Get the free Merchant Signatory Authorization Letter

Get, Create, Make and Sign merchant signatory authorization letter

How to edit merchant signatory authorization letter online

Uncompromising security for your PDF editing and eSignature needs

How to fill out merchant signatory authorization letter

How to fill out merchant signatory authorization letter

Who needs merchant signatory authorization letter?

Merchant Signatory Authorization Letter Form: A Comprehensive Guide

Understanding the merchant signatory authorization letter

A Merchant Signatory Authorization Letter is an essential document that allows business owners to designate specific individuals with the authority to act on behalf of their merchant accounts in various transactions. This letter is pivotal in facilitating business dealings, especially when establishing bank accounts, engaging in financial transactions, or entering contractual obligations. Having this document in place is critical to streamline operations and ensure that the intended signatories have the legal backing to conduct negotiations, authorize payments, and sign contracts.

The importance of this document cannot be overstated; in the realm of business transactions and banking, it acts as an assurance to banks and partners that the designated signatories are indeed authorized to perform particular actions. Without it, businesses might face hurdles in executing essential agreements or conducting day-to-day operations efficiently.

Legal implications

Legally, the Merchant Signatory Authorization Letter grants authority to the signatories to undertake actions that can bind the company. This includes the ability to enter into contracts, execute transactions, and manage accounts. It effectively provides a legal basis for the actions performed by the authorized individuals, protecting both the signatories and the business itself from potential legal disputes.

However, improper authorization can have significant negative consequences. If an unauthorized person acts on behalf of the business, it can lead to financial losses, legal penalties, and damaged relationships with clients and partners. As such, it's critical that businesses ensure the letter is correctly filled out, regularly updated, and properly secured.

When is a merchant signatory authorization letter needed?

There are several scenarios in which a Merchant Signatory Authorization Letter becomes necessary. Primarily, this document is required when opening new bank accounts, especially for business accounts. Banks demand such authorization as it helps them verify who is allowed to access and manage the account on behalf of the business.

Moreover, when securing business loans or entering credit agreements, lenders typically require proof that the individuals they are dealing with have the authority to bind the business financially. In situations where specific employees or agents are authorized to carry out transactions, it’s essential to have this letter to prevent misconduct or miscommunication.

Common industries utilizing these letters

Several industries commonly use Merchant Signatory Authorization Letters. E-commerce companies, for instance, often rely on being able to make quick payments and manage supplier agreements, necessitating clear signatory authority. Retail businesses also benefit from having designated individuals who can manage financial transactions and supplier agreements effectively.

Service providers, ranging from agencies to consulting firms, frequently need to establish clear lines of authority for their transactions and contracts, making the Merchant Signatory Authorization Letter an indispensable aspect of running their businesses.

