Get the free pdffiller

Get, Create, Make and Sign pdffiller form

Editing pdffiller form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pdffiller form

How to fill out payroll deduction form

Who needs payroll deduction form?

Complete Guide to Payroll Deduction Forms: Everything You Need to Know

Understanding payroll deductions

Payroll deductions are amounts withheld from an employee's paycheck, either mandated by law or agreed upon by the employee for various benefits. This financial process is crucial for both employees and employers, as it helps manage tax liabilities and fund employee benefits effectively.

Understanding payroll deductions is fundamental for effective financial planning. By knowing what is deducted and how this affects your take-home pay, you can make informed decisions regarding spending, saving, and retirement planning.

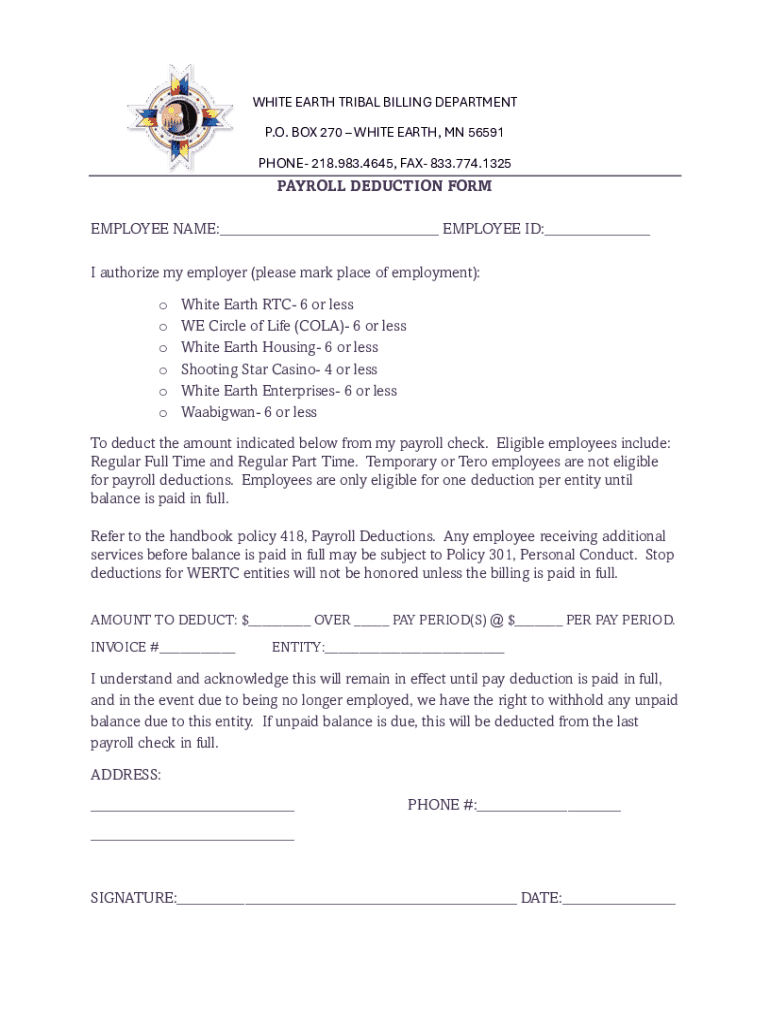

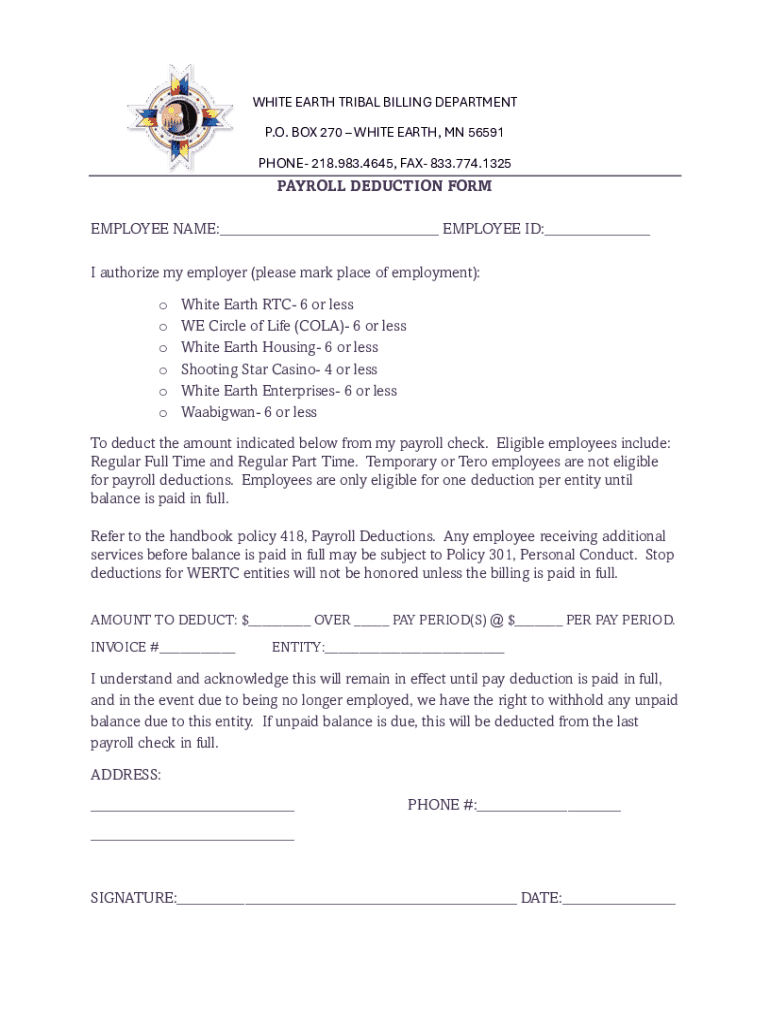

Overview of the payroll deduction form

A payroll deduction form is a document that employees use to authorize their employer to withhold specific amounts from their wages. This form is fundamental in the payroll process, ensuring that deductions are made accurately and comply with both legal standards and individual choices.

Typically, this form includes several key components necessary for processing deductions and ensuring that both parties understand the commitments involved.

Step-by-step guide to completing the payroll deduction form

Successfully completing a payroll deduction form involves several careful steps to ensure all necessary information is accurately provided. Following this guide will help facilitate a smooth submission process.

Common mistakes to avoid

Filling out a payroll deduction form can seem straightforward, but several common pitfalls could lead to problems in the future. Being aware of these mistakes can save time and frustration.

Editing and managing your payroll deduction form

Once you've submitted your payroll deduction form, it’s crucial to understand how to manage and edit it as necessary. Changes might be required due to updated benefits, changes in personal circumstances, or revised financial plans.

FAQs about payroll deduction forms

Navigating payroll deductions can be confusing. Here are some frequently asked questions that clarify common concerns related to payroll deduction forms.

Utilizing interactive tools for payroll deductions

Incorporating technology into managing payroll deductions makes the process smoother and more efficient. Platforms like pdfFiller provide tools to simplify your experience.

Tips for effective payroll deduction management

To ensure you make the most of your payroll deduction management, consider these practical tips and strategies aligned with your financial goals.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my pdffiller form in Gmail?

How can I get pdffiller form?

How do I make changes in pdffiller form?

What is payroll deduction form?

Who is required to file payroll deduction form?

How to fill out payroll deduction form?

What is the purpose of payroll deduction form?

What information must be reported on payroll deduction form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.