Get the free Tax Extension: Deadline and How to File One

Get, Create, Make and Sign tax extension deadline and

Editing tax extension deadline and online

Uncompromising security for your PDF editing and eSignature needs

How to fill out tax extension deadline and

How to fill out tax extension deadline and

Who needs tax extension deadline and?

Understanding Tax Extension Deadlines and Forms

Understanding tax extensions

A tax extension allows taxpayers additional time to file their federal income tax returns. However, it is essential to clarify that an extension only applies to the filing aspect and not to the payment of taxes owed. Filing an extension gives you the right to submit your tax return later, specifically until the extended deadline.

The difference between an extension to file and an extension to pay is distinct: while you may have until the extension deadline to file your paperwork, any taxes owed must typically be paid by the original due date. This means that if you don't pay your estimated taxes on time, you may incur penalties or interest.

How tax extensions work

Filing for a tax extension is a straightforward process. Taxpayers must submit Form 4868 to the IRS, which grants an automatic six-month extension for individual taxpayers. However, many people misunderstand that an extension to file is not an extension to pay; thus, any estimated taxes should still be timely submitted.

A common misconception is that filing for an extension condones late payment of taxes. This is false. The IRS charges interest and possible penalties for late payments, so it's crucial to estimate your tax liability and pay any due amount as best as you can, even if you're filing for an extension.

Key tax extension deadlines

The federal tax extension deadline is April 15 for most taxpayers, providing them until October 15 of the same year to file their returns if an extension is filed. However, this date may vary slightly depending on weekends or holidays, so it is always wise to double-check. Additionally, state-specific deadlines may also apply, and they can vary significantly from state to state.

Failure to meet tax deadlines can lead to penalties, which can accrue quickly. The IRS implements a failure-to-file penalty of approximately 5% of unpaid taxes for each month the return is late, equating to a maximum of 25%. Therefore, understanding when your taxes are due, even with an extension, is paramount.

When are taxes due with an extension?

After a tax extension is granted, the original payment deadlines typically remain intact. This means that while you have until October 15 to file, any estimated taxes owed must still be paid by April 15. Not paying the correct amount by this deadline may result in the accumulation of interest and penalties.

