Get the free Tax Experience Affidavit

Get, Create, Make and Sign tax experience affidavit

How to edit tax experience affidavit online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax experience affidavit

How to fill out tax experience affidavit

Who needs tax experience affidavit?

Tax Experience Affidavit Form: Your Comprehensive How-To Guide

Understanding the tax experience affidavit form

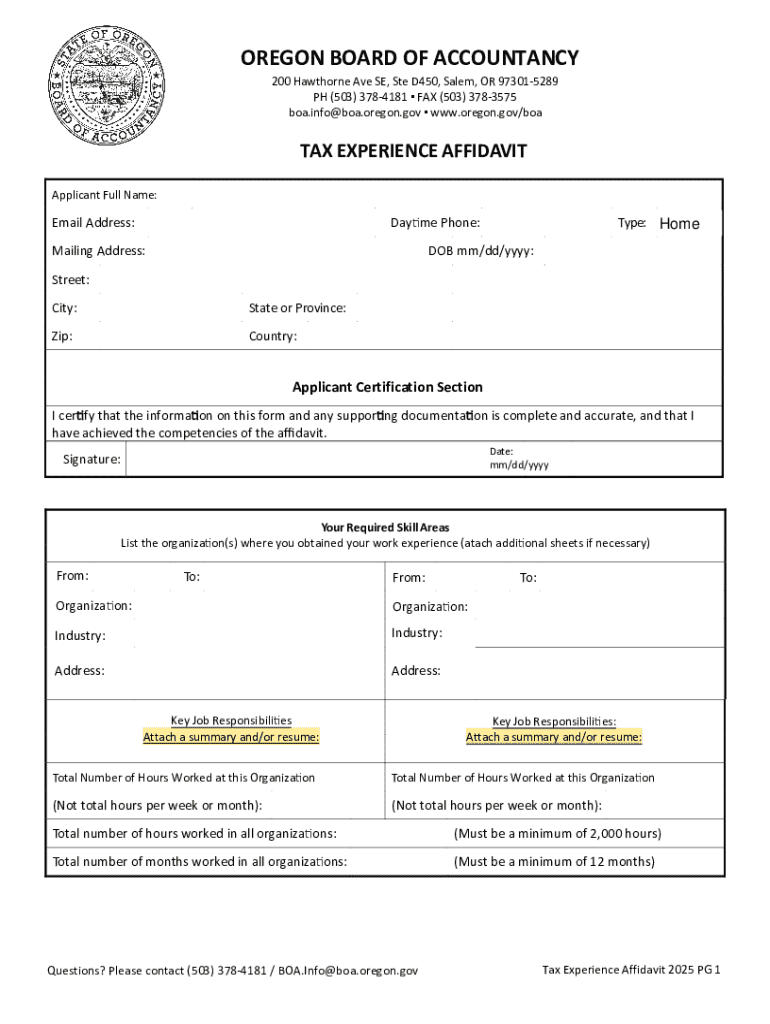

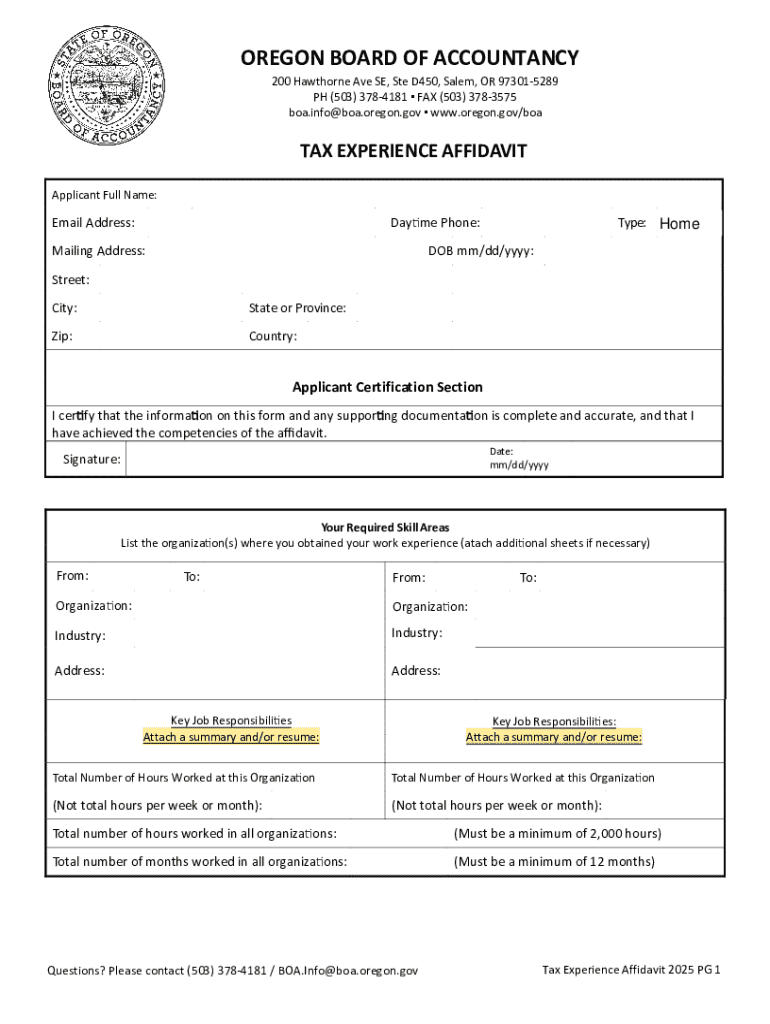

A Tax Experience Affidavit Form is a crucial document that provides verification of an individual's experience in tax-related fields. Mainly utilized in applications for CPA licenses and other tax qualifications, this affidavit serves as a formal declaration that outlines an individual’s professional experience in tax preparation, planning, or compliance. This form can support one's credibility by affirming their qualifications to handle complex tax matters.

The importance of the Tax Experience Affidavit Form cannot be understated. Lenders, regulatory bodies, and organizations often require it to ensure that the person in question possesses the necessary experience to fulfill professional responsibilities. Especially in sectors involving financial audits or tax consultation, having a well-articulated affidavit can significantly augment a candidate's application.

Situations requiring the form

There are several typical scenarios where a Tax Experience Affidavit Form is essential. First, aspiring Certified Public Accountants (CPAs) often need to submit this form as part of their licensing process to prove their relevant job experience. Additionally, it is required in various state and federal tax filings where specific experience validation is necessary. Another instance might be during audits where documenting the experience of tax preparers is critical for compliance.

Key components of the tax experience affidavit

