Get the free (SIP) / Systematic Transfer Plan (STP ... - Akash Associates - akashassociates

Show details

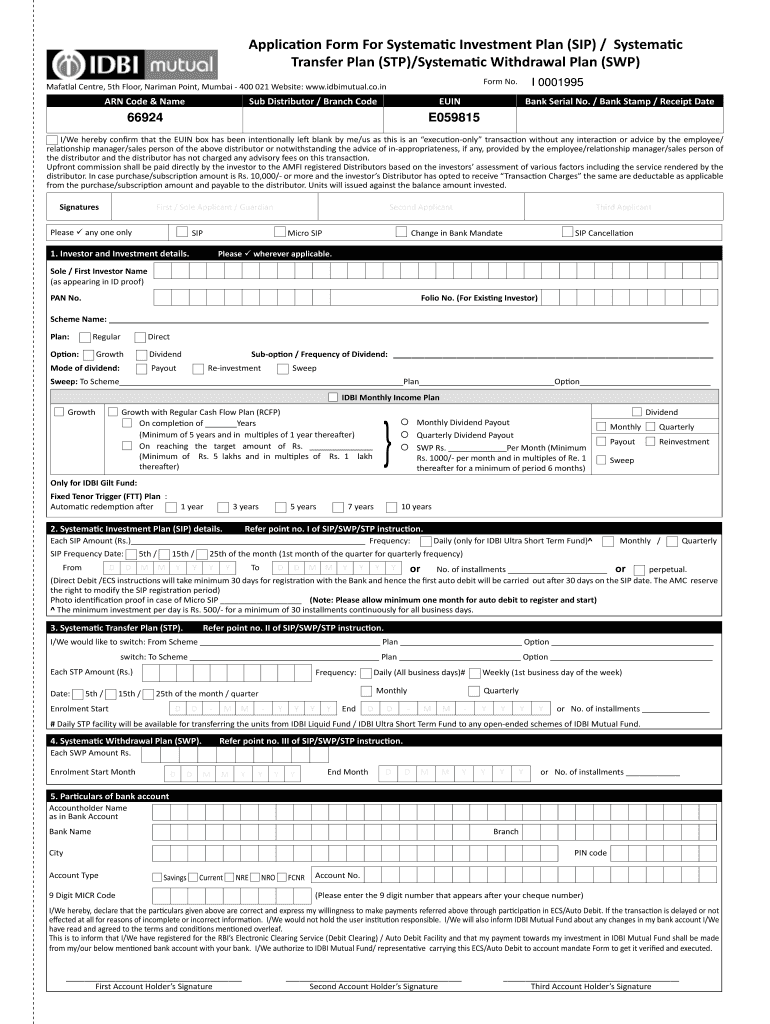

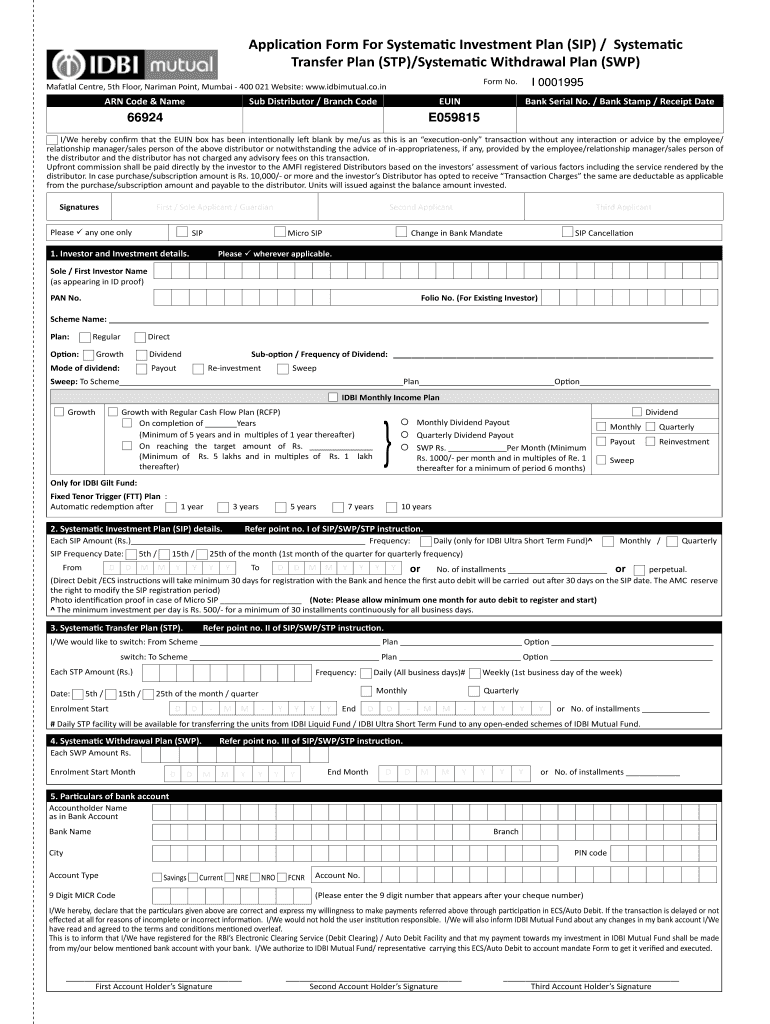

Application Form For Systematic Investment Plan (SIP) / Systematic Transfer Plan (STP)/Systematic Withdrawal Plan (SVP) Form No. Mazatlan Center, 5th Floor, Norman Point, Mumbai 400 021 Website: www.idbimutual.co.in

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign sip systematic transfer plan

Edit your sip systematic transfer plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sip systematic transfer plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit sip systematic transfer plan online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit sip systematic transfer plan. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out sip systematic transfer plan

How to fill out a SIP systematic transfer plan:

01

Start by researching and selecting a SIP systematic transfer plan that meets your investment goals and risk tolerance. Look for plans offered by reputable mutual fund houses and evaluate the historical performance of the funds.

02

Open an account with the selected mutual fund house or investment platform that provides the SIP systematic transfer plan. This may involve completing an application form, providing necessary identification and address proof documents, and fulfilling any applicable KYC (Know Your Customer) requirements.

03

Decide the amount you want to invest regularly through the SIP systematic transfer plan. This can be a fixed amount or variable, depending on your financial capability. It is advisable to start with an amount that fits comfortably within your budget.

04

Choose the source fund where the initial investment will be made. The source fund can be a debt fund, liquid fund, or any other suitable option based on your investment objectives and risk appetite. Consider factors such as the fund's past performance, expense ratio, and asset allocation before making a decision.

05

Determine the target fund where the money will be systematically transferred from the source fund. The target fund can be an equity fund, balanced fund, or any other investment option aligned with your financial goals. Consider the fund's historical returns, investment philosophy, fund manager's track record, and other relevant factors when making your selection.

06

Decide the transfer frequency and intervals for the systematic transfer plan. This could be monthly, quarterly, or any other regular basis as per your preference. The transfer intervals can be fixed or flexible, allowing you to align investment decisions with market trends or personal financial circumstances.

07

