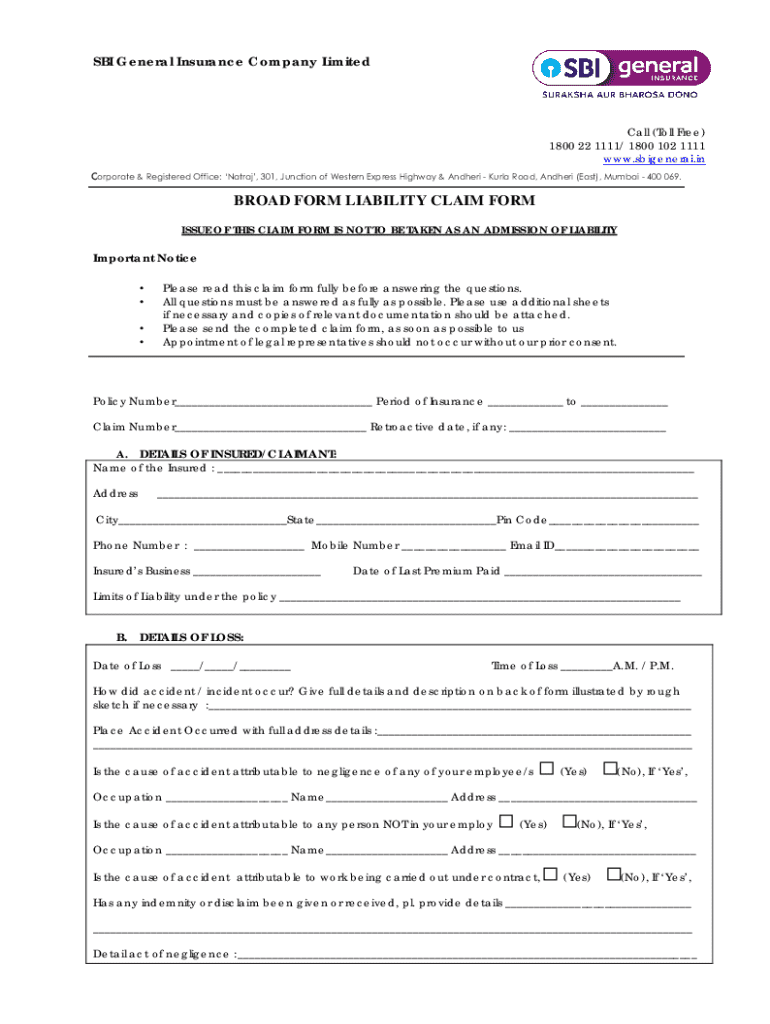

Get the free Broad Form Liability Claim Form

Get, Create, Make and Sign broad form liability claim

How to edit broad form liability claim online

Uncompromising security for your PDF editing and eSignature needs

How to fill out broad form liability claim

How to fill out broad form liability claim

Who needs broad form liability claim?

Understanding the Broad Form Liability Claim Form: A Comprehensive Guide

Overview of broad form liability claims

Broad form liability is a type of insurance coverage that provides extensive protection against various liabilities. This coverage is essential across numerous industries such as construction, manufacturing, and service sectors, where potential risks can lead to significant financial exposure. It covers the insured against both bodily injury and property damage claims that could arise from business operations.

The importance of broad form liability cannot be overstated. In industries prone to accidents, having such protection can safeguard businesses from unforeseen incidents that lead to legal claims. This insurance not only helps in managing risk but also instills confidence in clients and stakeholders, showcasing the business's commitment to resilience and safety.

Understanding the broad form liability claim form

A broad form liability claim form is a specialized document used to initiate a liability claim under a broad form liability policy. This form serves as an official notification to the insurance provider regarding an incident that has resulted in a claim. Its primary purpose is to provide all necessary details pertaining to the incident, enabling the insurance company to assess the claim promptly.

The broad form liability claim form is particularly used in scenarios where there is a potential for extensive liability exposure. It differs from other liability claims forms by encompassing a broader range of incidents and typically requiring more detailed documentation. Understanding this form is crucial for anyone navigating the claims process, as it can significantly affect the outcome of the claim.

Step-by-step guide to filling out the broad form liability claim form

Filling out the broad form liability claim form can be straightforward if approached methodically. Here’s a breakdown of the critical sections you’ll encounter in the form:

Editing and modifying your broad form liability claim form with pdfFiller

Using pdfFiller to edit your broad form liability claim form enhances accuracy and efficiency. This cloud-based platform allows you to modify your form seamlessly, making the claims process much easier.

To begin editing your form, simply upload the PDF to pdfFiller. You can then take advantage of its tools to fill out fields, add annotations, and correct errors. If additional information is needed, pdfFiller enables you to insert extra fields as required, maintaining the integrity of the document while ensuring it meets submission standards.

eSigning the broad form liability claim form

eSigning your broad form liability claim form is a crucial step in the claims process. Electronic signatures are increasingly accepted across various sectors and serve as a legally binding approval of your document.

Using pdfFiller, signing your form electronically is straightforward. After completing the necessary sections, simply click on the eSign feature, follow the prompts to create or insert your signature, and authenticate your approval. eSigned documents carry the same weight as traditional signatures, making them invaluable for timely submissions.

Submitting the broad form liability claim form

After completing and signing your broad form liability claim form, the next step is submission. Multiple options are available, including online submissions through your insurer's portal, sending via email, or delivering the form in person.

To ensure that your claim is received and processed without delays, consider these tips: double-check all information for accuracy, retain copies of your submission, and, if submitting electronically, confirm receipt with your insurer. Following these steps can significantly expedite your claims processing timeline.

Common mistakes to avoid when filing a broad form liability claim

Filing a broad form liability claim can be fraught with pitfalls, especially if one is unaware of common mistakes that can lead to denial or delays. Here are some frequent errors to watch out for:

Frequently asked questions (FAQs) about broad form liability claims

As you navigate the broad form liability claims process, it’s normal to have questions. Here are some frequently asked inquiries to help clarify common concerns:

Resources available on pdfFiller for broad form liability claims

pdfFiller offers a wealth of resources to assist you in managing your broad form liability claims effectively. The platform not only provides interactive tools for editing and signing documents but also gives access to templates for various claims and policies.

Utilizing these resources can streamline your claims experience, enabling you to focus on other critical aspects of your business. For those needing assistance, pdfFiller's support team is available to guide you through any challenges you might encounter.

Additional considerations in broad form liability claims

Navigating broad form liability claims requires awareness of additional factors that could affect your coverage. For example, engaging in risk management practices can significantly reduce the likelihood of future claims and contribute to lower insurance premiums.

Additionally, staying informed about industry trends, such as changes in liability laws or emerging risks, is crucial. By understanding the landscape, you can make more informed decisions regarding insurance needs and drafting more effective claims.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send broad form liability claim for eSignature?

How do I complete broad form liability claim online?

How do I complete broad form liability claim on an Android device?

What is broad form liability claim?

Who is required to file broad form liability claim?

How to fill out broad form liability claim?

What is the purpose of broad form liability claim?

What information must be reported on broad form liability claim?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.