Get the free Mortgage Request

Get, Create, Make and Sign mortgage request

How to edit mortgage request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mortgage request

How to fill out mortgage request

Who needs mortgage request?

Complete Guide to the Mortgage Request Form

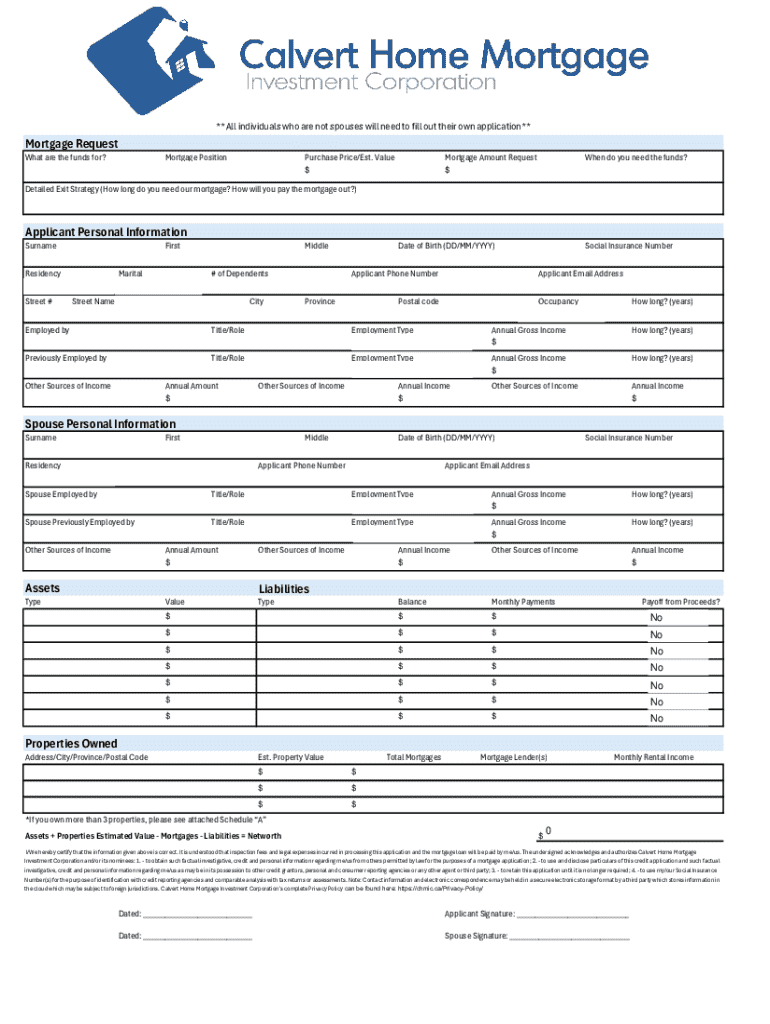

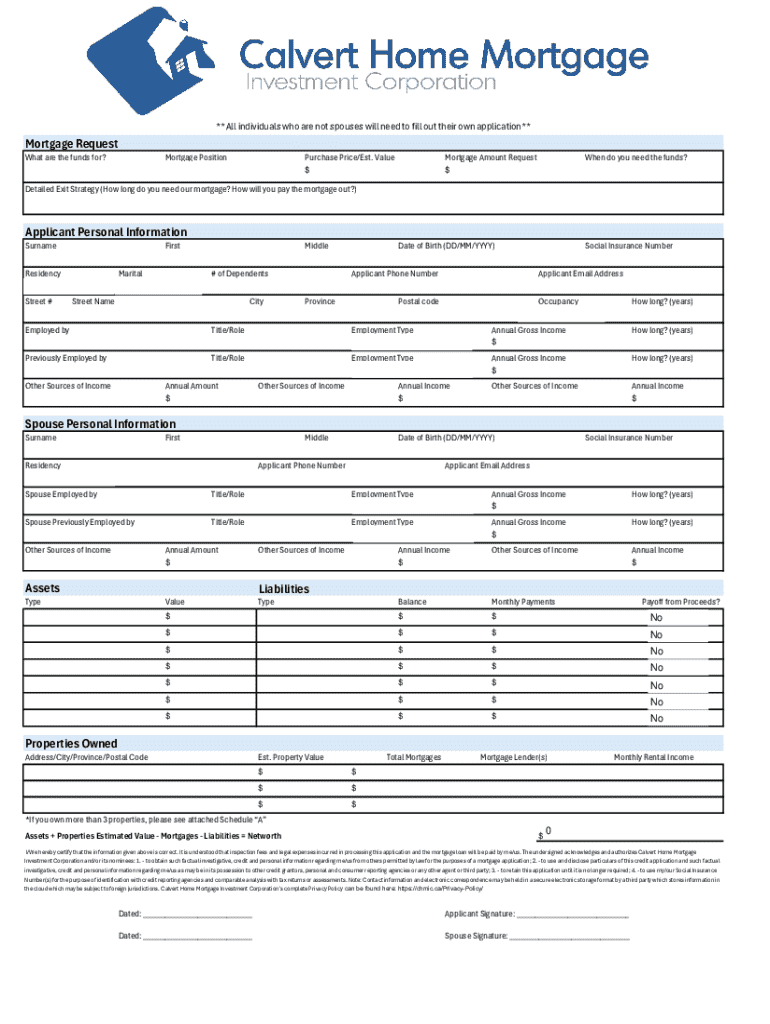

Understanding the mortgage request form

A mortgage request form serves as a crucial document in the home buying process, acting as the first step for potential homeowners to formally express their interest in borrowing funds for a property purchase. This form collects essential information that lenders use to assess the creditworthiness of applicants and determine the terms of the mortgage. By accurately completing this form, prospective borrowers set the foundation for their financial journey, making it a vital component of the home financing process.