Submit the necessary instructions to start the systematic transfer plan. This may involve providing details such as the amount, frequency, source fund, target fund, and transfer date to the mutual fund house or investment platform.

Who needs a SIP systematic transfer plan:

01

Investors who have a lump sum amount to invest but want to spread their investment over a period of time to mitigate market timing risks and volatility.

02

Individuals who aim to capitalize on long-term investment growth potential while gradually shifting from safer instruments like debt funds to relatively higher-risk options like equity funds.

03

Investors looking for a disciplined approach to investing and accumulating wealth over time, by making regular contributions through the SIP systematic transfer plan.

04

Those who prefer to automate their investments and benefit from the convenience of regular, pre-determined transfers from one fund to another, without needing to actively monitor their portfolio.

Note: It is always recommended to consult with a financial advisor or professional before making any investment decisions, including the selection of SIP systematic transfer plans.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is sip systematic transfer plan?

SIP systematic transfer plan is a systematic way of transferring funds from one investment option to another.

Who is required to file sip systematic transfer plan?

Investors who want to transfer funds systematically between different investment options.

How to fill out sip systematic transfer plan?

SIP systematic transfer plan can be filled out online through the investment company's website or with the help of a financial advisor.

What is the purpose of sip systematic transfer plan?

The purpose of SIP systematic transfer plan is to help investors transfer funds regularly and systematically between different investment options to achieve their financial goals.

What information must be reported on sip systematic transfer plan?

SIP systematic transfer plan must include details of the investor, investment options being transferred between, transfer frequency, and amount to be transferred.

How do I make edits in sip systematic transfer plan without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing sip systematic transfer plan and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I fill out the sip systematic transfer plan form on my smartphone?

Use the pdfFiller mobile app to fill out and sign sip systematic transfer plan. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

How do I complete sip systematic transfer plan on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your sip systematic transfer plan, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

Fill out your sip systematic transfer plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sip Systematic Transfer Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.