Get the free pdffiller

Get, Create, Make and Sign pdffiller form

How to edit pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out 2025 personal property declaration

Who needs 2025 personal property declaration?

2025 Personal Property Declaration Form - A Comprehensive How-To Guide

Overview of the 2025 personal property declaration form

The 2025 Personal Property Declaration Form serves as a crucial tool for individuals and businesses alike to report their taxable personal property. This declaration ensures that property assessments are fair and equitable, impacting local tax revenue and community funding for essential services.

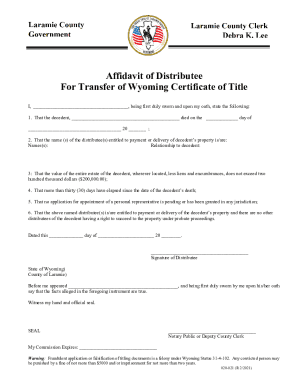

Filing a personal property declaration form is a requirement that varies by jurisdiction, often mandated for anyone who owns personal property such as vehicles, equipment, or furniture. The purpose behind these declarations is to ascertain the value of personal property for tax assessment. Many jurisdictions rely on these disclosures to accurately capture local tax bases.

The 2025 form may include several key changes compared to its predecessors, including adjustments in valuation guidelines, expanded categories of property to include, and potential shifts in filing methods to incorporate more digital options.

Preparing to complete your personal property declaration

Before you dive into filling out the 2025 personal property declaration form, it is essential to gather certain documents. Accurate records make the process smoother and ensure that your declaration is complete.

It’s also important to understand local guidelines and regulations. Many municipalities have specific rules regarding what constitutes taxable personal property. Being aware of these regulations can significantly aid in an accurate submission.

Filing deadlines are another crucial aspect. Typically, personal property declarations must be submitted annually by a certain date, and failing to meet these deadlines can lead to penalties. Familiarize yourself with specific deadlines in your locale to avoid unnecessary fees.

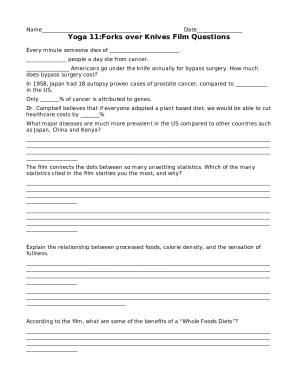

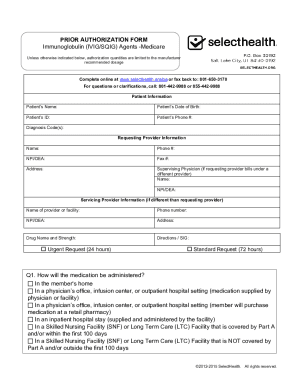

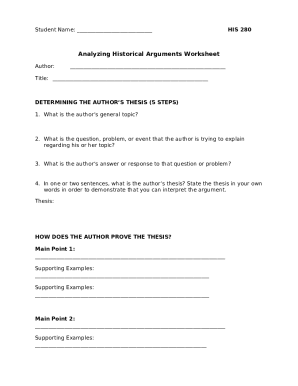

Step-by-step instructions for filling out the form

Completing the 2025 personal property declaration form involves several sections. It is important to approach this methodically to ensure all required information is accurately provided.

Common errors to avoid include underreporting your property and failing to include all necessary documentation. Utilizing interactive tools on pdfFiller can help mitigate these mistakes by guiding you through the process.

Electronic vs. paper submission

Filing the 2025 personal property declaration can be done either electronically or via traditional paper methods. Each has its own advantages, but electronic filing tends to offer superior ease and efficiency.

For those opting for paper submissions, ensure you know where to mail your completed form. It’s recommended to follow safe mailing practices to guarantee timely delivery.

Frequently asked questions (FAQs)

Filing a personal property declaration is straightforward, but questions often arise during the process. Here are some common inquiries:

Interactive tools and resources available on pdfFiller

pdfFiller provides users with access to a myriad of interactive tools designed to enhance the experience of completing the 2025 personal property declaration form.

Additional information you should know

Navigating personal property declarations can be complex. It is beneficial to understand the broader context of local tax assessments and how they may influence your financial obligations. Engaging with state-specific regulations or variations is essential, as guidelines can differ significantly depending on your location.

Stay updated on any recent changes to the declaration process that may arise, including legislation affecting personal property taxation. Knowing this information helps mitigate the risk of unexpected assessments or penalties.

Points of contact for further assistance

If you require additional help with your declaration, numerous resources are available. Consider reaching out to your local tax assessor’s office, as they can provide official answers and additional guidance tailored to your specific situation.

Emphasis on pdfFiller's unique value proposition

pdfFiller is committed to streamlining the document management process. With features that enable seamless editing, signing, and collaboration, users can handle the complexities of the 2025 personal property declaration form with confidence. By addressing common pain points such as accessibility and ease of use, pdfFiller empowers both individuals and teams to manage important documents efficiently from a single cloud-based platform.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the pdffiller form in Chrome?

How do I fill out the pdffiller form form on my smartphone?

How do I complete pdffiller form on an Android device?

What is 2025 personal property declaration?

Who is required to file 2025 personal property declaration?

How to fill out 2025 personal property declaration?

What is the purpose of 2025 personal property declaration?

What information must be reported on 2025 personal property declaration?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.