Get the free Affiliated Business Arrangement Disclosure Statement Notice

Get, Create, Make and Sign affiliated business arrangement disclosure

Editing affiliated business arrangement disclosure online

Uncompromising security for your PDF editing and eSignature needs

How to fill out affiliated business arrangement disclosure

How to fill out affiliated business arrangement disclosure

Who needs affiliated business arrangement disclosure?

Understanding the Affiliated Business Arrangement Disclosure Form

Understanding affiliated business arrangement disclosure

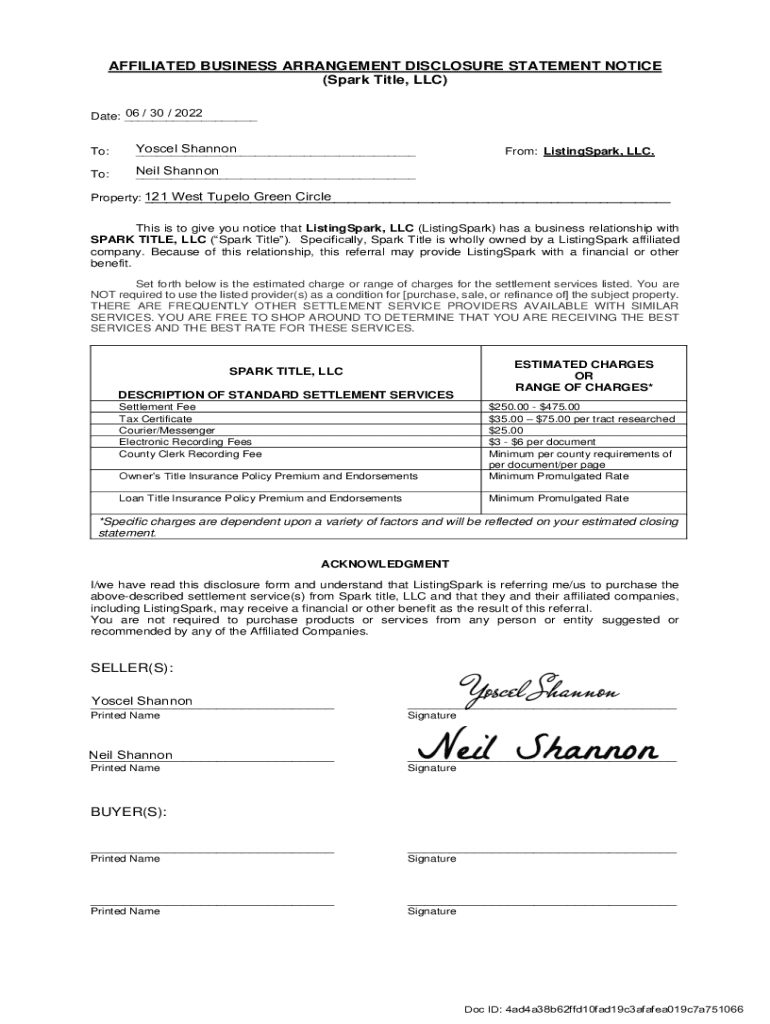

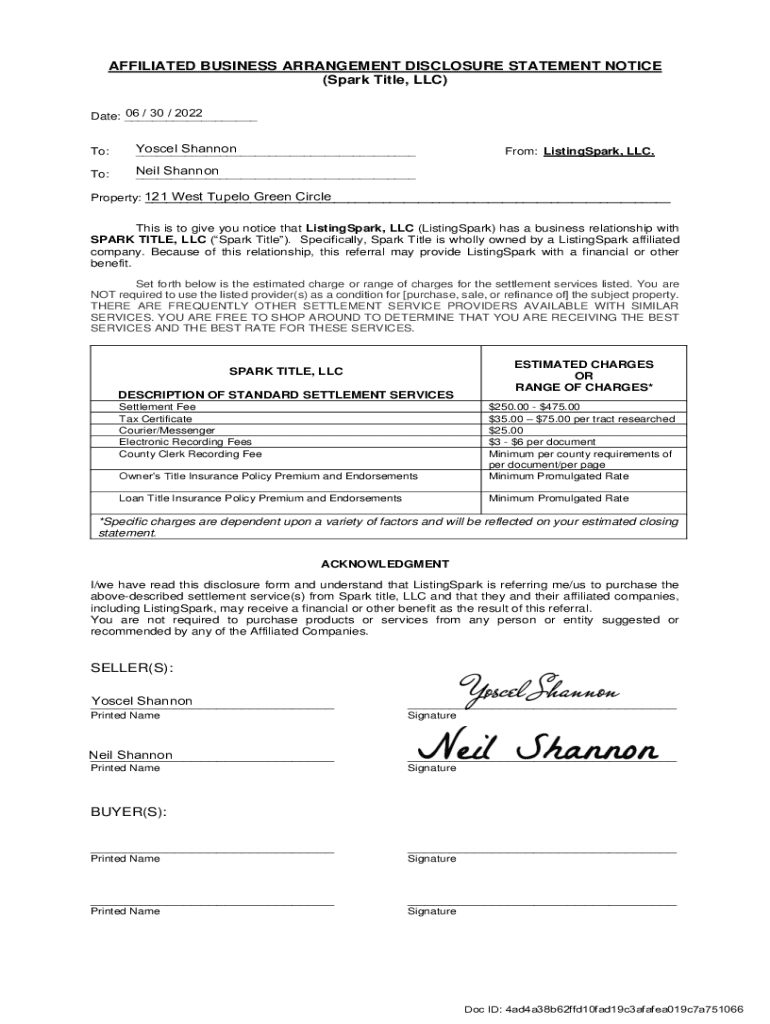

The affiliated business arrangement disclosure form is a crucial document in real estate and mortgage transactions. An affiliated business arrangement (ABA) occurs when a service provider in a real estate transaction refers clients to another business they have a financial interest in. This form serves to inform consumers about these relationships, ensuring they are aware of any potential conflicts of interest.

The primary purpose of this disclosure form is to promote transparency and consumer awareness. It is vital for all parties involved to understand these relationships as they can impact decisions related to their real estate transactions. Furthermore, the disclosure aims to ensure compliance with regulatory standards set by the Real Estate Settlement Procedures Act (RESPA), which emphasizes the importance of disclosure to protect consumers.

By utilizing the affiliated business arrangement disclosure form, businesses can uphold integrity and build trust among clients. Transparency is not merely a legal obligation but a crucial aspect of fostering lasting relationships in real estate and associated fields.

Key components of the affiliated business arrangement disclosure form

The affiliated business arrangement disclosure form includes several critical components that must be accurately filled out. Specific information required on the form includes the names of all affiliated businesses involved, the nature of the relationship between the referring party and the affiliated business, and a clear disclosure of any financial interests that may exist.

