Get the free Financial Assessment & Income Collection Team Referral Request for Lpft Clients

Get, Create, Make and Sign financial assessment income collection

How to edit financial assessment income collection online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial assessment income collection

How to fill out financial assessment income collection

Who needs financial assessment income collection?

Financial Assessment Income Collection Form: A Comprehensive Guide

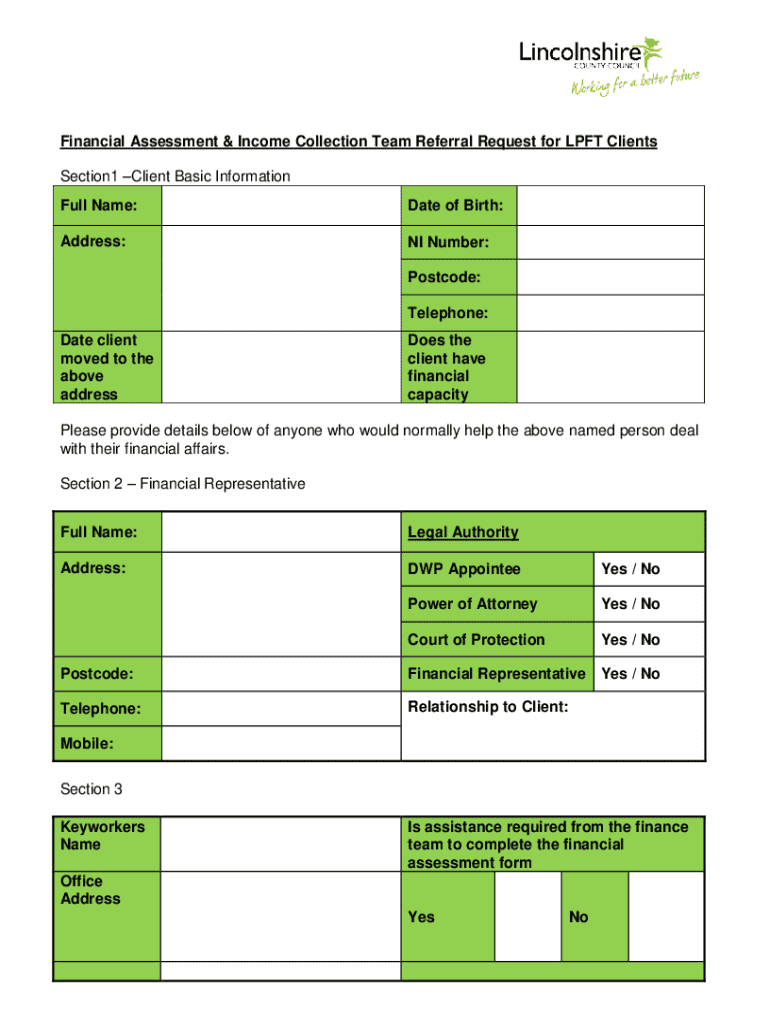

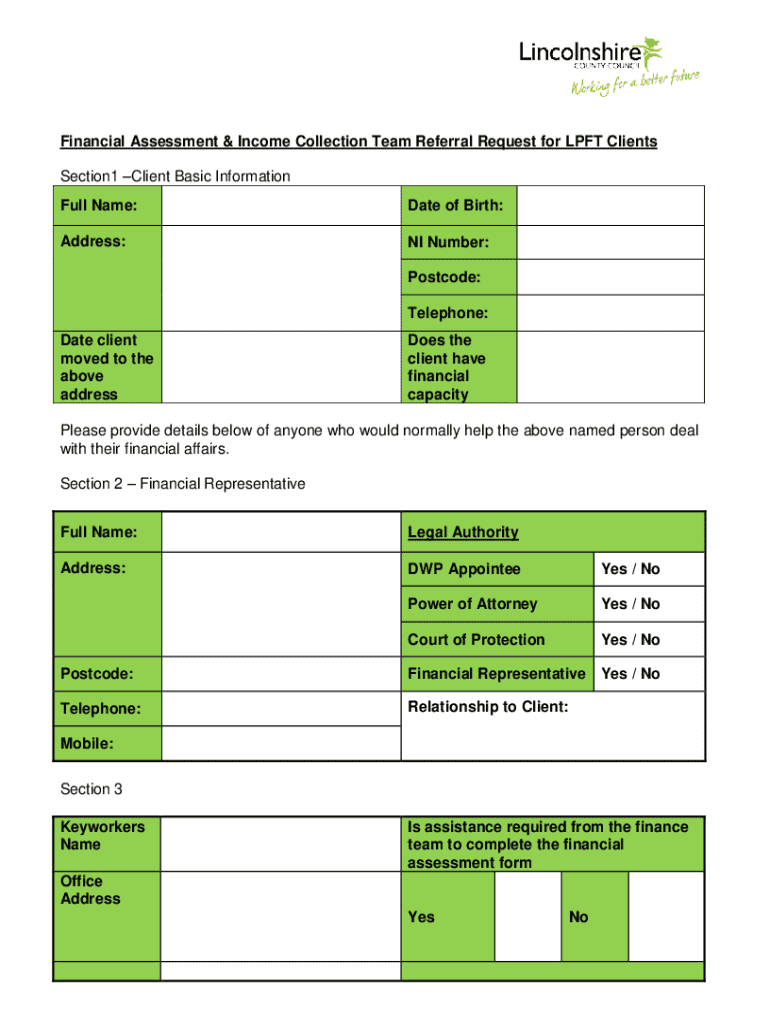

Understanding the financial assessment income collection form

The financial assessment income collection form is a crucial document used to evaluate and assess an individual's or entity's financial status. This form collects pertinent information regarding income, expenses, assets, and liabilities, providing a comprehensive financial picture necessary for various purposes such as loan applications, rental agreements, and financial aid assessments.

