Get the free form 8919 pdf

Get, Create, Make and Sign form 8919 pdf

Editing form 8919 pdf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8919 pdf

How to fill out form 8919

Who needs form 8919?

Your Complete Guide to Form 8919: What You Need to Know

Understanding Form 8919

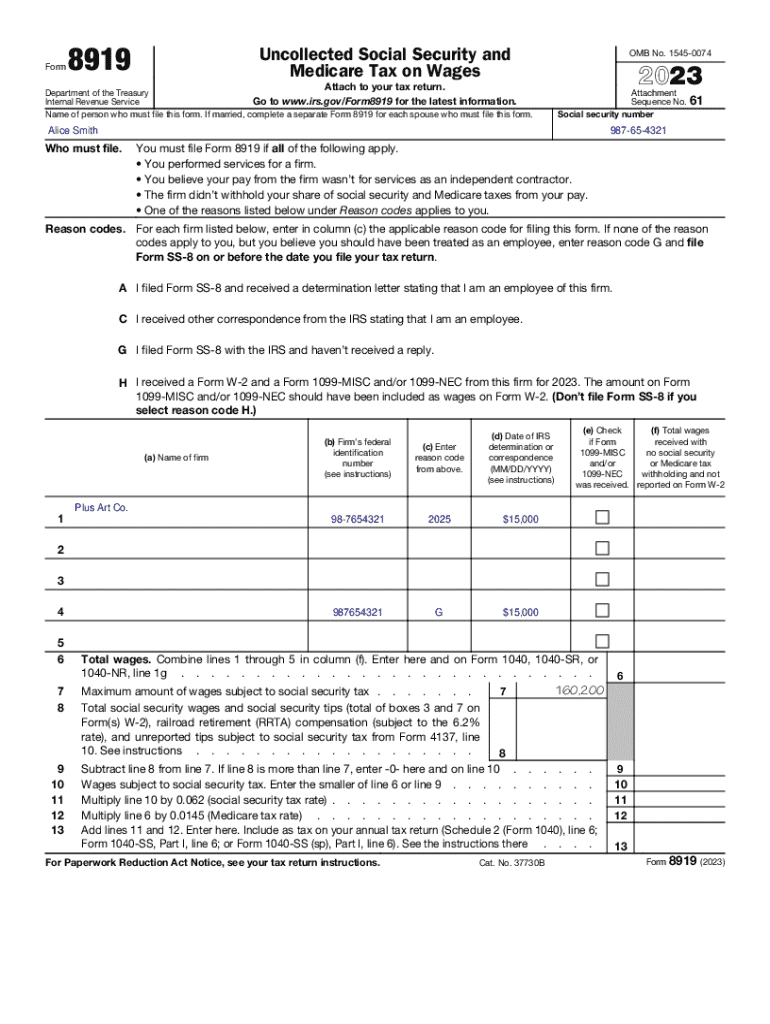

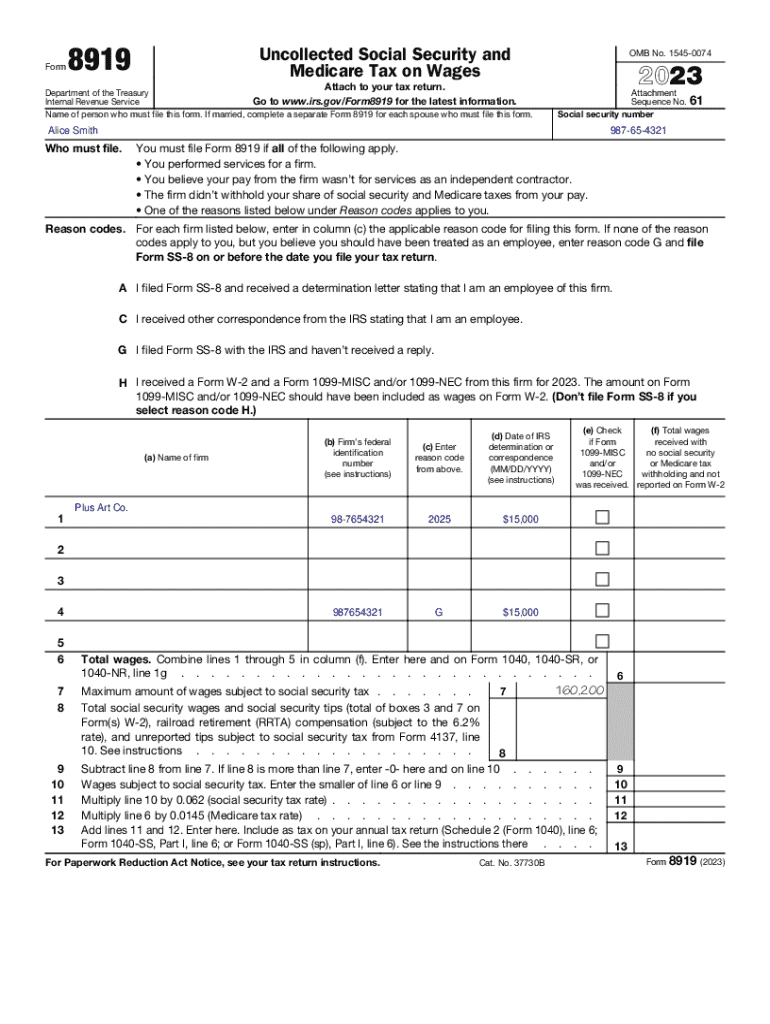

Form 8919, also known as the 'Uncollected Social Security and Medicare Tax on Wages,' is a tax form designed for employees who wish to report uncollected Social Security and Medicare taxes due to their employer's classification of their work status. It plays a pivotal role in ensuring that taxpayers fulfill their tax obligations despite discrepancies or mistakes made by employers regarding employee classification.

The significance of Form 8919 cannot be overstated, as it empowers taxpayers to take charge of their tax situations. Misclassification can result in employees missing out on critical benefits like Social Security and Medicare. For those who find themselves in this position, Form 8919 provides a path to correct the record and ensure compliance with tax regulations.

Who should use Form 8919?

This form is primarily for individuals classified as independent contractors by their employers but believe they are actually employees. Individuals in specific scenarios, such as freelancers who perform work equivalent to that of employees, should consider Form 8919. If your employer failed to withhold Social Security or Medicare taxes, and you believe employment criteria have been misapplied, you must file this form.

Key components of Form 8919

Understanding Form 8919 not only involves knowing who should use it but also dissecting its components. The form is divided into several sections, each designed to collect specific information from the taxpayer. The first section requires personal information, such as your name, address, and taxpayer identification number—essential for the IRS to process your submission correctly.

Subsequent sections ask for details about your employer, including the amount of wages paid and the uncollected Social Security and Medicare taxes. Typically, entries in these sections should reflect direct payments made to you by your employer during the tax year.