The importance of this document cannot be overstated; it is the initial point of assessment for lenders and highlights the applicant's financial health and readiness to take on a mortgage. Understanding the key components and how to effectively fill out a mortgage request form can significantly enhance the chances of securing favorable loan terms.

When to use a mortgage request form

The mortgage request form becomes essential when you are in specific situations, such as when you've found a property that interests you or when you're just beginning to explore your financing options. Key indicators that signal the right time to fill out the mortgage request form include having a substantial savings account for a down payment, a steady income, and the desire to compare loan offers from various lenders. Additionally, if you're ready to enter into a purchase agreement, this form becomes a necessary tool for securing financing.

Key components of the mortgage request form

Understanding the essential elements of the mortgage request form is crucial for successful completion. Generally, there are four primary sections within the form: personal information, financial information, property information, and loan information.

The personal information section requires details like your name, address, and contact information. Accuracy here is paramount since any discrepancies can cause delays or miscommunication with lenders. Next is the financial information section, which requests financial specifics such as income sources, employment status, monthly debts, and any other financial obligations.

The property information section pertains to the details of the asset you wish to finance, such as its address and estimated value. Providing detailed property information helps lenders evaluate the risk associated with the loan. Finally, the loan information section is where applicants indicate the type of mortgage they are seeking and the amount they wish to borrow, allowing lenders to match them with suitable products.

Step-by-step guide to completing the mortgage request form

Completing the mortgage request form may seem daunting, but following a structured approach can simplify the process. Here’s a step-by-step guide to ensure a smooth completion experience.

Common pitfalls when filling out the mortgage request form

When filling out the mortgage request form, applicants often fall into common pitfalls that can lead to complications in their mortgage process. A frequent mistake is providing incomplete or incorrect information, which could result in loan denial or processing delays.

Clarifying ambiguities is equally important; if you're unsure about a section, seek assistance rather than guessing. Additionally, overlooked signatures or dates can invalidate the document, so ensure that all necessary parties have signed and dated where required. These minor errors can create significant obstacles in securing the mortgage you need.

Enhancing your mortgage request with pdfFiller

Utilizing pdfFiller can significantly enhance your experience with the mortgage request form. This platform allows users to effortlessly edit their forms, ensuring that all details are accurate and up-to-date.

Collaboration features are particularly beneficial, enabling you to share the form with financial advisors or family members for their input. Furthermore, pdfFiller allows you to eSign documents electronically, streamlining the submission process. After completing your form, you can store and manage your documents securely in the cloud, ensuring easy access and retrieval whenever needed.

Frequently asked questions (FAQs)

Navigating the mortgage application process can raise many questions. Here are some frequently asked queries applicants often have regarding the mortgage request form.

Best practices for a successful mortgage application

To increase your chances of success for your mortgage request, consider these best practices. Preparing financially is essential before applying; this can include reducing outstanding debts or saving more for a down payment.

Understanding what lenders look for in a request form can also give you a competitive edge. Lenders typically review your credit score, employment history, and debt-to-income ratio, so presenting a strong financial profile is crucial. By boosting your financial health and crafting a thorough, error-free application, you enhance the likelihood of securing your desired mortgage.

Real-life examples and success stories

There are numerous anecdotal experiences from individuals who successfully navigated the mortgage request process through meticulous preparation. For instance, one couple, after diligently organizing their financial documents and filling out the mortgage request form accurately, managed to secure a favorable interest rate that significantly eased their financial burden.

Additionally, stories of applicants who faced initial rejections but reviewed their forms, corrected errors, and reapplied illustrate the importance of persistence and thoroughness in this journey. These experiences emphasize the significance of being prepared and attentive in ensuring a successful mortgage application.

Interactive tools

Utilizing interactive tools on pdfFiller can greatly assist during the mortgage application process. Whether it's estimating potential mortgage payments based on various loan amounts or comparing different loan options, these tools provide invaluable preliminary insights.

Such resources can not only aid in making informed decisions but also equip applicants with the knowledge to fill out their mortgage request forms more accurately, aligning their expectations with realistic financial capabilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my mortgage request in Gmail?

How do I edit mortgage request online?

How do I fill out the mortgage request form on my smartphone?

What is mortgage request?

Who is required to file mortgage request?

How to fill out mortgage request?

What is the purpose of mortgage request?

What information must be reported on mortgage request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.