Get the free site facebook com site fb me site youtube com site youtu be site youtube be site twitter com site instagram com site tiktok com site vm tiktok com site t co site x com site reddit com hatton national bank

Get, Create, Make and Sign site facebook com site

How to edit site facebook com site online

Uncompromising security for your PDF editing and eSignature needs

How to fill out site facebook com site

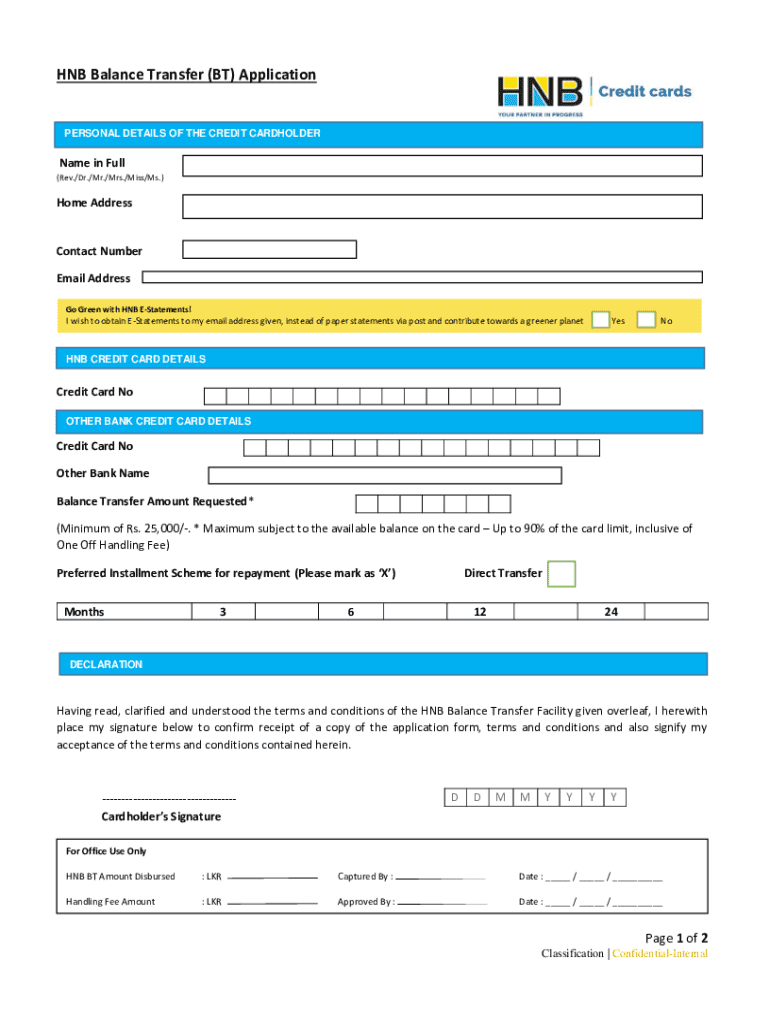

How to fill out hnb balance transfer bt

Who needs hnb balance transfer bt?

Your Comprehensive Guide to the HNB Balance Transfer BT Form

Understanding HNB balance transfer

A balance transfer is a financial strategy allowing you to move existing debt from one credit account to another, typically to enjoy lower interest rates or consolidate payments. The HNB balance transfer offers an advantageous way to manage your financial obligations, significantly reducing your interest-related costs.

Utilizing HNB for balance transfers comes with numerous benefits, such as lower interest rates, flexible terms, and promotional offers that can lead to substantial savings. This service is particularly beneficial for individuals struggling with high-interest credit card debts, offering them a pathway to financial relief.

Typical scenarios for HNB balance transfers include transferring high-interest credit card debt or consolidating multiple small debts into a single, more manageable payment.

Preparing for your balance transfer

Before initiating a balance transfer with HNB, it's essential to assess your overall financial situation. Carefully evaluate your current debts, income, and expenses, which helps in determining how much you can afford to transfer without stretching your finances thin.

Identify eligible debts for transfer, focusing mostly on high-interest credit card balances. Remember, not all debts are suitable for balance transfers; consider which debts will maximize your interest savings.