To complete a Tax Experience Affidavit Form, several key components must be included. The personal details section typically requires your full name, address, and contact information. Following this, you need to provide a detailed description of your work experience, including specific roles, responsibilities, and the duration of your employment at each position related to tax functions.

Additionally, you must include any relevant certifications or credentials that bolster your qualifications. It's essential to keep this information precise because it not only establishes your authority in the field but can also influence the decisions made during the assessment process.

Formatting and length

The recommended structure for a Tax Experience Affidavit Form should ideally range between one to two pages. It should employ clear and concise language, using bullet points wherever necessary to improve readability. Specific examples of tasks or experiences should be included rather than vague descriptions to convey your qualifications effectively.

Step-by-step guide to filling out the affidavit

When filling out the Tax Experience Affidavit Form, it's best to start by gathering all necessary documentation. Examples of supporting documents are pay stubs, employment letters, and performance reviews that clearly illustrate your tax-related experience. Having these at hand ensures accuracy and supports your claims.

Filling out each section

In the personal information section, include your name, address, and contact details clearly. Next, in the work experience section, elaborate on your responsibilities and the roles performed in relation to tax functions. Use metrics and specific accomplishments to demonstrate your effectiveness in these roles, as they add weight to your affidavit.

Finally, in the certification section, list any licenses, certifications, or professional affiliations that are pertinent. Avoid common pitfalls such as omitting details or exaggerating experiences, which can undermine your credibility. Always verify accuracy and present your experience honestly.

