Get the free Nt 05-01.a

Get, Create, Make and Sign nt 05-01a

How to edit nt 05-01a online

Uncompromising security for your PDF editing and eSignature needs

How to fill out nt 05-01a

How to fill out nt 05-01a

Who needs nt 05-01a?

Comprehensive Guide to the nt 05-01a Form

Understanding the nt 05-01a form

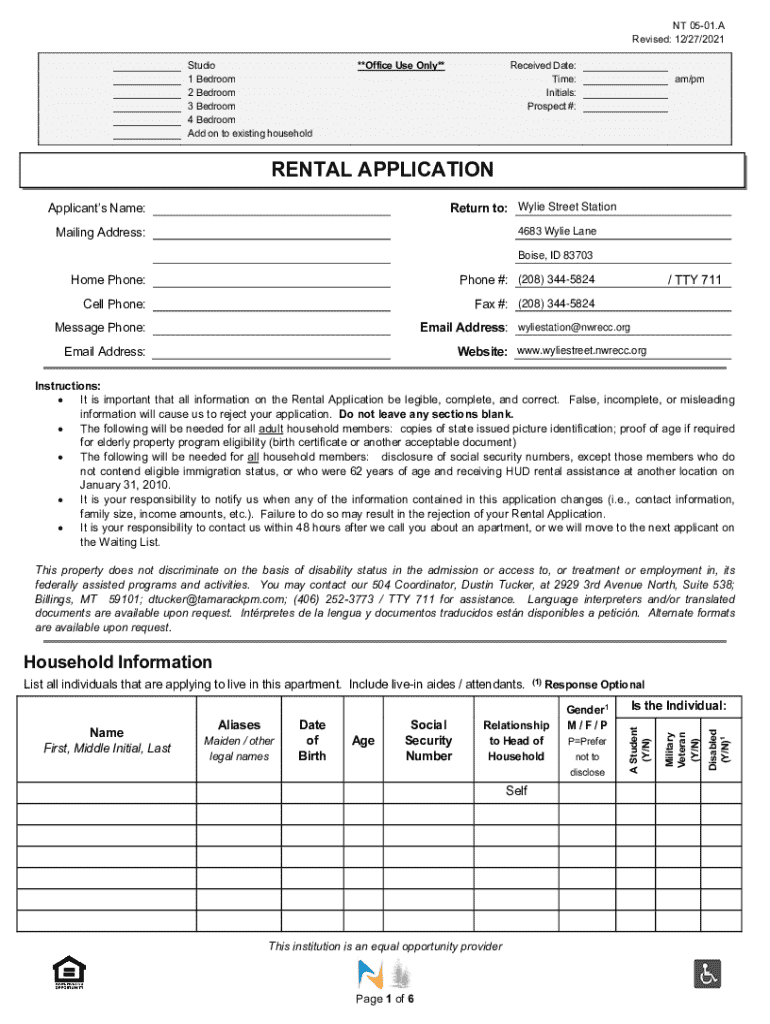

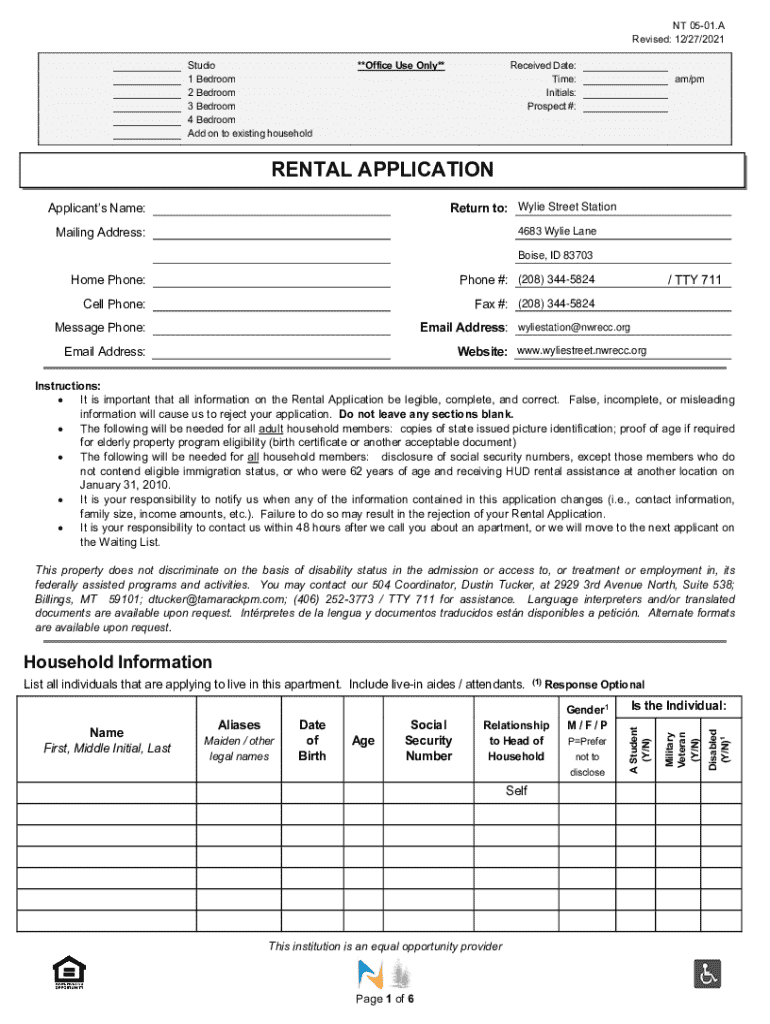

The nt 05-01a form is an essential document used primarily for financial reporting and taxation purposes. Designed to capture specific personal and financial data, this form represents a crucial step in various filing processes, ensuring compliance with legal standards and accurate record-keeping. It's particularly significant for individuals and teams engaged in income reporting or tax preparation, as it aids in creating a clear financial picture when dealing with taxation authorities.

The importance of the nt 05-01a form cannot be overstated, as it serves as a formal declaration of one's income and financial activities. By providing this information, users contribute to the transparent functioning of financial systems, whether for personal finances or organizational records. Furthermore, its structured format simplifies the data entry process, making it accessible for users of various skill levels.

Key features and components of the nt 05-01a form

The nt 05-01a form is structured with several essential sections, each designed to capture specific types of information. Understanding these sections is crucial for accurate completion and ultimately for submitting a viable document. The primary sections encompass personal information, financial specifics, and legal disclaimers which ensure everything is documented properly.