Understanding HNB's transfer terms and conditions is crucial. Review the intricacies regarding fees, interest rates, and any promotional periods to ensure you're making an informed decision that aligns with your financial goals.

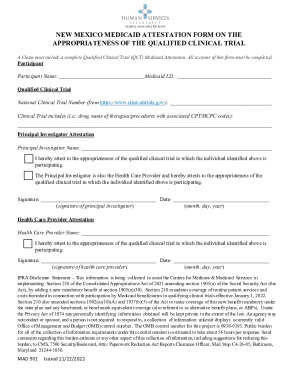

Accessing the HNB balance transfer BT form

Finding the HNB balance transfer BT form is a straightforward process. You can access it directly through the HNB website or branch locations. The form is designed to capture all necessary information to facilitate your balance transfer efficiently.

pdfFiller is your go-to solution for document creation, providing an easy interface to fill, edit, and manage your forms online. Utilizing pdfFiller to access the HNB balance transfer BT form streamlines the process, making it straightforward to ensure all needed information is accurately completed.

Using pdfFiller for easy access and editing of the HNB form allows you to work from anywhere while ensuring all data is securely saved and easy to manage.

Step-by-step instructions to fill out the HNB balance transfer BT form

Filling out the HNB balance transfer BT form involves several distinct sections, each requiring accurate information.

Editing and customizing your form with pdfFiller

One of the benefits of using pdfFiller is its ability to enhance your form submission experience. You can easily add digital signatures and dates, making the document legally binding with just a few clicks.

If needed, you can insert or remove sections in the form to suit your specific requirements. This flexibility ensures that you submit a complete and accurate balance transfer request.

Collaboration is another advantage; pdfFiller allows you to share documents with others, making it easy to co-manage your transfer request with a partner or financial advisor.

Submitting your HNB balance transfer BT form

Once you've filled out the HNB balance transfer BT form, it's time to submit it. You have various submission methods, including online forms through HNB's secure portal, in-person at branch locations, or via traditional mail.

Before submitting, consider key factors such as ensuring all information is complete and accurately reflects your financial situation. Omissions or errors can delay the approval process.

After submitting, you can expect to receive notifications regarding your application status and timeframes for when the balance transfer will be effective.

Tracking your balance transfer status

Keeping tabs on your balance transfer application is vital. HNB typically provides a way for you to check your application status online or through customer service.

If you encounter delays or issues, understanding potential setbacks can help you manage your expectations. HNB’s customer support is readily available to assist you throughout the balance transfer process.

Common FAQs about HNB balance transfers

Many individuals have questions surrounding the HNB balance transfer process. Common concerns include:

Tips for successful balance transfers

To maximize the benefits of your HNB balance transfer, consider implementing the following strategies:

Why choose pdfFiller for your HNB balance transfer BT form?

Choosing pdfFiller enhances your balance transfer form experience. With cloud-based convenience, you can access your documents from anywhere, ensuring you have the tools you need at your fingertips.

The platform provides comprehensive document management features to keep all your forms organized efficiently. Additionally, its seamless integration of eSigning and sharing capabilities makes the balance transfer process smoother.

Feedback and continuous improvement

Improving the HNB balance transfer process starts with your feedback. If you have suggestions or experiences to share regarding the transfer process, consider reaching out to HNB to ensure your voice is heard.

Sharing your success stories can also inspire others. Your experience with HNB balance transfers can help guide future customers in making informed financial decisions.

Exploring further financial solutions with HNB

Beyond balance transfers, HNB offers various other financial services designed to cater to different customer needs, from personal loans to savings accounts. Each service provides unique benefits, assisting you in managing your finances effectively.

By utilizing HNB’s comprehensive financial solutions, you can create a tailored plan that fits your lifestyle and financial aspirations.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the site facebook com site in Chrome?

How can I edit site facebook com site on a smartphone?

How do I fill out the site facebook com site form on my smartphone?

What is hnb balance transfer bt?

Who is required to file hnb balance transfer bt?

How to fill out hnb balance transfer bt?

What is the purpose of hnb balance transfer bt?

What information must be reported on hnb balance transfer bt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.