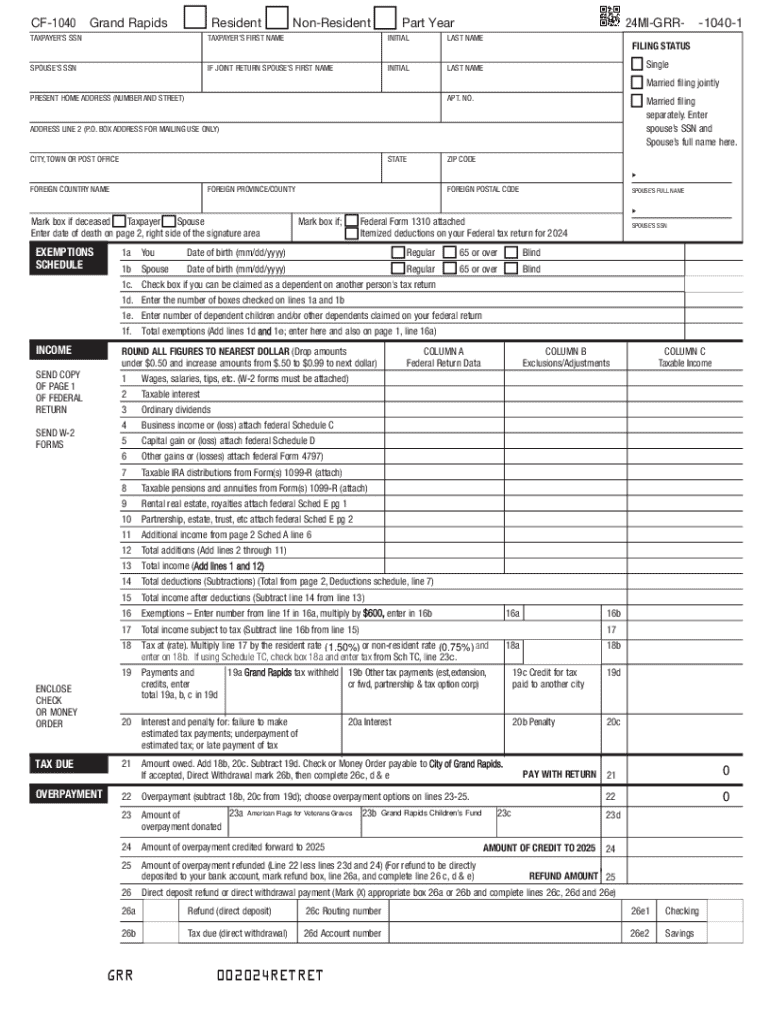

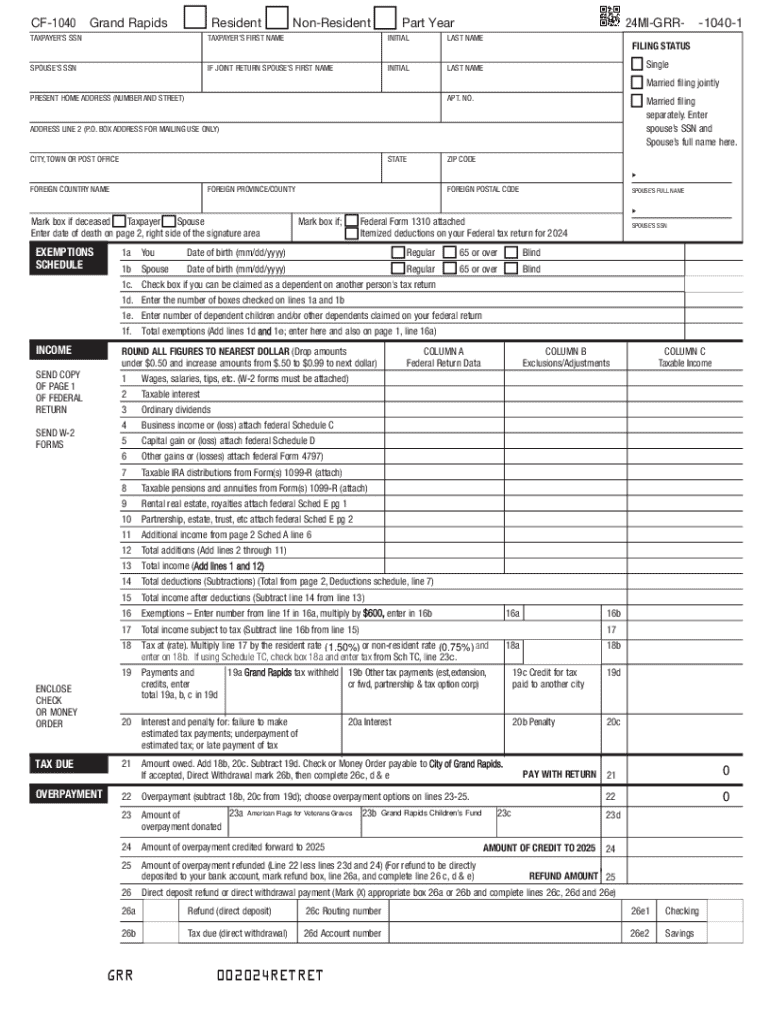

Filing a tax extension form

Filing a federal tax extension electronically is the most efficient method for most taxpayers. You can use IRS e-file options via commercial tax software or through authorized tax professionals. To assist in this process, follow the step-by-step guide outlined below:

In addition to online options, taxpayers can also file through traditional methods such as mailing the completed form to the IRS. For those opting for a paper submission, ensure that your extension request is postmarked by the original filing deadline.

How do you file a state tax extension?

Each state has its rules regarding tax extensions. While many states recognize the federal extension process, they may require separate applications to secure a state extension. Check your specific state's treasury or revenue website for their form and filing requirements.

Usually, form numbers for state extensions can differ, and some states may charge fees or specify unique deadlines distinct from federal guidelines. Links to state tax extension forms will typically be available on state department websites.

Automatic tax extensions

Automatic tax extensions are provided to individuals by the IRS, as long as Form 4868 is submitted accurately. These extensions grant an additional six months for filing taxes, extending the deadline primarily for taxpayers who can't submit their returns by the original due date.

It's noteworthy that automatic extensions in some states may have additional criteria. For example, certain states might require taxpayers to meet specific conditions before granting an extension. Always check the regulations to ensure compliance.

Cost considerations for filing extensions

Typically, filing a tax extension with the IRS is free of charge; however, if you use tax preparation software or services, fees may apply. These costs can vary widely based on the platform and services provided. It's essential for taxpayers to weigh these costs against the potential of penalties incurred by late filing.

Bearing in mind that the financial implications certainly add to the stresses of tax season, assessing early on whether to file an extension can help you to strategically plan your finances.

Frequency of tax extensions

Generally, taxpayers can file for only one extension per tax year. However, if you find yourself needing extra time beyond the six months, you may still file a request with the IRS via a special circumstance application. Most tax professionals recommend being selective about seeking extensions and to plan ahead for complexities and established deadlines.

Using extensions strategically can relieve stress, but filing on time when possible can prevent unnecessary complications and potential tax penalties.

Special circumstances for tax extensions

Military personnel stationed outside the U.S. are granted extended timeframes for filing their taxes without the need to submit a formal extension request. The IRS provides automatic extensions for military members and their families, recognizing the unique challenges faced while serving abroad.

Individuals living outside the U.S. or in Puerto Rico may also request additional time for filing under specific international tax guidelines. It is advisable for such taxpayers to familiarize themselves with the IRS guidelines that pertain to expatriates and seek assistance if necessary.

Important tools and tips for managing tax extensions

To manage tax extensions effectively, various useful tools can help streamline the process. Tax calculators can assist in estimating your tax liability, ensuring no payments are overlooked. Utilizing templates for tax extension forms is another practical resource that can save time and reduce errors.

For enhanced efficiency in document management, tools such as pdfFiller provide an excellent solution. With pdfFiller, users can fill out, edit, and eSign tax forms seamlessly, ensuring easy collaboration on tax-related documents, thereby making the entire process more manageable.

Navigating tax extensions with confidence

Utilizing pdfFiller as a comprehensive document management solution enhances the experience of editing, eSigning, and managing tax forms. With its cloud-based features, users gain access to essential tools that save time and reduce the headaches associated with the tax season.

Being prepared for tax deadlines and understanding tax extension forms empowers you to navigate tax time more confidently. With the right tools and knowledge, managing your taxes, whether filing on time or requesting an extension, becomes a more streamlined experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify tax extension deadline and without leaving Google Drive?

How do I execute tax extension deadline and online?

How do I make changes in tax extension deadline and?

What is tax extension deadline?

Who is required to file tax extension?

How to fill out tax extension?

What is the purpose of tax extension?

What information must be reported on tax extension?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.