Get the free Year 3 Annual Report

Get, Create, Make and Sign year 3 annual report

Editing year 3 annual report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out year 3 annual report

How to fill out year 3 annual report

Who needs year 3 annual report?

Year 3 Annual Report Form - How-to Guide

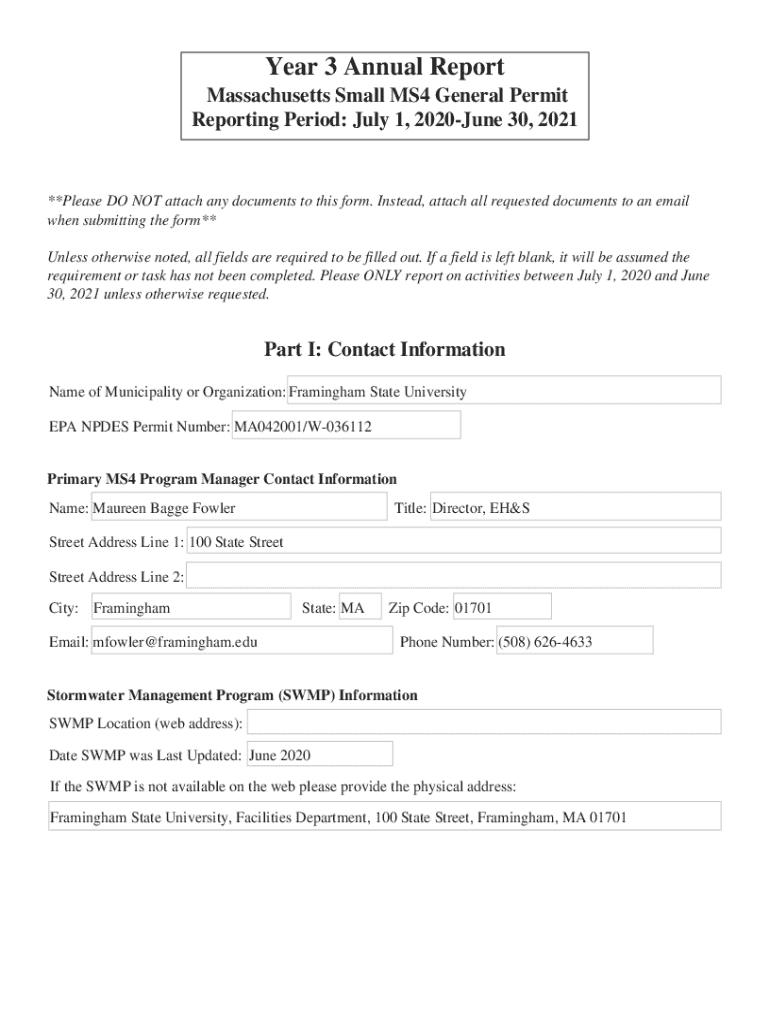

Understanding the Year 3 Annual Report Form

A Year 3 Annual Report serves as a vital document for businesses as they progress through their corporate lifecycle. This report encapsulates an organization's performance over the first three years, providing critical insights into growth, challenges, and overall operational efficiency.

Filing this report is a requirement for many businesses, reflecting their financial health and compliance with state regulations. It helps stakeholders, including investors and regulatory bodies, assess the organization's viability and trustworthiness.

Who needs to file a Year 3 annual report?

The requirement to file a Year 3 Annual Report typically applies to corporations, limited liability companies (LLCs), and partnerships that are registered in a specific state. Businesses often need to comply based on their structure, revenue, and state-specific regulations.

However, there are exceptions. For instance, nonprofits may have different reporting regulations to follow, possibly exempting them from certain requirements based on their charitable status. It's crucial for companies to familiarize themselves with the criteria set by their governing bodies to avoid unintentional non-compliance.

Deadlines and filing periods

It's essential to be aware of deadlines for submitting the Year 3 Annual Report. Generally, these reports are due within a specific timeframe after the end of the fiscal year. Each state sets its deadline, which could range from 30 days to several months post-fiscal year-end.

