

Type A dependents

Type A dependents generally include qualifying children, who meet specific age requirements, are related to the taxpayer, and reside with them for more than half the year. To qualify as a Type A dependent, individuals must not provide more than half of their financial support. Important documentation includes birth certificates and proof of residency.

Type dependents

Type C dependents often encompass qualifying relatives, which can include parents, siblings, and more. Unlike Type A dependents, there are varied financial support and relationship criteria that must be met, as most Type C dependents do not live with the taxpayer for the majority of the year. Documentation could include proof of financial support and legal guardianship papers if applicable.

Other categories of dependents

In addition to Type A and Type C, there are other categories, such as domestic partners or those living under the care of a taxpayer in a non-relative context. Each category has unique qualifications that should be understood to ensure correct filing and maximization of benefits.

Eligibility criteria overview

Determining who qualifies as a dependent involves navigating several eligibility criteria. These criteria include age, relational ties to the taxpayer, financial support tests, and residency requirements. Each of these aspects plays a pivotal role in confirming that dependents are eligible for claims.

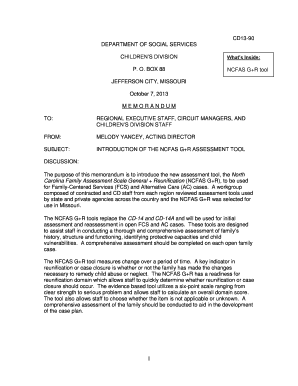

Step-by-step guide to filling the dependents form

Filling out the dependents form can appear daunting; however, following a structured approach can simplify the process. Start by gathering relevant personal and financial information before moving on to the application, whether online or offline.

Gathering necessary information

Compiling necessary information is the first step. Gather details such as Social Security numbers, dates of birth, and documentation supporting your relationship and financial status with the dependents. Be sure to have any required tax documents on hand.

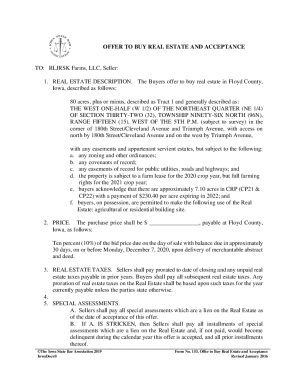

Online vs. offline applications

Consider whether you will be filling the form online or submitting a physical copy. Online applications via platforms like pdfFiller are often more efficient, providing functionalities like easy document management. Offline applications will require printing and possibly mailing, which can add to processing time.

Completing the form: Section by section

Tips for accuracy and completeness

Ensure that all specifics are accurate to avoid delays. Check for typos and ensure all fields marked as required are filled. Additional notes on your dependents can provide further clarification and support your claims.

Common mistakes to avoid

Even small errors can derail your dependents form submission, leading to denials or delays. Understanding the common pitfalls may help you navigate more efficiently.

Frequently asked questions (FAQs)

As you prepare to fill out the dependents form, various queries may arise. Addressing these common questions can clarify your understanding and ease the submission process.

Interactive tools and resources

Resources that simplify the dependents form process include calculators and document checklists. Utilizing these tools can help ensure thorough preparation and accuracy in your submission.

Managing your dependents form

Once you have completed your dependents form, effective management of the document plays a crucial role in ensuring ongoing compliance and updates. Adequate document management and tracking provide peace of mind.

How to edit and update your form

Using cloud-based solutions like pdfFiller allows you to easily access and edit your forms whenever changes are necessary. Make sure to retain previous versions for reference.

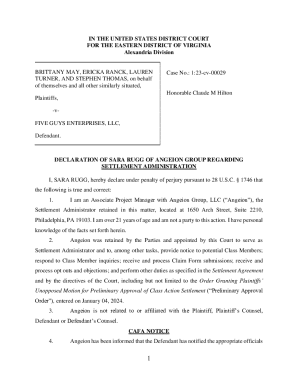

Signing and submitting your form online

After completing your form, utilize eSignature tools for quick online submission. Online submissions tend to process faster and often receive quicker acknowledgments.

Tracking the status of your submission

Utilize any status tracking features offered by the submission platform to stay updated on your form’s processing situation and address any concerns quickly.

Understanding the impact of your dependents status

The classification of dependents impacts various areas of your financial situation, including tax implications and healthcare benefits. Being informed about these effects can help in making strategic decisions.

Support and assistance

If you encounter hurdles while filling out the dependents form or have questions, numerous support options are available. Rely on customer support or community forums to gather insights.

Best practices for document management

Effective document management ensures that your dependents form and supporting documents are secure, accessible, and organized. Following best practices can prevent confusion and facilitate seamless updates.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send eligibility criteria for dependents for eSignature?

Where do I find eligibility criteria for dependents?

How do I fill out eligibility criteria for dependents using my mobile device?

What is eligibility criteria for dependents?

Who is required to file eligibility criteria for dependents?

How to fill out eligibility criteria for dependents?

What is the purpose of eligibility criteria for dependents?

What information must be reported on eligibility criteria for dependents?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.