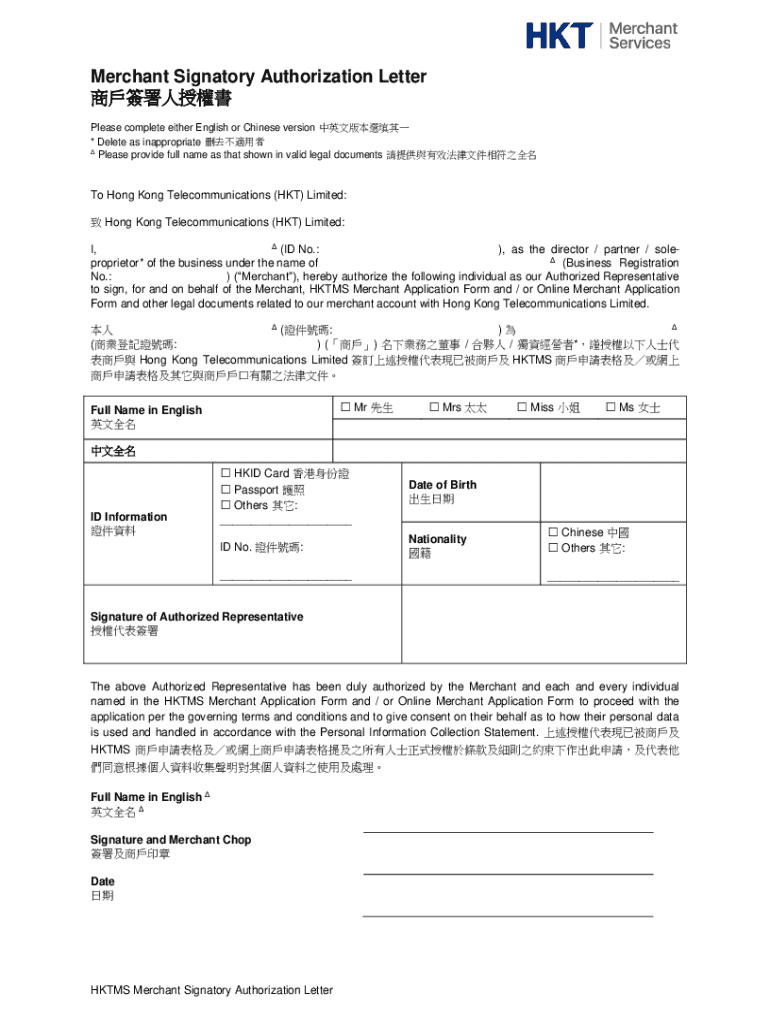

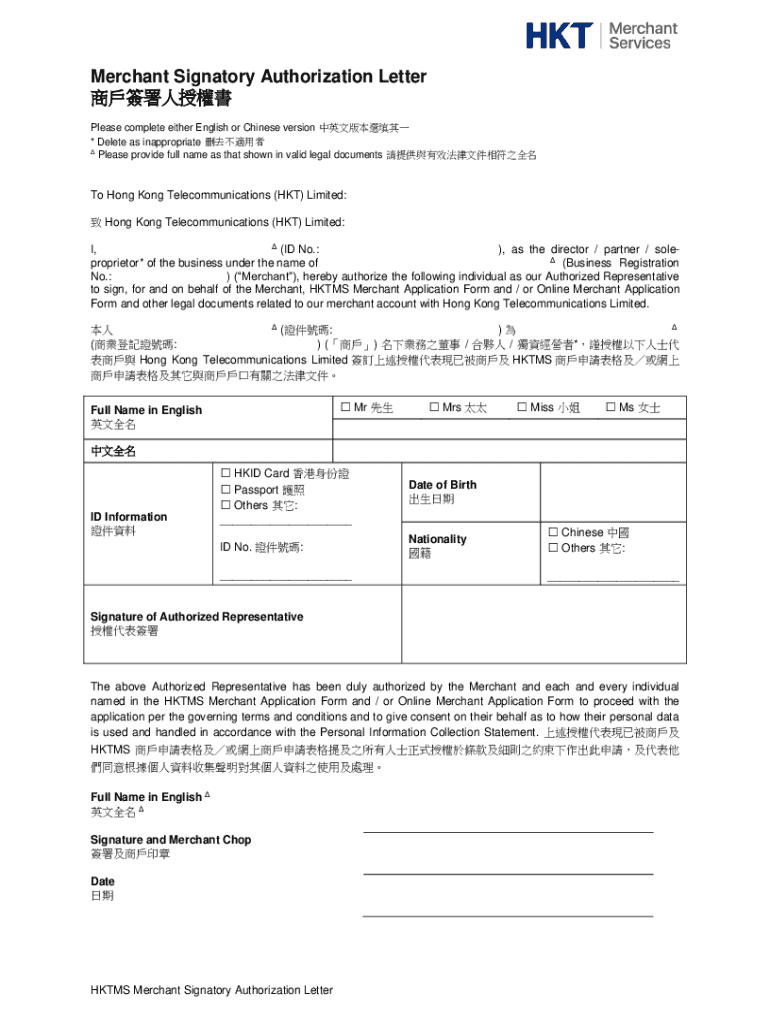

Components of a merchant signatory authorization letter

When drafting a Merchant Signatory Authorization Letter, certain essential components must be included. First and foremost are the company details, such as the business name, address, and contact information. This ensures that the institution receiving the authorization can easily identify the company.

Next, it’s crucial to include the signatory's personal information, which should encompass their full name, job title, and a legitimate signature. Alongside this, the intent of authorization must be clearly defined, indicating specifically which actions or transactions the signatory is permitted to carry out.

Optional details for comprehensive coverage

For a more thorough authorization letter, consider including optional details. Indicating the duration of the authorization can be highly beneficial, as it determines how long the signatory can act on behalf of the business. Specific transaction limits can also be integrated, helping to prevent unauthorized or excessively large transactions that could jeopardize the company’s finances.

Furthermore, confidentiality clauses may be added to protect sensitive business information when the authorized individual interacts with third parties.

Step-by-step guide to filling out the merchant signatory authorization letter

To create a Merchant Signatory Authorization Letter, start by preparing your document. This involves selecting the correct form or template—ideally, one compatible with your business’s structure. Companies can access templates easily via platforms like pdfFiller, which offers customizable options to streamline the process.