Editing the tax experience affidavit

Once completed, redundancy and errors in the Tax Experience Affidavit Form can compromise its credibility. Utilizing editing tools like pdfFiller can simplify document revisions, allowing you to catch mistakes and collaborate with peers for additional review. pdfFiller offers a variety of features that enhance the editing process, including the ability to merge documents, add annotations, or format text consistently.

Best practices for document review

Implementing a checklist can help streamline your review of the affidavit. Focus on grammar, punctuation, and overall formatting consistency. Ensuring that the layout is visually appealing can significantly enhance the presentation of your Tax Experience Affidavit, catching the attention of evaluators and lending professionalism to your application.

Signing and submitting your affidavit

After your affidavit has been finalized, it needs to be signed and submitted. With tools such as pdfFiller, electronic signatures can be easily integrated into the document. To e-sign within pdfFiller, simply use the signature feature, which allows you to draw, type, or upload a signature, ensuring that you comply with legal requirements.

Submission guidelines

The submission process will vary based on jurisdiction. Always check with your local tax authority or licensure board to determine the proper submission channels. Be aware of submission deadlines and consider following up a few days after submission to confirm that your affidavit was received without any issues.

Managing your tax documents post-submission

Once your Tax Experience Affidavit Form is submitted, organizing and storing your documents become vital. pdfFiller’s cloud storage solutions allow you to access your documents anytime from anywhere, ensuring quick retrieval when needed. Keep all correspondence regarding your submission well-organized, along with copies of the affidavit.

If you wish to track the status of your affidavit post-submission, regularly checking the appropriate portal or contacting the relevant authority can help find out its progress. Be proactive, as addressing any potential issues can save time and reduce stress during the application process.

Frequently asked questions about the tax experience affidavit form

Many individuals have similar queries regarding the Tax Experience Affidavit Form—primarily about its usage and regulations. Common concerns include who qualifies to sign the affidavit and whether updates can be made post-submission. Typically, only supervisors or colleagues who can vouch for your experience should sign the affidavit.

Regarding updates, once submitted, changes are often not permissible, so ensure your affidavit accurately reflects your experiences before submission. Seek assistance through professional organizations or resources related to tax documentation if you encounter challenges.

Related forms and resources

There are several other forms related to tax applications that may warrant consideration, such as additional CPA applications and renewal forms. Understanding the landscape of these documents can provide further insights into the necessary qualifications for tax professionals.

Accessing official resources is crucial. Links to tax authority websites and professional websites can be incredibly valuable for obtaining accurate information and guidance throughout your application process.

Establishing credibility through your affidavit

The impact of a professionally presented Tax Experience Affidavit Form extends well beyond mere compliance. A well-prepared affidavit reflects your commitment to professionalism and diligence in your tax career. It establishes your credibility and can influence the decision-makers reviewing your application.

To optimize personal branding in your affidavit, present your experience and accomplishments effectively. Use solid metrics to quantify your contributions and ensure your narrative aligns with the requirements of those reviewing the affidavit. Engaging storytelling backed by facts can effectively demonstrate your qualifications.

Exploring the benefits of using pdfFiller

Utilizing a cloud-based document solution such as pdfFiller presents numerous advantages. Access to your documents from any device ensures that you can make edits or collaborate on your Tax Experience Affidavit Form anytime, anywhere. The collaborative features allow you to work with supervisory staff or mentors easily, enhancing the refinement process.

Enhancing your document management experience is critical in today's fast-paced world. By selecting pdfFiller, you gain the ability to streamline the entire process from drafting to submission, which means you can concentrate on building your professional reputation, rather than getting bogged down by paperwork.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit tax experience affidavit from Google Drive?

How do I make edits in tax experience affidavit without leaving Chrome?

How can I fill out tax experience affidavit on an iOS device?

What is tax experience affidavit?

Who is required to file tax experience affidavit?

How to fill out tax experience affidavit?

What is the purpose of tax experience affidavit?

What information must be reported on tax experience affidavit?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.