Filing late can lead to significant penalties, including fines or even administrative dissolution of the business in extreme cases. Thus, businesses must keep an accurate calendar of important dates to ensure timely submission.

Preparing to fill out the Year 3 annual report form

Before diving into completing the Year 3 Annual Report Form, it's crucial to gather all necessary information. This typically includes financial statements, profit and loss records, revenue details, and information regarding directors and officers.

Common pitfalls include not having up-to-date financial records or incomplete documentation. It's advantageous to prepare these details ahead of time to smooth the submission process.

Choosing the right platform

Selecting the right platform for filing the Year 3 Annual Report can significantly ease the filing process. pdfFiller stands out as a comprehensive tool that allows users to fill, edit, and sign documents effortlessly from any device.

In comparison to traditional methods, using pdfFiller simplifies the process by offering features such as cloud storage, real-time collaboration, and automatic formatting. Businesses can adapt their filings quickly, adjusting to new information without the need for cumbersome paperwork.

Step-by-step guide to completing the Year 3 annual report form

Accessing the Year 3 Annual Report Form on pdfFiller is straightforward. Users can search for the form within the platform, ensuring they are using the most current version. New users can follow the guided interface to locate and download the document quickly.

Once you have the form, filling it out section by section is vital. Begin with your company information, including name, address, and contact details. Next, detail revenue figures and earnings to give a clear snapshot of financial performance. Conclusively, provide accurate data about company officers and board members, as regulatory bodies require this for approval.

Editing and reviewing the form with pdfFiller

pdfFiller’s editing tools provide an easy way to make corrections and adjustments on the fly. After filling out the form, it's advisable to utilize the editing features for a final review to ensure that all information is accurate and complete.

You can also leverage collaboration features to allow team members to review the document before finalizing it. This ensures that all pertinent information is vetted, reducing the risk of errors.

Signing and submitting the Year 3 annual report form

Utilizing eSign on pdfFiller brings the benefit of immediacy to the signing process. Electronic signatures are legally recognized and provide a secure way to sign documents without the need for printing or physically mailing them.

The step-by-step signing process ensures that every signatory can easily add their approval. After signing, users can submit the form directly through pdfFiller, or they can opt for alternative methods such as mailing or in-person submissions if preferred.

Managing your Year 3 annual report after submission

Tracking your submission status is an important task once you've filed your Year 3 Annual Report. pdfFiller provides tools to follow up on your submission, allowing you to check the status and resolve any potential delays.

If you encounter any issues or need to amend your report, it's essential to understand the process for making changes to an already filed document. Common mistakes can often be rectified straightforwardly, ensuring continued compliance.

Frequently asked questions about the Year 3 annual report form

Understanding the implications of missing the filing deadline is crucial for maintaining compliance. Penalties can range from fines to more severe repercussions, which can affect your business's status.

Getting a copy of your filed report is also possible through pdfFiller; users can easily navigate the platform to retrieve their documents post-submission. Furthermore, businesses can familiarize themselves with the fee structures associated with filing, ensuring they choose the right payment method.

Additional tips for a successful filing experience

Employing best practices ensures that the filing process for the Year 3 Annual Report is as smooth as possible. Regularly reviewing compliance obligations and maintaining complete financial records can prevent last-minute issues that lead to stress or inaccurate filings.

Utilizing technology tools, especially pdfFiller's cloud-based solutions, allows users to enhance efficiency. Moreover, connecting with expert resources and community forums can provide valuable insight for those who need further assistance during the filing process.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get year 3 annual report?

Can I create an electronic signature for signing my year 3 annual report in Gmail?

How do I fill out the year 3 annual report form on my smartphone?

What is year 3 annual report?

Who is required to file year 3 annual report?

How to fill out year 3 annual report?

What is the purpose of year 3 annual report?

What information must be reported on year 3 annual report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.