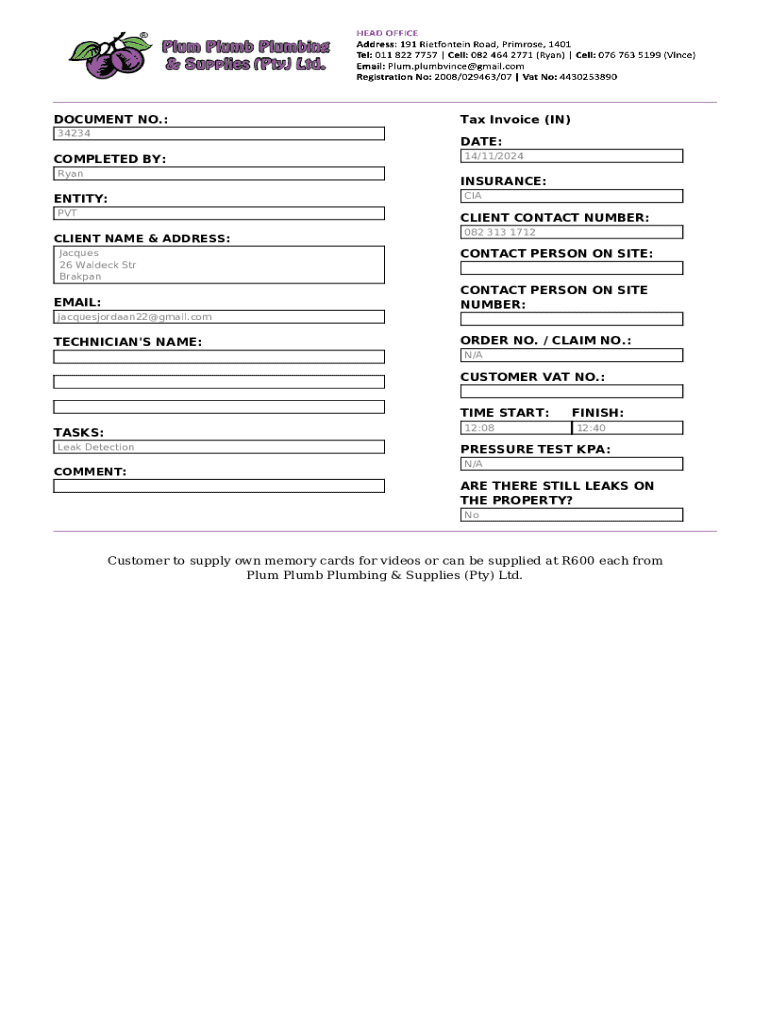

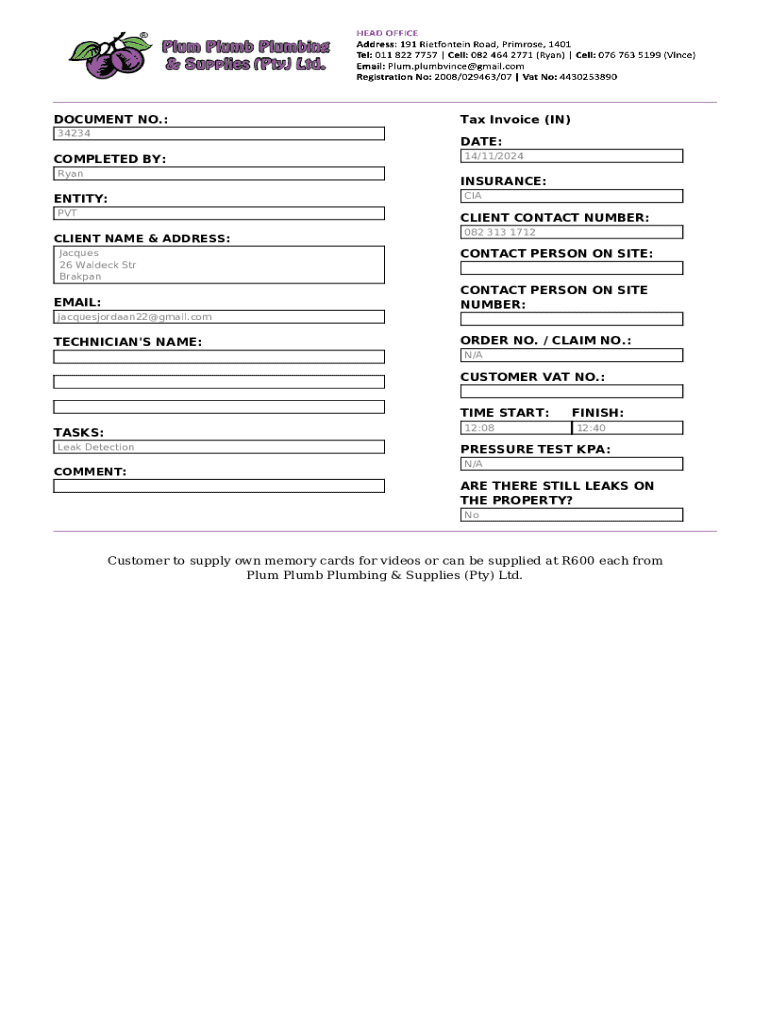

Get the free Tax Invoice (in)

Get, Create, Make and Sign tax invoice in

How to edit tax invoice in online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax invoice in

How to fill out tax invoice in

Who needs tax invoice in?

Tax Invoice in Form: A How-to Guide

Understanding tax invoices

A tax invoice is a crucial document generated during a business transaction that indicates a sale has occurred and outlines the tax applicable on that sale. Its primary purpose is to provide evidence of a transaction for tax reporting and compliance purposes. For businesses, understanding the intricacies of a tax invoice is essential, as it can directly affect cash flow and tax liability.