Understanding the importance of a financial assessment income collection form is essential, as it ensures financial institutions and organizations have standardized access to the financial data necessary for evaluating a person's creditworthiness or financial stability. Accurate and complete information helps minimize risk for lenders, property owners, and service providers.

Navigating the pdfFiller platform for your form

pdfFiller offers a user-friendly interface designed for document management, including the ability to edit, sign, and share forms easily. One of the standout features is its cloud accessibility, which allows users to access forms from any device, ensuring that the financial assessment income collection form can be filled out anytime, anywhere.

To access the financial assessment income collection form, users can follow a simple series of steps—first, log into pdfFiller, and then navigate to the templates section. Here, searching for ‘financial assessment income collection form’ will yield direct results, allowing users to select and begin working on the document immediately.

Filling out your financial assessment income collection form

Completing the financial assessment income collection form consists of multiple sections: personal information, income sources, and an overview of expenses and assets. The personal information section requires details such as name, address, and contact information. For income details, users need to provide specifics such as salary, business income, and any other sources contributing to total income.

An accurate and thorough completion of this form is crucial. Common mistakes include skipping fields, miscalculating total income, or providing outdated financial information. Ensuring each section is filled out correctly and completely helps to prevent potential delays or issues during the assessment process.

Editing and customizing the form

The flexibility of pdfFiller allows users to edit and customize the financial assessment income collection form to better suit their specific needs. With the editing tools available, users can add text boxes, highlight sections, or even insert images when necessary. This customization is especially helpful for users with unique financial circumstances that require more tailored disclosures.

Using pdfFiller's editing features can streamline the completion process. For example, you might need to include additional income sources or specific notes about particular financial situations. Making these adjustments allows for a more thorough assessment and ensures clearer communication of your financial standing.

Collaborating on your financial assessment income collection form

Collaboration is a key component in managing the financial assessment income collection form, especially for teams or families working together on financial disclosures. pdfFiller allows users to share documents securely with others, enabling stakeholders to input their information or provide feedback directly. This seamless sharing capability enhances the accuracy of the financial data gathered.

Moreover, pdfFiller’s tracking feature is invaluable when multiple users are involved. Keeping track of changes and comments helps streamline communication and ensures every piece of feedback is addressed. This way, the final version of the form will be comprehensive and reflect everyone's contributions.

Signing the financial assessment income collection form

Once the form is completed, adding an electronic signature is the next essential step. pdfFiller simplifies this process, allowing users to insert their e-signature quickly and securely. With a few clicks, individuals can apply their electronic signature to the financial assessment income collection form without the hassle of printing or scanning.

The legality of e-signatures is established under laws such as the ESIGN Act and UETA in the United States, ensuring that signed documents have the same legal standing as traditional handwritten signatures. This means that your financial assessment income collection form, once signed electronically, is legally binding and can be submitted to financial institutions, landlords, or any other relevant parties.

Submitting your completed financial assessment income collection form

After signing, it’s time to submit your financial assessment income collection form. Best practices for submission include double-checking that all required fields are accurately filled out and that the signature is in place. This thorough review minimizes the chance of any issues arising during the submission process.

Utilizing pdfFiller also provides beneficial tools for tracking and ensuring that your submission has been received. Users can often request confirmation or tracking numbers from the recipients, ensuring that their documentation is accounted for and any follow-up is straightforward.

Frequently asked questions

A common query regarding the financial assessment income collection form revolves around its necessity. Many users wonder if everything disclosed needs to be complete or can estimations suffice. Generally, accurate reporting is crucial—especially for loans or financial assistance—because discrepancies can lead to complications or even denial.

Another issue individuals face is technical difficulties with the digital form. Users encountering problems such as inability to save or submit should check for updates or consult the pdfFiller support center for assistance. They provide guides and troubleshooting tips to address frequent challenges users might encounter during the document management process.

More templates and resources

In addition to the financial assessment income collection form, pdfFiller offers a range of related financial forms that can be beneficial. These include expense reports, loan applications, and budgeting templates, each serving specific purposes in financial management.

Furthermore, pdfFiller integrates seamlessly with various financial management tools and apps, enabling users to enhance their document handling efficiency. This connectivity allows for smoother transitions between different financial tasks, ensuring that all documents, including the financial assessment income collection form, align as needed.

Case studies: Successful use of the financial assessment income collection form

Numerous individuals and organizations have successfully utilized the financial assessment income collection form to streamline their financial assessments. For instance, a young entrepreneur seeking a small business loan used the form to present a detailed overview of her income and projected expenses, which aided in her securing the necessary funding. Another example includes a family applying for rental assistance who used the form to clarify their income situation, resulting in a smoother application process.

These case studies illustrate practical applications of the financial assessment income collection form in real-world scenarios. Through these proactive approaches, users can glean insights and learn strategies to improve their financial communication and overall success.

About pdfFiller

pdfFiller is a leading provider of document management solutions designed to simplify the way individuals and organizations handle their paperwork. The company's mission is to empower users to create, edit, e-sign, and manage documents seamlessly from a single, cloud-based platform. This approach enhances efficiency and saves time by centralizing document processes.

Feedback from users consistently highlights pdfFiller's transformative impact on their document management practices. Many report increased productivity due to the ability to access forms and complete tasks from anywhere, utilizing features that enhance collaboration and verification.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my financial assessment income collection in Gmail?

Where do I find financial assessment income collection?

Can I create an eSignature for the financial assessment income collection in Gmail?

What is financial assessment income collection?

Who is required to file financial assessment income collection?

How to fill out financial assessment income collection?

What is the purpose of financial assessment income collection?

What information must be reported on financial assessment income collection?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.