Additionally, the form typically contains sections for signatures and dates, where all parties must sign to acknowledge their understanding of the information provided. Acknowledgment statements are also included, allowing clients to confirm they have received and understood the disclosure.

Step-by-step instructions for completing the form

Completing the affiliated business arrangement disclosure form is straightforward if you follow these steps carefully. First, gather all necessary information, which includes identifying the affiliated businesses and compiling any relevant financial data. This preparation will ensure you have everything at your disposal before filling out the form.

Step 1 involves identifying the affiliates clearly. This means knowing which businesses are affiliated and the nature of those affiliations. Step 2 is to fill out the form by following detailed guidance on each section, ensuring clarity and accuracy. After completion, Step 3 involves reviewing the form for accuracy. This review should focus on completeness and checking for spelling errors, especially in names and financial figures.

Finally, in Step 4, you'll submit the form. Make sure you know where to send it, whether electronically or via postal service. Adhering to these steps ensures that the form is completed correctly and submitted on time.

Common mistakes to avoid when filling out the form

Many individuals overlook critical details when filling out the affiliated business arrangement disclosure form due to the complexity of the information required. One common mistake is leaving out incomplete information, which can lead to misunderstandings or legal disputes down the line. Ensuring every section of the form is thoroughly filled is paramount.

Another frequent error is failing to sign or date the document, which nullifies the purpose of the disclosure. It is essential for all parties involved to acknowledge their understanding through signatures. Additionally, incorrectly disclosing relationships or financial interests can lead to claims of fraud or misrepresentation, jeopardizing the entire transaction.

