Get the free Credit Card Account Request Form

Get, Create, Make and Sign credit card account request

How to edit credit card account request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out credit card account request

How to fill out credit card account request

Who needs credit card account request?

Understanding the Credit Card Account Request Form

Understanding the credit card account request form

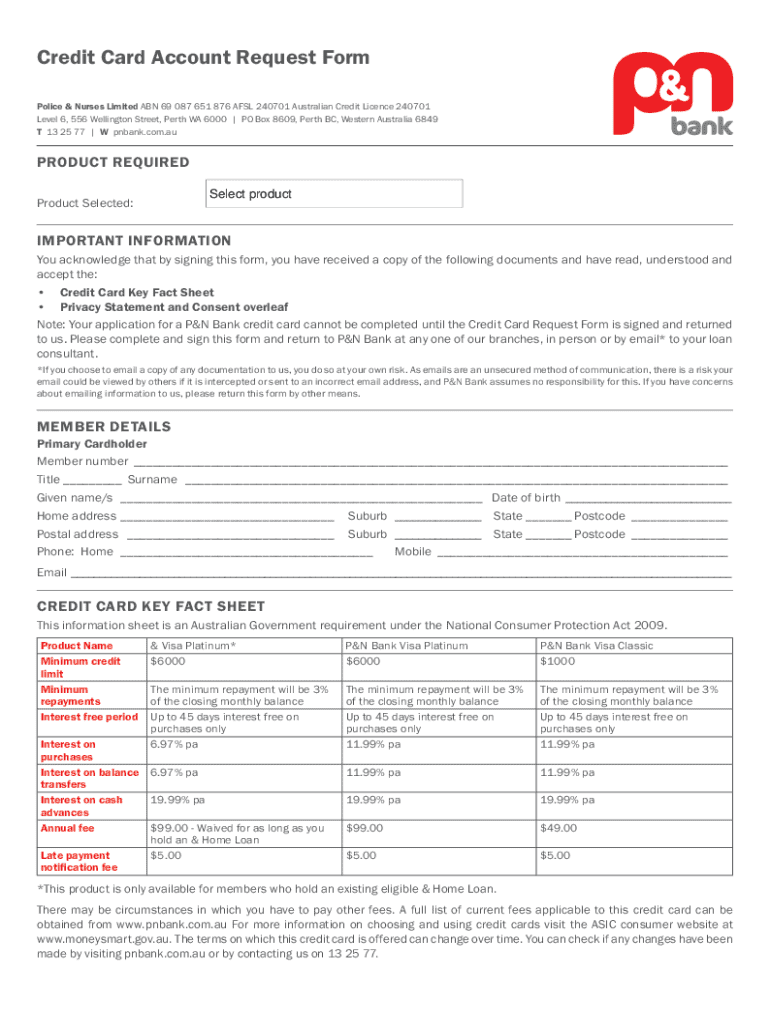

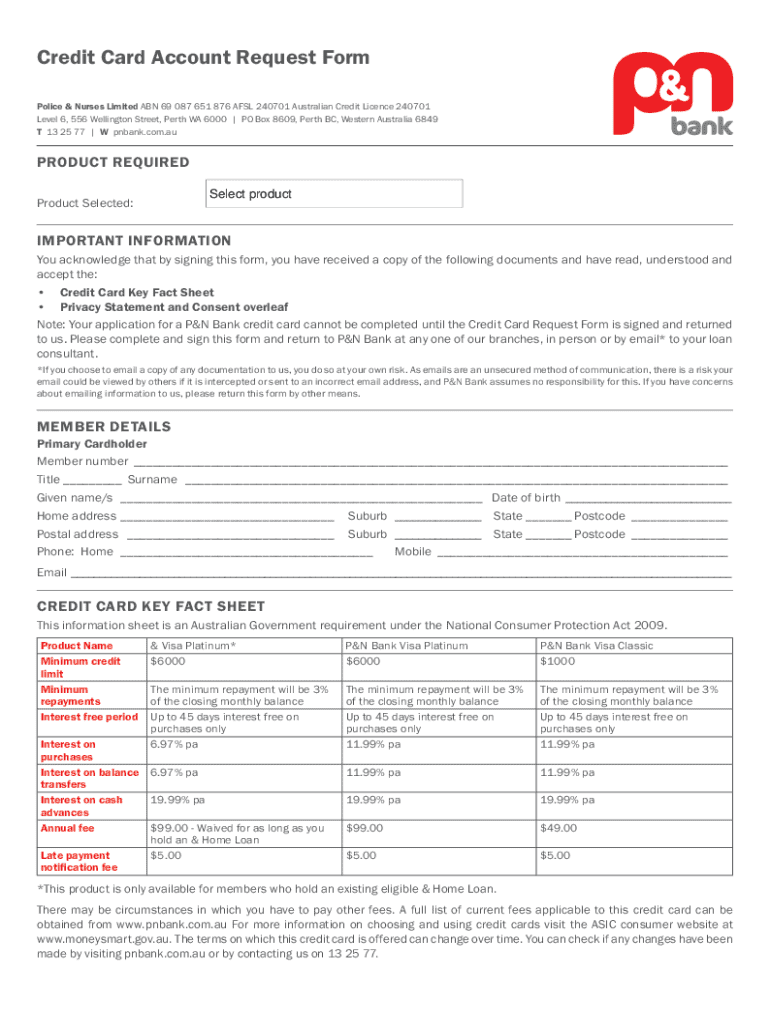

A Credit Card Account Request Form is a formal document used by individuals to initiate the application process for obtaining a credit card. This form captures essential personal and financial information that credit card issuers require to evaluate the eligibility of the applicant. Not only is this document pivotal in securing credit, but it also serves as a foundational step in establishing an individual's credit profile with financial institutions.