The personal information section typically requires details such as name, address, and tax identification numbers. The financial information section then demands precise income data, deductions, and other monetary aspects relevant to the user's financial standing. Following this, the form requires signatures and includes legal disclaimers that confirm the information provided is correct and truthful.

When filling out the nt 05-01a form, attention to detail is paramount. Accurate data entry ensures compliance and helps avoid potential audits or penalties. Users should double-check their entries against the gathered documentation to ensure full accuracy and completeness.

Preparing to complete the nt 05-01a form

Preparation is key when completing the nt 05-01a form. Users should begin by gathering all necessary documents and information, including tax documents, previous filing records, and personal identification details. Having all pertinent information readily available will facilitate smoother data entry and reduce the likelihood of omissions or errors.

In terms of important dates and deadlines, it's crucial to be aware of the filing dates for the nt 05-01a form. Missing these deadlines can result in penalties or complications with taxation authorities. Keeping a calendar with specific submission times is advisable to ensure timely compliance with reporting requirements.

Step-by-step instructions for filling out the nt 05-01a form

Completing the nt 05-01a form can be simplified through a systematic approach. Here are detailed instructions to follow for effective form completion.

Following these steps will help ensure that the nt 05-01a form is correctly completed and ready for submission.

Interactive tools for efficient form management

pdfFiller provides a range of interactive tools that enhance the efficiency of managing the nt 05-01a form. One of the most notable features is the ability to edit the form directly within the platform. Users can add text, modify existing fields, or even insert new sections based on their needs without the hassle of redrafting an entirely new document.