Each section of the form needs to be filled out diligently. Begin with the company information, ensuring that all details are accurate and up-to-date. Following this, fill in the signatory details, specifying their role in the company to reaffirm their authority.

Clearly specify the scope of the authorization next. This means elaborating on the actions the authorized individual can perform. Don’t forget to have the document reviewed; proofreading is critical to catch any errors or missing information, and ensure that all required signatures are included to validate the authorization.

Editing and managing your merchant signatory authorization letter

Managing your Merchant Signatory Authorization Letter doesn’t stop at filling it out. Utilizing a platform like pdfFiller can significantly enhance your document editing experience. With features designed for editing PDFs, users can make changes seamlessly, ensuring that the latest information is always reflected.

Moreover, team collaboration on documents is made easy via pdfFiller, allowing for multiple users to review and provide input on the authorization letter. This feature supports greater accuracy and efficiency, especially in businesses where many individuals may need to weigh in on authority assignments.

Saving and storing your document

After creating your Merchant Signatory Authorization Letter, saving and storing it correctly is crucial. Utilizing cloud-storage solutions, like those offered by pdfFiller, ensures that your document can be accessed from anywhere, enhancing operational flexibility. Businesses benefit from having all their documents securely stored online, reducing the risk of loss or damage to physical files.

With cloud storage, team members can retrieve the document quickly whenever needed, ensuring that the authorization is readily available for any financial interaction.

Signatures: effective execution of the authorization

An important aspect of the Merchant Signatory Authorization Letter is the inclusion of signatures, which validate the document. There are different types of signatures to consider; traditional handwritten signatures are still widely used, but electronic signatures have gained popularity due to their convenience.

The validity of electronic signatures is recognized in many jurisdictions, provided they comply with legal standards. This makes eSigning through platforms like pdfFiller a practical solution for businesses seeking to enhance efficiency without sacrificing legal compliance.

When eSigning, it’s important to follow a simple process within pdfFiller, where users can draw their signature, upload an image of their signature, or use a pre-stored version. This makes signing documents quick and accessible and ensures that all signatories can approve the letter swiftly.

Common mistakes to avoid when creating a merchant signatory authorization letter

When drafting a Merchant Signatory Authorization Letter, being meticulous is necessary to prevent errors. One common mistake is entering incorrect information about the company or signatory details. Such errors can lead to confusion or disputes, especially if the document is presented in a critical transaction.

Another frequent oversight is failing to obtain proper signatures. All necessary parties should sign the document to validate its contents. Ensure that neither the business owner nor the designated signatories overlook their responsibility to provide signatures, as this could render the authorization invalid.

Best practices for using a merchant signatory authorization letter

Having a Merchant Signatory Authorization Letter is only the first step; businesses must also engage in regular updates and reviews. This should be especially true whenever there are changes in personnel or company policy, which could necessitate alterations to who is authorized to act on behalf of the company.

Additionally, adopting defensive practices is crucial. Safeguarding the integrity and security of the document is vital; using secure platforms like pdfFiller can help with that. Ensuring only authorized personnel have access to the letter can prevent unauthorized actions that could harm the company's financial standing.

Interactive tools for streamlined document management

Leveraging the capabilities of platforms like pdfFiller can enhance the management of Merchant Signatory Authorization Letters. The tools available can integrate your authorization letters with functionalities such as invoice generation and digital filing, effectively streamlining overall business operations.

Case studies show that businesses employing pdfFiller have improved their operational efficiency by reducing time spent on document handling, ensuring that authorization processes are swift and secure. Companies now enjoy the feasibility of linking authorization letters directly to other transactional documents, optimizing their workflow.

Frequently asked questions (FAQs)

1. What to do if a Merchant Signatory Authorization Letter is denied? If your authorization letter is denied, reach out to the issuing entity to understand their reasons. Ensure you provide all necessary information and that the signatory’s credentials match the requirements.

2. Can authorization letters be revoked or altered? Yes, a Merchant Signatory Authorization Letter can be revoked or altered. It’s essential to document any changes and communicate them effectively to all relevant parties.

3. How are disputes resolved regarding authorization content? Disputes regarding the contents of the authorization letter can typically be resolved through mutual agreement between involved parties, potentially involving legal counsel if necessary.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify merchant signatory authorization letter without leaving Google Drive?

How do I make edits in merchant signatory authorization letter without leaving Chrome?

Can I sign the merchant signatory authorization letter electronically in Chrome?

What is merchant signatory authorization letter?

Who is required to file merchant signatory authorization letter?

How to fill out merchant signatory authorization letter?

What is the purpose of merchant signatory authorization letter?

What information must be reported on merchant signatory authorization letter?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.