The importance of this form cannot be overstated; it plays a crucial role in managing your credit card applications effectively. Completed accurately, it helps streamline the review process, reducing delays in receiving approval or denial notifications. Whether you're applying for your first credit card or looking to expand your existing credit portfolio, understanding the nuances of this form is essential.

How the credit card account request form works

Completing a Credit Card Account Request Form involves several critical steps that ensure your application is complete and accurate. First and foremost, gathering the necessary information is vital. This usually includes personal details such as your name, address, and contact information, as well as financial information like your income and employment details.

Once you have your information gathered, it's time to provide credit card details. This section usually asks about the type of credit card you desire, the credit limit you seek, and other preferences. It's crucial to include all relevant information and avoid common mistakes such as typos or omissions, as these can lead to application delays.

Before you submit your request form, take a moment to review it thoroughly. Key areas to double-check include your spelling, figures in financial declarations, and overall completeness of the form. An error at this stage could result in unnecessary hurdles in your application process.

Tips for completing the credit card account request form effectively

To ensure your Credit Card Account Request Form is completed accurately, start by double-checking all entries for correctness. This diligence helps prevent delays in processing your application, ultimately expediting your credit card acquisition journey. Additionally, utilizing digital tools like pdfFiller can greatly enhance your form-filling experience.

pdfFiller provides features that allow you to edit and manage the form directly within its platform, making corrections easy. Its eSigning capabilities further streamline the process, allowing you to sign the form digitally, which is increasingly accepted by many credit card issuers.

Common questions about the credit card account request form

Navigating the intricacies of the Credit Card Account Request Form often leads to several common questions from applicants. One primary concern revolves around the mandatory information required on the form. Typically, you must provide certain personal and financial details, which are essential for a comprehensive assessment of your application.

Another frequent query pertains to the application status. Applicants often wonder how to know if their application is approved or denied. Most issuers will contact you via email or mail, providing clarity on your application status. Additionally, you may be curious whether it's legally mandated to use this form for credit applications; the answer generally leans towards no, but it's highly advisable to follow your chosen issuer's preferred procedures.

Lastly, if an error occurs on the form, don’t panic. Contact your credit card issuer as soon as possible to rectify any mistakes, as timely correction is essential for smooth processing.

Best practices for managing your credit card accounts

Once your Credit Card Account Request Form is successfully submitted and approved, managing your credit card accounts becomes paramount. Start by storing signed forms safely and securely, which is critical for future reference, especially if disputes arise. Keeping track of deadlines related to payments and follow-ups is equally important; you don’t want to miss a due date that could impact your credit score.

Regularly reviewing your account status and any changes in terms can help you stay informed and adapt your usage strategy accordingly. Monitoring your credit card activity can also alert you to potential fraud or unauthorized charges, safeguarding your finances.

Interactive features and tools available on pdfFiller

With pdfFiller, users have access to a range of interactive features that simplify the completion of the Credit Card Account Request Form. The platform allows you to edit and customize your form with ease, enabling you to make necessary adjustments or updates without hassle. Additionally, leveraging cloud storage means you can access your form anytime, anywhere, ensuring significant convenience.

Collaboration is another strong suit of pdfFiller. If you're working in a team setting, collaborators can easily engage in the form completion process, facilitating faster finalization and submission.

Exploring alternatives to the traditional credit card account request form

As technology advances, so do the options available for submitting Credit Card Account Request Forms. Digital signatures are rising in popularity and can offer a quick and secure way to validate your application without the need for handwritten approval. Additionally, many credit card issuers now provide mobile applications that allow you to complete your application entirely online, bringing the process right to your fingertips.

While traditional methods still hold value, considering third-party tools such as pdfFiller can accelerate and simplify the application process. Weighing the pros and cons of digital versus traditional methods will guide you to the best solution for your individual needs.

The future of credit card applications and documentation

The landscape of credit card applications is evolving rapidly due to technological innovations. Future trends in digital document management indicate a shift towards fully online and automated processes, where applicants can experience faster approvals and fewer complications associated with paperwork. Artificial intelligence and machine learning are being integrated to assist lenders in evaluating risk profiles more accurately.

pdfFiller is at the forefront of this transformation, offering tools that simplify financial documentation management while ensuring compliance with best practices. The platform’s capabilities enable users to adapt to these changes seamlessly, facilitating better management of credit card applications and other financial documents.

Resources to further enhance your understanding

To deepen your understanding of the Credit Card Account Request Form and its associated processes, pdfFiller provides numerous resources. You can explore related forms and templates directly from the platform, ensuring that you have all the necessary documentation at your fingertips. Educational content about credit management can guide you in making better financial decisions, while community discussions or forums can offer diverse user experiences and practical tips.

Engaging with these resources can empower you not only to fill out your forms correctly but also to elevate your overall financial literacy, positioning you for success in managing your credit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find credit card account request?

How do I edit credit card account request online?

How do I edit credit card account request straight from my smartphone?

What is credit card account request?

Who is required to file credit card account request?

How to fill out credit card account request?

What is the purpose of credit card account request?

What information must be reported on credit card account request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.