Get the free Anti Money Laundering Verification Form

Get, Create, Make and Sign anti money laundering verification

Editing anti money laundering verification online

Uncompromising security for your PDF editing and eSignature needs

How to fill out anti money laundering verification

How to fill out anti money laundering verification

Who needs anti money laundering verification?

Anti Money Laundering Verification Form: A How-to Guide

Understanding Anti Money Laundering (AML) Verification

Anti Money Laundering (AML) refers to a set of regulations and procedures designed to prevent criminals from disguising illegally obtained funds as legitimate income. These measures are essential for financial institutions and businesses to protect themselves from being used as conduits for illicit financial activities. The significance of AML cannot be overstated; it safeguards the financial system and helps combat organized crime and terrorism.

Several key regulations govern AML compliance globally, including the Bank Secrecy Act (BSA) and the USA PATRIOT Act in the United States, along with various directives established by the Financial Action Task Force (FATF). These regulations outline the responsibilities of institutions in detecting and reporting suspicious activities, thus ensuring a robust framework for financial integrity.

The role of verification in AML

Verification plays a critical role in AML by ensuring that institutions accurately identify their customers and assess the risks associated with them. This risk-based approach enables businesses to apply appropriate measures to mitigate potential threats effectively. Verification typically involves confirming the identity of clients, understanding the nature of their dealings, and monitoring their transactions for any unusual activity.

Common verification methods include Know Your Customer (KYC) procedures, which require firms to collect and verify personal details, and enhanced due diligence for higher-risk customers. These processes help to create a secure financial landscape and instill trust among customers, businesses, and regulatory bodies.