Understanding ‘Reason Codes’

A critical part of filling out Form 8919 is selecting the correct 'Reason Code.' These codes help clarify why you are filing the form and assist the IRS in understanding your specific situation. Each code corresponds to different scenarios, including situations where you were never classified correctly by your employer or where you believe the classification should be updated.

Preparing to file Form 8919

Before you dive into completing Form 8919, gathering all the essential information and documentation is vital. This includes your wage statements, previous tax returns, and records of any communication concerning your employment status. Ensuring you have these documents on hand will streamline the process and reduce errors.

Additionally, you must understand the related IRS guidelines concerning Form 8919. Familiarize yourself with the IRS regulations relevant to your employment classification. Keeping track of key deadlines is critical—failing to file by the required date can result in penalties or complications with your tax return.

Completing Form 8919

Completing Form 8919 requires a meticulous approach. Start by filling in your personal information in Part I. Next, provide the employment information and wage details in Part II. Double-check calculations when entering the total wages and taxes; even minor mistakes can carry significant implications for your filings.

Avoid common pitfalls that can derail your filing process. Be diligent with the details you provide, as incomplete or incorrect information can lead to prolonged processing times or rejection of your submission. Always refer back to the IRS instructions for the form to ensure accuracy and completeness.

Interactive tool: Form filling assistant

To further streamline your filing experience, pdfFiller offers an interactive Form Filling Assistant that guides you through each section of Form 8919. This tool features prompts and tips to help you provide the right information without missing critical details.