Legal obligations related to the disclosure form

Understanding the legal obligations when dealing with the affiliated business arrangement disclosure form is critical. Regulatory requirements, mainly stemming from RESPA, mandate transparency in real estate transactions involving affiliated business arrangements. Not providing the requisite disclosures can lead to severe repercussions, including penalties, lawsuits, or losing license privileges.

The law clearly states that consumers must be made aware of any affiliations that could affect their financial decisions. Therefore, strict adherence to filling out the form correctly and maintaining transparency is legally necessary and fundamentally supportive of consumer rights.

How to edit and manage your form with pdfFiller

Using pdfFiller to edit and manage your affiliated business arrangement disclosure form provides a seamless experience. Start by utilizing pdfFiller’s robust editing tools to add, delete, or modify information as necessary. The platform is user-friendly, making it easy to navigate through each section of the form.

Once edited, you can save and store your document securely within the pdfFiller system. This feature is advantageous for future reference or audits. Additionally, pdfFiller supports collaborative sharing, allowing you and your team to work together on completing the form efficiently, ensuring all inputs are captured clearly and accurately.

eSigning the affiliated business arrangement disclosure form

The use of electronic signatures (eSignatures) for the affiliated business arrangement disclosure form is legally recognized, providing a modern solution to document management. Implementing eSignatures not only simplifies the signing process but also expedites the overall transaction timeline.

With pdfFiller, the process of eSigning is straightforward. Simply follow the step-by-step instructions provided within the platform to add your signature. The benefits of using eSignatures extend beyond convenience — they enhance security and provide a tamper-proof record of agreement that can be invaluable in case of disputes.

Frequently asked questions (FAQs)

Many users have questions concerning the affiliated business arrangement disclosure form. Common inquiries include what to do if a mistake is made on the form — the best practice is to correct the error immediately and re-sign the document to maintain accuracy. Another frequent question is whether the disclosure form is standardized across all states; the answer varies, as regulations may differ by jurisdiction.

Clients often ask how often they should update this form. The recommended practice is to review and update the form whenever there are changes in affiliations or financial interests. Regular updates not only ensure compliance but also reinforce transparency with clients.

Real-world examples of affiliated business arrangements

Real-world applications of the affiliated business arrangement disclosure form can be quite enlightening. For instance, in a successful real estate transaction, an agent might refer clients to a specific mortgage lender with whom they have a financial relationship. Through the proper use of the disclosure form, clients are made aware of this relationship, ultimately enhancing their trust in the transaction process.

On the other hand, lessons can be learned from mismanaged disclosures. One case involved a real estate agency failing to properly disclose financial ties with a contractor. This oversight resulted in legal repercussions and damaged the agency's reputation. Such examples illustrate the critical importance of rigorous adherence to disclosure protocols.

Client success stories with pdfFiller

Numerous clients have benefited from using pdfFiller for managing the affiliated business arrangement disclosure form. Testimonials from users highlight how pdfFiller has streamlined their documentation processes, saving time and reducing the likelihood of errors. One user noted that the editing tools enabled quick adjustments, leading to faster approvals in transactions.

Another client shared that the collaborative features of pdfFiller have significantly improved their team’s efficiency in managing disclosures, with real-time updates and shared access fostering a smoother workflow. These success stories demonstrate how utilizing pdfFiller enhances the document management experience and ensures compliance.

Contact support for further assistance

For users who require further assistance with the affiliated business arrangement disclosure form or pdfFiller's services, accessing customer support is straightforward. pdfFiller offers various resources, including a comprehensive help center and live chat options, allowing users to troubleshoot any issues they encounter.

The customer support team is well-equipped to assist with specific queries related to the form and provide guidance on best practices for management. Users can also find helpful tutorials and community forums that contribute to a deeper understanding of the platform's functionalities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get affiliated business arrangement disclosure?

Can I create an electronic signature for signing my affiliated business arrangement disclosure in Gmail?

How do I complete affiliated business arrangement disclosure on an Android device?

What is affiliated business arrangement disclosure?

Who is required to file affiliated business arrangement disclosure?

How to fill out affiliated business arrangement disclosure?

What is the purpose of affiliated business arrangement disclosure?

What information must be reported on affiliated business arrangement disclosure?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.