Another significant feature of pdfFiller is its collaborative capabilities. Teams can benefit from real-time editing, allowing multiple users to work on the form simultaneously. This is particularly useful for teams handling joint financial reporting where accuracy and speed are essential. Sharing options within the platform also simplify the distribution of forms to colleagues or stakeholders for review and signatures.

Common mistakes and how to avoid them

When completing the nt 05-01a form, numerous common errors can arise, affecting the validity of the submitted information. These often include inaccuracies in personal or financial information and missed signatures, which can lead to complications once the form is submitted. Users should familiarize themselves with these pitfalls to navigate around them effectively.

To avoid such mistakes, double-check all information for accuracy and ensure that it aligns with your documentation. Additionally, pdfFiller’s error notification feature is invaluable in this context, as it alerts users to inconsistencies or potential issues before submission, enhancing compliance and reducing stress during the filing process.

Legal considerations and secure document handling

Understanding the legal implications of the nt 05-01a form is imperative for users. By signing this form, individuals and entities affirm that the provided information is complete and truthful, holding them accountable for any discrepancies. It's crucial to grasp these responsibilities fully to avoid potential legal complications in the event of an audit or review.

In addition, document security is a priority when handling such sensitive information. pdfFiller offers secure cloud storage options that protect user data from unauthorized access. Furthermore, eSignature legality and verification features ensure that signed documents are legally binding, thus reinforcing the integrity of your submissions.

Managing and submitting your nt 05-01a form

Effective management and submission of the nt 05-01a form require awareness of various submission methods and tracking options. Users can submit their form online through pdfFiller, enjoying a streamlined process that helps ensure timely delivery and receipt acknowledgments. Alternatively, the option to print and submit via traditional mail remains, but it often lacks the tracking benefits of online submissions.

After submission, tracking the status of your nt 05-01a form is essential for peace of mind. Following up with the relevant authority is recommended to confirm receipt and check for any issues. Keeping a record of submission confirmations or receipts can be helpful during this process.

Case studies: Successful handling of the nt 05-01a form

Exploring case studies can offer practical insights into how the nt 05-01a form can be effectively managed. For individuals, personal experiences often highlight the significance of accurate data entry and timeliness, revealing that delays or errors can lead to unwanted audits or penalties. One such example includes a freelancer who meticulously organized documents and completed the form within the deadlines, avoiding any complications.

In a team setting, collaboration can be crucial, especially when multiple stakeholders are involved in financial reporting. Successful outreach for a small business revealed that using pdfFiller allowed multiple team members to edit and confirm entries simultaneously, streamlining their process significantly and ensuring that all financial aspects were covered with minimal risk of error. From these cases, key lessons learned include the value of preparation, collaboration, and utilizing technology for better outcomes.

Frequently asked questions about the nt 05-01a form

Addressing common queries related to the nt 05-01a form can greatly assist users in navigating its complexities. A frequent concern involves understanding when professional advice should be sought, especially if one encounters difficulties during completion. For more complicated tax situations or further clarification on legal implications, consulting a tax advisor or a financial expert is advisable.

Additionally, users often ask about the necessary documentation required alongside the form. To minimize hassle, it’s best to keep all relevant financial documents near at hand when filling out the form. This preparation will not only help in completing the form more swiftly but will also result in higher accuracy and compliance.

Conclusion and next steps

Completing the nt 05-01a form doesn’t have to be a daunting task when using the right tools and techniques. pdfFiller not only provides users with the means to edit and eSign documents securely but also supports collaborative efforts in document management. Staying informed about any updates to the form or changes in procedures is also advisable to maintain compliance with current standards.

As users proceed with filing their forms, leveraging the power of pdfFiller allows for a seamless experience, thus empowering individuals and teams to manage their document needs with confidence and efficiency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in nt 05-01a without leaving Chrome?

How do I fill out the nt 05-01a form on my smartphone?

How do I edit nt 05-01a on an iOS device?

What is nt 05-01a?

Who is required to file nt 05-01a?

How to fill out nt 05-01a?

What is the purpose of nt 05-01a?

What information must be reported on nt 05-01a?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.