Using the Form Filling Assistant can significantly reduce errors and make the process less daunting. Simply follow the interactive guide, and you’ll be well on your way to submitting your form correctly.

E-signing and submitting Form 8919

Once you have completed Form 8919, it’s time to submit it. You have options regarding submission methods—either electronically or via paper. E-filing is generally faster and more secure, reducing the risk of delays in processing.

If you opt for electronic submission, ensure you’re using a platform that allows for safe e-signing, such as pdfFiller. Signing through pdfFiller is simple and efficient, allowing you to finalize your document without any hassle. After submitting your form, be aware of the timelines the IRS has for processing; typically, you should allow a few weeks for the IRS to acknowledge receipt and process your submission.

Implications of filing Form 8919

Filing Form 8919 can significantly impact your overall tax return. It allows you to have uncollected Social Security and Medicare taxes recognized by the IRS, ensuring that your future benefits are not jeopardized. Whether successful or not, the ramifications of filing—or failing to file—this form can influence your tax obligations and how much you owe.

Moreover, filing Form 8919 can have lasting effects on your employment situation. Properly clarifying your classification may assist in future job opportunities, as employers are likely to take legal compliance into account when making hiring decisions.

Common questions and issues

Not every taxpayer is well-versed in IRS procedures, which raises numerous questions when dealing with Form 8919. Some of the most common inquiries include understanding how to handle discrepancies in employer classification and what happens if the IRS denies your filing. Knowing where to seek help is crucial when faced with such issues.

In many cases, seeking professional help can save time and prevent errors. If you find yourself confused about how to fill out the form or if you're uncertain about your situation, reaching out to a tax professional can provide you with the guidance needed to navigate complexities successfully.

Additional resources and tools

While Form 8919 is vital for addressing your tax obligations, it’s also essential to be familiar with other related tax forms you may encounter. Forms such as the W-2, 1099, and IRS Form 1040 commonly correspond to situations involving Form 8919, particularly concerning reporting income.

For further assistance, explore available support options through the IRS website or reach out to customer support teams of tools like pdfFiller. Having these resources at hand can ensure you have the up-to-date information and help you require.

Real-life examples

The practical implications of Form 8919 can be better understood through real-life scenarios. For instance, consider an independent contractor who performs work for several companies and finds that only one has opted to withhold taxes. By utilizing Form 8919, this taxpayer successfully ensures that all relevant income is reported, preserving access to Social Security and Medicare benefits.

Conversely, another case could highlight the complications that arise when a taxpayer fails to file the form. This individual could face increased tax liabilities down the line or, worse, denial of benefits when age-related Medicare enrollment begins. Analyzing such scenarios illustrates the form's importance and the potential repercussions of neglecting it.

Expert tips for filing Form 8919

Filing Form 8919 accurately requires strategic thinking. One of the best practices is to review the form's instructions thoroughly before you start. This preparation will ensure you understand what is expected of you, reducing the chances of error and delay.

Using pdfFiller can significantly optimize your experience. Features such as error checking and form validation help ensure completeness. Additionally, saving your document in the cloud allows for easy access and adjustments as needed, making the filing process seamless.

Conclusion remarks

Form 8919 is an essential tool for ensuring you fulfill your tax obligations properly, particularly in instances of misclassification. By understanding its importance, components, and filing process, taxpayers are better equipped to navigate their obligations confidently. This guide has illuminated various aspects of Form 8919 and equipped you with the necessary knowledge to handle your tax filings effectively.

Explore further

As you continue your journey in understanding tax forms, consider exploring other related content that can enhance your financial literacy. Further articles on document management, additional tax forms, and strategic tax planning will prove invaluable in maintaining compliance and maximizing benefits. Stay informed, and leverage resources like pdfFiller to manage all your document needs efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 8919 pdf directly from Gmail?

How do I edit form 8919 pdf on an iOS device?

How do I fill out form 8919 pdf on an Android device?

What is form 8919?

Who is required to file form 8919?

How to fill out form 8919?

What is the purpose of form 8919?

What information must be reported on form 8919?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.