Legally, a tax invoice serves as proof of the sale between a buyer and a seller. It holds a significant role in the taxation system, ensuring that businesses accurately report their earnings and pay the right amount of taxes. Without proper tax invoicing, companies may risk audits or penalties from tax authorities. Additionally, maintaining solid tax invoicing practices can help in value-added tax (VAT) or goods and services tax (GST) claims.

Types of tax invoices

Tax invoices come in various forms, each designed to cater to different transaction scenarios. Understanding these types can optimize your invoicing strategies and processes. The most common types include full tax invoices, simplified tax invoices, electronic tax invoices, and hybrid formats.

A full tax invoice is typically issued for large transactions, including all required details, allowing buyers to claim tax credits. In contrast, a simplified tax invoice is often used for smaller transactions, containing fewer details while still meeting basic legal requirements. Electronic tax invoices have gained popularity due to their efficiency, allowing for quick generation and submission. Hybrid formats combine characteristics of both full and simplified invoices, providing flexibility depending on the needs of the businesses involved.

Key components of a tax invoice

Creating an effective tax invoice hinges on including key components that ensure clarity and legal compliance. The mandatory information required typically includes details about both the seller and buyer, an invoice number, date of issue, item descriptions, and amounts.

Optional information, while not legally required, can enhance the clarity and usability of the invoice. For instance, including payment terms, delivery details, or VAT/GST registration numbers can provide added context for the transaction. Best practices for formatting include ensuring legibility, using a consistent layout, and skipping unnecessary jargon to maintain professionalism and user-friendliness.

Requirements for issuing a tax invoice

Issuing a tax invoice comes with specific requirements that can vary by jurisdiction. First and foremost, businesses must adhere to their local regulations concerning what information must be included. Compliance not only avoids penalties but also builds credibility with clients and tax authorities.

Timelines for both generating and submitting tax invoices are critical as well; delays can affect cash flow and tax reporting accuracy. Common penalties for non-compliance can include fines, improper claim denials, and considerable disruption to business operations. Additionally, maintaining thoroughly organized and accurate invoices can aid in resolving disputes if they arise.

How to create and manage a tax invoice

Creating a tax invoice involves a systematic approach to ensure all required components are accurately included. A step-by-step process can significantly streamline this task. Start by choosing your chosen method of creation, whether manual or using software like pdfFiller, which offers interactive templates.

Using templates not only saving time but also ensures consistency across invoices. Editing and signing tax invoices can be seamlessly done via platforms such as pdfFiller, allowing for collaborative features that enable team members to work together on a single document without needing to send multiple files back and forth.

Understanding VAT/GST on tax invoices

The mechanisms of VAT or GST on tax invoices can be a complex subject for many organizations. Understanding the implications of these taxes will ensure accurate calculations are made on every invoice. It is imperative for businesses to calculate VAT/GST correctly, as both under- and over-calculating can lead to significant issues with tax compliance.

Adjustments and corrections related to VAT/GST are also crucial for maintaining accurate financial records. Any discrepancies should be addressed promptly to avoid compliance issues. Being vigilant about these calculations not only protects the company but can also enhance the transparency and trustworthiness of the business in the eyes of its clients.

Scenarios requiring a tax invoice

Certain scenarios necessitate the issuance of a tax invoice. This includes any sale of goods or services where tax is applicable. Furthermore, understanding special cases, such as exempt supplies or foreign currency transactions, can minimize confusion and empower businesses to remain compliant while maximizing cash flow.

Self-billing is another relevant practice. In this scenario, the buyer creates the invoice on behalf of the seller. This practice requires explicit agreement between parties but can streamline processes, particularly in ongoing transactions where regular invoicing occurs.

Common mistakes and how to avoid them

Mistakes in tax invoicing can lead to severe repercussions for businesses. One of the most common issues includes inaccurate data entry, which can result in failing to address vital information. A systematic approach to data entry, verifying each field's content before submission, will greatly reduce this risk.

Another prevalent mistake is keeping inadequate records associated with tax invoices. Proper data management isn’t just good practice; it is crucial in resolving potential disputes. Lastly, understanding how to deal with credit and debit notes is essential for clarity in financial dealings and accurate accounting.

Utilizing pdfFiller for optimal tax invoice management

Leveraging pdfFiller for managing tax invoices can greatly enhance the efficiency of your invoicing process. pdfFiller's cloud-based access allows users to create, store, and manage invoices from anywhere, ensuring immediate availability for review and adjustments.

The platform provides interactive editing tools making invoice customization straightforward. Additionally, successful case studies demonstrate how teams have saved valuable time and eliminated errors using pdfFiller, setting it apart from other document creation solutions on the market.

Frequently asked questions (FAQs)

As businesses navigate the complexities of tax invoicing, several questions frequently arise. First, it's essential to know what should be included on your tax invoice; this typically encompasses seller and buyer information, the unique invoice number, transaction date, item descriptions, and the applicable tax amounts.

Another common query involves the simplistic creation of tax invoices. Yes, using platforms like pdfFiller can simplify and streamline that process. Questions about handling adjustments to tax invoices and what records to keep are also vital as maintaining accuracy and compliance is critical in today’s business climate.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit tax invoice in straight from my smartphone?

How do I complete tax invoice in on an iOS device?

Can I edit tax invoice in on an Android device?

What is tax invoice?

Who is required to file tax invoice?

How to fill out tax invoice?

What is the purpose of tax invoice?

What information must be reported on tax invoice?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.