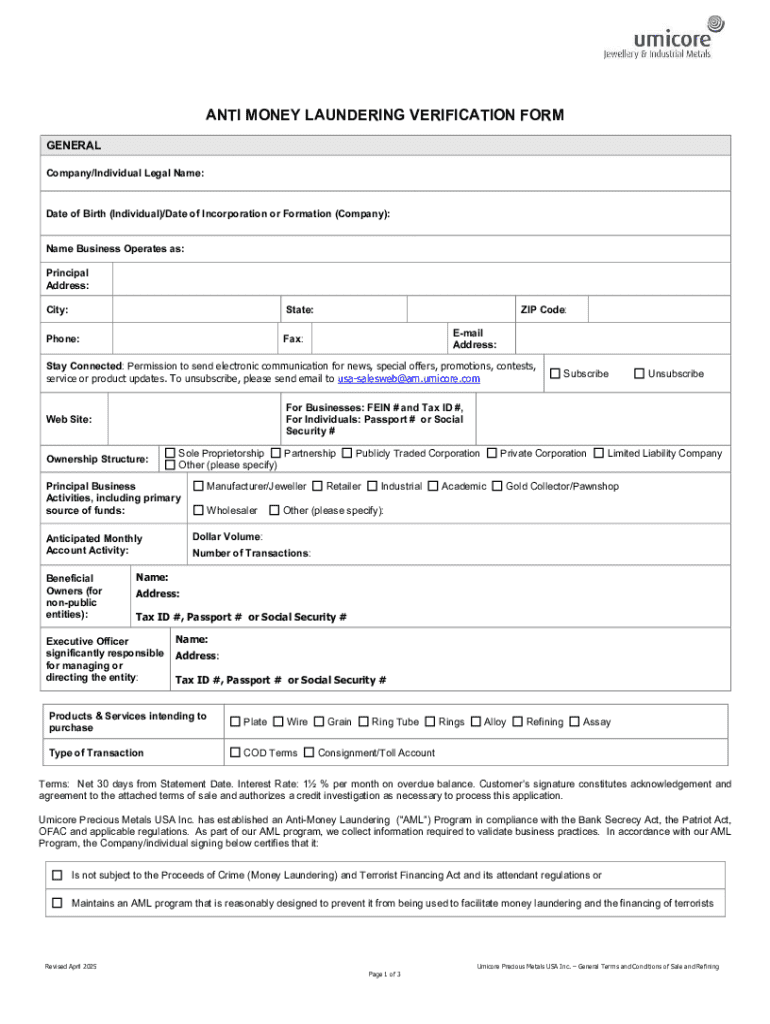

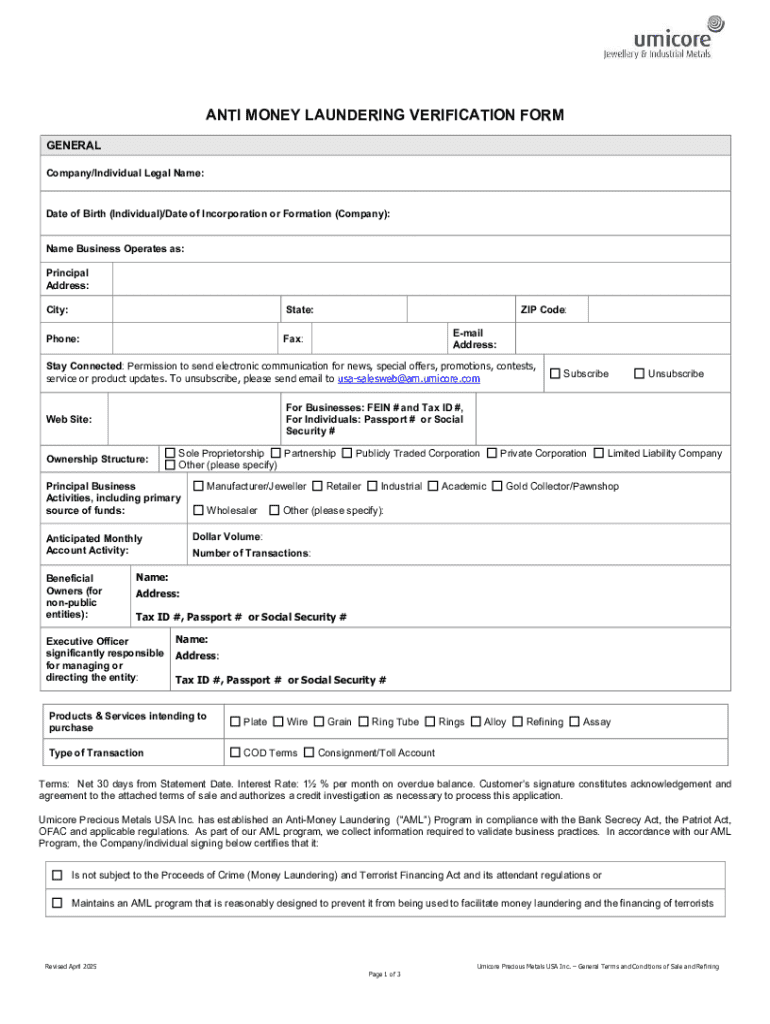

Overview of the Anti Money Laundering Verification Form

The AML Verification Form is a crucial document utilized by financial institutions and businesses to collect information necessary for compliance with AML regulations. It serves as a standardization tool, promoting consistency in the data gathered for verification purposes. This form is vital not only for the organizations using it but also for clients, who must provide accurate details to ensure their transactions are processed lawfully.

The target audience for the AML Verification Form includes individuals opening banking accounts, businesses engaging in significant transactions, and even financial institutions themselves. Each entity must ensure they complete the form accurately to avoid penalties or the risk of financing illegal activities.

Key components of the form

The components of an AML Verification Form vary by institution but generally include essential personal and transactional information such as:

Understanding the purpose of each section is crucial for ensuring compliance and avoiding delays in processing.

Step-by-step guide to filling out the AML verification form

Filling out the AML Verification Form may seem daunting, but by following a structured process, you can ensure that your submission is accurate and compliant.

Editing and managing your AML verification form online

Utilizing modern document management tools like pdfFiller can significantly enhance your experience with the AML Verification Form. With easy editing tools, you can make necessary changes seamlessly, ensuring your document is accurate and up-to-date.

pdfFiller also offers collaborative features where you can share the form with team members for input or review. This is particularly useful for businesses that require multiple approvals before submission.

eSigning the AML verification form

An authentic signature holds significant importance in AML compliance. The AML Verification Form may require a signature to validate the information provided and demonstrate the intent to comply with regulations.

With pdfFiller, eSigning is straightforward. By following step-by-step instructions, you can add your signature digitally, ensuring the process remains efficient and compliant with legal standards.

Frequently asked questions (FAQs) about the AML verification form

Tips for successful anti money laundering compliance

Understanding the broader context of AML is essential for compliance and risk management. Institutions must stay updated with the latest regulations and evolving best practices to mitigate potential risks effectively. Regular training and resources, such as AML certifications, can improve understanding and compliance across teams.

Interactive tools to assist with your AML verification

Using pdfFiller’s interactive tools can streamline the process of filling out your AML Verification Form. Templates and checklists are available to ensure all necessary information is captured, reducing the risk of errors.

Interactive field guides can provide live support during form completion, enhancing the user experience and promoting efficient document management.

Final thoughts on the AML verification process

The AML verification process is a fundamental aspect of compliance that ensures financial institutions operate within the law. The importance of accuracy and completeness in the AML Verification Form cannot be overstated, as it protects both the institution and the client.

Leveraging platforms like pdfFiller not only helps users achieve efficiency in the verification process but also supports ongoing compliance efforts, making it easier for individuals and businesses to manage their documentation effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send anti money laundering verification to be eSigned by others?

How do I edit anti money laundering verification in Chrome?

Can I edit anti money laundering verification on an Android device?

What is anti money laundering verification?

Who is required to file anti money laundering verification?

How to fill out anti money laundering verification?

What is the purpose of anti money laundering verification?

What information must be reported on anti money laundering verification?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.